Ah, Bitcoin! The illustrious golden child of the cryptocurrency world, which, at the dawn of last week, danced gracefully above the $88,000 mark, as if it were a prima ballerina in the grandest of operas. However, akin to a dramatic twist in a Russian novel, a steep correction befell it on Friday, March 28, when the somber news of February core inflation data descended upon the market like a winter chill. Who could have foreseen such a descent?

Now, as the price precariously hovers beneath $84,000, one can almost hear the collective sigh of anxious investors, reminiscent of a gathering of peasants awaiting the verdict of a cruel lord. The murmurs of panic echo through the air, as fears of further declines loom large over the realms of this digital gold.

So, Is Bitcoin Preparing for a Descent to $71,000? 🤔

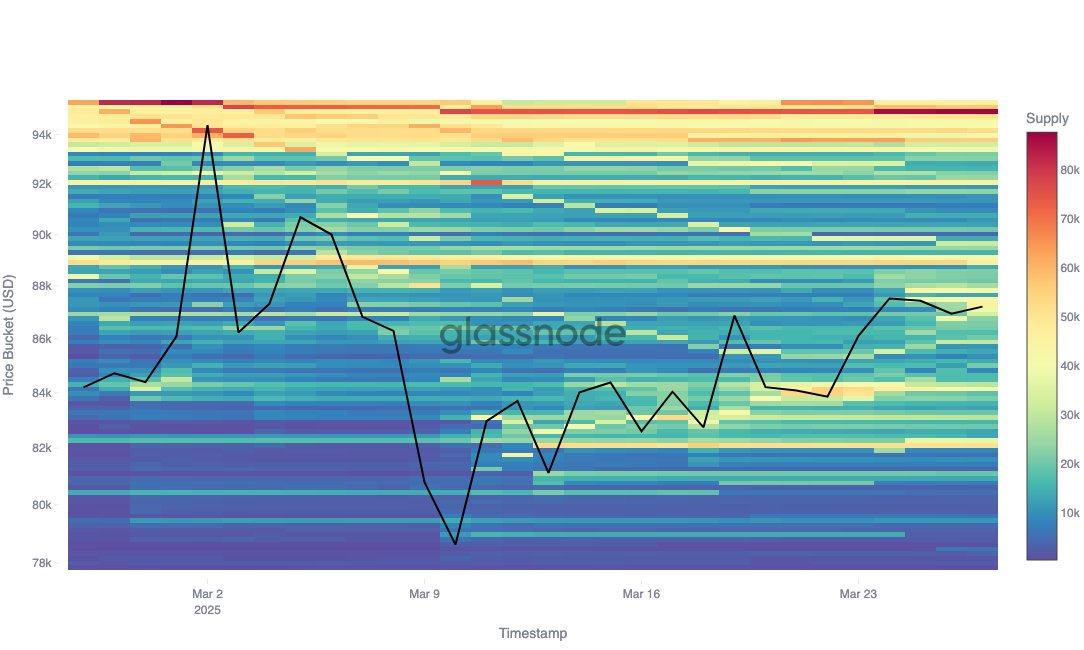

In a most enlightening discourse on the X platform, our wise oracle from the blockchain analytics firm Glassnode has shared insights into the recent behavior of investors and the potential ramifications for Bitcoin’s future. This sage analysis springs from the depths of cost basis distribution data, revealing the secrets of investor intentions concerning the sacred Bitcoin price.

The wise Glassnode has elucidated that this sacred data illustrates the immense Bitcoin supply hoarded by addresses, grouped by average cost basis within distinct price thresholds. The accompanying chart, a veritable masterpiece, depicts a heat map displaying the intensity of BTC supply in various price realms. 🗺️🤑

It is indeed a curious affair that the critical support levels for the noble Bitcoin rest around $84,100, $82,090, and $80,920. These are the sacred grounds where 40,000 BTC, 50,000 BTC, and 20,000 BTC were acquired, respectively. Yet, should this beloved coin succumb to the trials of market forces and dip below these hallowed levels, a grievous decline may ensue.

Should misfortune strike and deeper corrections become the order of the day, let us not be too hopeful for solace at $78,000, as past investors may not find comfort in a former cherished price point. Glassnode’s wisdom suggests that a dive could take us as low as $74,000 — a point where 49,000 BTC found their keepers, followed by the ominous $71,000, where another 41,000 BTC await their fate. “These levels,” the oracle proclaims, “reflect zones of stockpiled convictions, poised to weather the oncoming storm.”

A Snapshot of Bitcoin’s Current Plight

As the quill of destiny writes this account, Bitcoin rests at approximately $83,800, bearing the burden of a nearly 4% decline in the last day — a tale of woe for all who have invested their dreams and hopes into this fleeting digital treasure.

Read More

2025-03-29 18:41