- One analyst pointed to Bitcoin’s fractal patterns as evidence that holders are positioning the asset for sustained growth.

- Data suggested that Bitcoin is far from its cyclical market peak, leaving room for significant price gains.

As a seasoned crypto investor with a knack for recognizing patterns and trends, I find the recent analysis of Bitcoin (BTC) particularly compelling. Having navigated through multiple market cycles since its inception, I can attest to the unpredictable yet fascinating nature of this digital asset.

For the immediate future, Bitcoin’s (BTC) decline by 1.53% over the last 24 hours indicates a less optimistic outlook. Negative trends are growing stronger, but long-term indicators hint that this dip might be temporary. The market is forecasted to rebound as sentiment becomes more positive again.

To gain more insights about where Bitcoin might be headed, AMBCrypto offers an in-depth examination of the essential factors influencing its future trend.

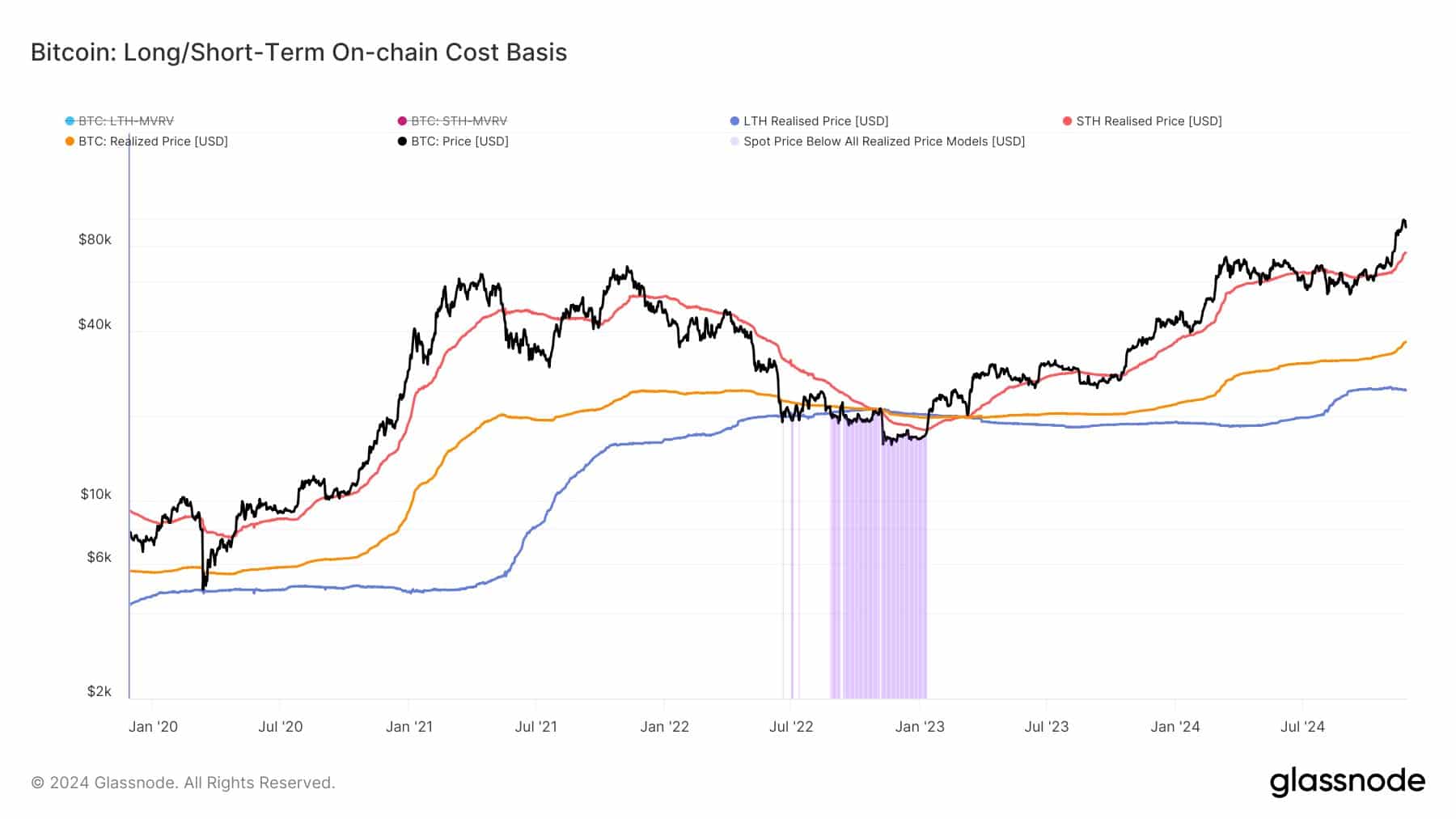

Long-term holders stay steady as short-term buyers provide key support

According to analyst James Van Straten, Bitcoin appears to be experiencing a critical juncture reminiscent of late 2020, where its value dipped to around $10,000 before soaring up to $60,000.

According to Van Straten’s examination, Short-Term Holder’s Realized Profit (STH RP) plays a crucial role in serving as a significant floor or support point for Bitcoin prices. Notably, when Bitcoin experiences a dip and returns to this level, there tends to be increased buying activity which subsequently helps boost the price back up.

He noted:

Observe that the actual price is going up, but the profit for long-term investors (Long-Term Holders’ Realized Profit or LTH RP) either stays the same or decreases.

As an analyst, I’ve observed that when my long-term holdings show no increase or even a decrease in realized profits, it usually means I’m confident about the asset’s future value. Instead of cashing out, I tend to either keep holding onto it or even add more to my portfolio. This pattern of behavior seems to fuel optimism and maintain market stability.

If the current trajectory persists, Bitcoin could potentially bounce back from its recent decline, reaching the Support Trendline Resistance Point (STH RP) which indicates an upward momentum resumption.

Additional insights from AMBCrypto echo this perspective, suggesting more signs that could signal an upcoming price increase.

Bitcoin market outlook: Room for further gains

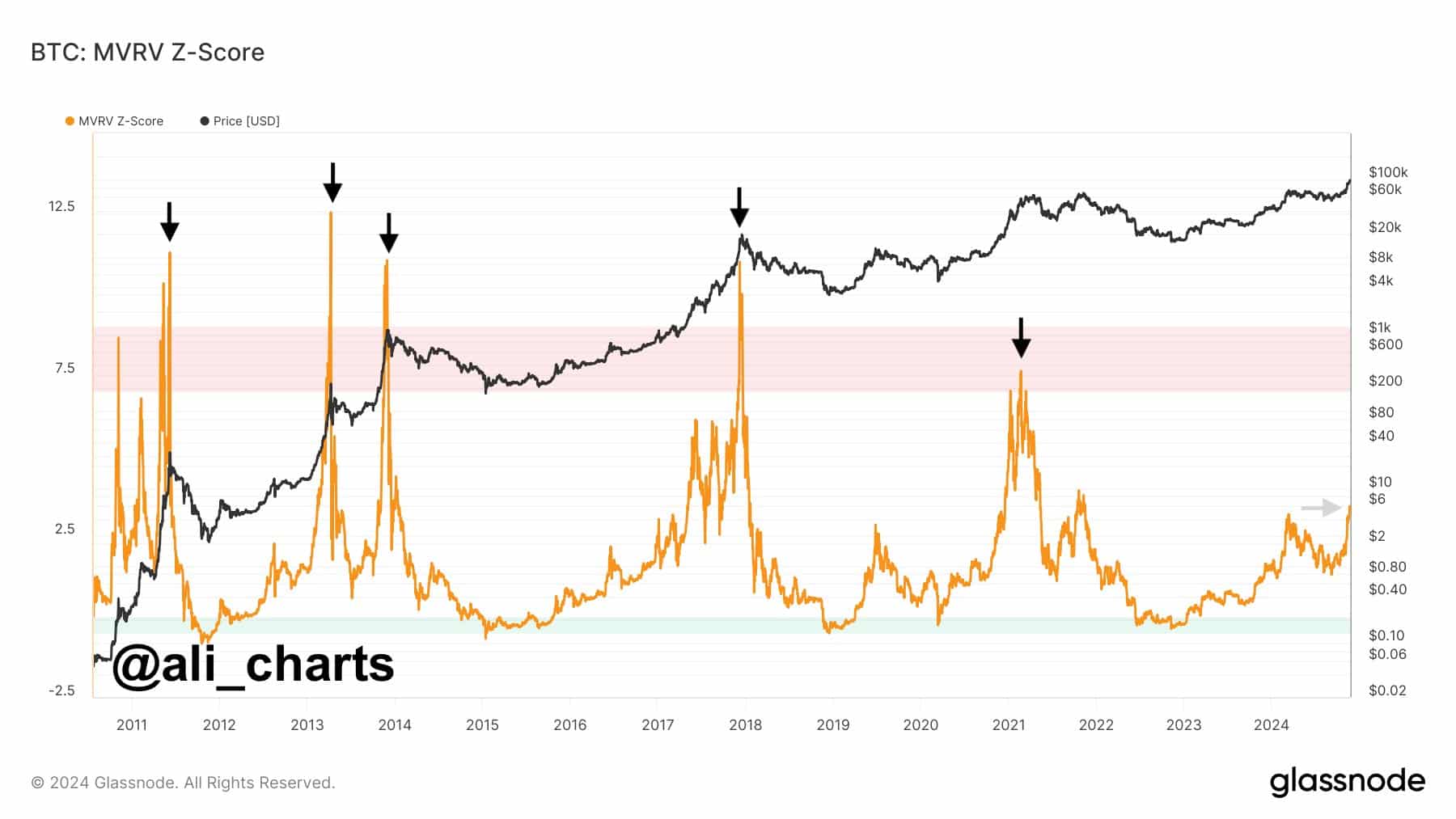

In his latest update, crypto analyst Ali Chart expresses optimism about Bitcoin’s future growth. He believes that despite the current positive market sentiment, Bitcoin has not yet hit its cyclical market peak – a point often preceding a significant price drop.

In his words:

“BTC is far, far, far away from a market top!”

According to the MVRV Z-Score analysis by Ali, Bitcoin currently lies towards the lower end of the chart. This implies there’s potential for significant growth since the data shows Bitcoin hasn’t reached an overvalued state yet.

If the MVRB Z-Score starts showing an upward trend, it might be a sign that Bitcoin’s price will increase as well, possibly suggesting the beginning of a long-term price surge.

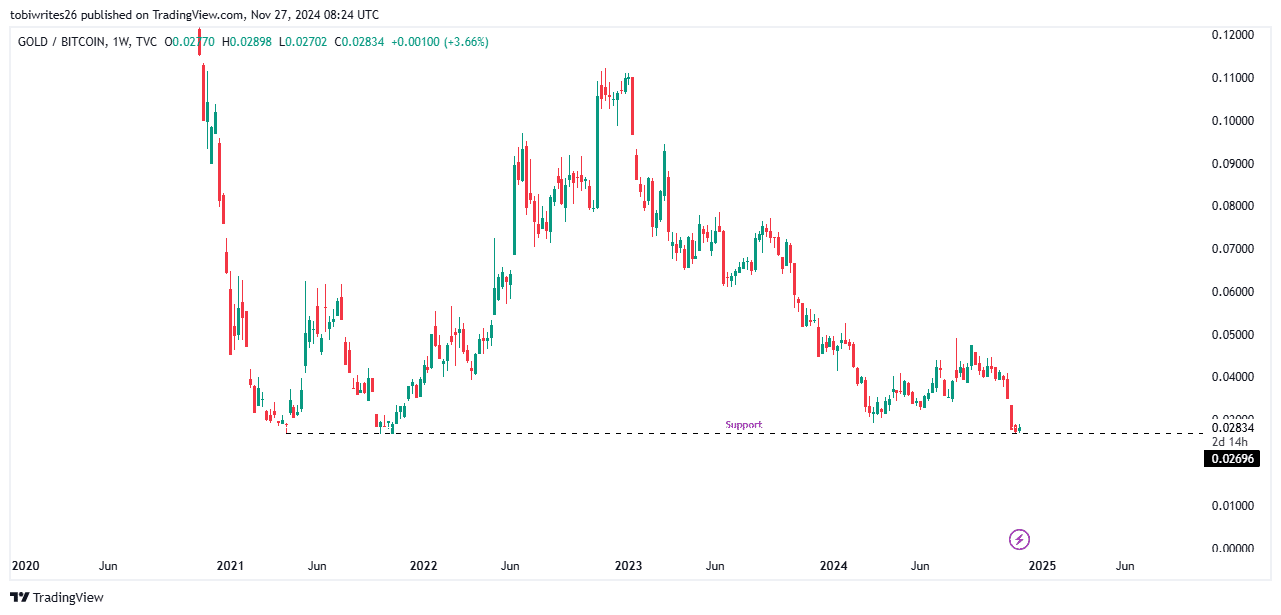

Will Bitcoin overtake Gold?

As a financial analyst, my latest findings indicate that should Bitcoin’s value continue to outpace gold, it could potentially exceed gold in US dollar terms, as evidenced by the trend depicted in the graph.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If Bitcoin surpasses its present resistance point, it might trigger a change as this level has previously prevented additional drops.

A malfunction at this point could indicate a shift in investor opinion, where they begin to view digital currencies as an influential factor in the economy – a transformation that might boost Bitcoin’s value.

Read More

2024-11-27 20:07