- Bitcoin’s open interest has reached an all-time high, with a notable increase in shorting activity.

- While “cautious optimism” has kept BTC near $100K, the rally to $130K remains elusive.

As a seasoned market analyst with over two decades of experience under my belt, I’ve seen my fair share of market cycles and trends. The current Bitcoin [BTC] situation reminds me of that game of Jenga we used to play at family gatherings – it’s tense, it’s exciting, and there’s always the fear of a sudden collapse.

Recently, some investors predicted that Bitcoin’s price could reach $100,000 by the end of this quarter. Within only two weeks, Bitcoin has come very close to this prediction, reaching nearly $99,000 and establishing a new all-time high.

In the time since the election, approximately $4 billion has been invested in U.S.-based Bitcoin exchange-traded funds (ETFs). Recently, BlackRock’s ETF alternatives have had a successful launch, with more investors opting for call options, or bets on price growth, over put options, which are wagers on price decreases.

Even though Bitcoin is experiencing significant increases, it hasn’t completely reached its intended level of growth. Every new all-time high since the election has encountered resistance, suggesting that the current growth may be overextended.

Reaching $100K with the current pace seems plausible. Yet, it’s important to consider some critical aspects before expecting Bitcoin to hit $130K. These include Bitcoin open interest at an all-time high, Relative Strength Index (RSI) indicating overbought conditions, and signs of weaker investors exiting the market.

High Bitcoin open interest underscores strong demand

Over the past ten trading days, Bitcoin’s day-to-day increase has decreased to approximately 3%, marking a significant drop compared to the immediate days following the election where daily gains exceeded 10%. This decrease could suggest a period of relaxation or consolidation.

On the other hand, despite some high-risk factors, there’s a positive twist in this situation. Unlike past cycles, investors seem to be adopting a more measured optimism as Bitcoin enters potentially risky zones, rather than rushing to exit, anticipating an immediate correction.

This optimism is driven by bulls targeting $100K as the next key milestone for Bitcoin, motivating investors to jump in and capitalize on the rally. As a result, the number of new addresses holding BTC has doubled in the last 30 days.

It appears that the trend in the derivative market is mirroring the main one. According to Coinglass, the open interest for Bitcoin has reached an unprecedented peak of $57 billion, suggesting that an increasing number of investors are wagering on Bitcoin’s future price movement.

Essentially, these elements emphasize a robust desire for Bitcoin at its current prices. The fear of missing out (FOMO) continues to stoke curiosity, which keeps Bitcoin steady even when it appears to be stretched beyond normal limits.

If the current momentum can maintain Bitcoin near $100,000, its future increase depends on the continued robustness of this trend and a positive overall economic environment. However, if short-sellers in the derivatives market regain control, or fear of missing out (FOMO) diminishes, there could be a long squeeze that drives Bitcoin down to $89,000 before reaching $130,000 – unless the current range becomes strong support instead.

Odds of $100K converting into firm support

Examining this graph, several alternative coins seem poised at significant points of attention, whereas Bitcoin seems ready for a possible false breakout beyond its current range’s peaks.

This warning indicates that Bitcoin’s rise might not last long or could be misleading, while altcoins are getting close to critical price thresholds where substantial price fluctuations are imminent.

Normally, once Bitcoin (BTC) reaches a specific price level, money tends to move towards alternative cryptocurrencies (altcoins), as investors seek to lower risks and spread their profits more widely throughout the entire market. This action can significantly hinder Bitcoin’s upward momentum or rally.

As a crypto investor, experiencing significant inflow of funds into Bitcoin at current price levels could potentially transform the resistance zone around $100,000 into a supportive one. This shift would be key in ensuring the sustainability of this price range over the long term.

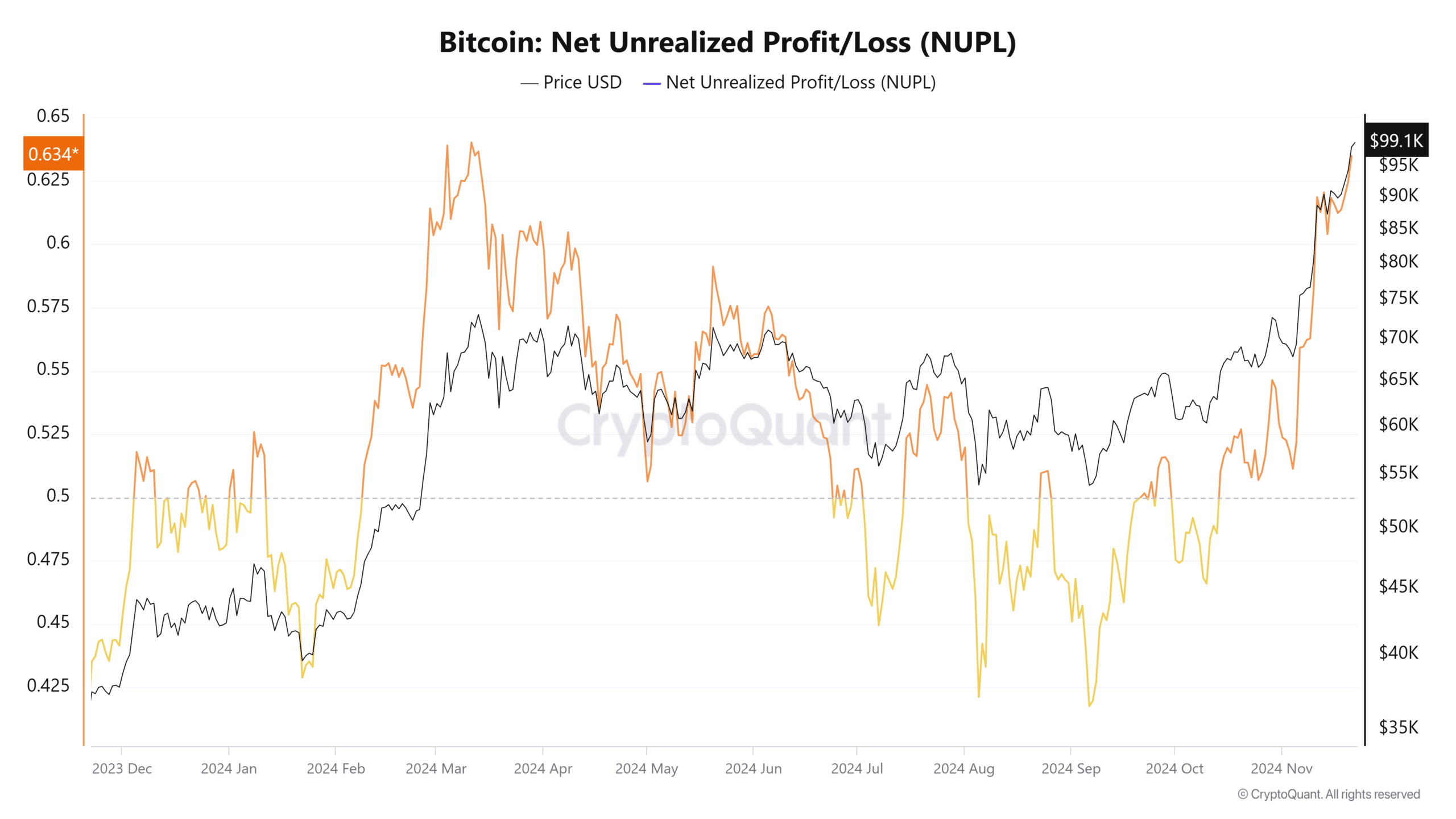

Source : CryptoQuant

Remarkably, the NUPL indicator appears to be mirroring a pattern seen in March, as it suggests that numerous investors are selling off their gains due to apprehension that the upward momentum may be reaching a plateau and the market might be peaking.

Earlier, I noted that demand has stayed robust, even managing to counteract selling forces, despite the market showing signs of excessive heat. Yet, it’s worth considering whether a peak might be imminent, particularly if significant alternative cryptocurrencies keep surpassing Bitcoin in performance.

Specifically, Solana is gearing up for potential major advancements prior to its upcoming Exchange Traded Fund (ETF) debut, an event that could significantly reshape market trends in the near future.

To put it simply, even though Bitcoin appears headed towards a $100K mark due to record-high open interests, escalating FOMO driving fresh enthusiasm, and robust demand offsetting indications of overexposure, there are other variables that may yet impact its course.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Considering the behavior of alternative cryptocurrencies, general market attitudes, and significant external factors, it’s important to understand if Bitcoin will continue to build steam or experience a possible pullback before reaching $130K.

As an analyst, I find this situation plausible given the significant short positions observed in Bitcoin’s open interest and the growing appetite among investors for cost-effective assets. Given the substantial risks associated with Bitcoin at these lofty prices, it’s no wonder that more investors are drawn to such opportunities.

Read More

2024-11-22 15:04