- Bitcoin’s allure diminishes as Tether’s minting spree on Ethereum and Tron boosts capital inflows.

- USDT supply is soaring amid rising market volatility, playing a crucial role in shaping crypto trends ahead.

As a seasoned researcher who has weathered many market cycles, I find myself intrigued by the ongoing dance between Bitcoin and Tether. The recent surge in USDT minting has undeniably impacted the crypto landscape, with capital inflows soaring amid rising volatility.

In November, there was an extremely optimistic trend in the market, largely due to the ‘Trump effect,’ the positive impact following the Bitcoin halving, a reassuring inflation data release, and the robust foundations underlying Bitcoin, further establishing it as a reliable asset for storing value.

Over the last month, approximately $114 billion has poured into the cryptocurrency market, with Tether’s [USDT] rapid creation significantly increasing liquidity. This surge underscores the robustness of the recent 30-day rally, suggesting a promising outlook for further short-term growth.

Nevertheless, the ambiguity surrounding Bitcoin’s upcoming psychological goal prompts worries about possible downward forces, particularly given that first quarter volatility might hint at prolonged market turbulence in the future.

Given the current market conditions, might I find myself inclined to adopt a more cautious investment strategy, viewing high liquidity assets as potential safe havens?

Expect high volatility in the coming days

At present, the market could be described as ‘unstable’ or ‘fluctuating’, which is evident in the increasing Crypto Volatility Index, suggesting that investors expect larger profits in a compressed time span.

Although the election outcomes brought a wave of optimism, propelling Bitcoin above $100K, this upward trend didn’t last long. The relentless speculation within the everlasting market compelled investors to prioritize quick profits, causing them to drive Bitcoin prices lower instead.

The ‘bubble’ phenomenon has caused market makers and observers alike to question where Bitcoin might establish its next resistance level. With numerous investors teetering at the edge of profitability prior to any possible price adjustment.

Therefore, it might be wise to consider stablecoins as a protective measure, providing a buffer during financial market turmoil.

On the other hand, this transition might lead to a rise in pessimism in the upcoming period. For Bitcoin to surge again and make $100K a strong foundation, its underlying strengths must be reactivated.

If the price reaches a local peak at this level, it may indicate a scarcity of available assets for sale. This could lead to more sellers cashing out, while potential buyers might pause their purchases due to the perceived high pressure. As a result, there could be an increased demand for USDT (a stable digital currency) to manage trades.

So, is $100K a Bitcoin top or a bottom?

At present, there’s a divide among market forecasts, with some rooted in ‘doubt’ and others stemming from ‘expectation.’ These contrasting sentiments can influence distinct market trends.

Many cautious investors might interpret the absence of confirmation as a potential peak for the $100K level, leading them to withdraw their investments in order to secure profits.

Over the past month, approximately $19 billion worth of USDT (Tether) has been created. In just the last four days, about $4 billion of that was minted on both the Ethereum and Tron platforms. With Bitcoin’s future movements uncertain, more investors are shifting their focus towards larger altcoins.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Nevertheless, a significant number of investors continue to harbor high expectations for a significant advancement. This persistent optimism has resulted in an observable growth in the USDT reserves.

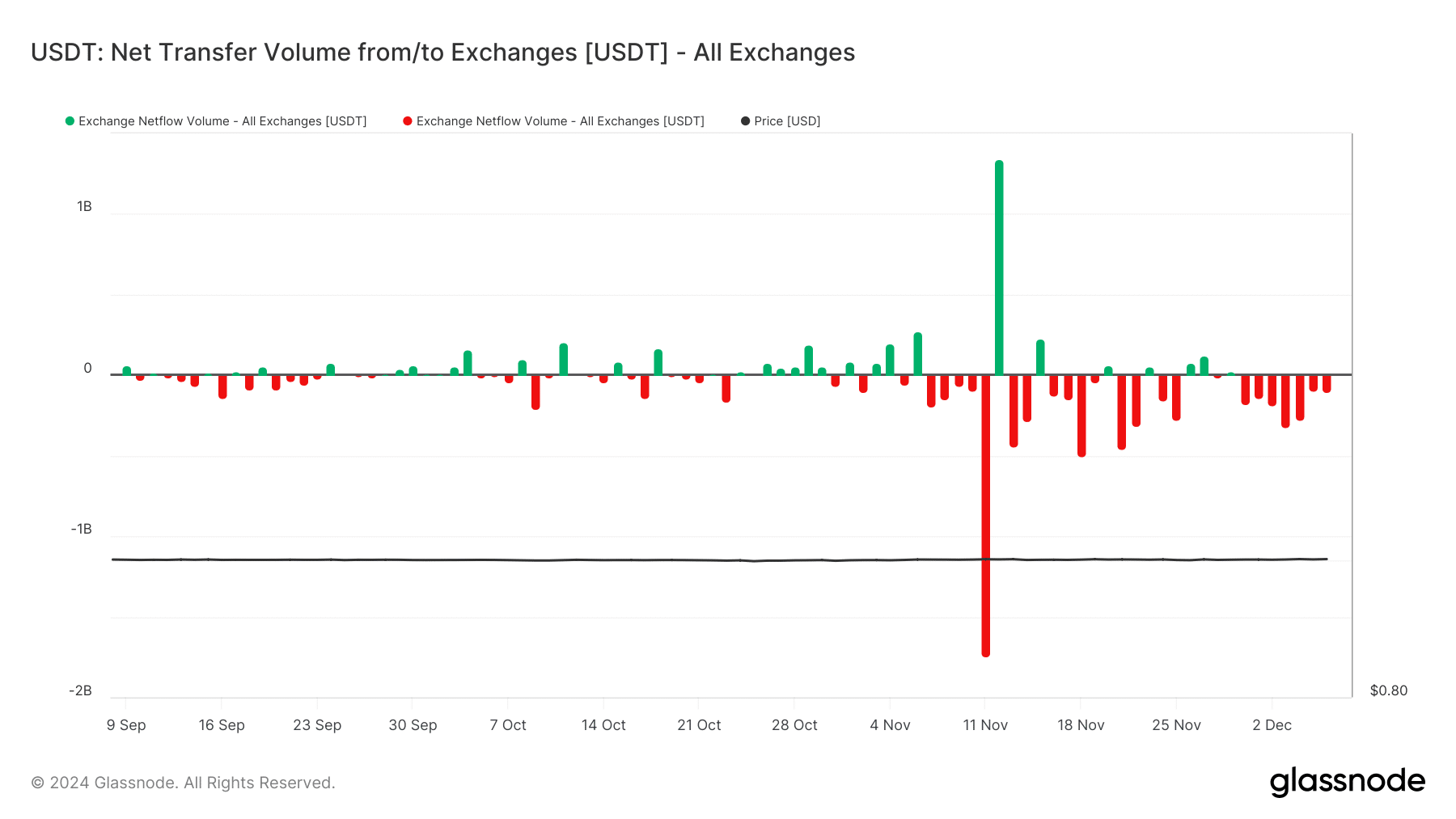

Additionally, it’s important to note that merely following USDT exchange flows isn’t sufficient. Analyzing these flows can provide valuable insights into how the market responds to varying price points.

As the surge in minting creates a swell of positive anticipation among analysts, they are closely monitoring the increase in liquidity as a possible trigger for a Bitcoin price increase, with investors eagerly exchanging Tether (USDT) for Bitcoin (BTC).

Nevertheless, increasing volatility might disrupt the strategy, making Bitcoin less attractive compared to its competitors. Tether (USDT) remains the preferred safe haven in such situations.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-07 18:16