- Bitcoin has a bearish short-term outlook with its series of lower highs in the past month

- The drop to $56.5k meant the liquidity below it would likely be tested soon

As a researcher with extensive experience in analyzing cryptocurrency markets, I share the bearish sentiment towards Bitcoin’s short-term outlook. The series of lower highs over the past month is a clear sign of bearish momentum, and the drop to $56.5k meant that the liquidity below it would likely be tested soon.

Over the weekend, Bitcoin (BTC) managed to hold its ground near the $60,700 mark of support. However, the bearish sentiment towards it in the short term remained strong.

An in-depth examination of the current liquidity situation by AMBCrypto indicates potential areas for a price shift in this week’s market trends.

As a researcher studying the Bitcoin market, I came across an intriguing piece of news: two wallets that had been inactive for almost a decade suddenly became active and sold Bitcoins worth approximately $60.9 million. This unexpected move might cause uneasiness among market participants due to its potential impact on the market dynamics. Furthermore, recent data indicated a decrease in crucial on-chain Bitcoin metrics, adding another layer of uncertainty to the situation.

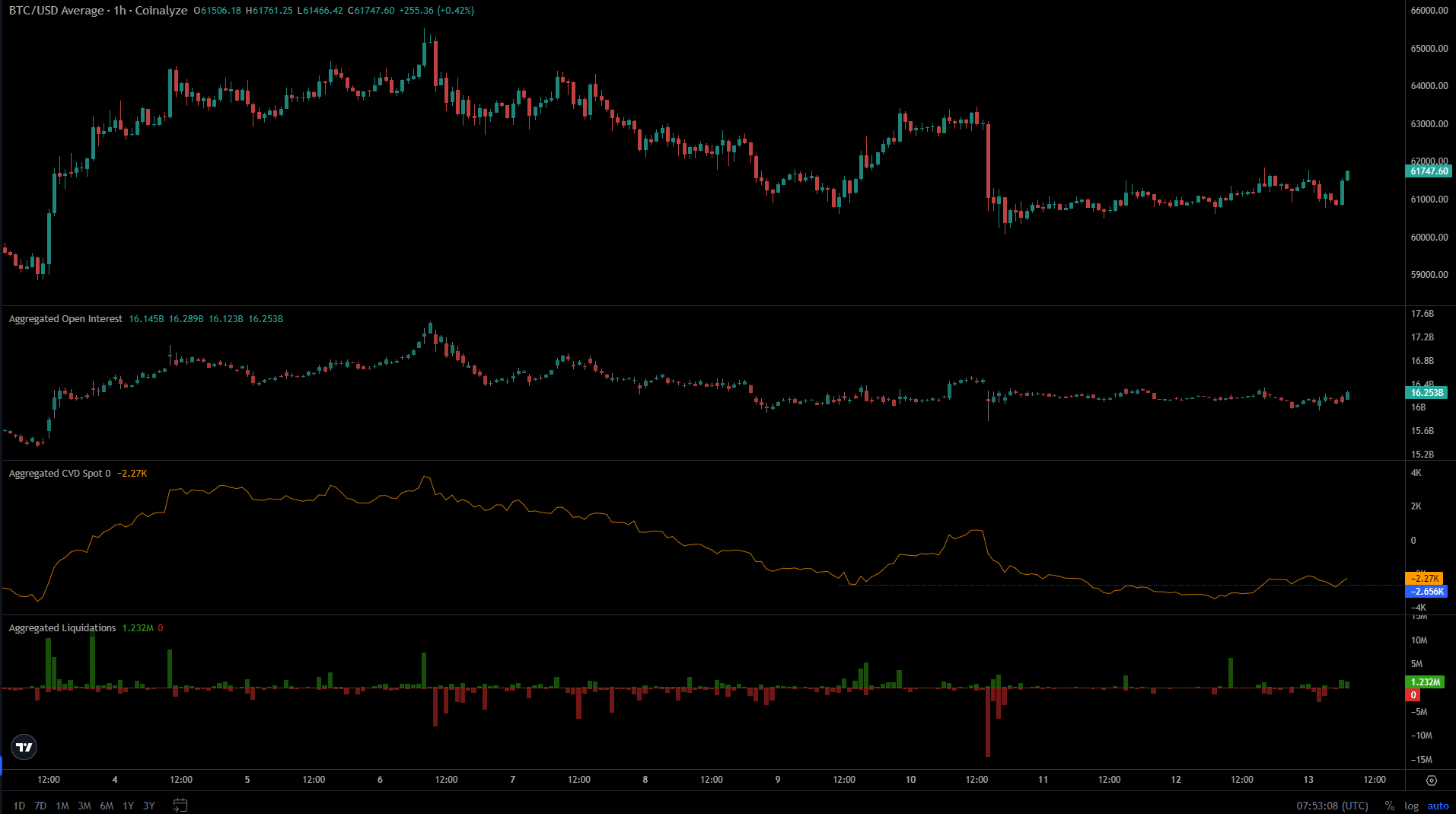

The capital inflows for BTC showed indecisiveness

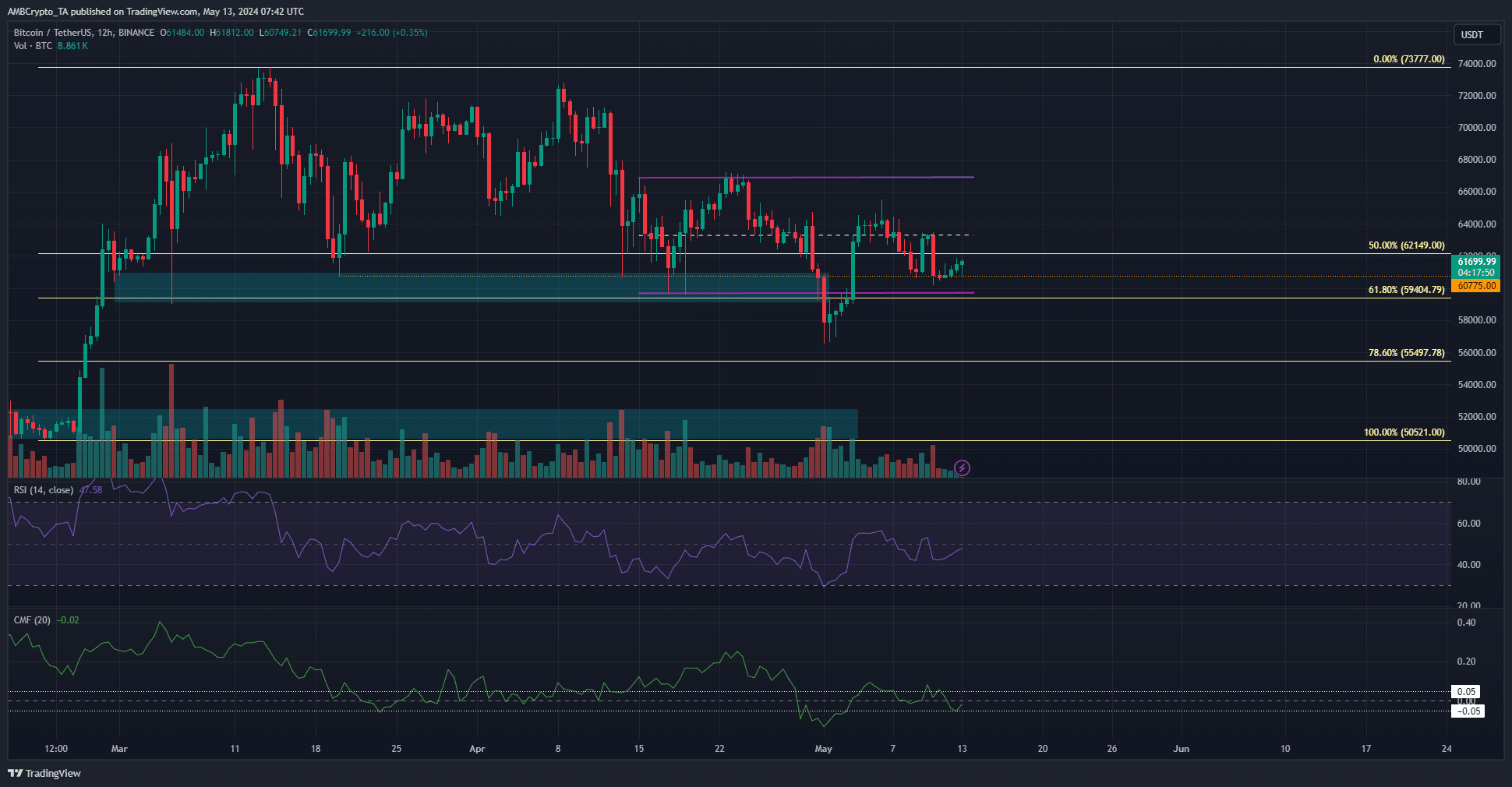

On May 1st, the support level for Bitcoin’s price range was decisively broken as the cryptocurrency plummeted to $56,500. Despite rebounding to $65,500 a week later, the technical analysis of its shorter-term market charts indicated a bearish trend.

According to AMBCrypto’s analysis, the price of Bitcoin is likely to decrease and approach the $56,000 level based on current trends. The Relative Strength Index (RSI) currently stands at 47, indicating a downward trend.

The price has formed lower highs since mid-April.

As a crypto investor, I’m keeping a close eye on the market and have noticed that we’ve reached the 78.6% Fibonacci retracement level at $55,500 in the current downtrend. This means that the price may pull back to this level before continuing its decline towards the bottom. However, it’s important to note that nothing is certain in cryptocurrency markets, and the situation remains unclear. With that said, I recommend being prepared for a potential revisit to $55,500 as part of the larger trend.

The spot CVD disagreed with the CMF indicator’s findings

As an analyst, I’ve observed that a strong capital inflow and robust investor confidence are key drivers of an asset’s upward trend. However, over the last week, both Open Interest and Bitcoin have shown signs of lethargy, failing to establish a clear direction in the market.

However, the spot CVD began to climb higher, and reclaimed a former short-term support level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Buying activity was evident in the spot markets, while short positions were closed out over the last two days.

If the liquidated Bitcoin positions result in compulsory purchases, the price might rebound upward if this trend persists.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-13 16:07