In the space of a mere month, the price of Bitcoin has declined by 26 percent, sliding from a January high of 97,682 dollars to about 67,190. The retreat is not the stuff of glossy pamphlets, but it has the village-boom crowd of investors, those indefatigable habitués of the trading salon, fretting as if a scandal had broken at a suburban raffle. Even with the alleged flood of institutional buying and the vast sea of global liquidity, Bitcoin lingers behind venerable darlings such as gold and silver.

Lost Bitcoin Supply and Quantum Computing Fear

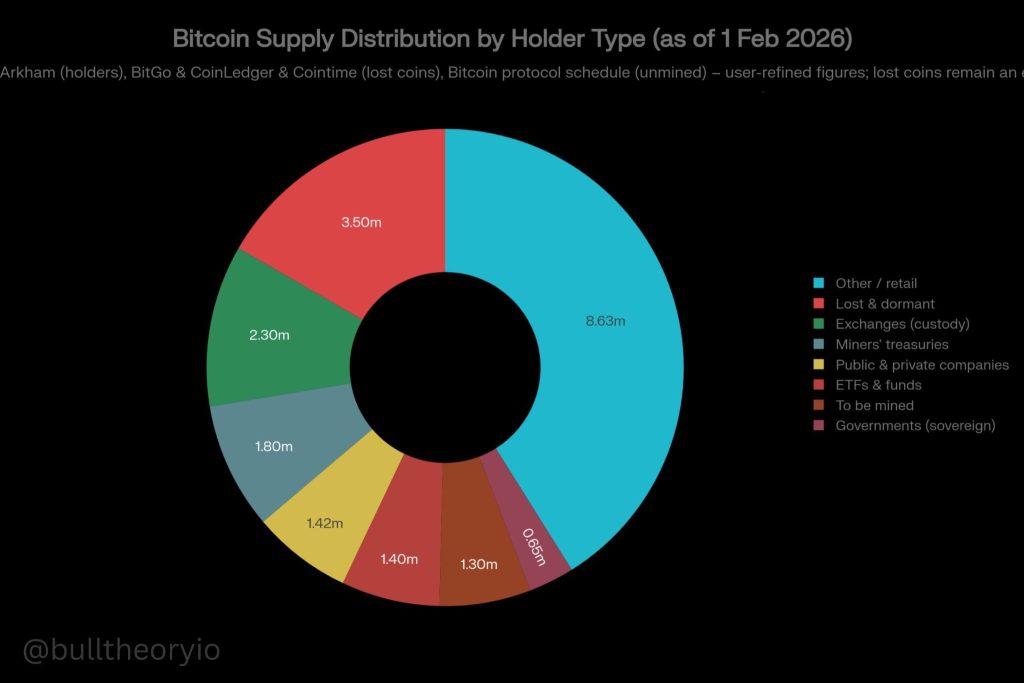

One major anxiety concerns the enormous tally of coins that have fallen into permanent stasis. Crypto savants put the figure at around 3.5 to 4 million BTC-nearly 18% of the total supply-that have not moved since Bitcoin’s infancy and are thought to be irretrievably lost. Then comes the not-so-hushed whisper that quantum computing might one day unlock these long-buried wallets with the ease of turning a page. Not confirmed, naturally, but markets love a phantom menace to sniff at during luncheon hours.

Perhaps, with rapid strides in quantum wizardry, these elderly wallets could become accessible, a plot twist suitable for a dire fictional banker. Even so, markets react to such possibilities with the gravitas of a footman hearing the doorbell ring twice.

If investors reckon some of these coins may return to the fold, future-supply fears grow and press the price down with the polite insistence of a clubman declining a drink he never ordered.

Institutional Buying Matches Lost Bitcoin Supply

Curiously, institutional investors have been buying Bitcoin with gusto over the past several years. Since the launch of the spot Bitcoin ETF, institutions and corporations have amassed roughly 2.5 to 3 million BTC. This amount is almost equal to the number of coins believed to be lost-a neat little symmetry that would delight a statistician with too much time on his hands.

Thus, while new demand exists, the fear that a treasury of coins might rouse itself from slumber tends to curb bullish momentum. Bitcoin is not galloping forward as some prognosticated at the tea room of speculation.

Massive Bitcoin Redistribution Adds Selling Pressure

On-chain data shows that around 13 to 14 million BTC have already moved in this market cycle, marking the largest redistribution in Bitcoin’s history. Yet the big move did not precipitate a full catastrophe; the market has absorbed a great flood of supply like a hearty supper after a long journey. This suggests that fears of another 3 to 4 million BTC returning in the future may have less rhetorical impact than some expect.

Bitcoin Price Liquidations Trigger Market Panic

The price reaction to the Fed’s decision to hold rates steady reveals how nerves can trump numbers in this peculiar theatre. Coinglass reports about 223 million dollars liquidated in the last period, while Bitcoin alone saw around 78 million liquidations after dipping below its crucial 200-week EMA near 68,000 dollars. At present, Bitcoin hovers near 66,900, a posture of continued weakness in market momentum.

Read More

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Legacy of Kain: Ascendance announced for PS5, Xbox Series, Switch 2, Switch, and PC

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

- Best Werewolf Movies (October 2025)

- This New Co-Op Stealth Action Game from ACQUIRE Brings Tenchu Vibes to PS5

- ‘Crime 101’ Ending, Explained

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

2026-02-19 12:07