-

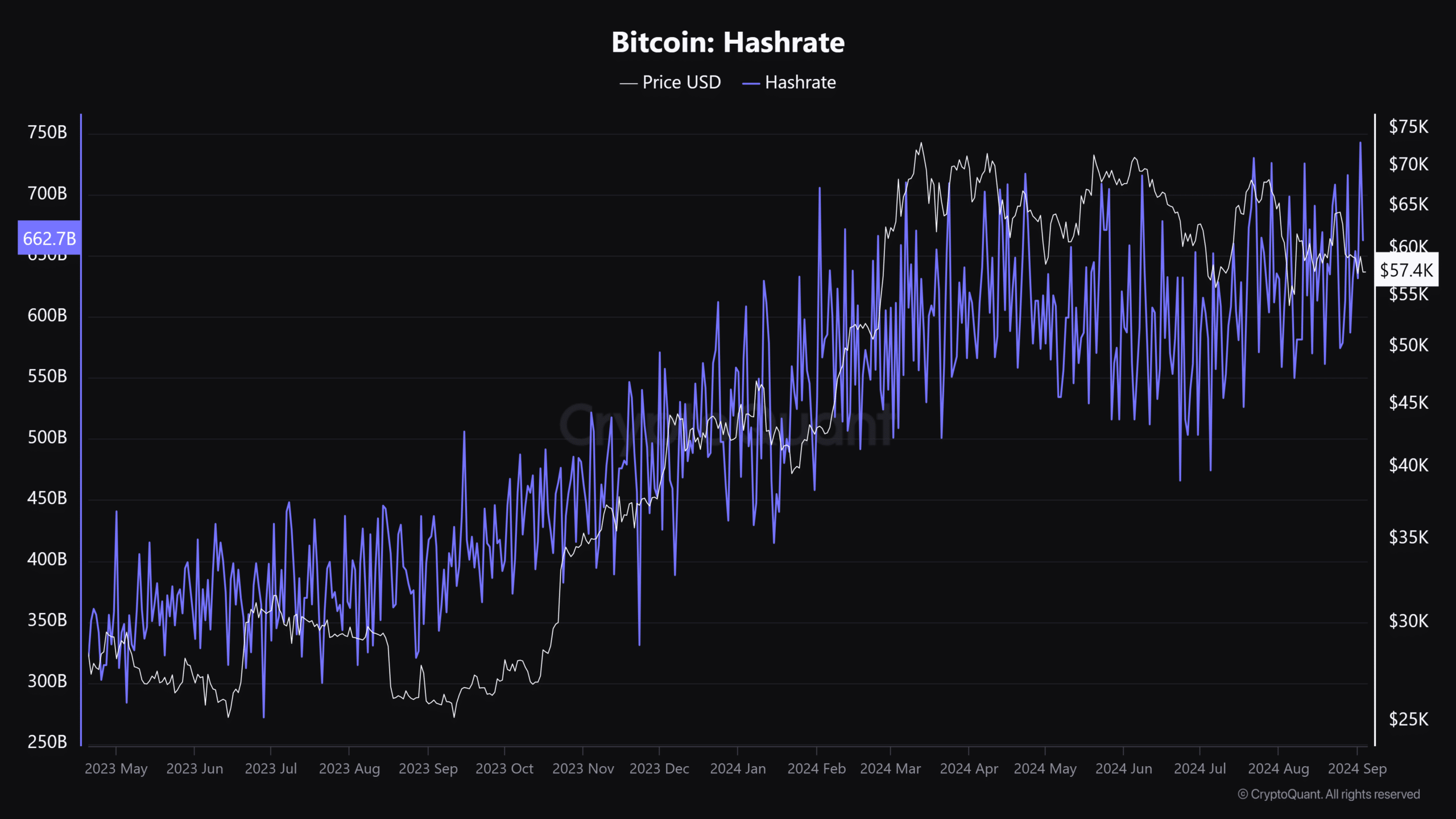

Network hashrate surged to a record high of 742 EH in September.

This increased mining costs and slashed miners’ profits, tipping them to sell 3000 BTC.

As a seasoned researcher with years of experience tracking the volatile world of cryptocurrencies, I can’t help but feel a sense of déjà vu as I observe the current state of Bitcoin miners. The record high network hashrate and soaring operational costs remind me of the gold rush days, where the lure of riches brought hordes of prospectors to the digital frontier.

Bitcoin [BTC] miners encountered challenging conditions in September due to the network’s hashrate reaching an all-time high, which put pressure on their earnings. The hashrate indicates the amount of computational power being used to mine Bitcoin. On September 1st, this figure peaked at a remarkable 742 Exahashes (EH)

The record hashrate is excellent because network security is much better than before.

On the other hand, the level of complexity in mining the next Bitcoin block stayed close to its all-time high of 90 trillion. In simpler terms, this means that it remains challenging for miners to discover the new Bitcoin block, as the difficulty level is nearly at a historic peak

To put it another way, as the difficulty of mining Bitcoin increased, miners found themselves requiring additional computational power. Essentially, this means that the potential cost for producing one Bitcoin might rise, which would particularly affect smaller-scale miners, potentially causing them underlining more pressure on these operators

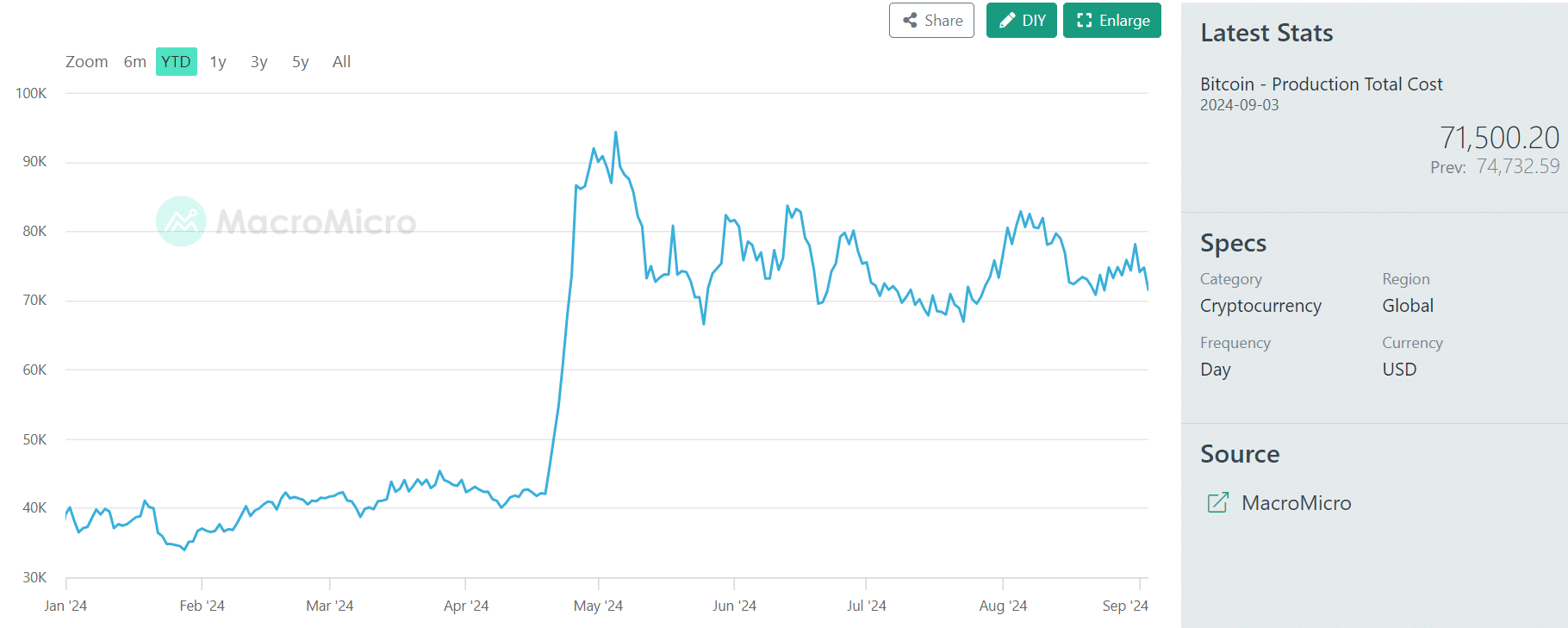

To mine one Bitcoin (Bitcoin, it costs approximately, it costs $714 September 1 BTC is estimated cost to mine BTC is approximately costs are both production costs to mine BTC’mining one coin. Estimation, the production cost to mine a single coin mining a single BTC, can be, was estimated at $7

In the long term, the value of Bitcoin (BTC) tends to increase towards its production cost. Yet, a significant gap at the start of September put pressure on miner profits. Daily earnings for miners decreased from approximately $36 million towards the end of August to around $26 million in September

Miners, faced with the BTC‘s could find themselves might have to offload their Bitcoin (BTC could be compelled to offload to BTC miner, to offloading their Bitcoin holdings holdings to offsetting their production costs, miners can be forced to cover increased production costs amid declining revenues revenue decline and increased production costs while declining

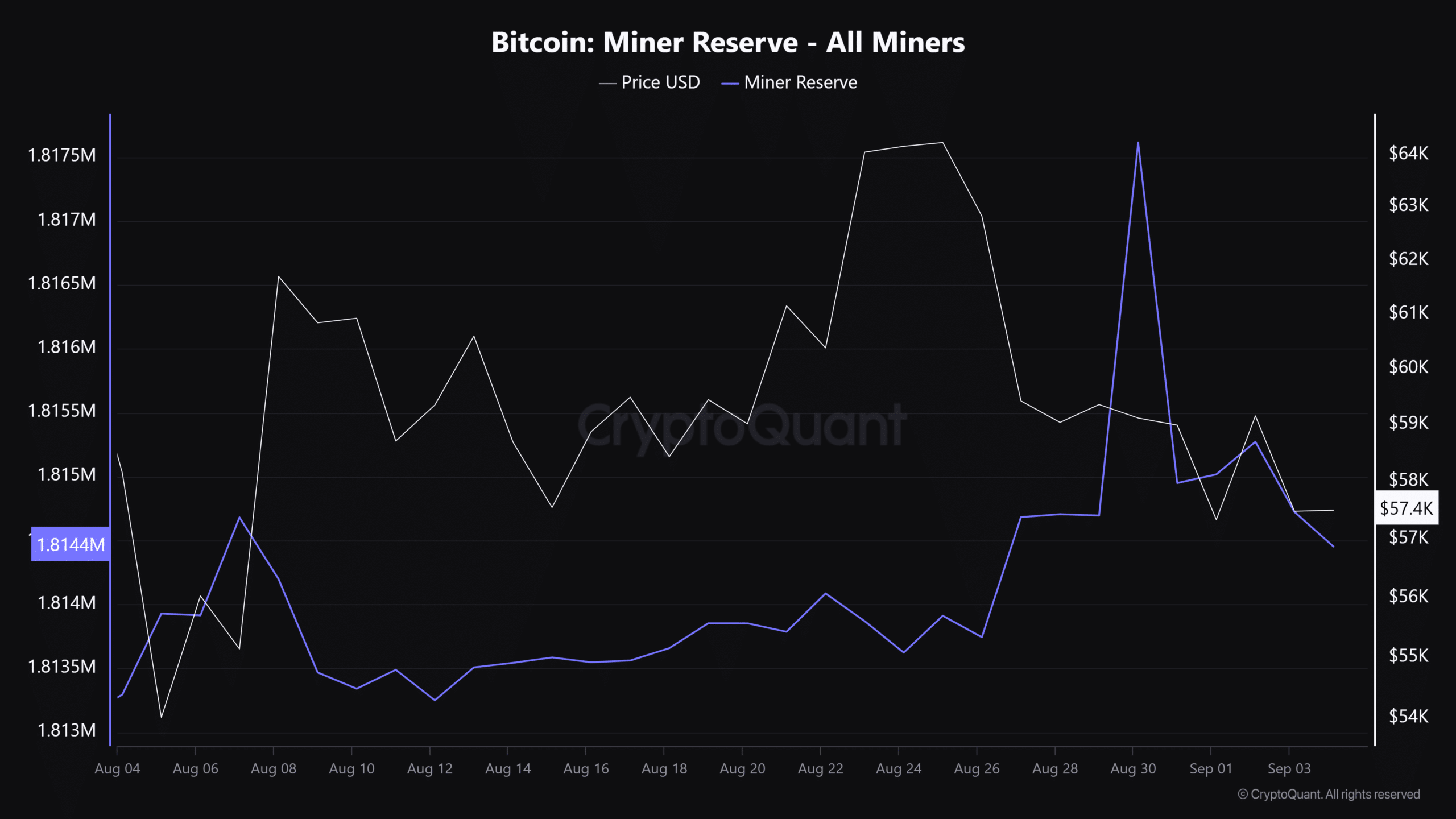

Based on data from CryptoQuant, the reserve of mined Bitcoins has decreased from approximately 1,817 thousand BTC to around 1,814 thousand coins over the last few days

The metric tracks the total BTC held by miners, and it trended upwards in August. This meant that miners held their mined BTC and, by extension, painted a mildly bullish outlook for BTC price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Instead, let me rephrase it for you: Initially, miners held onto their Bitcoin (BTC), but starting from late August, they began selling some of their holdings. As of now, miners have offloaded approximately 3000 BTC in September, a move that is probably aimed at meeting increased operational expenses

Currently, Bitcoin (BTC) is priced at approximately $57,900. If a prolonged minor selling trend continues, it might cause further decrease in BTC’s value. Therefore, keeping an eye on this situation, along with broader market news, seems advisable

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-09-05 11:03