- The weakening Yen may boost Bitcoin amid liquidity injections and currency devaluations.

- Despite bearish signals, Bitcoin edged up to $62K, with eyes on $64K resistance.

As an experienced financial analyst, I believe that the weakening Japanese Yen could indeed be a significant catalyst for Bitcoin and the broader crypto market. The historic low of the JPY against the USD is an indicator of potential currency devaluations and liquidity injections, which could benefit Bitcoin as a hedge against fiat currency instability.

About a month ago, Arthur Hayes, the founder of BitMEX exchange, voiced his confidence in the depreciating Japanese Yen (JPY) acting as a trigger, infusing liquidity and spurring growth in Bitcoin [BTC] and the overall crypto market.

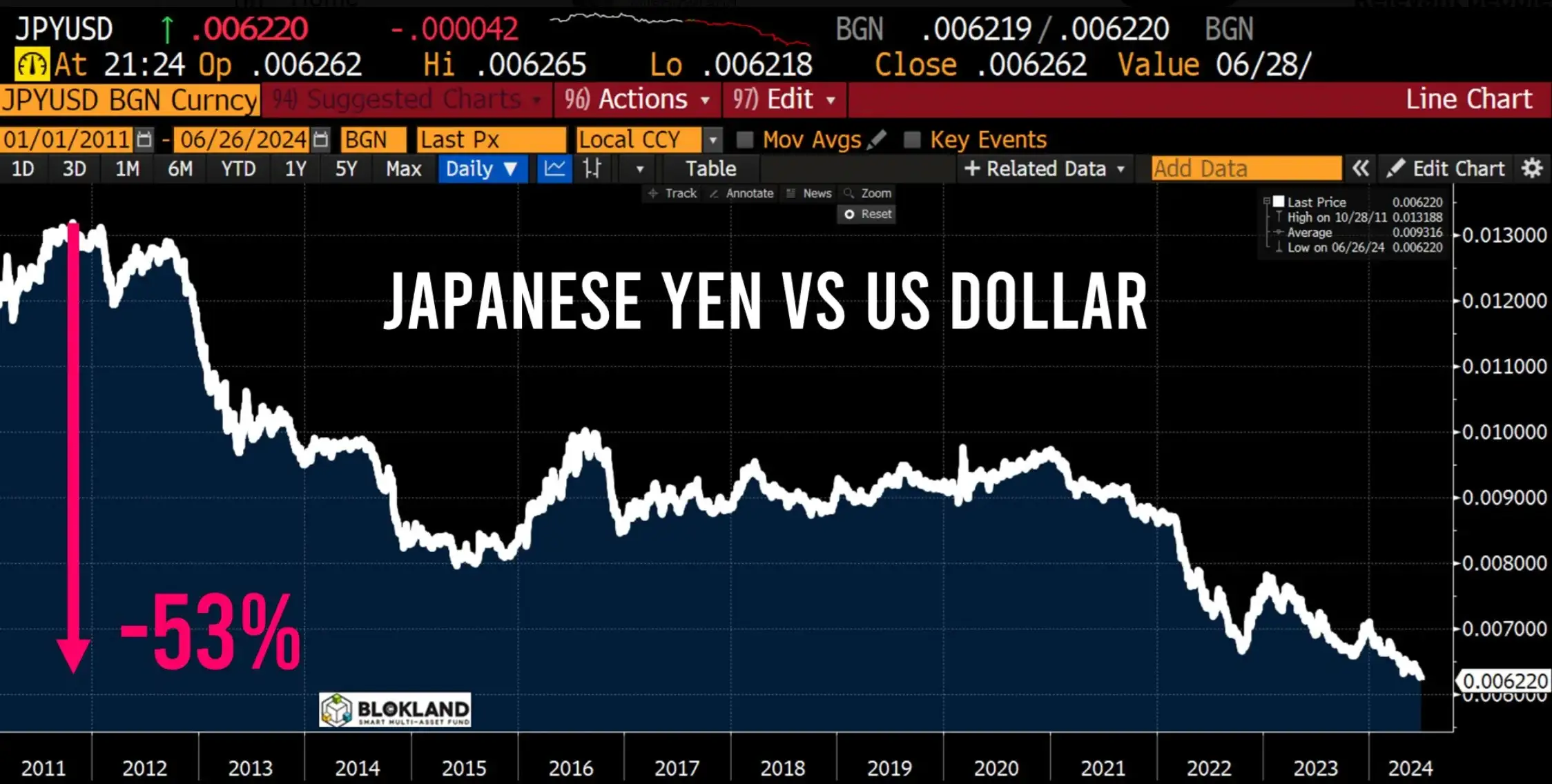

Yen falls to historic low against USD

Starting from June 26th, the Japanese Yen (JPY) hit its lowest record against the US Dollar in approximately 38 years. Consequently, there were rumors about possible interventions from market regulators to influence the exchange rate.

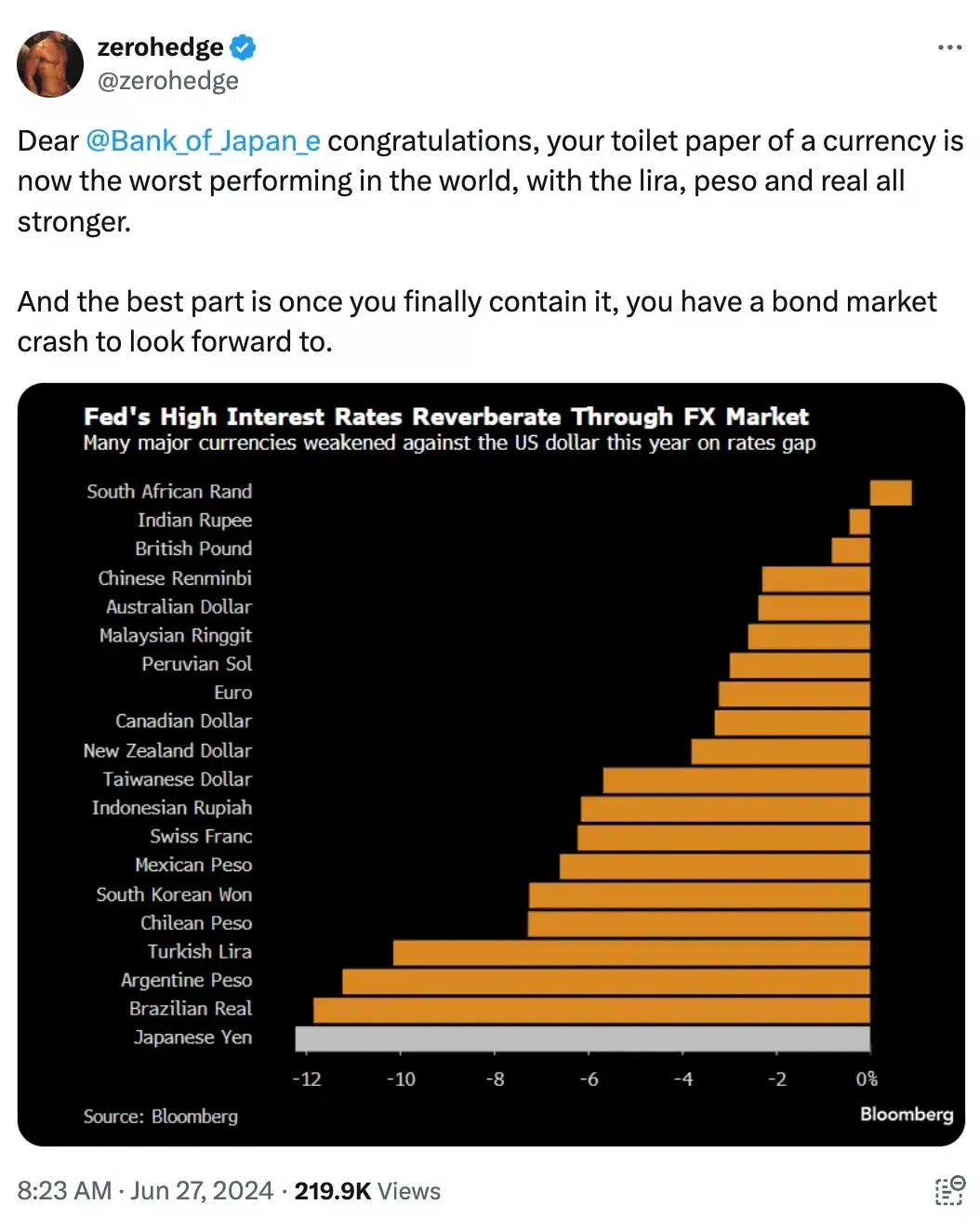

As a researcher studying currency markets, I’ve come across the observation that the Japanese Yen (JPY) has underperformed compared to other global currencies due in large part to the Federal Reserve’s choice to keep interest rates elevated.

Remarking on the same and echoing Hayes’ views, The Bitcoin Therapist said,

“Does Japan clandestinely purchase bitcoin using newly printed Yen? Such a tactic would mark a groundbreaking achievement for Japan’s economy. Alternatively, if not, the country may face imminent decline into third-world status.”

Based on FactSet’s figures, the Yen slid to a low of 160.82 versus the dollar, breaking the prior record of 160.03 hit on April 29th, and reaching its weakest point against the greenback since 1986.

As a researcher examining this data set, I’d like to contribute additional insights. Jeroen Blokland, the Founder and Manager of the Blokland Smart Multi-Asset Fund, made some noteworthy comments regarding this information.

As a researcher studying currency trends over the past decade and a half, I’ve discovered that the Japanese Yen has experienced a significant loss in value relative to the US Dollar. Specifically, it has declined by approximately 53%.

As a crypto investor, I’ve noticed that this development sparked quite a stir in the financial world. ZeroHedge, in their characteristic witty style, pointed out the ripple effects with a hint of irony.

A good sign for Bitcoin?

As a researcher studying the forex market, I recognize that a weakening Yen could instigate competitive currency responses from significant economies like Japan and China. Consequently, this situation might culminate in currency devaluations and subsequent monetary injections to boost liquidity (printing money).

Under these economic circumstances, Bitcoin, often seen as a protective asset against the depreciation of traditional currencies, may experience gains.

As a financial analyst, I believe that Bitcoin could thrive under conditions of global instability in the value of traditional fiat currencies. This digital asset is known for its resilience and ability to perform well during times of uncertainty in the world of conventional money.

Hence, Hayes best put it when he said,

“Crypto booms, as there is more dollar and yuan liquidity floating in the system.”

While observing the Yen’s downturn, Bitcoin rose by 0.56% and hit a trade value of $62,130.05 for me as a researcher.

The RSI’s value being well below the neutral threshold suggests a dominant bearish mood among traders. Yet, should Bitcoin succeed in breaking past its current resistance at $64,817, this could potentially mark a transition towards a bullish market scenario.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-06-28 11:03