- Bitcoin bulls have been showing up strong recently, pushing price closest to its ATH.

- Bullish optimism remains especially as the U.S elections draw near.

As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride for years now, I must admit that October 2024 has been quite an exciting month for Bitcoin enthusiasts like myself. The bullish flag pattern breakout and the push towards new all-time highs have been long anticipated, and finally, it seems we are on the brink of price discovery.

It’s widely agreed that October has been a favorable month for Bitcoin (BTC), with several factors coming into play. The accumulation trend has been steadily growing throughout the month, which played a significant role in triggering a notable shift in its overall pattern.

A potential development that might establish a lively trend and possibly reach record levels within the upcoming months.

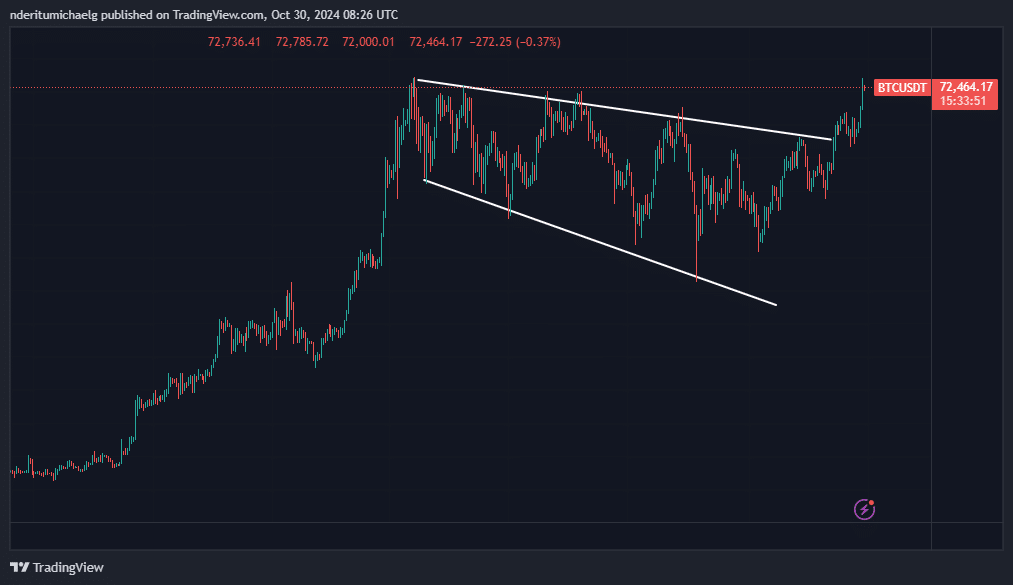

In simpler terms, following a strong upward trend during the initial three months of 2024, Bitcoin’s price action has resembled a long bullish pennant. This pattern started in March and is marked by gradually falling support and resistance lines.

The recent surge of BTC beyond its resistance point resulted in a victorious climb to $66,000, and it has since shown remarkable power in maintaining its position above that price point.

As a researcher examining Bitcoin’s price movements, I can confirm that the bullish momentum over the past five days has validated the breakout, propelling Bitcoin to approach its all-time high (ATH) of $73,777. The most recent peak in this upward trend reached $73,620.

For the first time in nearly seven months, the breakout of the bullish flag pattern has been initiated. This indicates that Bitcoin’s price might be about to embark on another significant upward trend, favoring the bulls. Essentially, we’re seeing a potential surge towards new price records and unexplored highs.

The next major Bitcoin catalyst

As the U.S. elections approach, there’s a strong anticipation that their results could significantly influence the movement of Bitcoin prices. This trend was noticeable back in July when opinions about presidential candidates and their stance towards cryptocurrency were particularly active.

Currently, Trump is viewed as the presidential candidate with the strongest support for cryptocurrencies. If he were to win, it could potentially lead to favorable movements in the price of Bitcoin. Conversely, if Harris wins, her presidency might not have the same beneficial impact on Bitcoin prices.

After the recent surge, there’s a return of uncertainty. The price seems to be struggling within its previous peak levels. Additionally, data from the blockchain indicates that major investors might be cashing out.

In the past few days, there’s been a significant increase in Bitcoin being withdrawn from large account holders. The outflow surged from no Bitcoins to 3,990 Bitcoins between October 26 and October 30. On the other hand, the inflow of Bitcoins into these large accounts peaked at 2,020 Bitcoins in the last day.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although this finding was made, the prevailing feeling indicates a rise in optimistic outlooks for the future. This was clear because the recent increase wasn’t instantly met with an upsurge of buy-off pressure.

However, higher levels of volatility are likely to manifest moving forward.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-10-30 22:16