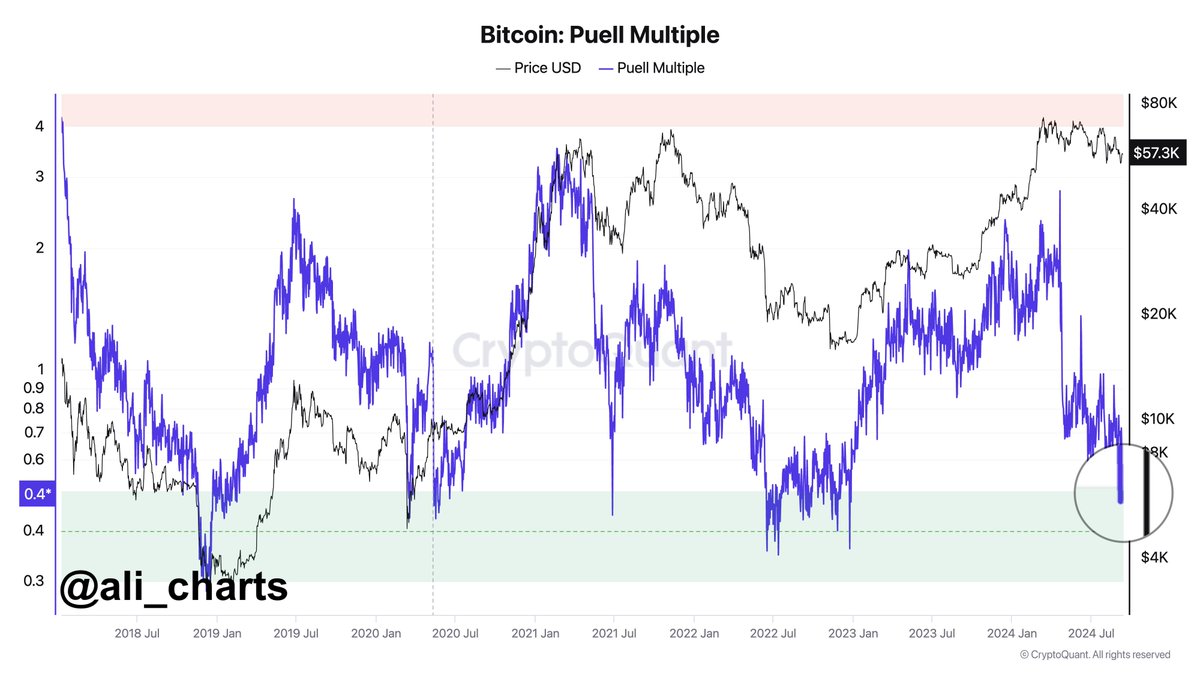

- Bitcoin’s Puell Multiple dropped below 0.4, signaling a market bottom and a fall in miner selling pressure

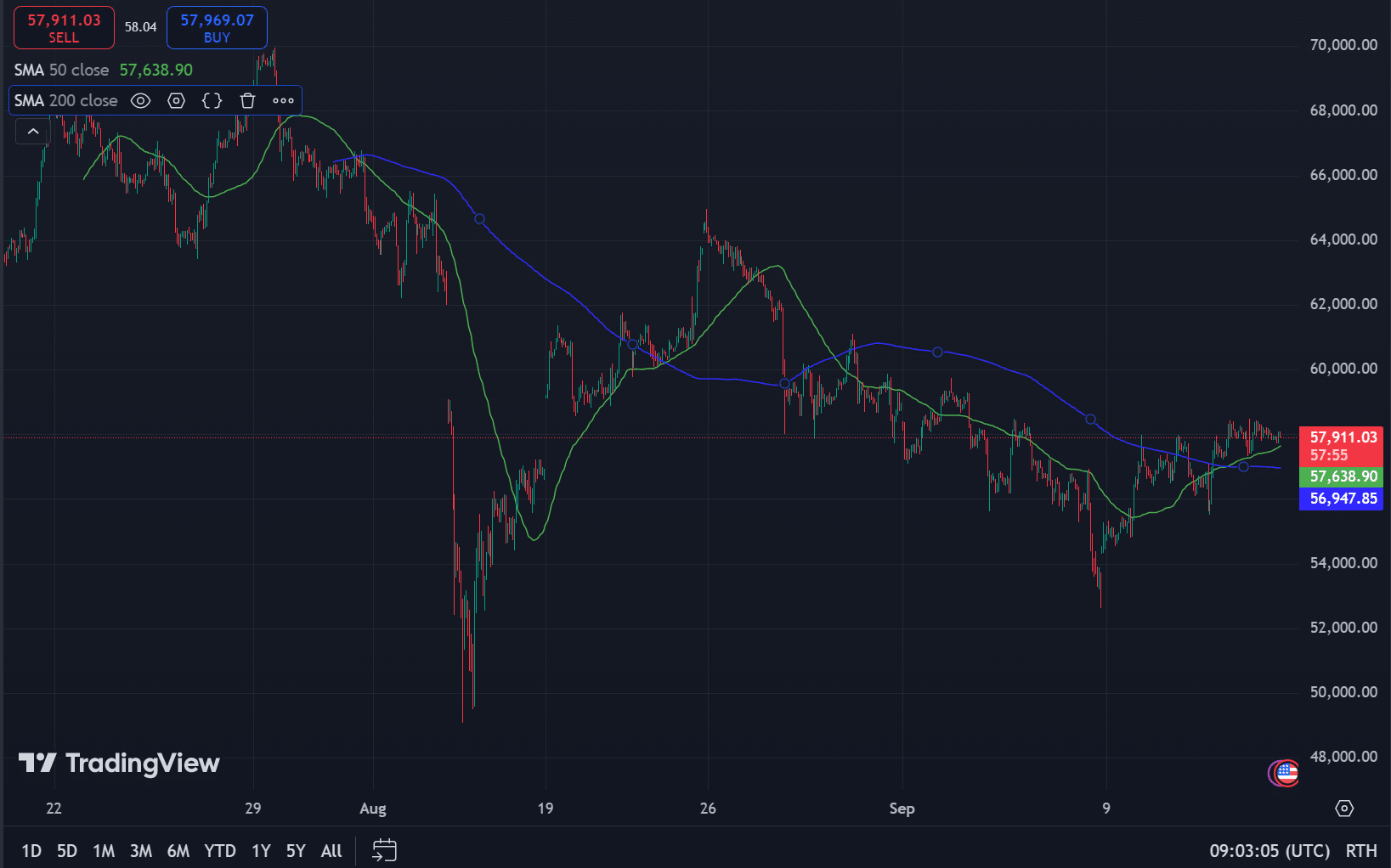

- A golden cross on the 2-month chart and tightening Bollinger Bands suggested a potential breakout

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The current state of Bitcoin [BTC] seems to be pointing towards a potential bullish momentum, which is an exciting prospect for investors and enthusiasts alike.

currently, Bitcoin (BTC) appears to be showing signs of a possible bullish trend, as the Puell Multiple falls below 0.4. This situation is accompanied by the formation of a ‘golden cross’ on its 2-month chart. These signals, combined with other on-chain data, imply that Bitcoin might be gearing up for a substantial price increase. It’s crucial to examine the details more closely to determine if Bitcoin is indeed set for an uptrend.

Example – Recently, the Puell Multiple dropped below 0.4, suggesting that Bitcoin miners are currently earning less than their usual average. Analyst Ali Martinez pointed this out on his platform (previously Twitter). In the past, this metric has been linked to market bottoms, implying that Bitcoin might be underestimated and potentially undervalued.

When miners make lower earnings, they tend to hold onto their assets more frequently. This decrease in supply for sale can lessen market pressure and typically paves the way for a price increase.

How are miners and on-chain activity supporting the bullish case?

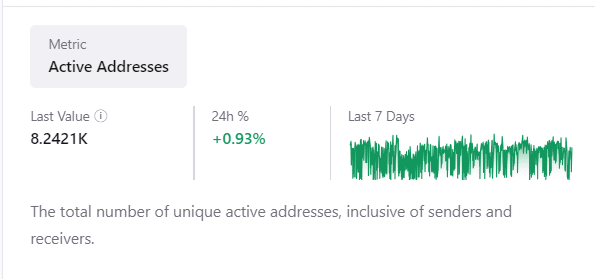

Even with a dip in Bitcoin mining profits, the network’s activity level is robust. In the last 24 hours, there has been a 0.93% increase in active addresses, amounting to approximately 8,240 – an indication of increased user interaction on the network.

With this increased action and miners presumably choosing to keep their holdings instead of selling, there might be a shortage of supply that could potentially push prices upwards.

As more miners choose to hold onto the cryptocurrency they mine instead of immediately selling it, and on-chain activity escalates, the available supply of that cryptocurrency tends to decrease. This could potentially drive up the price if demand for the cryptocurrency stays the same or increases, since there is less of it in circulation.

Golden Cross and other technical indicators

On a two-month graph, Bitcoin exhibited a Golden Cross – a situation where the 50-day moving average surpassed the 200-day moving average. This pattern is often interpreted as a bullish sign, particularly for longer timeframes. Essentially, this suggests that Bitcoin could be starting a prolonged upward trend on the charts.

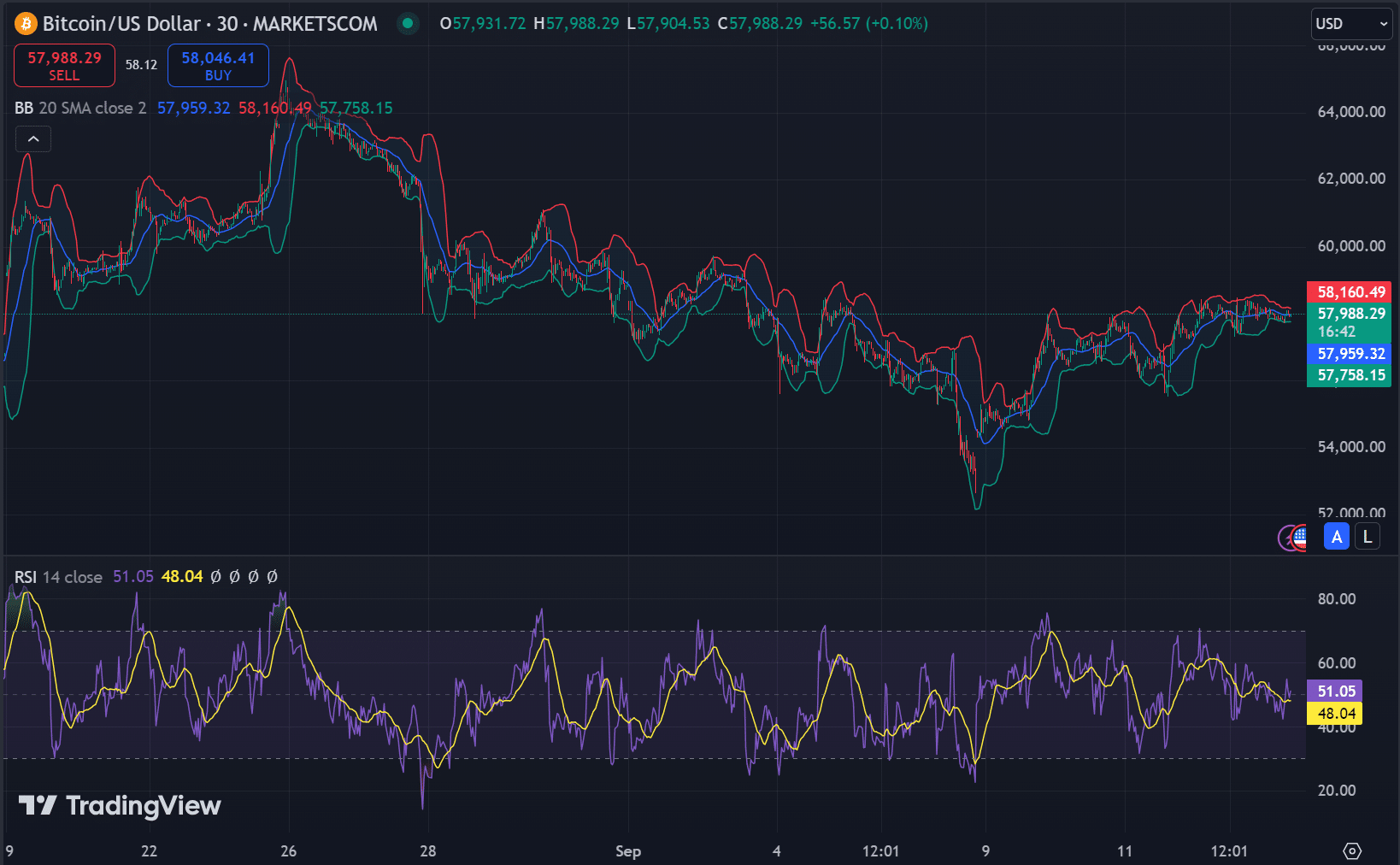

Furthermore, with a Relative Strength Index (RSI) standing at 51.05, this suggests that the market is neither bullish nor bearish, offering potential for further price increases.

The Bollinger Bands appeared to be narrowing around the $57,758.15 mark for Bitcoin, suggesting it might be overbought and due for an uptick in value shortly.

Is Bitcoin ready for a breakout?

If the Puell Multiple suggests we’re nearing a market bottom, a Golden Cross pattern appears, and crucial technical signs such as the Relative Strength Index (RSI) and Bollinger Bands point towards a positive trend, there’s a strong possibility that Bitcoin could be on the verge of a significant price increase.

The theory was also supported by a decrease in mineral sellers, an increase in on-chain activity, and robust technical indicators.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-14 05:11