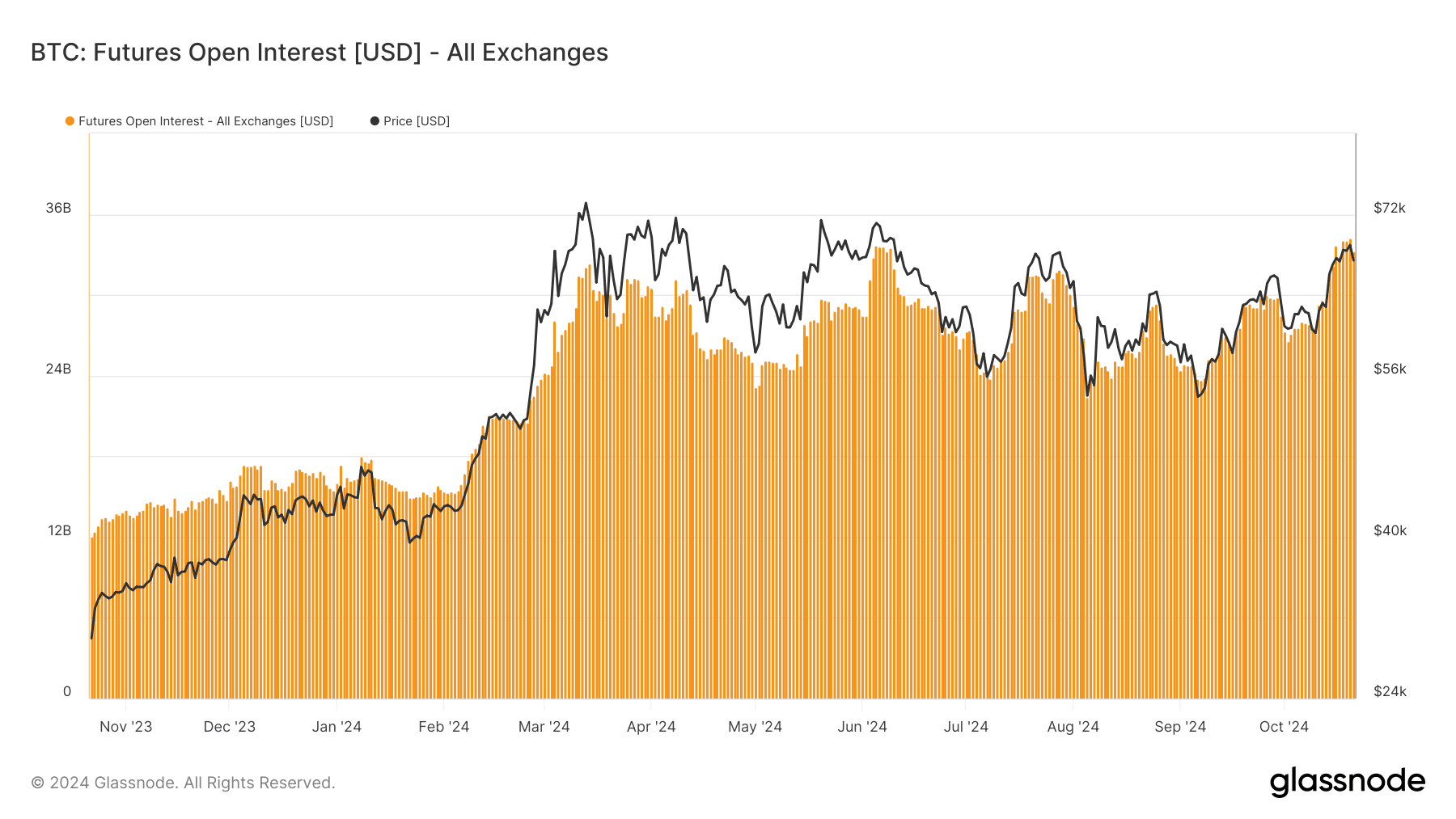

- BTC’s Open Interest has surged to $40 billion.

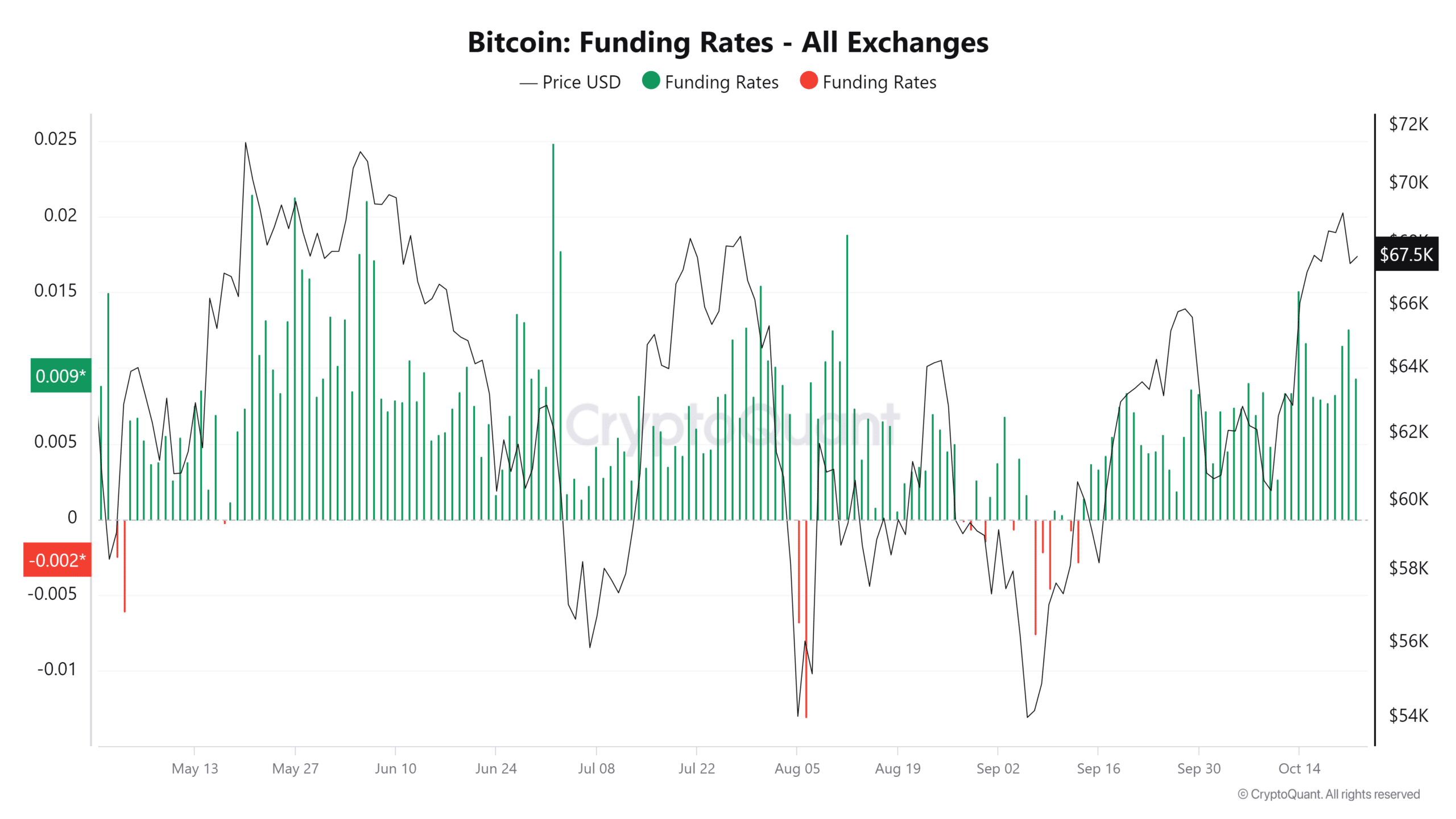

- Funding rates have also remained positive for days.

As a seasoned researcher with years of crypto market analysis under my belt, I find the current state of Bitcoin (BTC) to be quite intriguing. The Open Interest surging to $40 billion is a clear signal that the market is gearing up for some significant moves, much like a coiled spring ready to unleash its energy.

In simple terms, the total value of Bitcoin [BTC] contracts being held open in various futures markets has reached an all-time high of $40 billion in the year 2024. This spike indicates that Bitcoin is currently experiencing a significant phase, as traders are adjusting their positions in anticipation of potential price fluctuations.

Furthermore, indicators such as funding rates and trading activity provide valuable insights into the overall market mood and possible upcoming patterns.

Bitcoin’s price action and Open Interest surge

Recently, the value of Bitcoin has been steadily increasing. At the moment, it’s being bought and sold for approximately $67,578. There’s also been a notable surge in the number of open trades being conducted on different cryptocurrency platforms.

Since the beginning of October, Bitcoin (BTC) has experienced a surge in positive momentum, driven by robust market optimism. This upward trend has been reinforced by the 50-day moving average, which currently stands at approximately $62,120, providing solid support and pushing the price up to its current level.

In simpler terms, the technical indicators provide additional support for the optimistic outlook on Bitcoin. Specifically, the Relative Strength Index (RSI) stands at 62.18, suggesting that Bitcoin is currently in a bullish trend and there’s still potential for further growth before it reaches the point of being overbought.

In simpler terms, the Chaikin Money Flow (CMF) currently stands at 0.12, indicating persistent demand for Bitcoin with a significant increase in investment.

Based on Glassnode’s data, this increase in open interest indicates that traders are creating more leveraged trades, possibly expecting continued upward thrust or a substantial future price shift.

Typically, an increase in Open Interest (OI) signals the approach of increased market turbulence, as traders typically anticipate significant shifts and get ready for major market fluctuations.

Bitcoin funding rates show bullish sentiment

Examining the funding rates for Bitcoin on various trading platforms shows that these rates are usually higher than zero. This suggests that traders keeping Bitcoin in a long position are often paying more than those with short positions, suggesting a strong bullish outlook in the market.

However, while positive funding rates suggest optimism, they also come with a warning. Prolonged high funding rates can lead to overleveraged conditions, increasing the risk of long liquidations if the price suddenly corrects.

Beginning in early October, funding rates have surged along with price hikes, implying that although the market is optimistic, it might be approaching levels of resistance or potential profit-taking.

OI and volatility signals ahead

The surge in Open Interest and sustained positive funding rates reflect growing optimism in the Bitcoin market. However, with OI reaching $40 billion, traders should prepare for potential volatility.

The Average True Range (ATR) presently standing at approximately 96.16 suggests an increase in market turbulence, potentially causing significant fluctuations in prices, whether upward or downward.

Read Bitcoin (BTC) Price Prediction 2024-25

If Bitcoin continues along its current path and successfully breaches important barriers around the $68,000 mark, another price spike might occur.

As a researcher studying this market, I can’t help but notice the escalating Open Interest (OI) and funding rates, which could signal an impending price adjustment. Particularly if long positions are forced to close during a market downturn, this situation sets the stage for potential volatility in the near future. Therefore, it’s crucial that traders remain attentive and agile as we approach these days of uncertainty.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-22 23:03