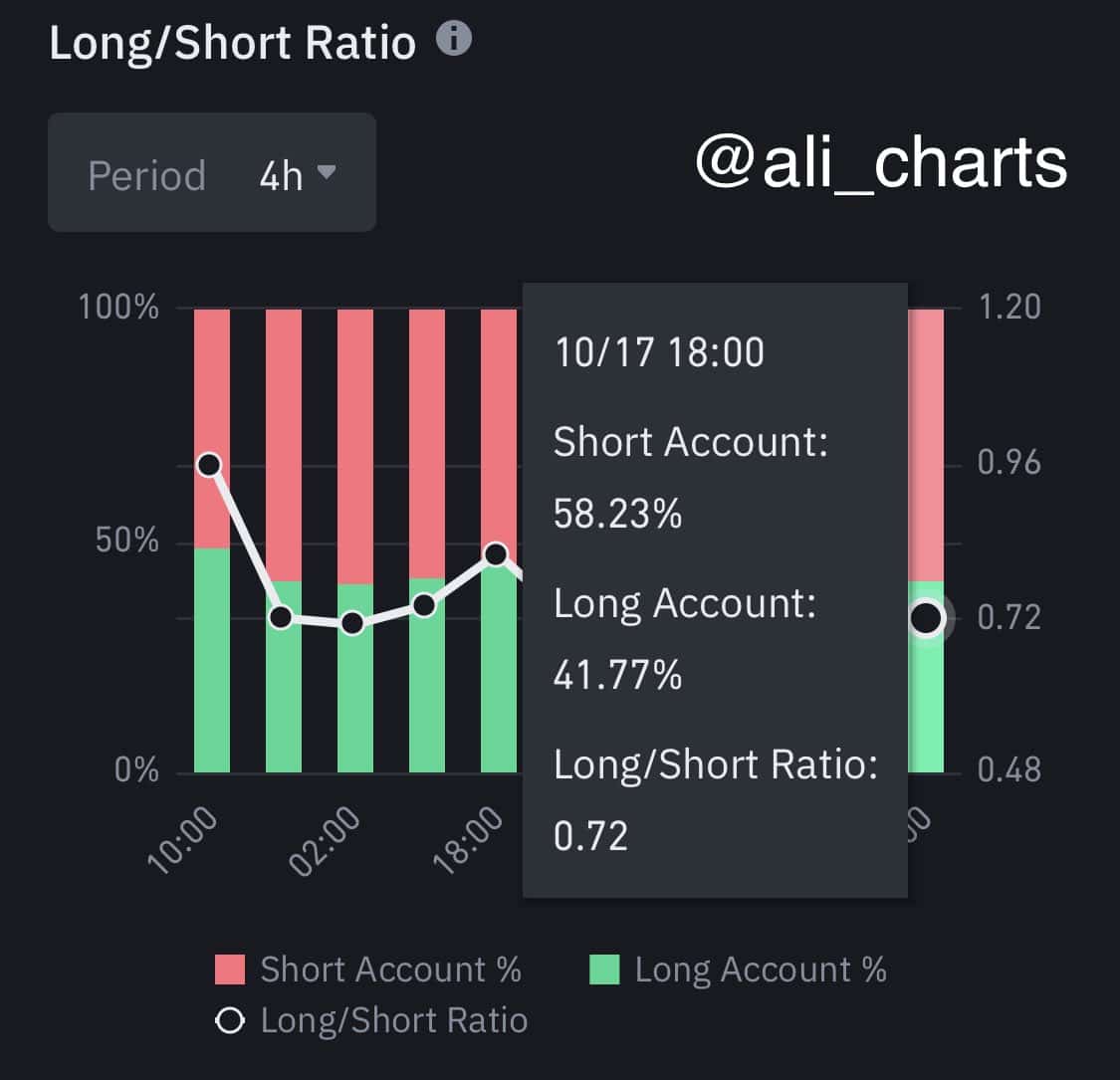

- Bitcoin short positions dominate Binance with 58.23% of accounts with open Bitcoin positions currently going short.

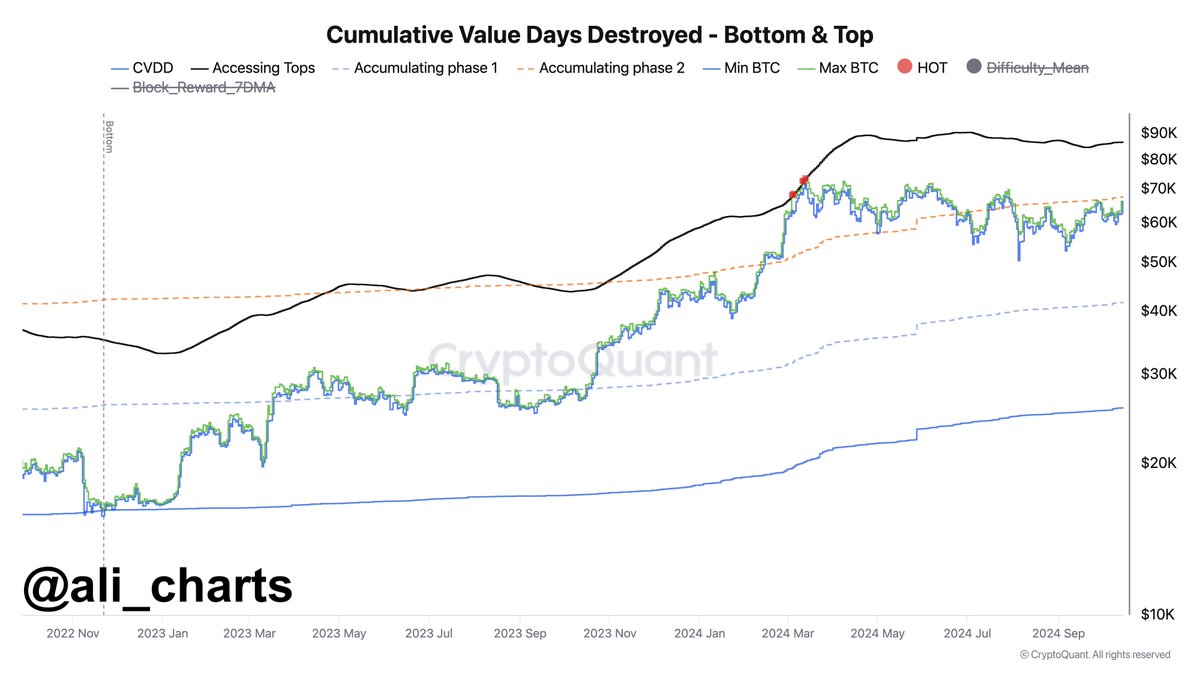

- A renown analyst suggest that break past $67,400 could push BTC to a potential top around $86,600.

As a seasoned researcher who has spent years navigating the intricacies of the cryptocurrency market, I find myself intrigued by the current state of Bitcoin [BTC]. The data from Binance and IntoTheBlock suggests a complex dynamic, with traders heavily betting on a price drop while also displaying increased interest and activity.

The price fluctuations of Bitcoin (BTC) have dominated discussions this past week, with latest figures from Binance and IntoTheBlock fueling renewed conjecture about its imminent direction.

There’s a lot to consider with many investors betting against the market and an increase in active wallets being used.

Majority of Bitcoin traders go short

Based on information from Coinglass, approximately 58.23% of active Bitcoin trading accounts on Binance have taken a bearish stance by going short. This trend suggests a high level of anticipation among traders that the price of Bitcoin may fall.

However, on the other side, such short positioning can also create sudden price jumps when Bitcoin does move against the crowd and forces those traders to cover their positions.

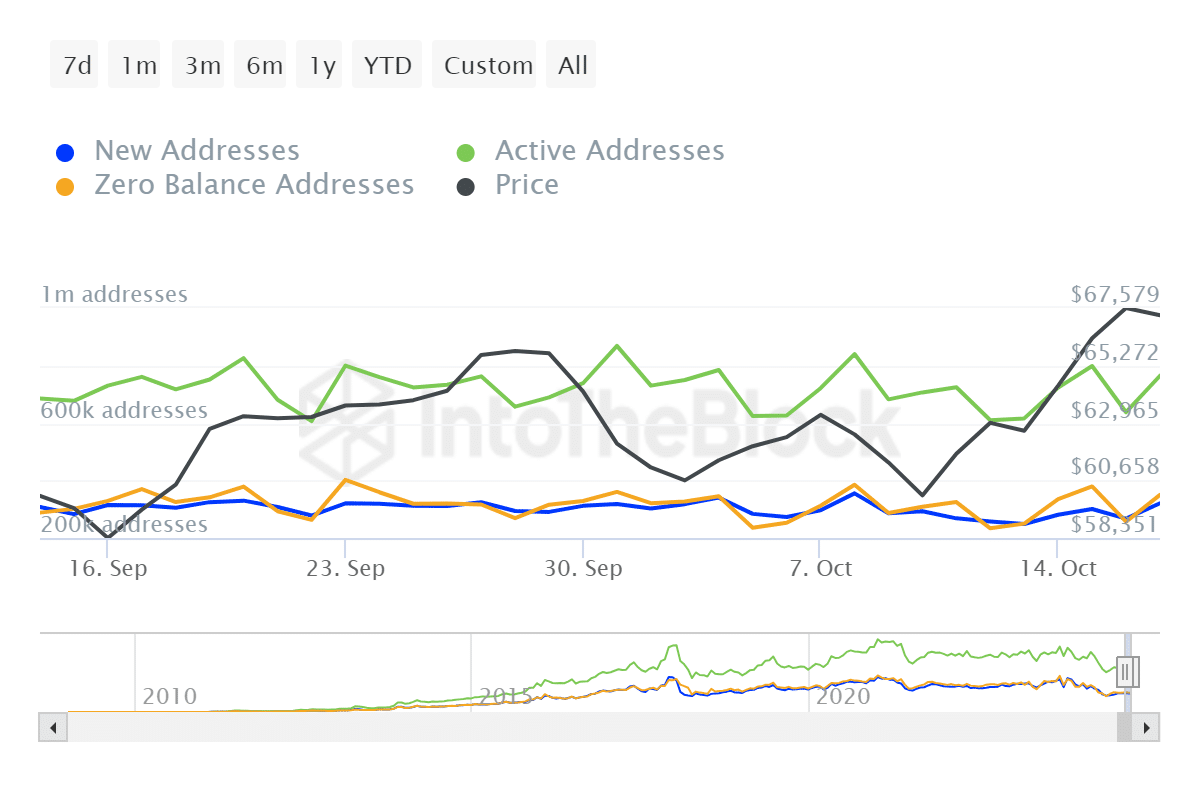

Bitcoin trading activity heats up

Based on data from IntoTheBlock, the number of active Bitcoin addresses has increased by 19% over the past day to reach approximately 764,380. Such an increase in activity typically indicates growing enthusiasm and engagement within the market, potentially hinting at a possible price fluctuation.

More active addresses hint at rising demand, adding more weight to the potential upward rally.

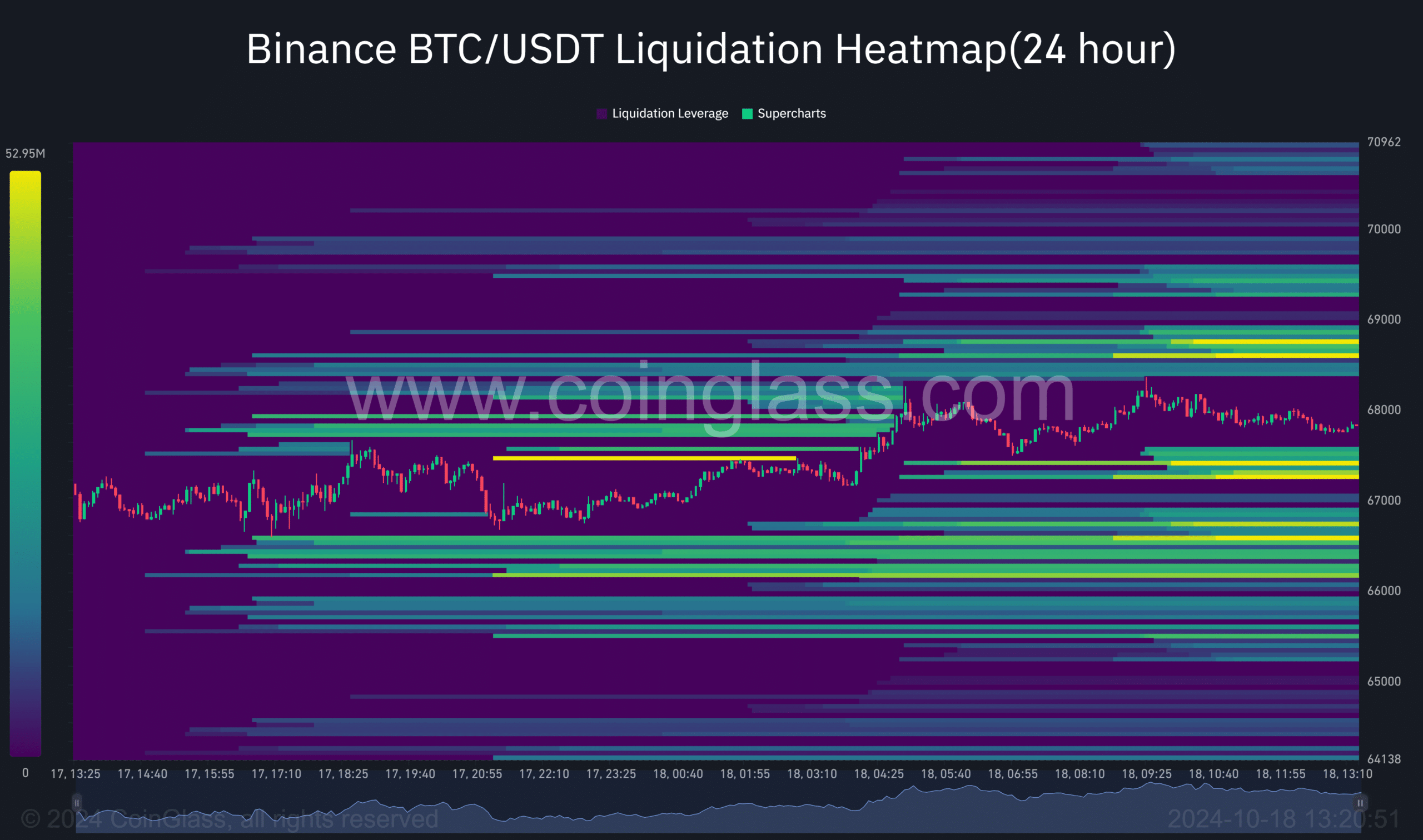

Bullish liquidity signals a potential upswing.

As an analyst, I’m observing that despite the short positions being active, the liquidity data indicates a predominantly bullish sentiment. A crucial price point to keep an eye on is the $68,600 level, as approximately $49.02 million in Bitcoin could potentially be liquidated at this price.

It appears that numerous market players anticipate a continued surge in Bitcoin’s price, mirroring its recent trend.

$67,400 breakout could spark a rally

According to a well-known cryptocurrency expert, if Bitcoin’s current price can surpass the present resistance at approximately $67,400, it might potentially reach a new level of around $86,600.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As an analyst, I find myself observing a fascinating divergence in the market. Although most traders are betting on a decline (holding short positions), there’s a different narrative unfolding with the surge in active addresses and liquidity indicators. This suggests that the market might be moving in a direction contrary to what many traders anticipate.

Bitcoin could soon push past its current price of around $67,400, potentially sparking further increases that might lead it to reach as high as $86,600.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-19 04:07