If you thought Bitcoin was about to enter its quiet retirement phase, think again. As May 2025 dawns, Bitcoin (BTC) comes striding onto the financial stage like a slightly overconfident wizard in a pointy hat, up 14% over the last month and now only 6.3% away from the mystical $100,000 barrier. The crowd gasps, the orchestra plays, and somewhere, a trader faints theatrically. 📈✨

In the background, Bitcoin’s “apparent demand”—that marvellous phrase that means people want to own it more than the hot pies at the Ankh-Morpork Guild of Pie Eaters—has turned positive for the first time since late February. The blockchain is abuzz like a Guild accountant who’s just discovered a decimal point in the wrong place.

But don’t start hurling your hats in the air just yet. Fresh investment inflows, especially from those mighty US-based ETFs (that’s “Extremely Thundering Funds,” probably), seem to have the same enthusiasm as a sloth in a hammam. MEXC’s Tracy Jin says a summer rally toward $150,000 could be as likely as rain falling upwards—possible, with enough wizardry and a brisk crosswind.

Bitcoin’s Demand Bounces Like a Rubber Chicken, But Investors Want Some Sauce

Apparently, 65,000 extra BTC have found loving homes in the last 30 days—a bit like kittens at a dwarfish adoption fair. Quite the leap, considering back in March everyone was running from Bitcoin as if it had developed a nasty cough (-311,000 BTC, to be precise).

For those new to “apparent demand”, this wizardry is about watching wallets rise and fall, then proclaiming loudly whether money is coming or going. Picture an accountant lecturing a turtle about the virtues of balance sheets and you’re halfway there.

//beincrypto.com/wp-content/uploads/2025/04/Bitcoin-Apparent-Demand_-30-day-sum.png”/>

However, the overall oomph behind this demand is faint, more of a worried cough than a dragon’s roar.

Most of the current Bitcoin accumulation seems to be existing holders squeezing their stashes a bit tighter, rather than a mob of newcomers crashing the door. For the next big leap, both demand and momentum need to dance together in joyous synchrony—a rare sight, like a tax collector doing the conga. Until then, don’t expect fireworks or trolls launching themselves from catapults.

American ETFs: Waking Up Slowly, Like a Troll in Winter

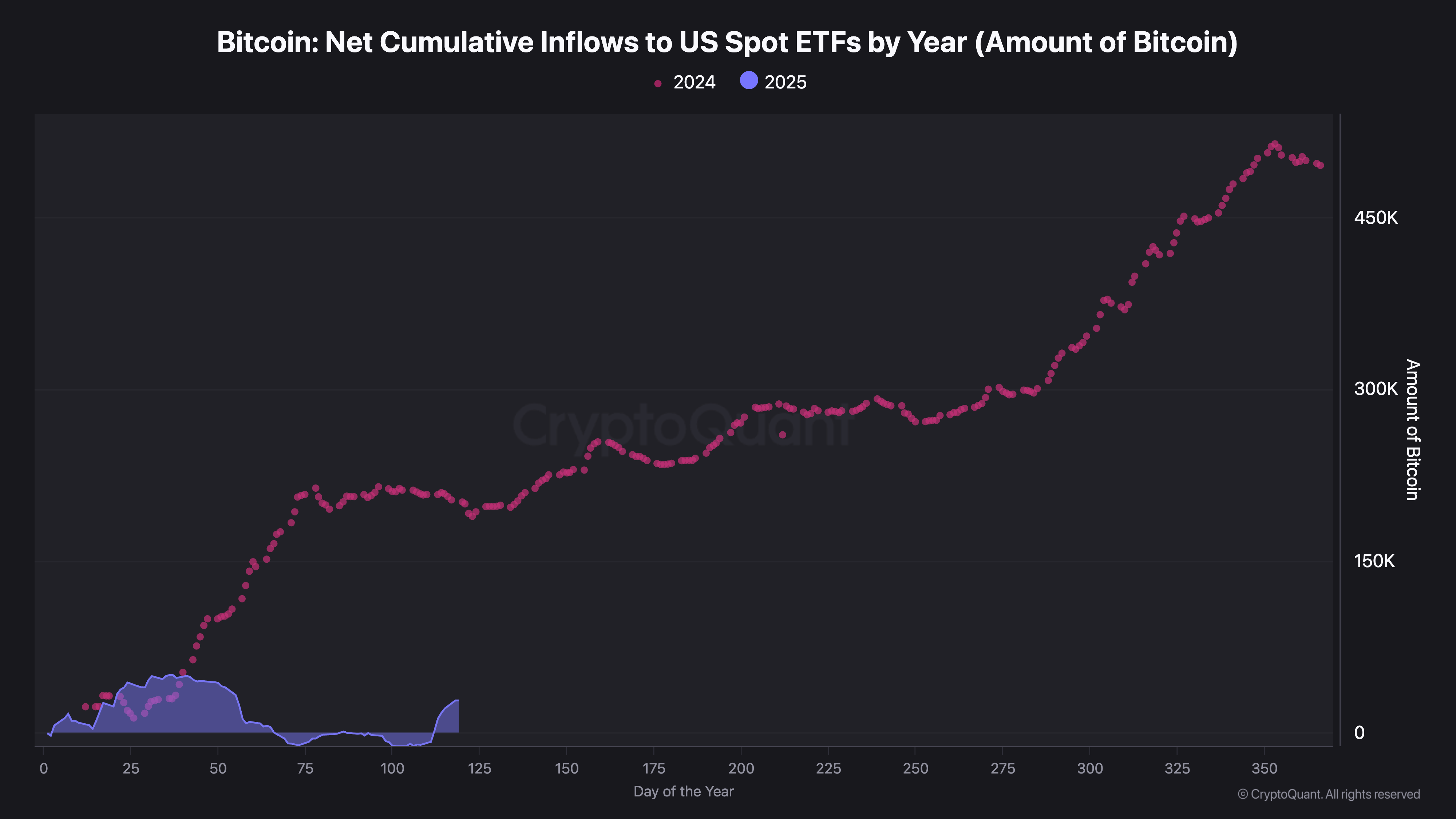

Meanwhile, US Spot Bitcoin ETF activity this year has been… let’s say, sedate. Between -5,000 and +3,000 BTC a day, which is the ETF equivalent of poking your porridge and deciding breakfast is too much effort.

Contrast that to late 2024, when ETFs were guzzling BTC at a rate of over 8,000 coins a day. Back then, it was all champagne and moon-bound rockets. Now it’s more like “I suppose I’ll have another biscuit.”

As of now, a mere 28,000 extra BTC have landed in ETF nests this year—a comical contrast to the 200,000 prix-fixe menu of 2024. Institutional excitement, it seems, is off enjoying a hobby elsewhere. (Perhaps embroidery?)

Recently, there are whispers of renewed ETF inflows—barely audible, but there if you press your ear to the cryptographic ground. Still, nobody’s putting on their party hats until the institutional whales come back from vacation, sunscreen and buy orders in tow.

Until then, the broader market momentum may struggle along, occasionally tripping on its shoelaces.

Bitcoin Nears $100K: Still Not a Substitute for a Magic Potion, But Much Shinier

After a brief detour under $75,000 in April (“Just looking for my keys!” Bitcoin might say), BTC is back up 14%. It shrugs off global chaos, macroeconomic headwinds, and even the latest tariff plot twists, like a terrier surrounded by very loud ducks.

The rest of the crypto zoo may be sunning itself nervously on a beach of volatility, but Bitcoin is striding ahead—less bothered by market shocks than your average Unseen University librarian (and with fewer bananas).

Sitting just 6.3% beneath the magical $100,000 line, Bitcoin is eyeing $110,000 as if it’s already written its name on the reserved sign. Tracy Jin at MEXC reports bullishness growing faster than a wizard’s beard:

“Beyond the regular ups, downs, and the occasional loop-de-loop, institutions are quietly getting peckish again. Shrinking supply, a world riddled with uncertainty, and Bitcoin’s stubborn refusal to act like a boring commodity all point to something structural shifting. BTC: The cheese-eating hedgehog of modern finance.”

Jin suggests the $95,000 range may soon be the starting line for a race that’s less of a sprint and more of a broomstick relay—likely heading toward $150,000, or even $200,000 by 2026, assuming global trade tensions don’t start another interesting bonfire.

“If trade drama settles and institutions stop sitting on their wallets, summer could see fireworks, rallies, and possibly a few fainting investors (again). Friday’s stock market smiles support Bitcoin over the weekend, which—let’s be honest—is the only kind of field trip this coin really wants.”

Read More

2025-05-01 00:42