- BTC ran up to $70K flipped network fundaments positive.

- Is it a bullish signal despite the short-term correction and likely consolidation?

As a seasoned crypto investor with battle scars from the infamous 2017 bull run and the subsequent bear market, I have learned to read between the lines when it comes to BTC’s network fundamentals. The recent surge in active addresses, mining difficulty, and network fees is indeed reminiscent of the bullish periods we’ve seen before. However, history has taught me that every bull run must face a correction or consolidation, which seems likely given the upcoming US elections.

For the initial time in October, the underlying structure of the Bitcoin [BTC] network showed signs of improvement, which a financial analyst interpreted as a promising indicator for the cryptocurrency’s future performance over the mid-term.

Based on CryptoQuant’s analysis, it’s common to see positive network indicators during bullish market phases. These signs often point towards a potentially favorable result for the asset, even if there might be an upcoming correction or period of consolidation.

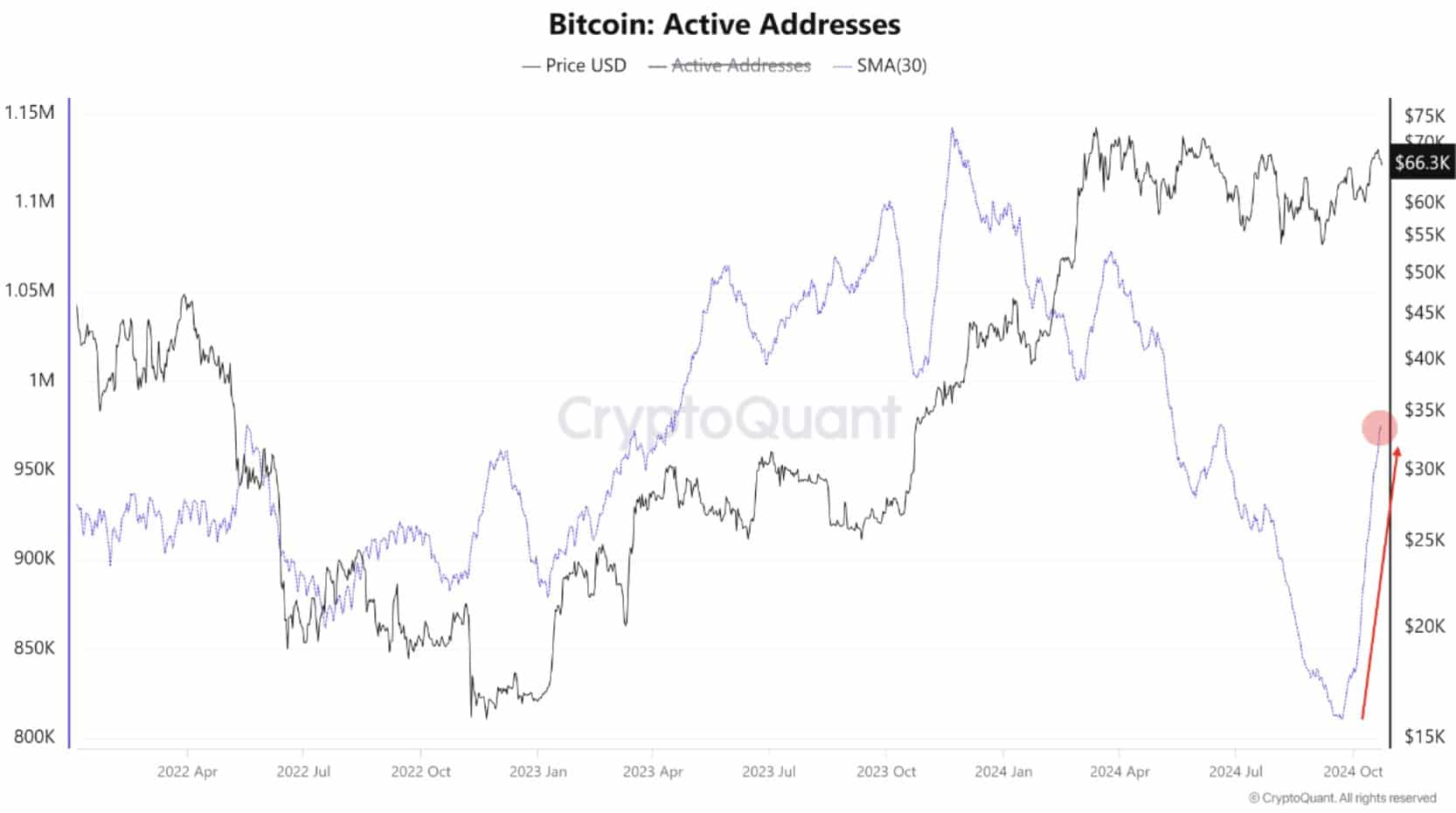

After reaching around $70K, the number of daily active Bitcoin addresses has been rapidly increasing and is now approaching 1 million. This figure hasn’t been this high since June, suggesting a significant resurgence of interest in the cryptocurrency during the recent price surge last week.

A BTC hike next?

In both the mining sector and transaction fees, a similar upward trajectory was observed. Significantly, the mining challenge reached its peak, signifying fierce rivalry among Bitcoin miners for rewards, which serves as an encouraging factor boosting Bitcoin’s inherent worth.

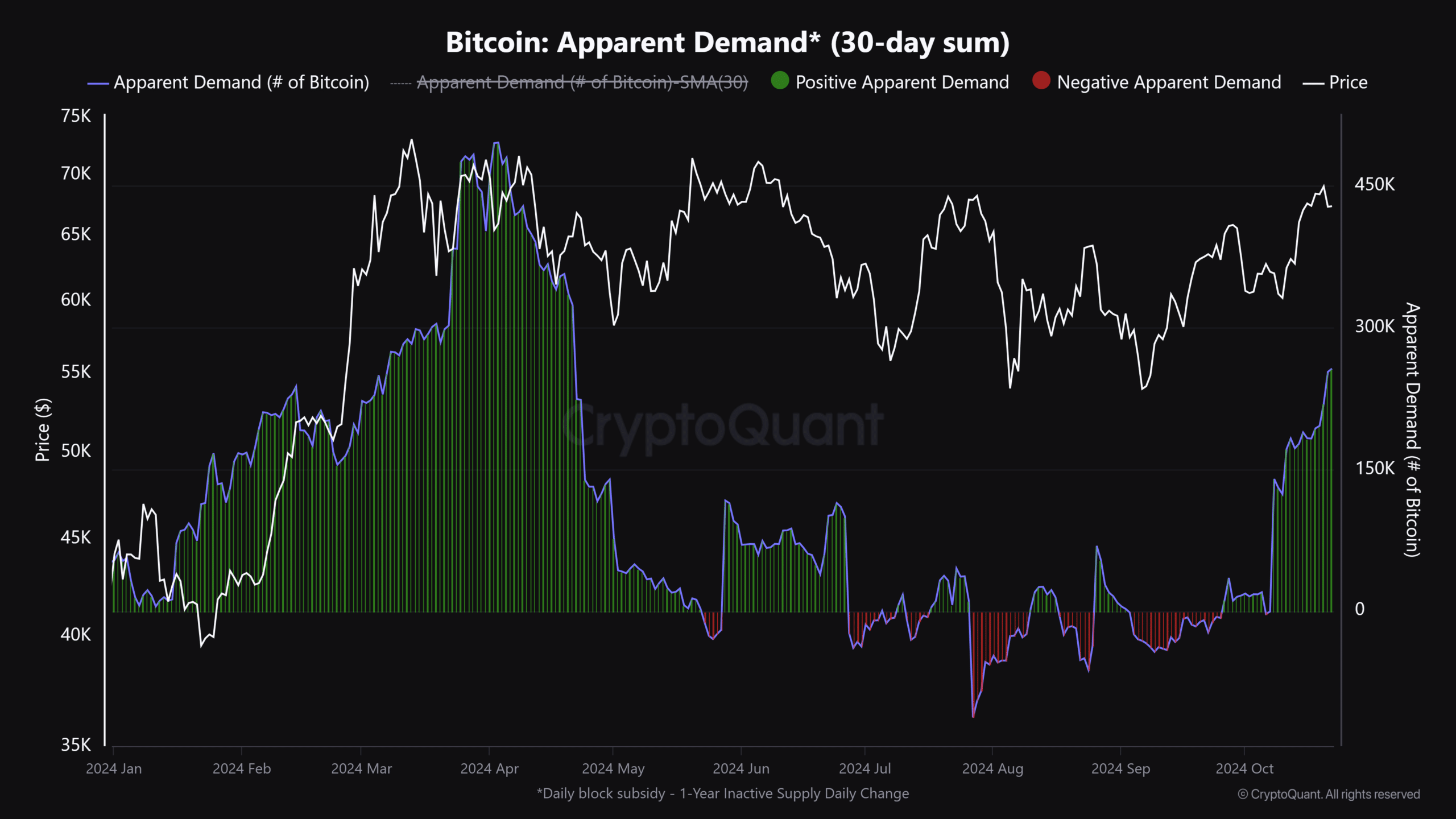

Furthermore, the gap between Bitcoin’s production and storage (demand) reached a six-month peak of 256,000 Bitcoins at the current moment. Typically, an increase in demand for Bitcoin comes before a rise in its market price.

Although there were several encouraging factors for Bitcoin, analysts’ predictions about its price fluctuated as the U.S. elections approached, reflecting a degree of uncertainty.

According to Blockworks’ analyst Felix Jauvin, it’s possible that Bitcoin (BTC) might remain within a specific price range until the upcoming election concludes.

It seems no one is keen on taking significant risks so near to the election. There might be a lot of market fluctuations before the election ends…

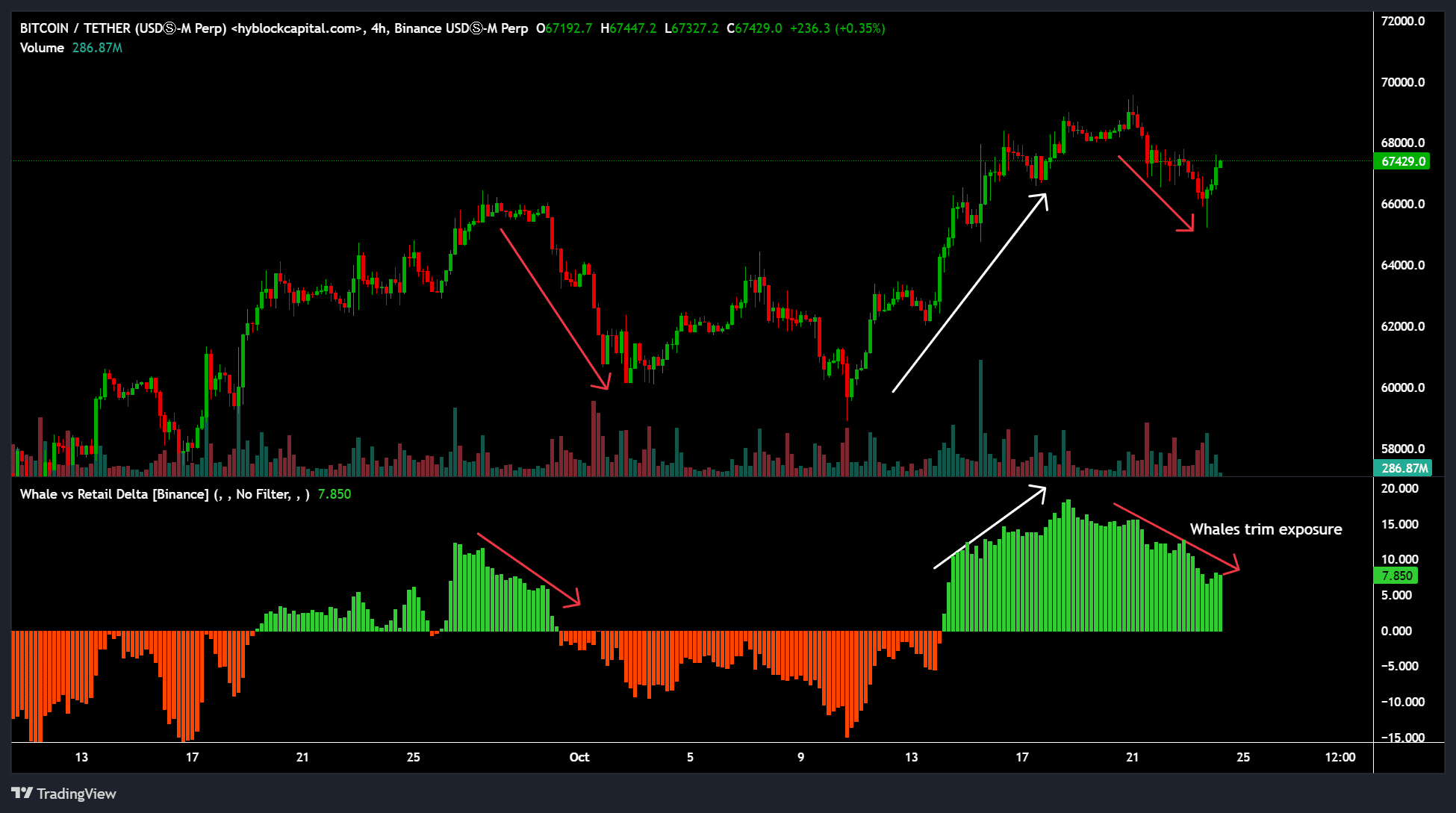

Another pundit, Justin Bennett, echoed his cautious sentiment, citing whales’ lack of interest in grabbing the recent mid-week dip.

As a researcher, since the 17th of October, I’ve been closely following the Whale vs. Retail Delta indicator, which compares the positions of ‘whales’ (large Bitcoin investors) with those of retail traders. Notably, this metric has shown a decrease recently, indicating that these larger players may have reduced their exposure in Bitcoin, signaling potential selling or trimming of positions.

It’s worth noting that options traders showed optimism, evident through their growing purchases of call options (essentially wagers that the Bitcoin price will go up), prior to the election day.

On the 22 October daily update, trading firm QCP Capital noted,

The short-term volatility prediction is reaching its highest point around the date of the election, showing an increase of approximately 10 points compared to the previous expiry. Additionally, options skews indicate a greater preference for call options over put options, even though Bitcoin is currently sitting about 8% below its record highs.

Read More

2024-10-24 14:15