- Bitcoin HODLers, it seems, are cashing in their chips like a bunch of old aunts at a bingo night.

- Is the sun about to set on this crypto cycle, or are we about to witness a dazzling new dawn?

Bitcoin[BTC] started November like a sleepy butler at Jeeves & Wooster’s, waking up at $68K, and by January, it had become a flash in the pan, soaring to a whopping $109K – a 60% surge, mind you.

With such gains, it was only a matter of time before the profit-taking began. December saw investors cash out a staggering $3 billion in profits – more than a small island nation’s GDP!

Now, the market is holding its collective breath, waiting for a recovery. Otherwise, even holding Bitcoin at $100,000 could turn into a nightmare more terrifying than a Battenberg cake in a thunderstorm.

FOMO or Greed: Who’s the King of the Hill?

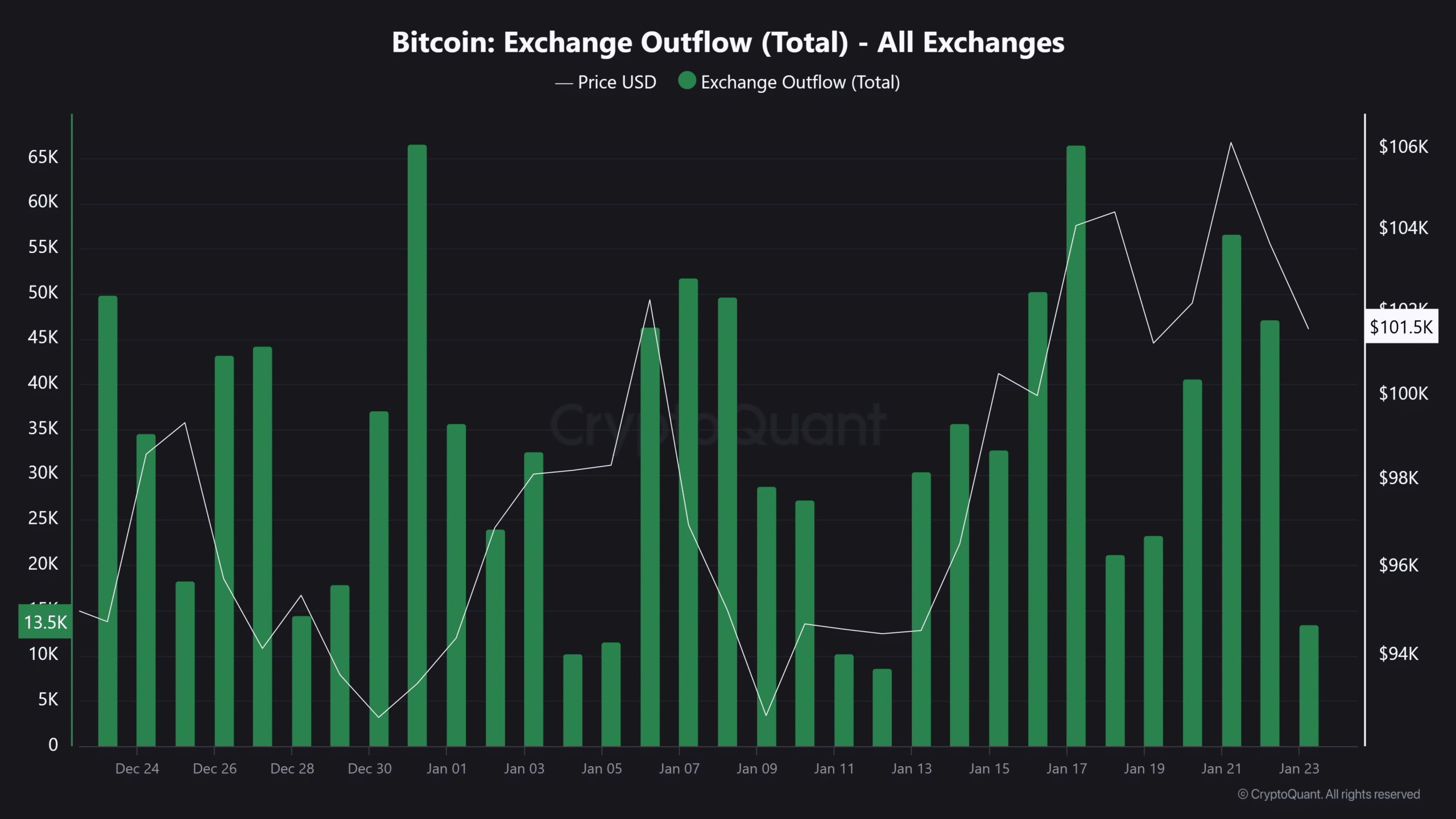

Traders are playing it safe in the derivatives market, where the leverage ratio is shrinking faster than a morning mist in the Cotswolds. This shows they’re unsure where Bitcoin’s price will go next. Also, fewer people are taking Bitcoin off exchanges, like a reluctant butler leaving a posh dinner party.

In fact, the exchange outflows saw a staggering 16% drop in a single day – more than a sharp decline in Bertie Wooster’s spirits after a disappointing day at Blandings.

Together, these factors suggest that FOMO is fading faster than a valet disappearing after a dinner engagement. However, the greed has bounced back from “extreme” levels – a bullish sign indeed. Why? Profit-taking might be nearing its peak, as indicated by a Glassnode report.

As per the report, profit-taking is way down, falling from $4.5 billion in December to just $316 million now – a 93% drop. According to AMBCrypto, if FOMO returns while excessive greed subsides, it could set the stage for a significant price increase, like a sudden surge of popularity for the Blandings cricket team.

A Glimpse into the Bitcoin Market

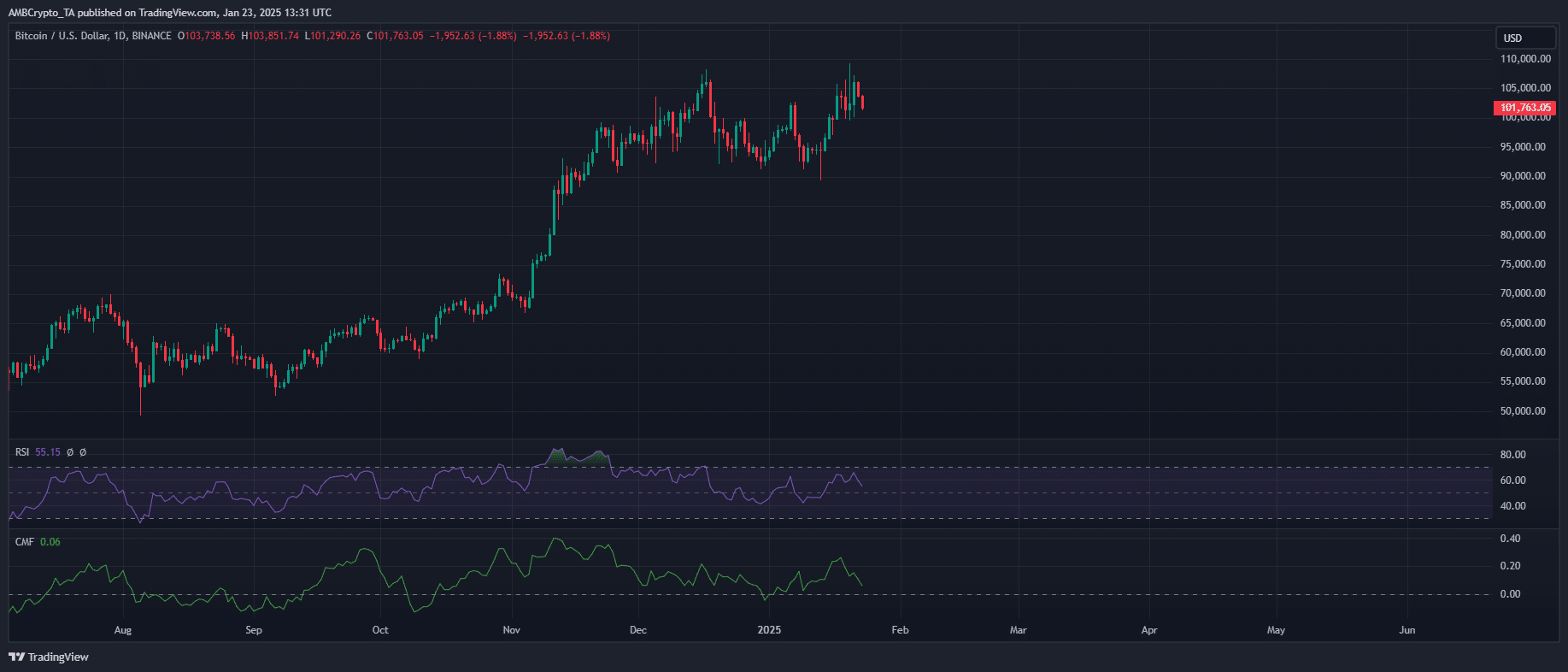

Bitcoin dropped 3.26% in a day, but the market isn’t overheating. This means strong buying, likely fueled by FOMO, is needed to push the price back up, much like a strong cup of tea is needed to keep the Dowager Countess awake.

However, the upcoming FOMC meeting could significantly impact Bitcoin’s recovery. With the meeting just a week away, uncertainty is likely to persist, making a strong rebound less probable in the near term – like a sudden snowstorm in July.

Interestingly, this consolidation period might be a positive sign. It could allow institutions to quietly accumulate Bitcoin while the market stabilizes after a period of significant profit-taking – like a secret society gathering in the attic of Blandings.

The key is what the Fed does. If they cut rates, things could get interesting. But if they surprise us, Bitcoin might dip further – like a sudden dip in the Dowager’s mood.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

For now, the market’s showing signs of life. Greed is back, and profit-taking is cooling down. This could ignite a new buying frenzy, especially once the Fed dust settles – like a sudden surge of interest in cricket at Blandings.

Keep an eye on the U.S. economic calendar – it will ultimately determine whether extreme greed takes over or FOMO makes a comeback – like a sudden change in the weather at a garden party.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-24 13:13