-

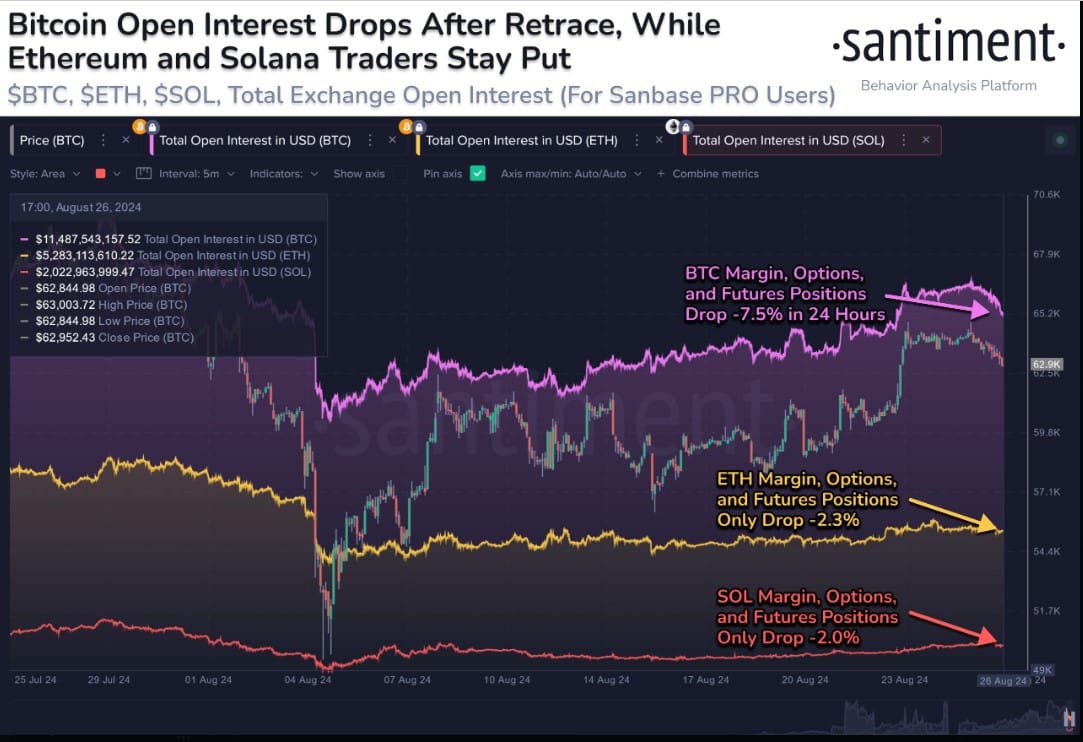

BTC’s 2.2% price drop led to a 7.5% decrease in open interest.

Ethereum and Solana show resilience with minimal open interest changes.

As a seasoned researcher with years of experience in the tumultuous world of cryptocurrencies, I find these recent market movements intriguing. The 2.2% drop in BTC‘s price resulting in a staggering 7.5% decrease in open interest is a stark reminder of the sensitivity of Bitcoin investors to even minor fluctuations.

In the past day, there was an interesting shift in the cryptocurrency market: Bitcoin‘s (BTC) price experienced a slight decrease of approximately 2.2%. According to Coinglass data, this decline in BTC’s value transpired over the last 24 hours.

Conversely, it’s worth noting that the total open interest on these exchanges has declined significantly by approximately 7.5%. This marked reduction suggests just how responsive Bitcoin investors can be, even in response to minor price fluctuations.

Altcoins display resilience amid Bitcoin’s volatility

During periods of volatility in Bitcoin’s price, many other cryptocurrencies seemed to maintain much of their worth.

For the majority of altcoins, there wasn’t a significant shift in total commitment from investors. Specifically, Ethereum (ETH) and Solana (SOL) experienced minimal decreases of approximately 2.3% and 2.0% respectively.

Ever since the significant decline on August 5, the cryptocurrency market appears to be bouncing back. This resurgence may have encouraged some investors to jump in again, potentially reassessing their investments.

The small adjustments in the open interest for Ethereum (ETH) and Solana (SOL) imply that these cryptocurrencies may be less responsive to Bitcoin’s (BTC) price fluctuations compared to their typical behavior.

A significant decrease in Bitcoin’s open interest indicates that there could be a movement of funds occurring, which is supported by relatively stable altcoin markets.

As an analyst, I suspect that major market participants might be rebalancing their portfolios by gradually moving away from heavily invested Bitcoin positions and increasing their holdings in alternative cryptocurrencies (altcoins).

This method might aim at achieving greater yields, diversifying investments across multiple assets as a strategy to reduce potential risks.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Shifts in market sentiments as August rebound potentially peaks

From the significant decrease in Bitcoin’s open interest, it seems investors believe the momentum of the August rebound may soon reach a peak.

Additional evidence for this theory could be found by examining current trends. Certain market players seem to be selling their holdings near the peak of the ongoing cycle.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-28 07:35