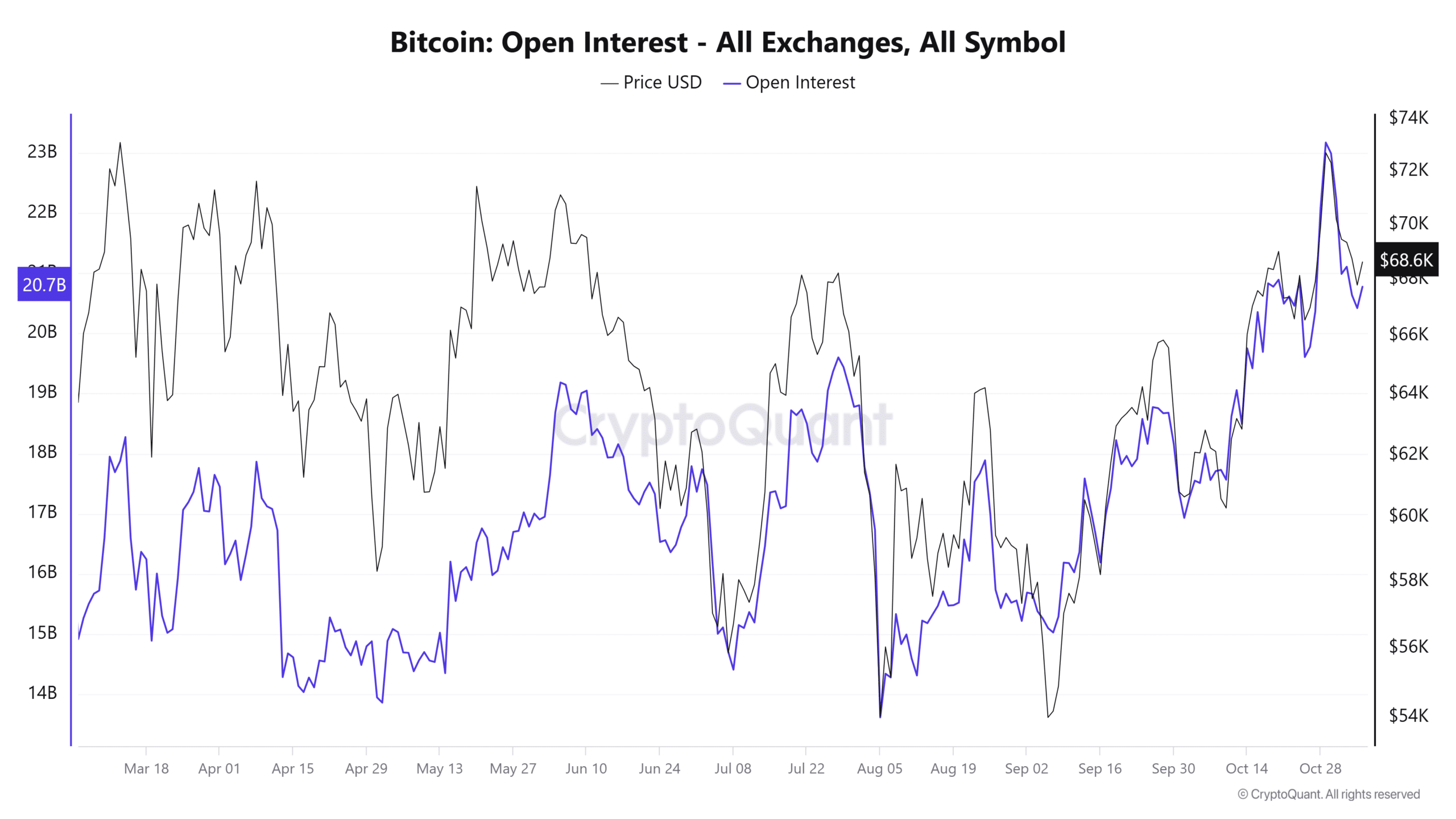

- Bitcoin open interest recently declined from $23 billion to $20.7 billion.

- Despite the drop in open interest, BTC’s price remains above $68,000.

As a seasoned market analyst with over two decades of trading experience, I have seen my fair share of market shifts and volatility. The current state of Bitcoin (BTC) open interest has caught my attention, with its recent decline from $23 billion to $20.7 billion. Historically, this trend indicates traders are becoming more cautious amidst uncertain market conditions, a pattern not unfamiliar in the world of finance.

Bitcoin’s [BTC] open interest and price movements are showing significant changes as market volatility rises leading up to the U.S. election week. The data reveals a steep decline in BTC’s open interest across all trading platforms, implying that traders are adopting a more cautious stance due to the uncertain state of the market.

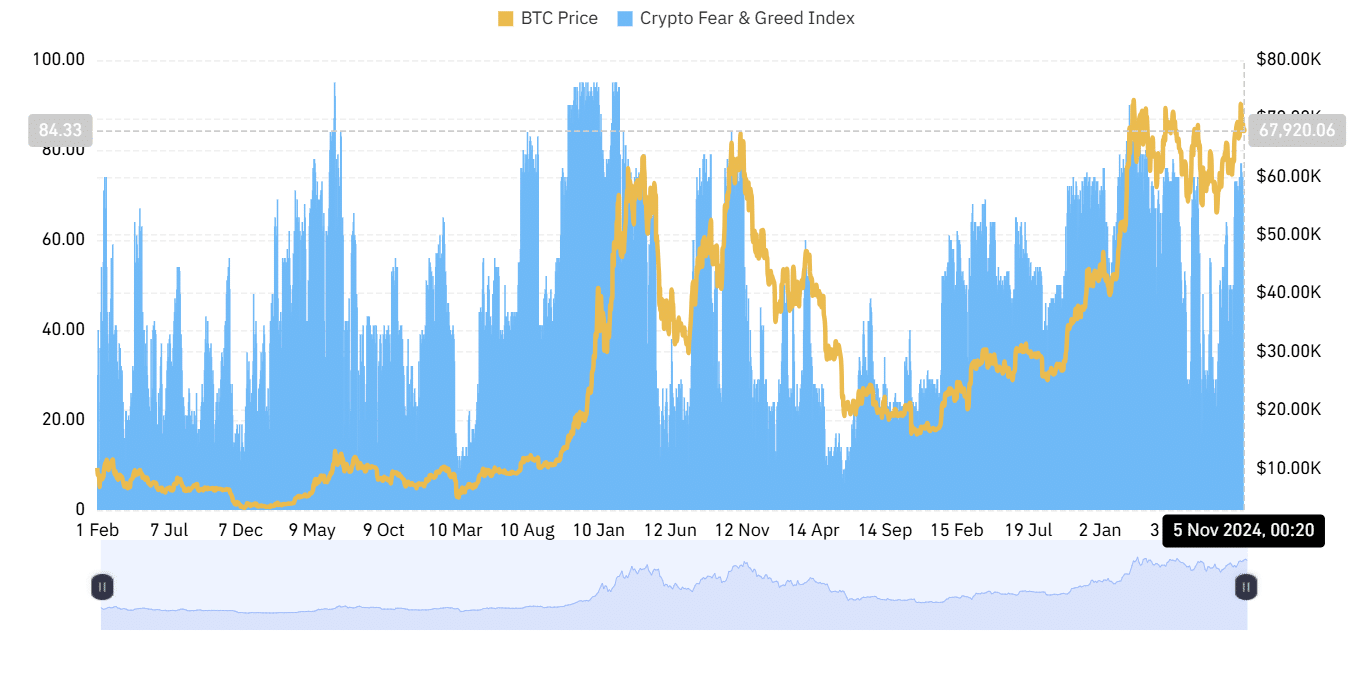

At present, we see a mix of caution and optimism dominating the current scene, accompanied by increased uncertainty as indicated by the escalating volatility in the S&P 500 (as measured by the VIX index) and the high levels on the Crypto Fear & Greed Index.

Bitcoin open interest decline: A sign of caution or an opportunity?

The current Bitcoin open interest has dropped from around $23 billion to $20.7 billion, indicating that traders are closing their leveraged positions and adjusting their strategies.

Historically, a decrease in open interest suggests traders are reducing their market exposure, possibly moving away from risky investments. This shift might be due to the upcoming U.S. election, as such political events can introduce additional uncertainties and volatility into financial markets.

It’s intriguing to note that even though open interest is falling, Bitcoin’s price continues to hover around $68,000. This stability could be a sign of its underlying power. The fact that it’s holding firm might mean that while people are reducing their leveraged positions, there’s still strong demand for buying Bitcoins outright, which could be fueled by long-term investors.

For traders, the reduction in open interest could signal a pause in speculative activity, but for long-term investors, it reinforces confidence in Bitcoin’s upward potential.

U.S. election’s impact on Bitcoin Open interest and market volatility

The Volatility Index (VIX) for the S&P 500 has climbed to approximately 21.97, indicating a surge of apprehension within conventional markets. Typically, elevated VIX values coincide with a more cautious approach towards riskier investments such as cryptocurrencies.

It seems that investors are getting ready for potential wider market swings with the upcoming U.S. election, impacting not only stocks but also cryptocurrencies such as Bitcoin.

The Relative Volatility Index (RVI) for Bitcoin, presently at approximately 47.7, suggests possible significant price fluctuations but with no clear dominant trending pattern.

As the Relative Strength Index (RSI) approaches 50, Bitcoin may continue to exhibit significant ups and downs, mirroring a sense of caution as the election draws near. Any regulatory changes following the election, especially those pertaining to digital assets, could potentially increase Bitcoin’s volatility.

Bitcoin Open interest and sentiment indicators: Optimism amid caution

As an analyst, I’ve noticed that although we’re exercising extra caution, the Crypto Fear & Greed Index reads a robust 70 (Greed). This indicates a predominantly positive sentiment despite the caution, suggesting that traders are optimistic. The disparity between this upbeat feeling and the restrained trading activities hints at a market eagerly awaiting clarity post-election, in search of more definite signs to guide their decisions.

Previously, Bitcoin tends to exhibit periods of stability or minor decreases after an election, only to resume its trend later on.

A mix of positive attitudes among traders and a decrease in the number of open Bitcoin positions might suggest that they’re cautious about adding more borrowed funds, but at the same time, they expect Bitcoin’s value to remain robust.

In simpler terms, when there’s an increase in positive feelings about investing, but less risk is being taken (lower leverage), it usually means a period of calm follows, where hopeful investors pause and watch for market turbulence to decrease before they decide to invest more fully again.

Outlook for Bitcoin’s price and Open interest post-election

The outcome of the U.S. election could significantly influence the direction of Bitcoin’s future price fluctuations. This is because both political decisions and broader economic trends play a crucial role in shaping its movement.

Traders might keep an eye out for Bitcoin surging past $70,000 or maintaining a steady rise above crucial support points as signs of a continued upward trend following the elections. On the flip side, an unforeseen election result or fresh regulations could potentially cause short-term disruptions in Bitcoin’s trajectory.

Read Bitcoin (BTC) Price Prediction 2024-25

With the election drawing near, Bitcoin seems to be maintaining a steady position, bolstered by lasting trust but also showing signs of cautiousness in the immediate future.

Essential indicators like the Bitcoin Open Interest and the Fear & Greed Index are key factors in determining market mood. Based on the election results, Bitcoin might hold steady or aim for fresh record-breaking heights in the coming months.

Read More

2024-11-05 18:16