- Bitcoin had a bearish bias due to the relentless selling.

- Accumulation has been strong over the past month and might set the stage for a recovery.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market fluctuations in Bitcoin [BTC]. The recent bearish bias due to the relentless selling has left many of us questioning the future of this digital asset. However, I believe that accumulation has been strong over the past month and might set the stage for a recovery.

Approximately three months have passed since Bitcoin [BTC] underwent a halving event, an occurrence that typically reduces the new supply of coins entering circulation. However, contrary to expectations, the anticipated bull market has yet to materialize. Some investors are perplexed as to why Bitcoin is experiencing difficulty gaining momentum despite factors such as increased demand from Exchange Traded Funds (ETFs) and decreasing inflation rates.

As a researcher delving deeper into the long-term metrics, I have found strong indications supporting the notion that the predicted Bitcoin market bottom is either imminent or has already occurred.

Bitcoin predictions: Gleaning clues from price action

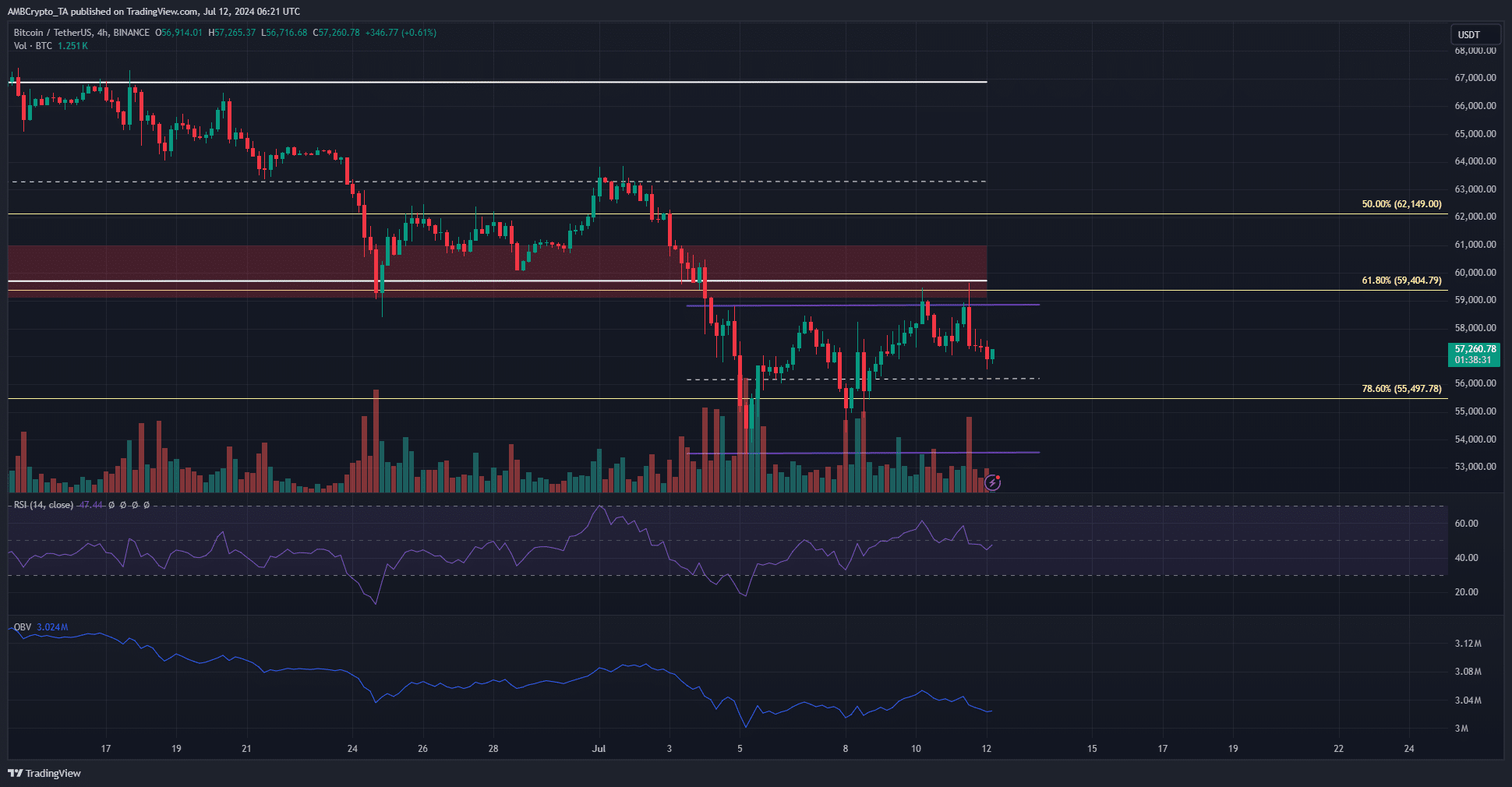

In simpler terms, the 4-hour price chart displayed a price range, denoted by the purple lines, between $53,500 and $58,900. The red box signifies an area of high supply at $59,200 to $61,000. Over the past few days, this zone has been attempted twice, but the price has failed to break through.

Based on the OBV analysis, it appeared that there was insufficient demand to drive up prices significantly. Following the price rejection at the upper end of the range, the RSI dipped beneath the neutral threshold of 50.

As a crypto investor, I’ve noticed that the bullish momentum has weakened, and there’s a strong possibility of prices dipping below the $60k mark towards $55k over the upcoming weekend. It would be prudent to brace yourself for this potential downturn in the market.

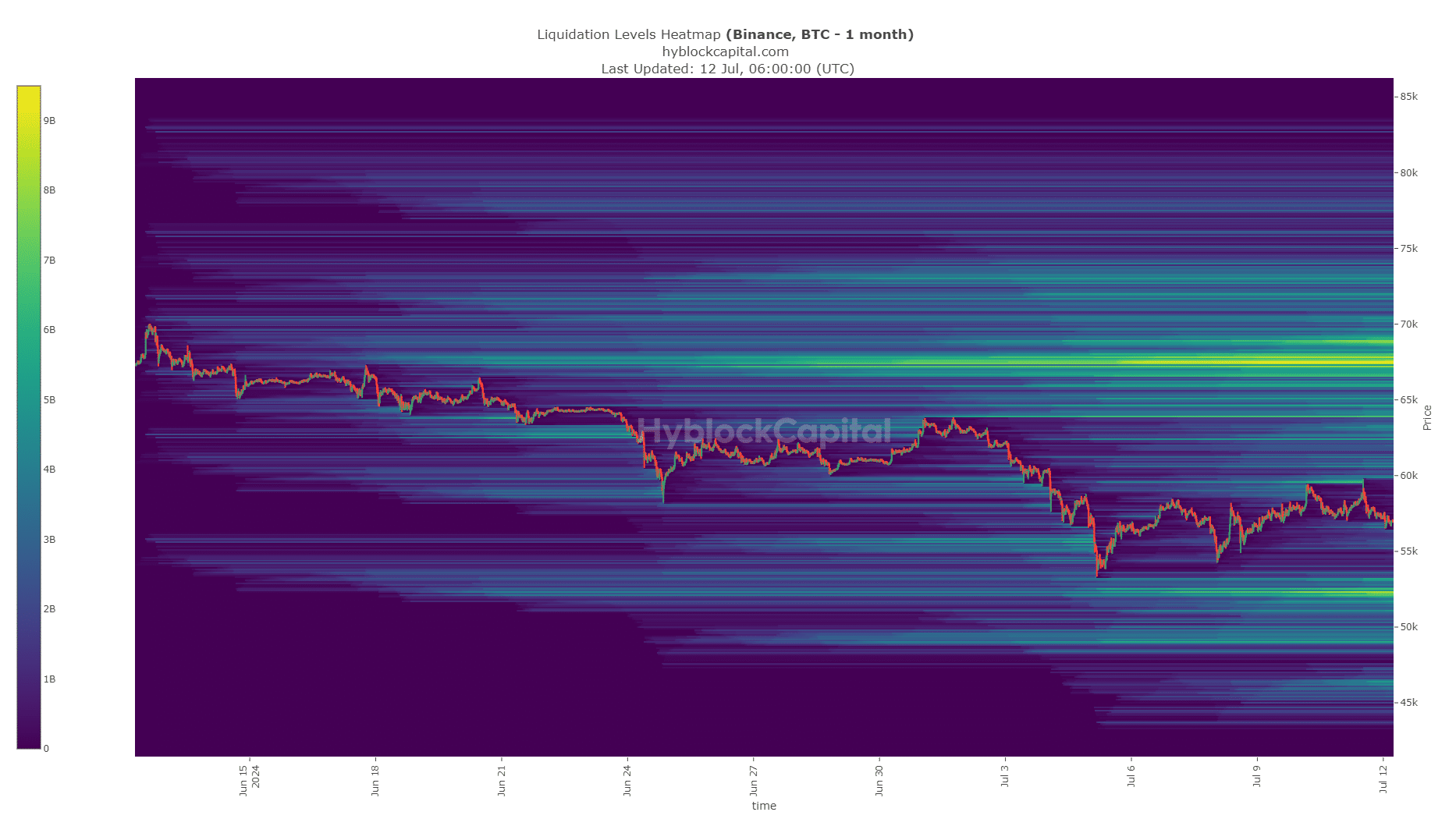

Over the past month, the liquidation heatmap indicated that the $59,500 area faced significant testing on July 11th. Following this event, prices swiftly reversed course, hinting that the next focus for market participants could be the $52,100 liquidity cluster.

If the buyers had held more power in the market, Bitcoin could have surpassed the $60,000 mark. However, since this didn’t happen, it’s likely that Bitcoin will experience further price drops based on current market trends.

Nice opportunity for traders

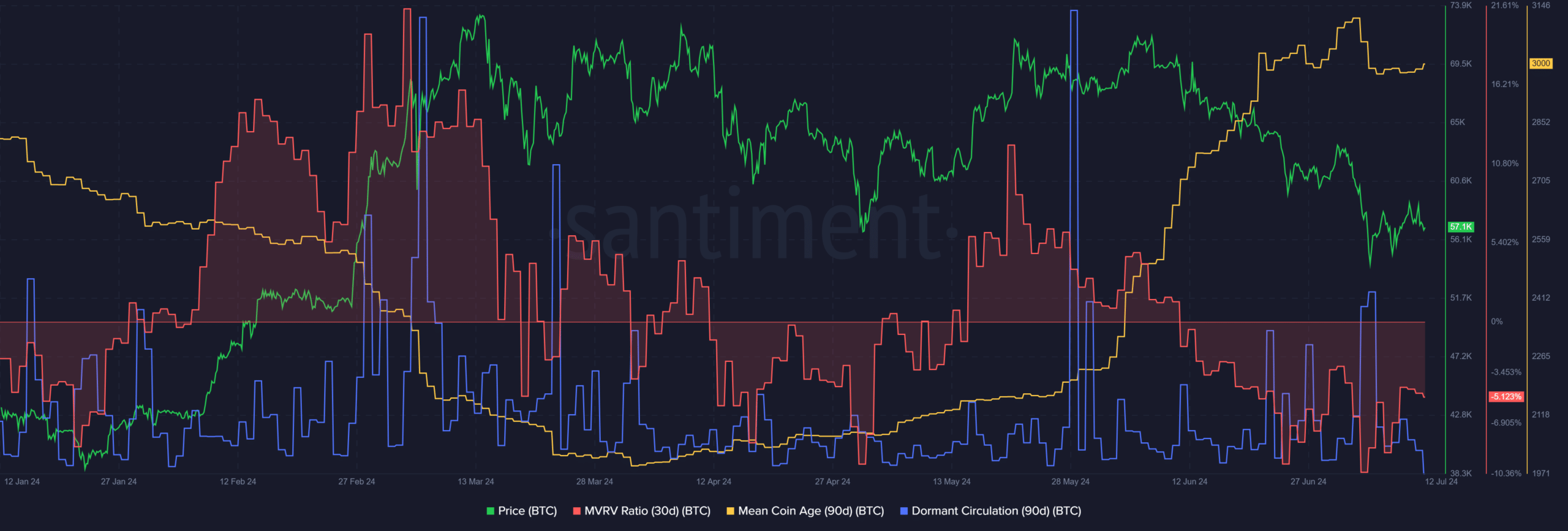

The average age of circulating coins has been increasing since May. Lately, over the last ten days, this trend has paused, but the larger pattern indicates significant coin hoarding across the entire network during the recent market downturn.

As a crypto investor, I’ve noticed that the 30-day MVRV (Moving Average of Realized Profits and Losses) has shown a negative result. This indicator suggests that short-term holders are currently experiencing losses. However, instead of being discouraged by this information, I view it as a promising sign. In my experience, when both the 30-day MVRV and the presence of short-term holder losses align, it often serves as a powerful buy signal.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On the fifth of July, there was a significant increase in dormant Bitcoin circulation when the prices took a steep dive. However, this activity level has decreased noticeably since then.

The significance of predicted Bitcoin losses is reinforced by the current liquidity level at $52,100. Should investor sentiment weaken further, the price could even drop to around $46,000. At present, however, it may be worth considering purchasing Bitcoin at lower prices.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-07-13 00:23