- Reduced risk hedging and increased on-chain activity suggested growing confidence in Bitcoin’s price potential.

- Bitcoin may be positioned for a breakout due to rising open interest and a lower NVT ratio.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I can confidently say that the current state of Bitcoin presents exciting opportunities. The reduced risk hedging, rising open interest, increased on-chain activity, and the lower NVT ratio all point to growing confidence in Bitcoin’s price potential.

As a researcher studying the Bitcoin options market, I’ve noticed a significant change in behavior among traders, as they appear to be scaling back on their risk-hedging strategies. This trend might indicate an upcoming breakout, hinting at potential market volatility and shifts in the near future.

With the enhancement of Bitcoin’s on-chain metrics, there arises a query about its current momentum: Could we be seeing a run towards fresh price peaks?

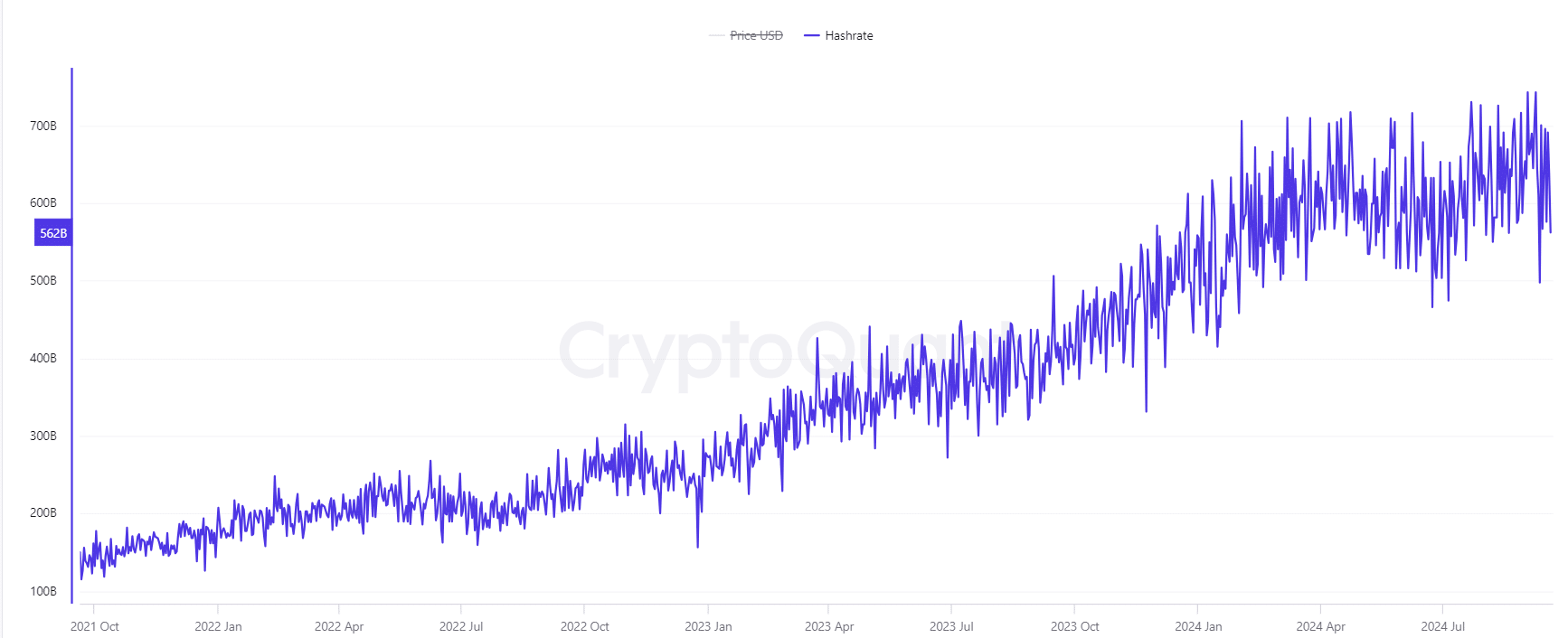

Is Bitcoin’s hash rate reflecting growing confidence?

Currently, the mining rate (hash rate) stands at approximately 562 billion, marking a 0.61% growth over the last day. This figure is significant as it usually signifies that miners are optimistic about Bitcoin’s future prospects.

When miners devote additional resources towards strengthening the network, it often signals greater stability or suggests a possible increase in the market value (price movement).

Do these metrics suggest rising demand?

Over the last 24 hours, there’s been a steady flow of transactions on the blockchain, with approximately 8.685 million unique wallets participating, representing a slight uptick of 0.91%. (CryptoQuant data)

Similarly, the daily transaction count has grown by 1.29%, reaching 584,631K.

Both measures show an uptick in network activity, typically a precursor to significant price fluctuations. Heavier transaction volumes suggest heightened curiosity and involvement, possibly setting the stage for a sharp increase in prices.

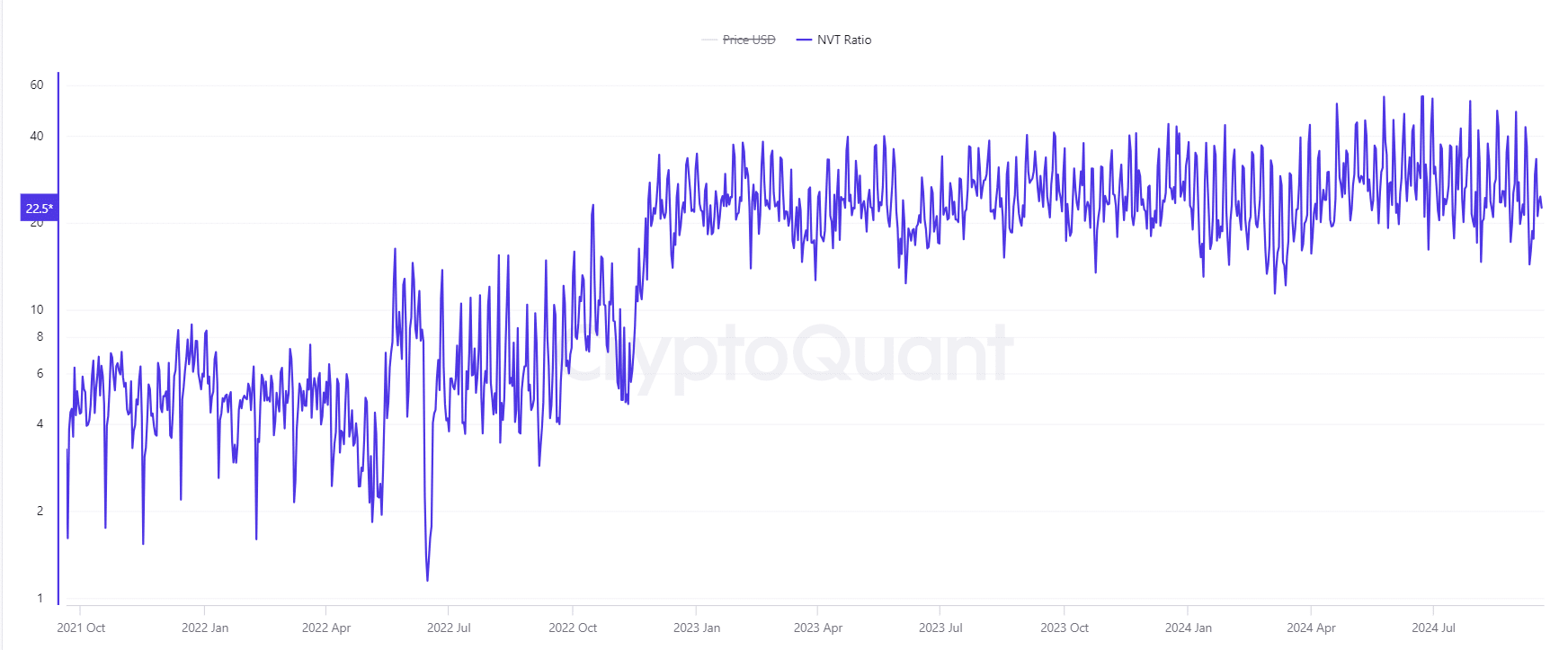

Is Bitcoin undervalued based on the NVT ratio?

Based on the current NVT ratio of 22.549, representing an 8.36% drop, it’s possible that Bitcoin is underpriced or undervalued.

The NVT (Network Value to Transactions) ratio compares a cryptocurrency’s market capitalization with its transaction volume. A smaller NVT ratio implies that there is more trading activity on the network compared to what the current market price indicates.

An imbalance like this could indicate a significant chance for price increases, particularly when combined with favorable on-chain patterns.

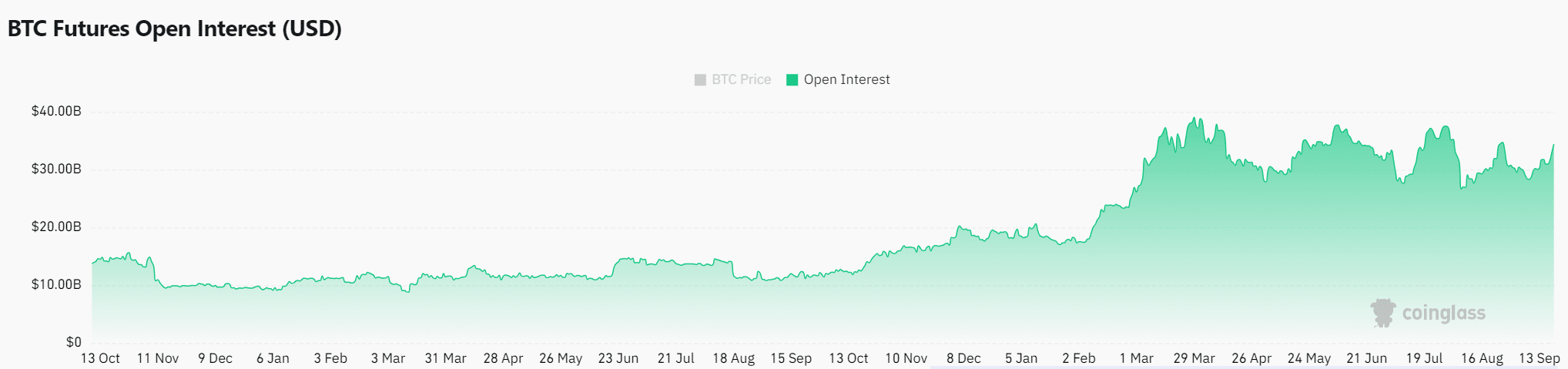

Could the surge in open interest trigger a price breakout?

Interest in Bitcoin options has grown by approximately 3.86%, now totaling around $35.38 billion. At this moment, Bitcoin’s value stands at $63,402.45, marking a 1.34% rise over the past 24 hours. This growth in value has significantly lessened the need for risk mitigation.

When traders decide to lower their safety nets (protective puts), it usually indicates that they anticipate reduced market fluctuations and perhaps a significant change in Bitcoin’s price trend. This pattern of trading could signal increasing confidence or optimism regarding Bitcoin’s price movement.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Are new range highs likely?

As the hash rate increases, on-chain activity becomes more frequent, and the Network Value to Transactions (NVT) ratio decreases, it seems Bitcoin is primed for an uptrend.

A significant increase in open positions, along with a decrease in protective measures, suggests that reaching new peak levels could happen soon.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-20 23:04