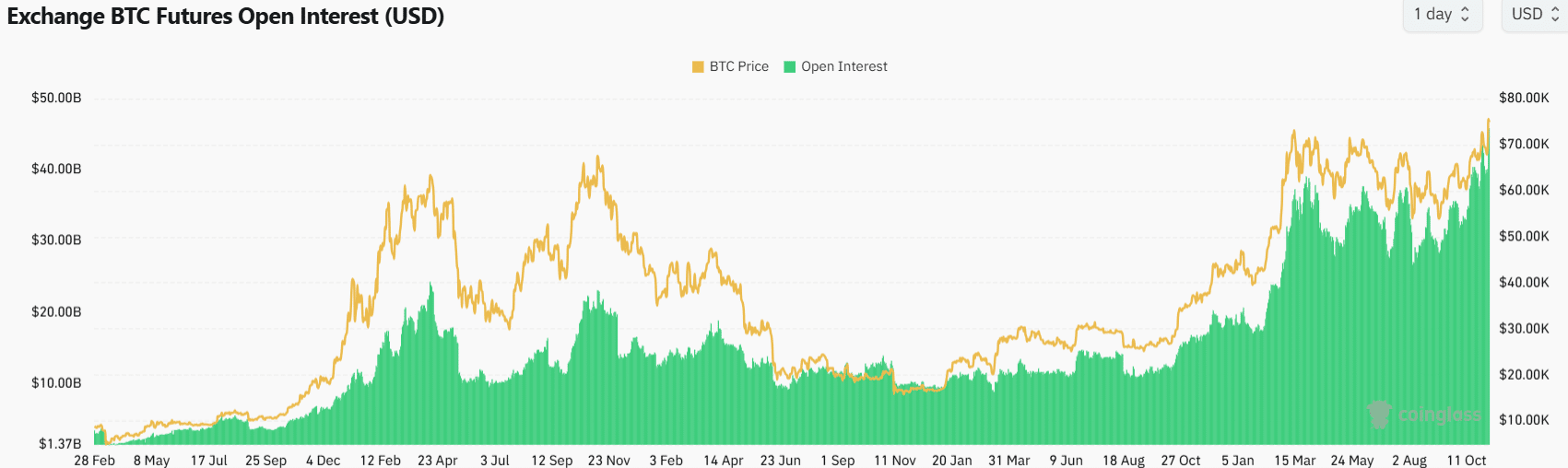

- Bitcoin set a new all-time high for Open Interest, reaching $45.8 billion.

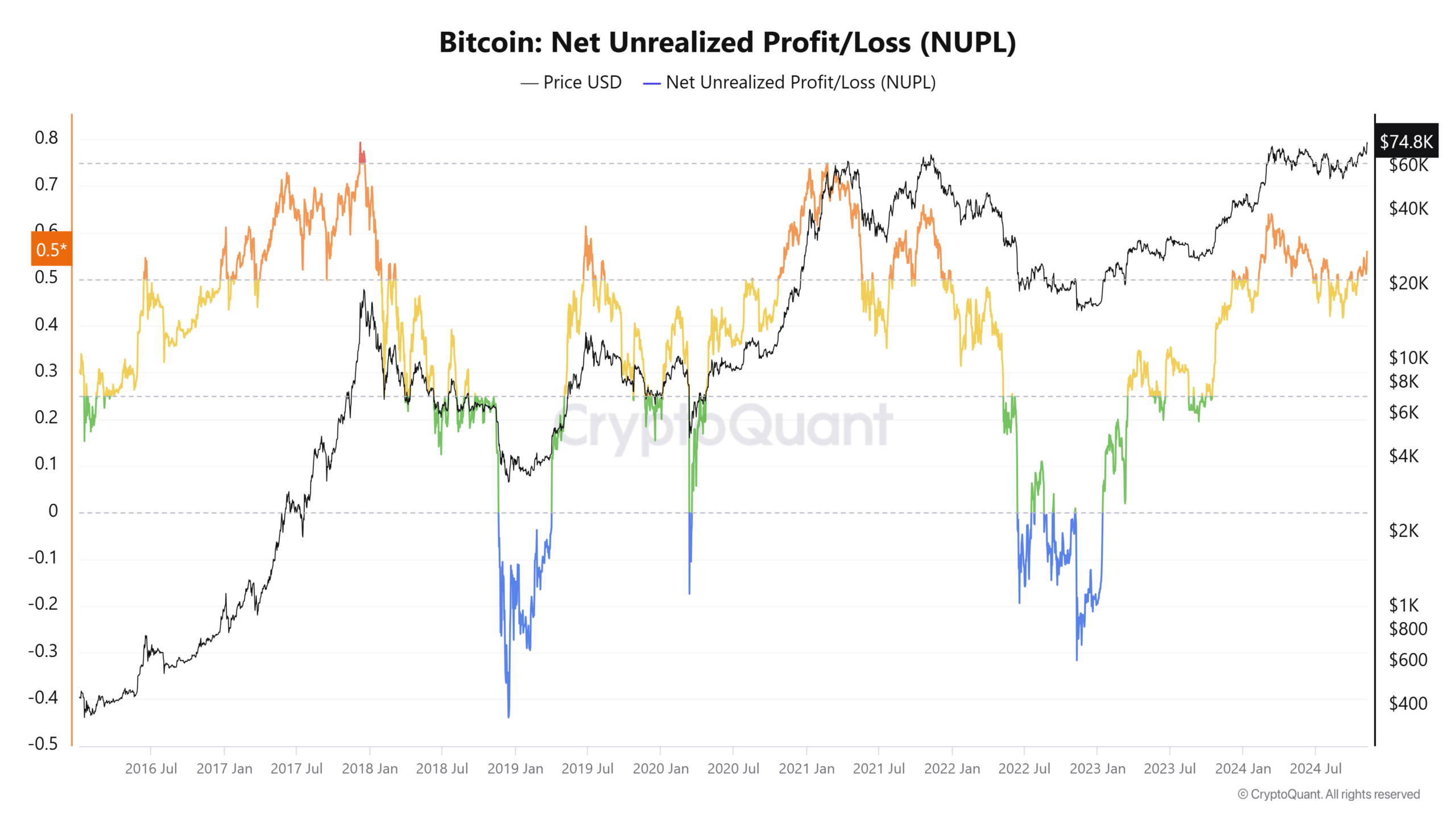

- The NUPL metric showed that the bull run is likely still in its early stages.

As a seasoned crypto investor with over a decade of experience under my belt, I find the recent surge in Bitcoin’s Open Interest and its new all-time high to be quite intriguing. Having weathered several market cycles, I can attest that November and December have historically been strong months for cryptocurrencies.

As the U.S. presidential election neared its end, with Donald Trump emerging as the winner, Bitcoin (BTC) reached a brand-new peak in value.

Historical trends suggest that November and December would be strongly bullish months for crypto.

According to the founder of CryptoQuant, Ki Young Ju, it’s unlikely that future price increases will exceed 30%-40%, unlike the 368% surge witnessed during the last market cycle.

Despite reaching unprecedented heights, Open Interest hit an all-time peak of $45.8 billion, and Bitcoin followed suit with a new record high at $76.4k. This suggests that optimism among investors is running high. Moreover, on-chain metrics are not yet near the levels typically seen during market peaks.

Futures Open Interest soars past 2024 highs

Over the last three years, the Open Interest has consistently increased. From October 2023 to March 2024, this increase saw the Open Interest rise from $11.9 billion to an impressive $38 billion.

These highs were broken on the 17th of October and then again on the 7th of November.

A surge in costs along with increased investor involvement suggests a robust optimistic trend, but the period for determining prices might bring significant fluctuations. Investors are advised to watch out for substantial declines in the upcoming months.

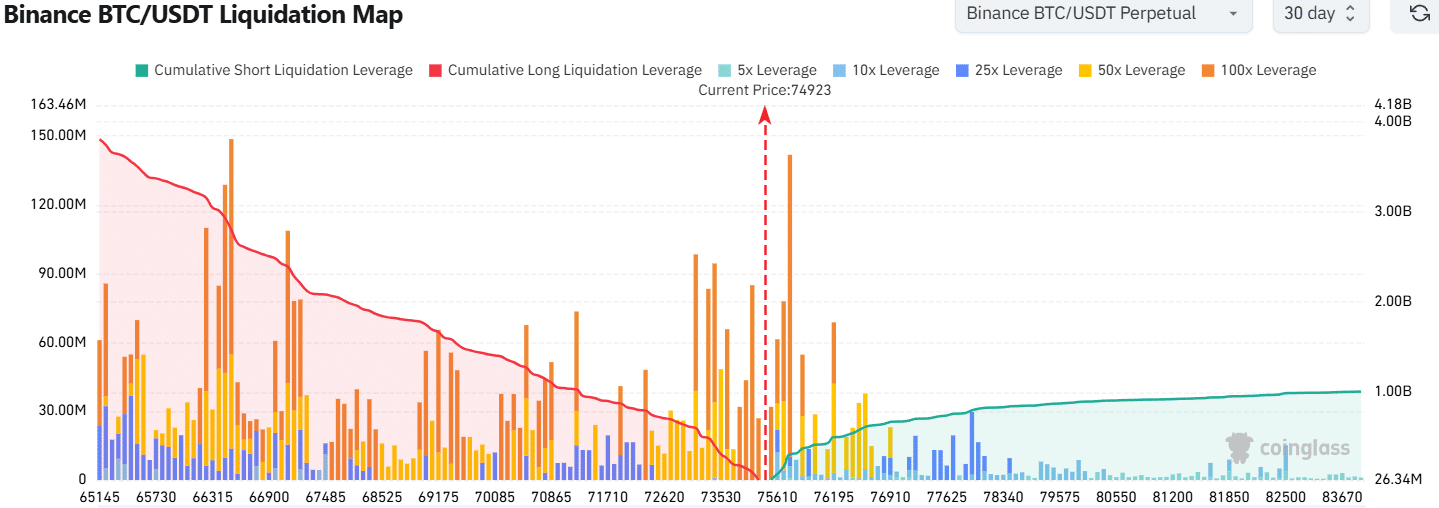

Currently, it appears that certain traders are looking to profit by betting against Bitcoin’s recent bullish trend, which has been evident for the last three weeks. A concentration of high-leverage liquidation points was observed at approximately $75,740 on the market map.

Similar-sized sell-offs occurred around the price point of $73,205, and if current trends continue, a dip down to $70,000 could be quite uncomfortable compared to an ongoing price increase.

NUPL echoes early bull run stage of previous cycles

At the current moment, the Net Unrealized Profit and Loss (NUPL) stood at approximately 0.559. This figure was also close to the same value back in December 2016, a time when Bitcoin was valued around $900, and again in November 2020, during which Bitcoin was being traded at approximately $15,400.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the last two market cycles, the NUPL peaked at 0.793 and 0.748. When this indicator reads approximately 0.7, it suggests that a significant number of investors have made profits, which often indicates that the bullish trend might be nearing an end.

Currently, it’s still quite a distance until we might reach the peak for Bitcoin, causing some speculation as to whether it can achieve such a rise of only 30%-40%.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-08 07:03