- Bitcoin was trading at around $98,000 at press time.

- Sentiment around it remained positive.

As a seasoned researcher with a knack for deciphering market dynamics, I’ve seen my fair share of crypto rollercoasters. And let me tell you, this Bitcoin [BTC] ride is no exception!

As I watch Bitcoin [BTC] approach the significant psychological level of $100,000, I find myself intently analyzing on-chain indicators to better understand the underlying forces shaping its movement.

Long-term investors are clearly making profits, but the increased demand for Bitcoin from exchange-traded funds (ETFs) is helping to maintain a balance in the market.

The balance among these elements might shape the direction of Bitcoin’s cost over a relatively brief to mid-term timeframe.

Bitcoin’s long-term holder activity and profit-taking

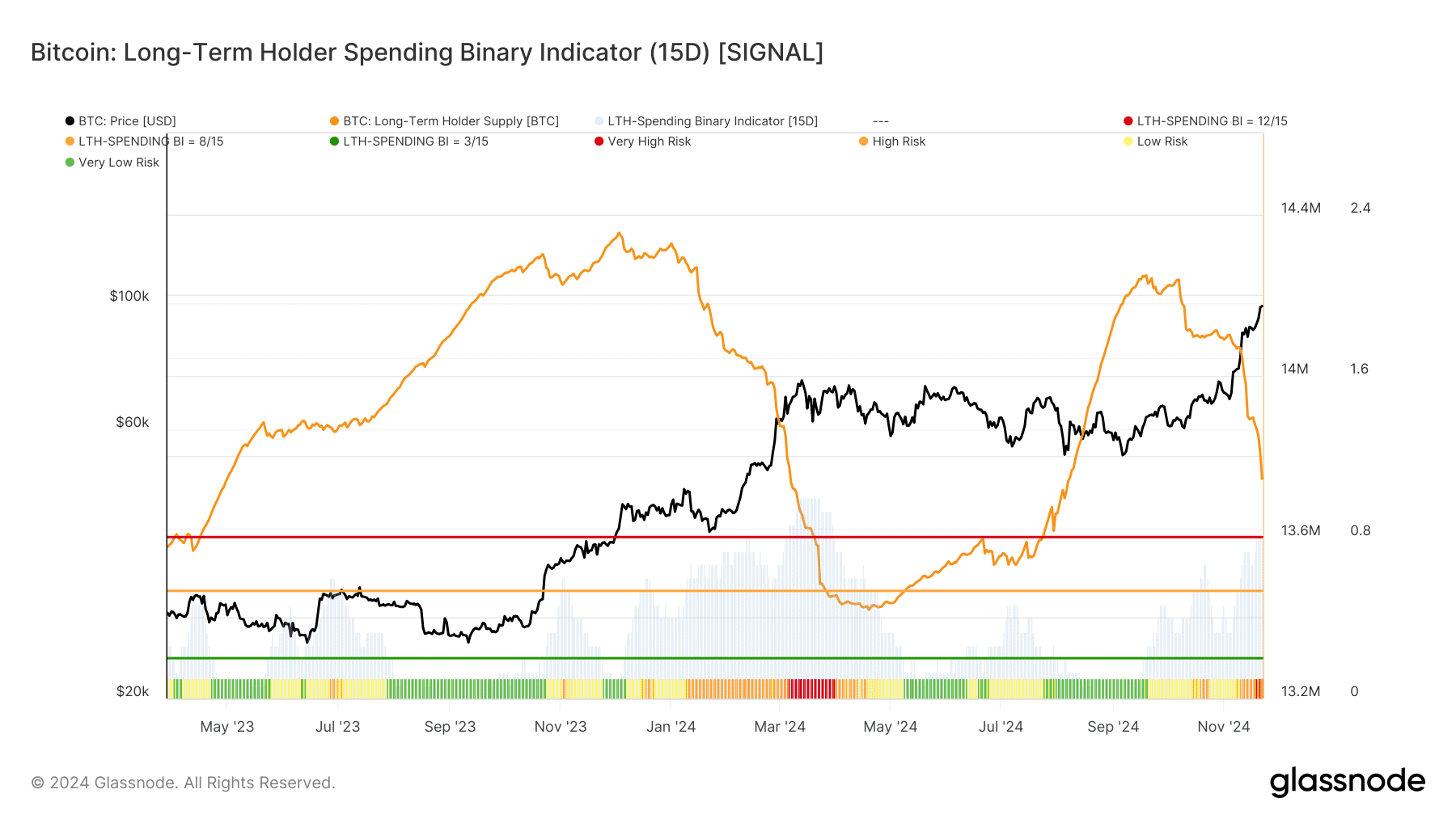

Analyzing the conduct of long-term holders (LTHs) plays a vital role in interpreting the market consistency of Bitcoin. A significant rise in their selling activity, as observed from the Long-Term Holder Position Change graph, was detected.

Over the last several weeks, we’ve seen a noticeable decrease in Long-Term Holder (LTH) positions on the market. A chart from Glassnode suggests that this drop is due to a high volume of profit-taking actions occurring during this timeframe.

In the midst of a bull market, it’s quite typical for Long-Term Holders (LTHs) to switch from storing their assets to dispersing them, given that they cash in on their long-held investments.

Including relevant details, we’re discussing the Long-Term Holder Spending Binary Indicator. This tool measures the risk level of long-term holders regarding their profits realization, and at present, it indicates a “High Risk” area approximately at 0.8.

Historically, periods with comparable risk levels tend to align with local maximum prices, implying that investors should exercise caution if they’re anticipating the market to continue rising above $100,000 without pause.

Bitcoin ETF demand balances sell-offs

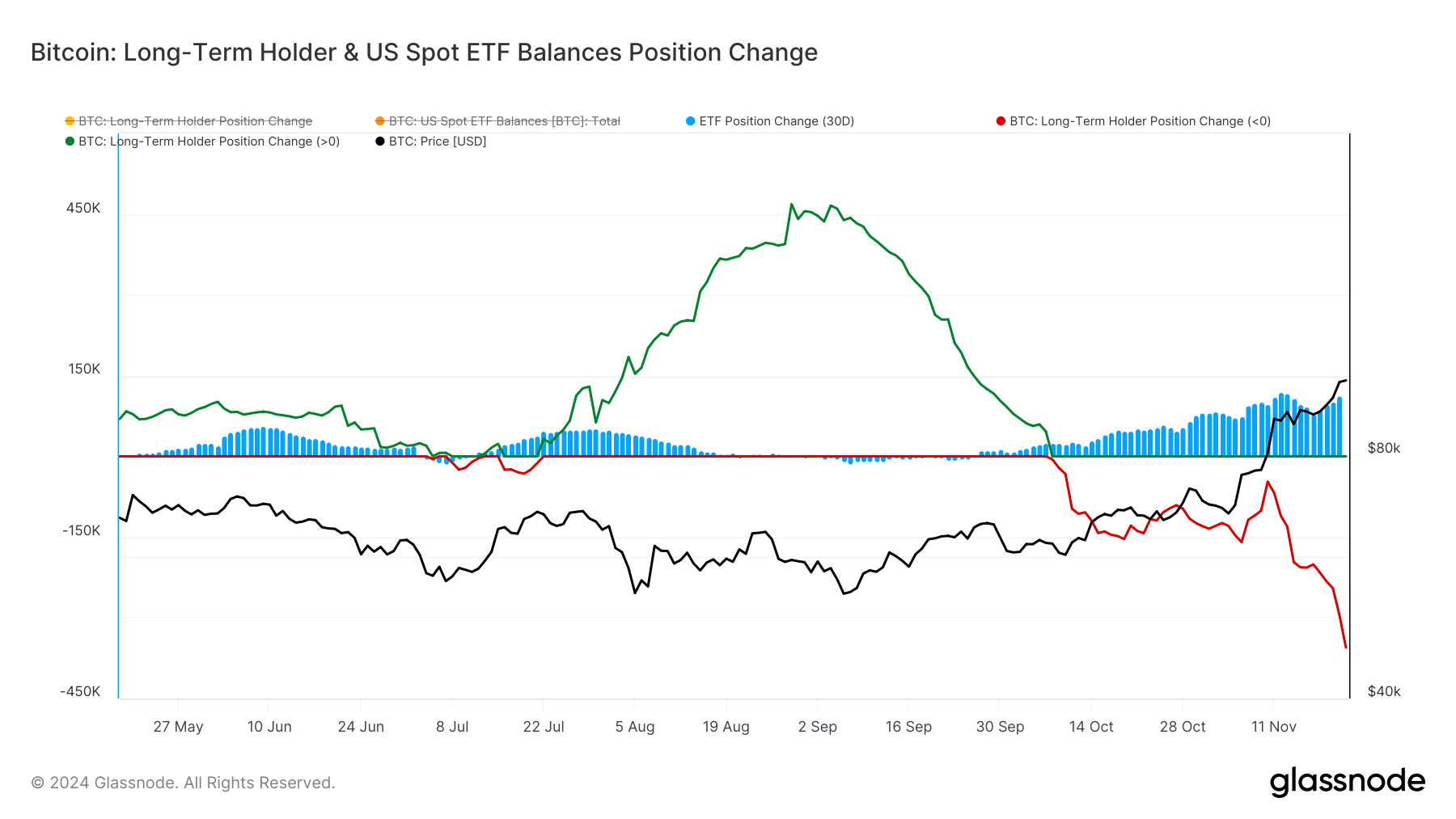

Counterbalancing the sell-off by LTHs is the strong demand for Bitcoin ETFs. The Spot ETF Position Change chart highlights consistent inflows, with over 450,000 BTC allocated to ETFs over the past month.

This surge emphasized the interest of institutional investors, who consider ETFs as an easier avenue for entering the cryptocurrency market.

The ETF flows are playing a pivotal role in absorbing the selling pressure.

In October, as the supply of LTH (Long-Term Holder) Bitcoin increased significantly, there was a notable surge in ETF holdings, suggesting that both individual investors and institutional players could be contributing to the ongoing upward trend in Bitcoin’s price.

BTC indicators signal bullish continuation

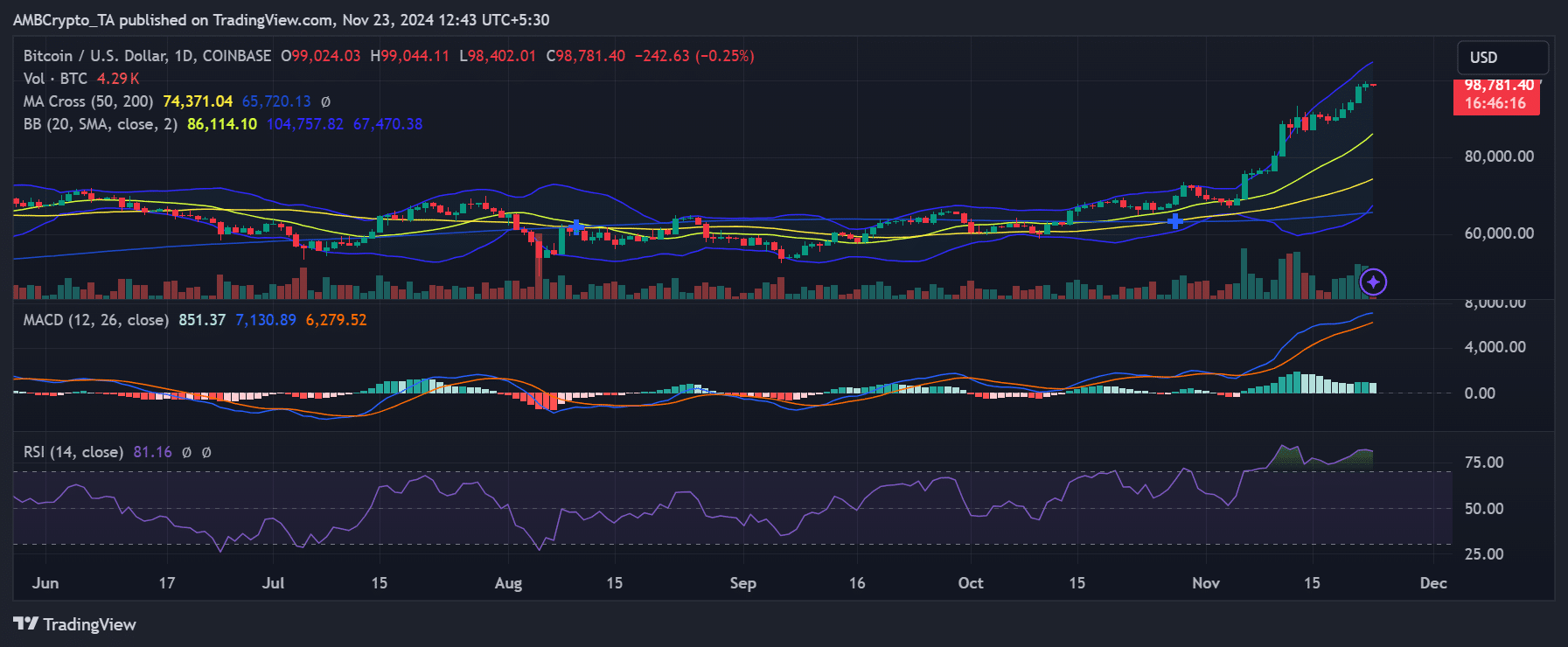

Bitcoin’s daily chart painted a promising technical outlook.

As an analyst, I observed that the price consistently hovered above crucial moving averages. Specifically, the 50-day and 200-day Moving Averages served as robust support levels at approximately $74,000 and $65,000 respectively.

Furthermore, the Bollinger Bands indicated increased price fluctuations, as Bitcoin was close to the upper limit – a signal suggesting strong upward movement.

Momentum indicators like the MACD and RSI further confirm the positive sentiment.

In simple terms, the Moving Average Convergence Divergence (MACD) suggested a bullish trend since it was positioned within positive territories. The histogram, which represents momentum, was escalating, showing a strengthening trend. Meanwhile, the Relative Strength Index (RSI) stood at 81, signaling that the market might be overbought, indicating a potential reversal could occur.

Regardless of Bitcoin appearing overbought, past market patterns indicate that it might continue rising during a bull run when it’s in this state.

The interplay between profit-taking by long-term holders and demand from spot Bitcoin ETFs highlights a market balancing act.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite the potential for a correction being high because of increased Long-Term Holder (LTH) activity, the arrival of institutional investment through ETFs may keep Bitcoin’s upward trend strong.

As BTC approaches $100,000, these metrics will be crucial in shaping its path forward.

Read More

2024-11-23 19:04