-

BTC bulls have managed to leverage the earlier dip to test the $61K ceiling.

The critical task now is to maintain $64K; missing this level could lead to a likely retracement.

As a seasoned crypto investor with a decade-long journey navigating the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The recent climb of BTC to $61K is an encouraging sign, but I remain cautiously optimistic.

1) The price of Bitcoin (BTC) is approaching its peak from late August at around $64,000. However, until it surpasses this level, the possibility of a breakout remains unclear since underlying factors might interfere and potentially slow or halt a breakout if market conditions weaken.

Bitcoin market is realizing profit

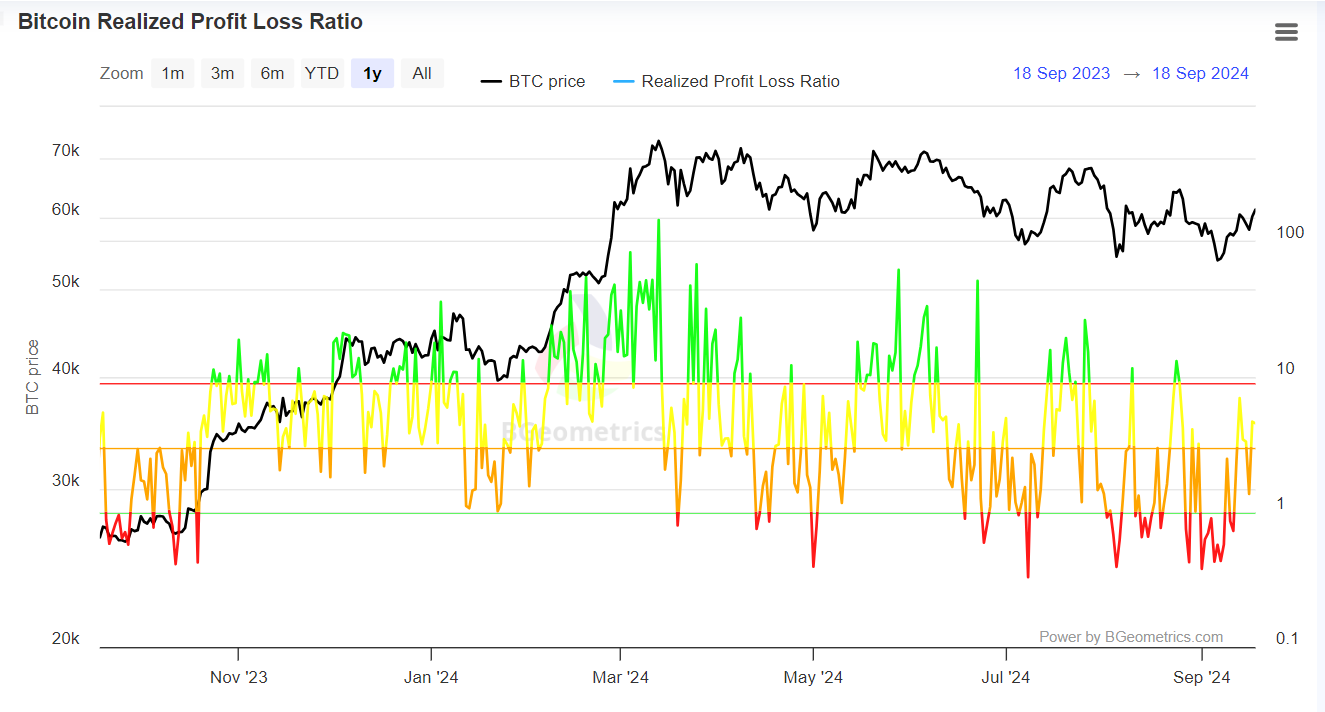

About a year ago, I observed that Bitcoin investors were facing losses, suggested by a nearly zero Net Realized Profit/Loss (RPL) ratio. In simpler terms, the number of Bitcoins sold at a loss was significantly higher during this period.

This usually happens during periods of significant market turbulence, when investors’ trust in a turnaround wanes.

Source : BGeometrics

Approximately a year on, the Bitcoin market is currently reaping significant returns, inspiring shareholders to continue holding in anticipation of further benefits. It’s clear that the Federal Reserve’s interest rate reduction has played a key role in driving this upward momentum.

From my perspective as an analyst, the market currently maintains a balanced stance. A substantial surge might flip the Net Relative Price Level (RPL) ratio, which could hint at a potential market peak, based on the insights from AMBCrypto.

To put it simply, the market still has room to grow, suggesting a positive trajectory and chances for further expansion. The crucial point is whether investors who are optimistic about this trend will seize the opportunity for significant profits or instead opt for more modest returns.

LTHs capitalize on BTC price bottom

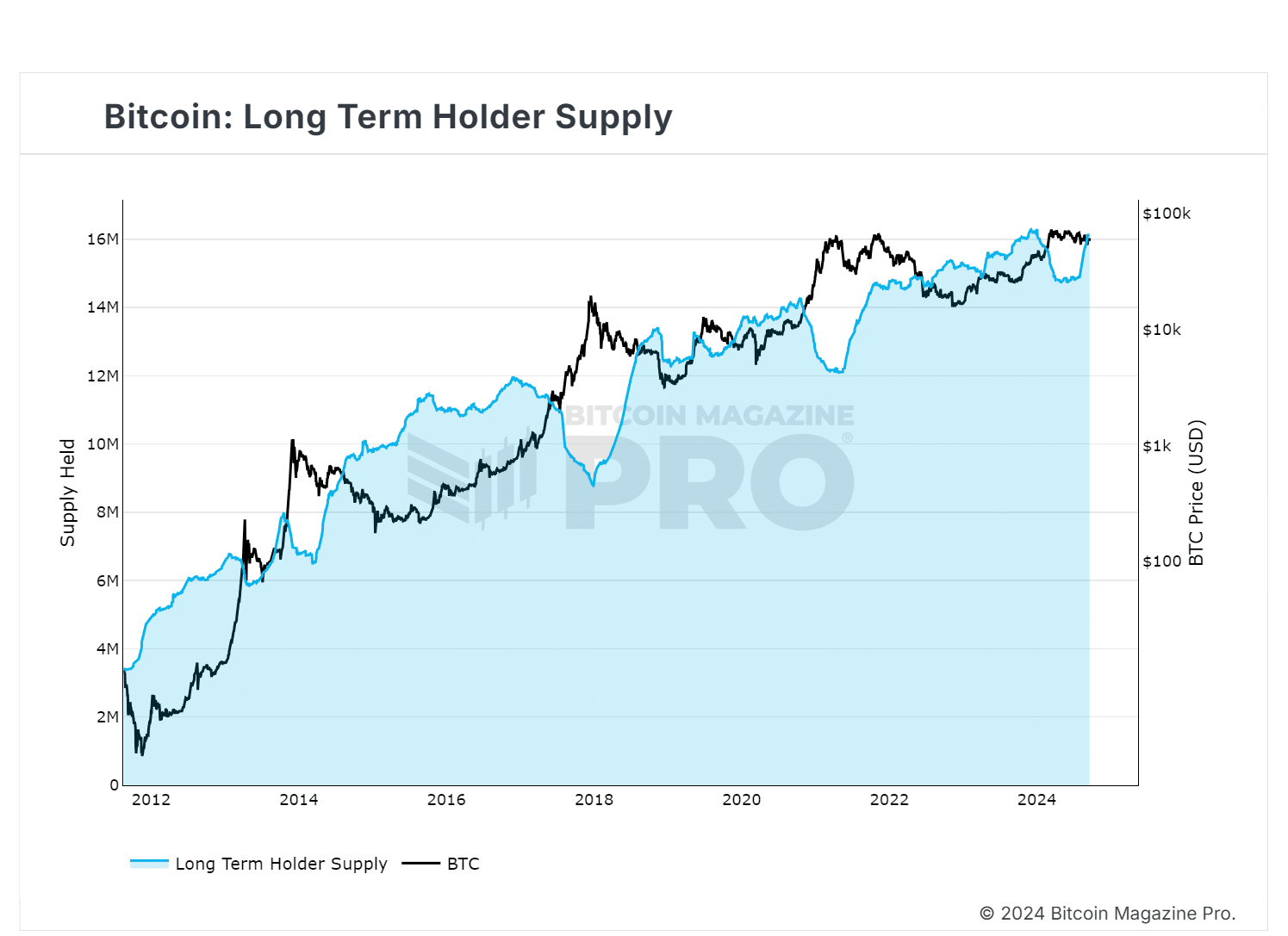

In the past, extended periods (over 155 days) of decreased Bitcoin (BTC) supply have frequently coincided with market peaks, as owners cash out their gains, causing prices to fall.

In the most recent event, when Bitcoin (BTC) dipped below $55,000, the volume of available supply significantly increased, suggesting that long-term investors seized the opportunity to buy at a lower price.

Source : Bitcoin Magazine Pro

This contributed to an increase in optimism, as it seems that major investors consider $64K as the base price, stockpiling for potential future profits, with their eyes set on the next resistance level approximately $70K.

In summary, the reduction in interest rates has served as a beneficial addition to our plan, boosting the chances for recovery and bolstering faith in keeping this investment.

Caution is advised

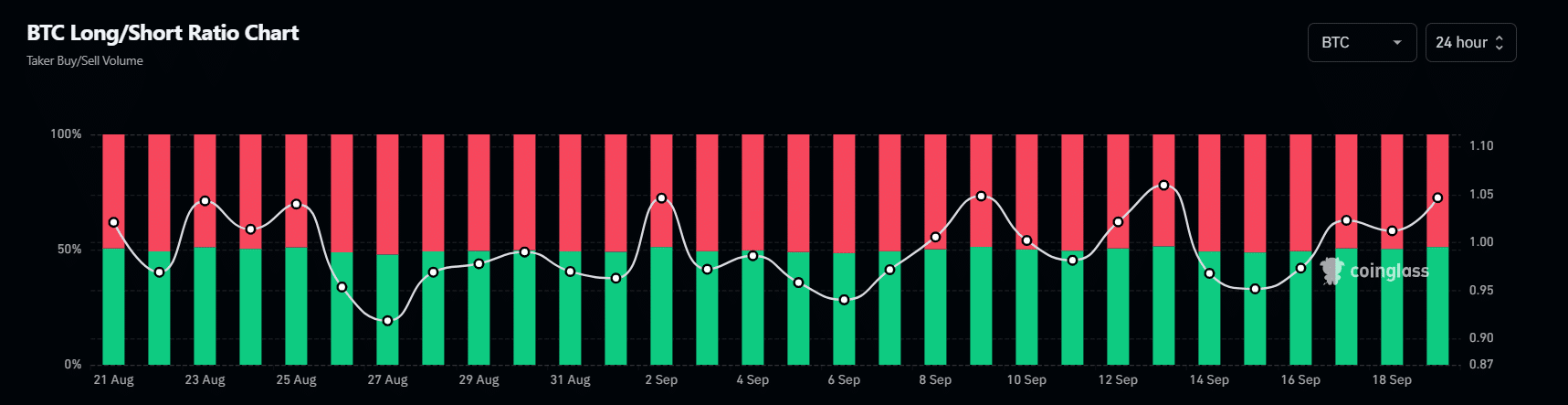

It’s not surprising that Bitcoin (BTC) is prone to fluctuations in the perpetual market given its current state. At present, there’s a predominance of long positions in speculative trading, while institutional investors are generally avoiding shorting Bitcoin.

Source : Coinglass

At the beginning of the final week in August, a comparable trend unfolded, as long positions exceeded short ones for three consecutive days, setting the stage for a situation that could trigger a ‘short covering rally.’

Read Bitcoin’s [BTC] Price Prediction 2024-25

Initially, Bitcoin soared up to $64K, but it tumbled down to less than $55K the following day when short positions took control again. To prevent a similar situation from happening, keeping your Bitcoin at $64K could be beneficial.

Even though graphs indicate a bullish trend currently, it’s important to exercise caution. A potential drop down to around $55K could occur if the bears regain dominance.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-20 10:16