-

BTC has experienced increased volatility over the past month.

Despite the decline, new whales continue to enter the market as old ones hold their position.

As a seasoned researcher with years of experience studying the cryptocurrency market, I have witnessed numerous ups and downs, but the current state of Bitcoin [BTC] has certainly piqued my interest. Historically, September is known for its bearish nature, yet BTC seems to be defying this pattern. However, it’s not a simple dance between bulls and bears; it’s more like a complex waltz with new whales joining the floor while old ones hold their ground.

In a surprising turn of events, Bitcoin (BTC) has exhibited one of the most remarkable Septembers on record. Typically, September is known for its bearish market trends. Yet, in contrast to this historical norm, Bitcoin has made a notable effort over the past week to buck this pattern.

Indeed, the value of cryptocurrency reached a recent peak of $60,670, climbing from an earlier low of $52,546. Currently, it’s being exchanged at approximately $58,819. This signifies a 3.19% growth when compared to weekly price trends.

Over the past three days, I’ve observed a reversal in Bitcoin’s trajectory, with its value plummeting back to a local minimum of $57,488 – undoing the previous gains it had made.

The current market actions suggest that bulls are trying to dominate the market, yet they lack the strength to push the bears aside at this time.

The current behavior of whales (large market players) clearly demonstrates their efforts to rebuild trust in the market.

According to an analysis by CryptoQuant, it appears that older whale investors are holding onto their cryptocurrency, while newer investors are entering the market.

Whales continue to hold

As reported by CryptoQuant, fresh investors (referred to as ‘new whales’) were seen actively purchasing cryptocurrencies even during a downturn, whereas the existing ones (known as ‘old whales’) opted to maintain their holdings instead.

These traders are buying up Bitcoin at an average price of $62,038, a decrease of 3.28% from before. This suggests their belief in Bitcoin’s future worth.

Conversely, older whales (those who have held onto their assets for more than 155 days) maintained their positions. This persistent holding pattern indicates that they might be expecting a price surge in the imminent period.

Their unwillingness to liquidate their positions despite the potential for additional losses demonstrates a high level of self-assurance.

These older whales have maintained their spots, initially priced at $27,843, which experienced an astounding increase of 115.54%.

Despite already making substantial gains, these veteran investors choose to keep their assets, expecting prices to rise even more. This action serves as yet another strong indication of a bull market.

In addition to whales, miners and Binance traders persistently hold onto their assets. Miners, who have a base price of $43,179, are currently enjoying a 38.19% profit margin, but there’s no indication of a massive sell-off, suggesting they might be holding on or selling gradually instead.

Typically, fresh participants, such as new whale investors and Binance traders, are aggressively purchasing assets, whereas established whales maintain their current holdings.

This mix suggests the possibility of future price rises and signals that the market is reaching maturity.

What BTC charts indicate

Despite Bitcoin currently showing signs of a bearish market, it’s possible that the existing circumstances may pave the way for significant price increases.

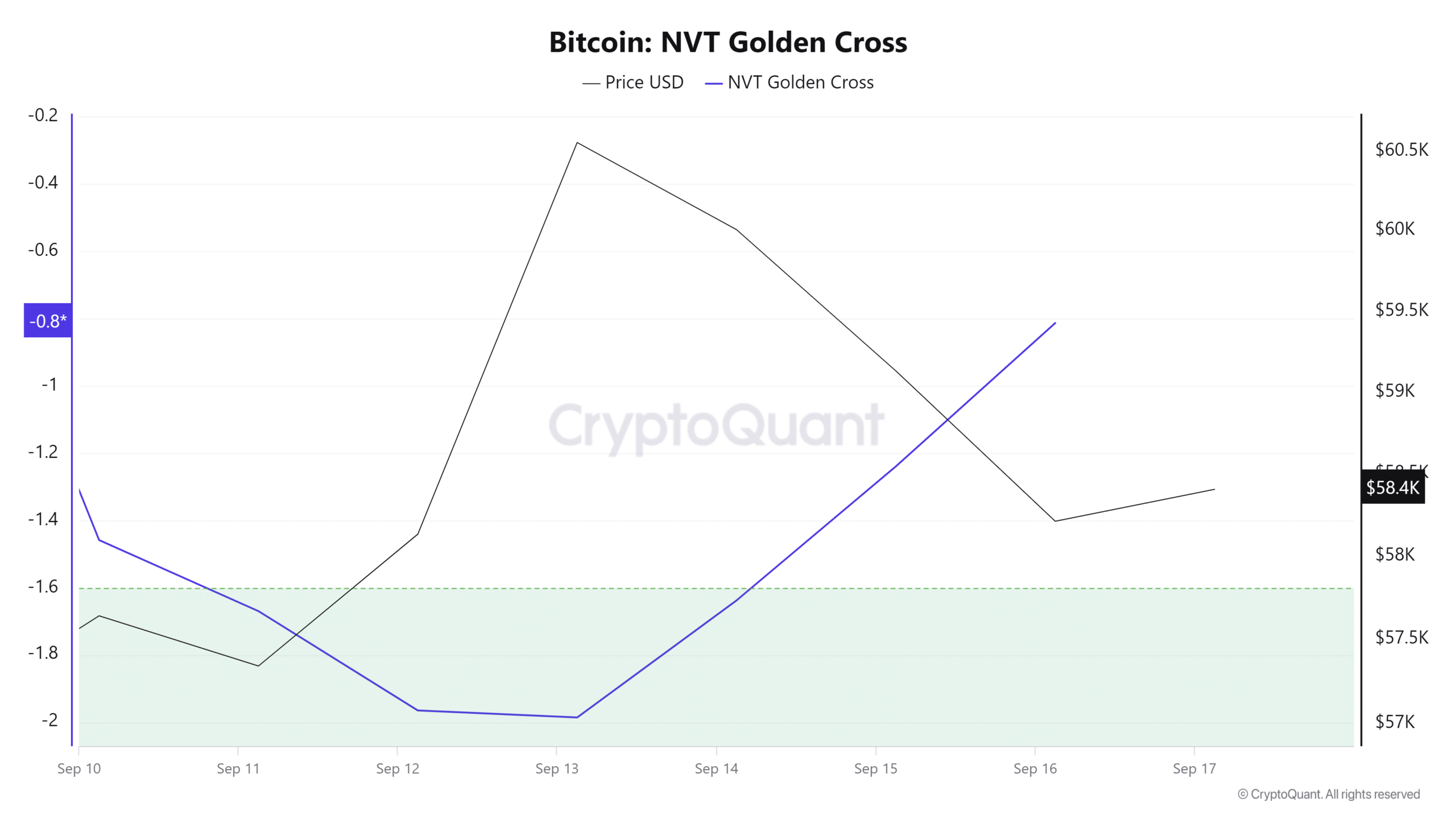

As a crypto investor, I’ve noticed an exciting development with the NVT Golden Cross recently. This technical indicator suggests that the short-term 50-day moving average of NVT has crossed above its longer-term 200-day moving average, signaling a potential upward trend in the near future.

It appears that this increase in market capitalization compared to the network’s transaction volume suggests that we might be moving into a period of rising prices, which is often referred to as a “bull market.

It appears that investors were anticipating more price growth due to the strength of the network’s underlying factors and the overall market mood.

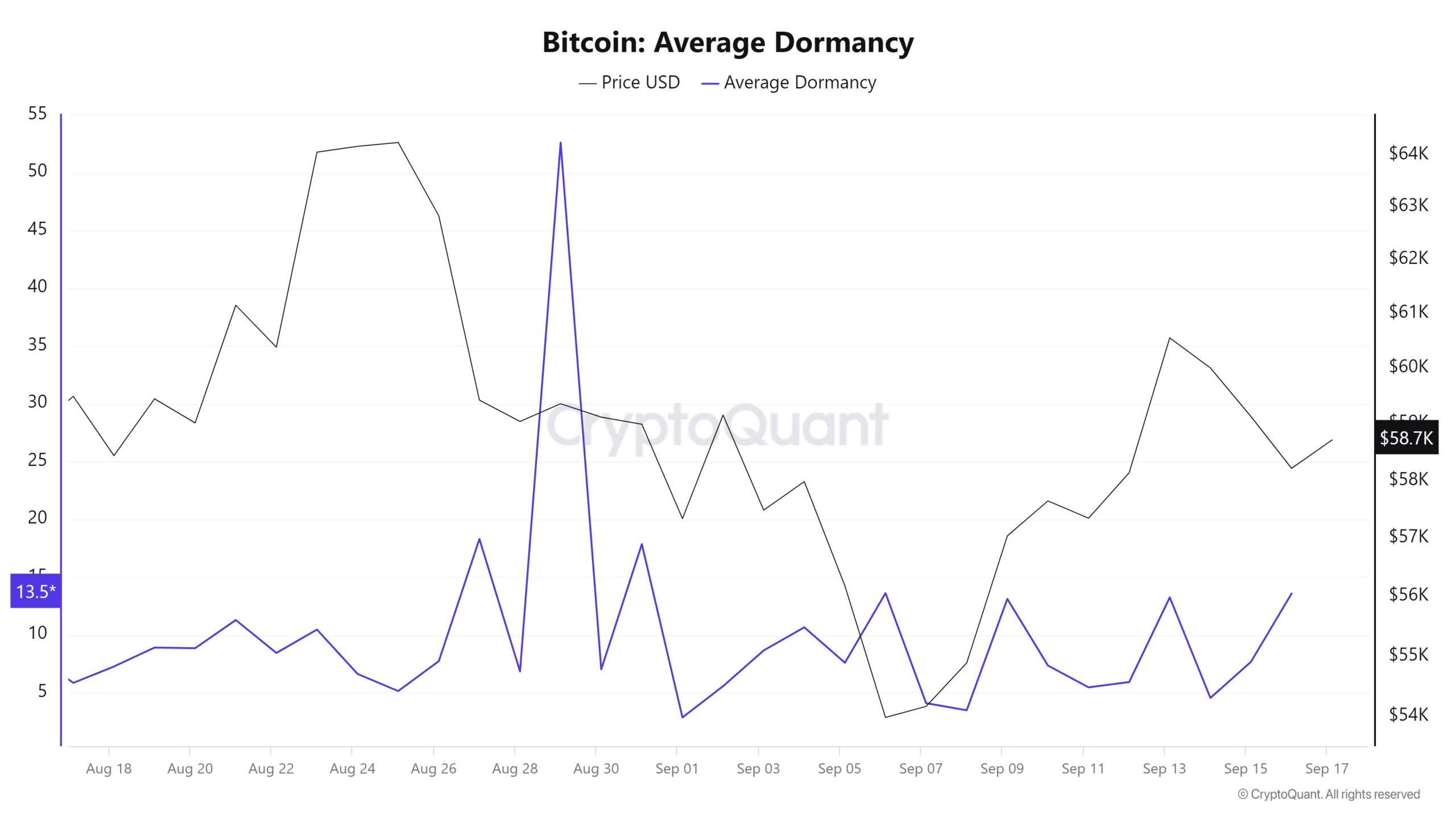

Moreover, the Average Dormancy of Bitcoin has decreased significantly since the 29th of August, going from 52.89 to 13.5 as of now.

An decrease in the average period of inactivity indicates that long-term investors are not liquidating their possessions, even though short-term investors seem to be offloading them.

It indicated that the market was moving into a buildup stage since short-term investors were unloading their positions to long-term investors who anticipated prices would increase in the coming days.

This indicates further optimism about the asset’s value, since the increase in long-term investors’ holdings suggests they are confident about its future cost.

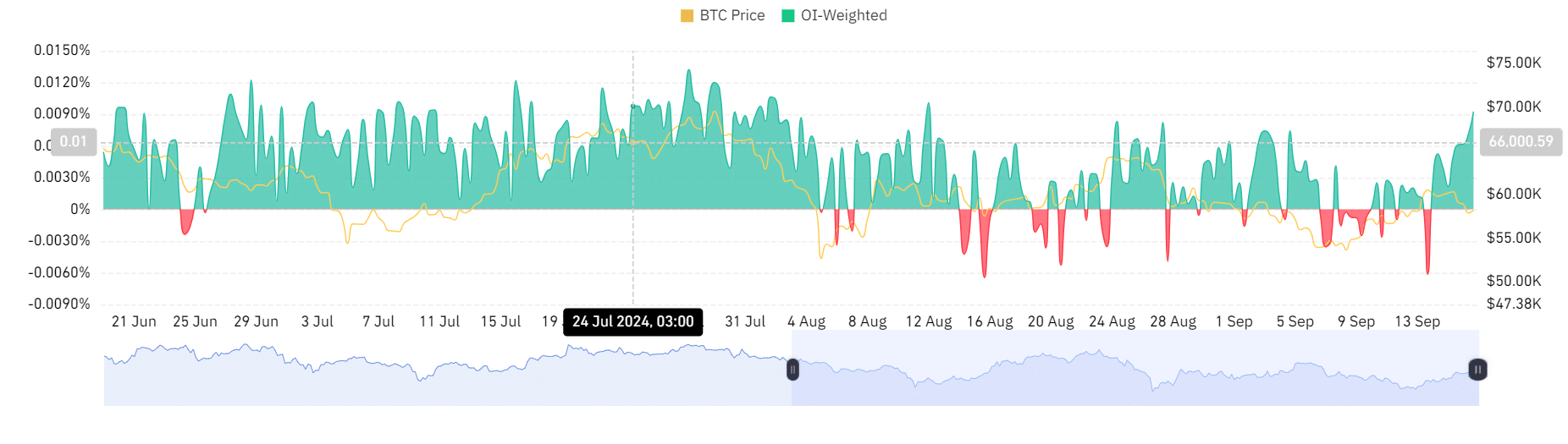

This demand for BTC’s long positions was further supported by a positive OI-weighted funding rate.

In simpler terms, a high Open Interest Weighted Funding Rate suggests that more traders are holding onto long positions (buying) rather than short positions (selling), indicating a greater market demand for long positions over shorts.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Consequently, according to the analysis by CryptoQuant experts, Bitcoin appeared to be gaining more preference from long-term investors.

This optimistic outlook toward the market suggested an anticipation for additional price increases. If this optimism persists, Bitcoin could potentially surpass the challenging $61,182 resistance point it’s been encountering.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-09-17 19:04