- The Mayer Multiple, a widely followed price indicator, suggests BTC has significant potential for an upward move.

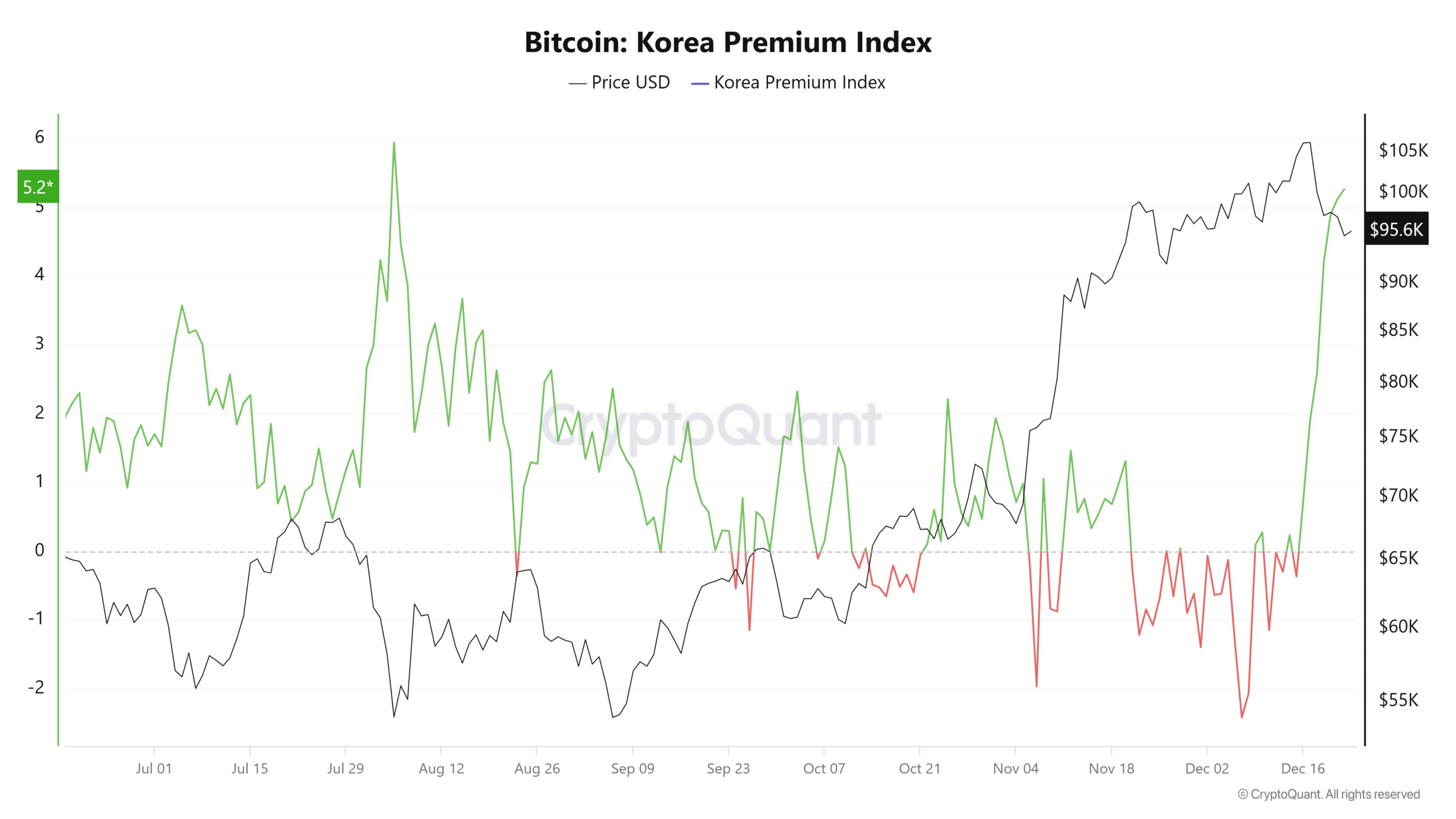

- Premium indexes reveal notable buying activity from Korean investors, which has supported BTC’s price action.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself consistently intrigued by the ever-evolving narrative surrounding Bitcoin [BTC]. The recent developments suggest a bullish trajectory for the world’s leading cryptocurrency, with various indicators pointing towards a potential rally to $168,000.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastCurrently, Bitcoin [BTC] is valued at approximately $95,646 per unit, representing a decrease of 7.89% compared to its peak price last week. Despite the minor 0.52% drop in value over the past day, this suggests that the selling pressure has lessened, possibly opening up opportunities for further increases.

As per AMBCrypto’s report, the recent drop to the $90,000 zone seems consistent with Bitcoin’s general upward trend, suggesting that the cryptocurrency may be headed for even greater heights.

Bitcoin price prediction: BTC set for a rally to $168,000

Based on the analysis by Ali Charts, Bitcoin continues to trend upward, even after experiencing a drop in its price recently.

The ongoing price adjustment is seen as a component of a broader market pattern that might push the cryptocurrency towards the $168,000 zone – an estimated high point calculated via the Mayer Multiple (MM). In simpler terms, this means that despite the current decrease in price, some analysts believe it could be part of a larger trend that eventually takes the value of the cryptocurrency up to the $168,000 region.

Using the Mayer Multiple, a metric accessible through Glassnode, we can determine possible market peaks and troughs. This is done by simply dividing the current Bitcoin price by its 200-day moving average.

According to this measurement, the market’s possible peak is signaled at a level of 2.4 MM (indicated by the red line), which translates to around $168,494. On the other hand, the bottom end is marked at 0.8 MM (green line), equating to approximately $56,141.

Keep in mind that the current Mayer Multiple of 1.3 suggests a reasonable value for Bitcoin, yet it doesn’t automatically determine the future trend of the market.

While there’s potential for growth towards the MM peak of 2.4, Bitcoin might surge up to $168,494. This price point would position Bitcoin as an overvalued asset.

Institutions and large investors keep BTC intact

Large institutional and significant financial backers significantly influence Bitcoin’s price fluctuations, with recent statistics showing a notable increase in their engagement as the digital currency gains traction once again.

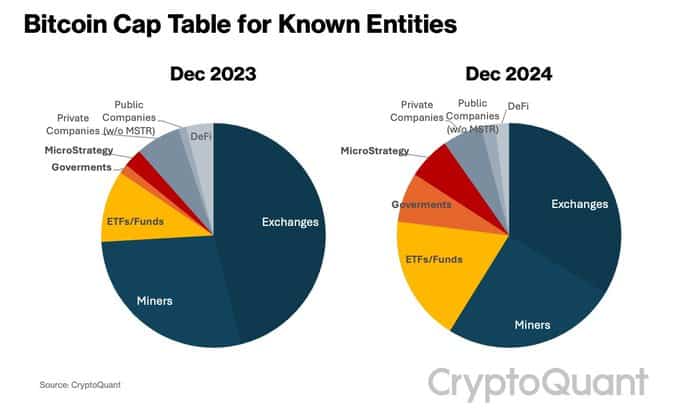

As reported by CryptoQuant, this particular group has noticeably expanded its ownership stake in Bitcoin’s list of significant entities, growing from a 14% share last year to 31% as of the most recent update.

If the current purchasing pattern persists, Bitcoin’s course might benefit, reinforcing its status as a significant player within traditional financial systems.

According to AMBCrypto’s investigation, a positive outlook towards Bitcoin remains strong among investors from the U.S., Korea, and other traditional markets, indicating their ongoing belief in Bitcoin’s future prospects.

Korean investors accelerate Bitcoin buying

Over the past day, there’s been a significant increase in Bitcoin purchases by South Korean investors. A similar surge was last observed in August. As a result, the Korean Premium Index now stands at 5.26, compared to -0.37 on December 15th.

This level of heightened buying activity indicates ongoing accumulation, which could soon reflect in BTC’s price, potentially driving it higher in upcoming trading sessions.

Contrary to this, American investors seem less keen on cryptocurrency investments, as suggested by a drop in the Coinbase Premium Index. Currently, the index stands at -0.1035, indicating a decrease in purchasing activity and potentially a cooling down of interest.

Read Bitcoin’s [BTC] Price Prediction 2024-25

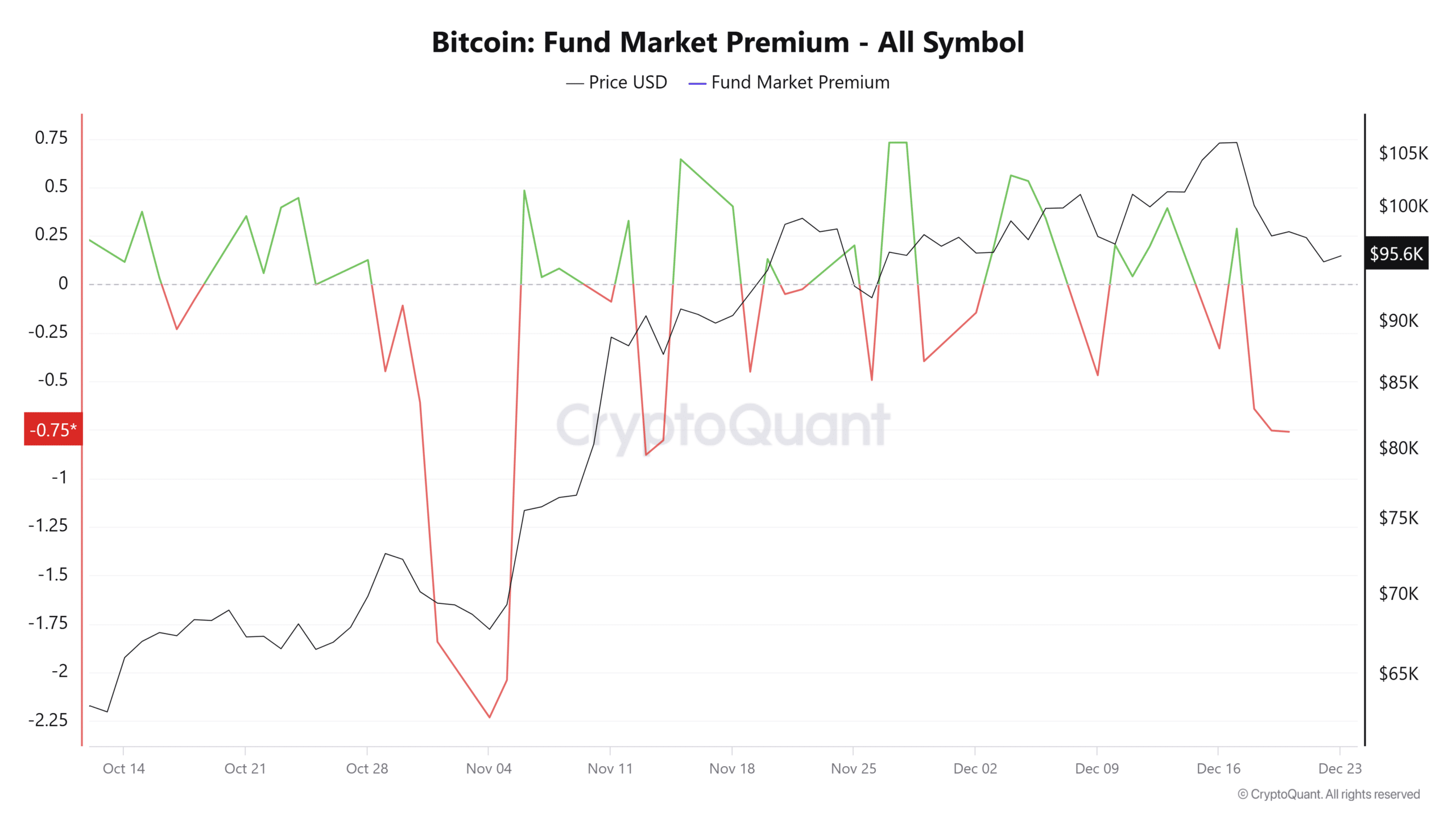

In a similar vein, the Fund Market Premium Index, serving as an indicator of institutional Bitcoin transactions, reflects this pessimistic outlook. At present, it’s sitting at -0.759, underscoring a decrease in institutional appetite for Bitcoin.

If American and institutional investors resume purchasing Bitcoin, along with the optimistic sentiment from South Korean investors, this collective buying power might propel Bitcoin’s value towards the $100,000 range.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-23 14:16