- New and old Bitcoin supply revealed that the coin lacked new investors

- Long-term holders are selling – Sign of a further price decline

As a researcher with extensive experience in analyzing Bitcoin’s on-chain data, I believe that the current market conditions suggest a lack of new investors and increasing selling pressure from long-term holders. Based on my analysis of new and old Bitcoin supply, it appears that new demand has not yet materialized to drive prices higher.

As an on-chain analyst, I’ve observed that Bitcoin (BTC) hasn’t reached its peak demand level based on current trends. This could be due in part to the relatively subdued interest from new investors compared to past bull markets.

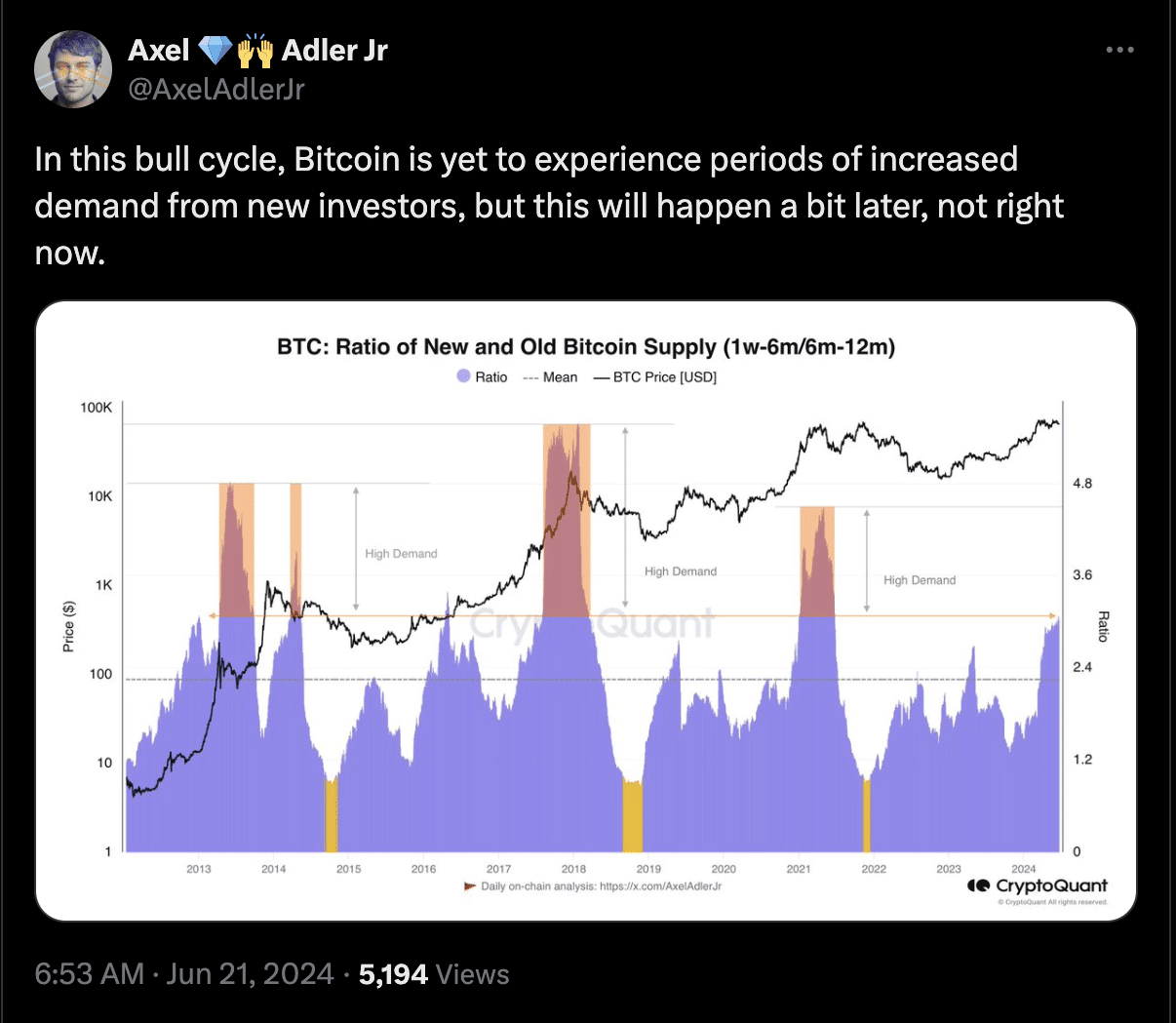

Alder expressed in his post on X that new investors started purchasing Bitcoin considerably later than initial investors. This notion is supported by the distribution of old and new Bitcoin supply.

Based on the chart presented, Bitcoin has yet to reach the points of significant buyer interest. Consequently, it’s possible that we may experience price increases in the coming months or years.

New investors are not around

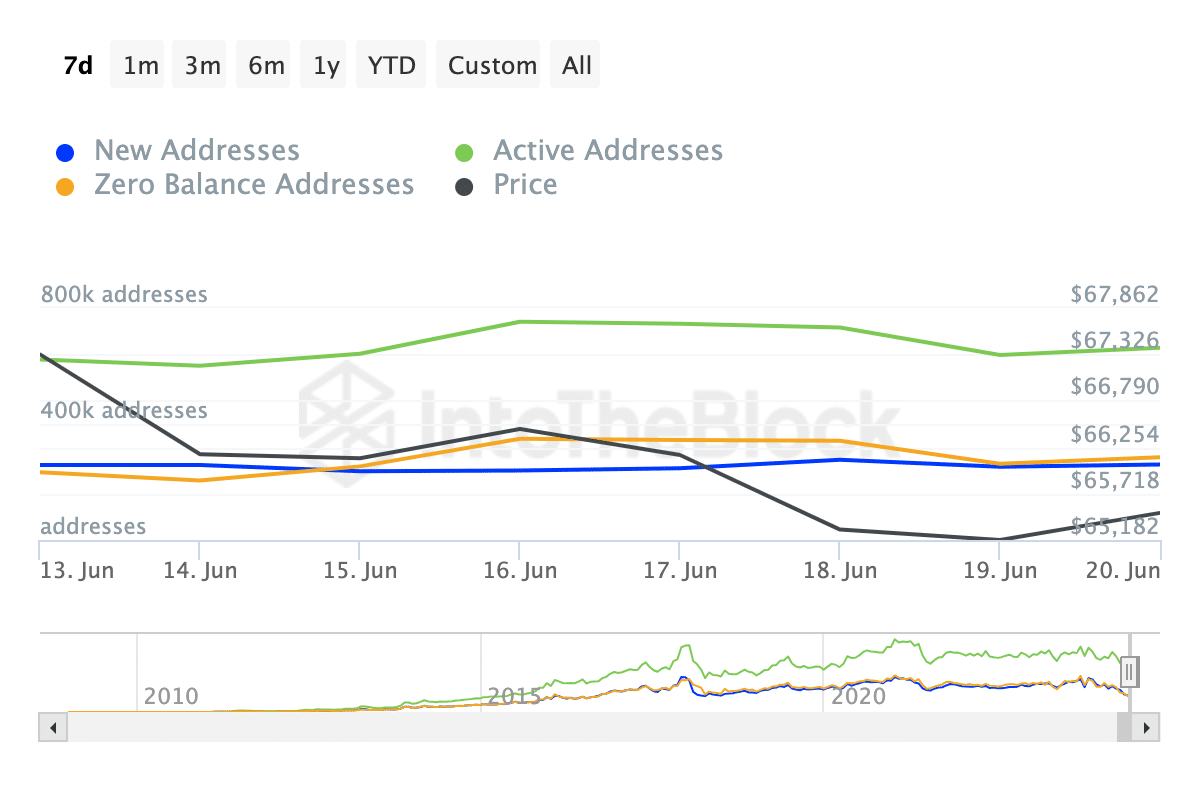

At the moment of reporting, Bitcoin’s value stood at $63,719 following a nearly 5% decrease over the past week. To assess whether Bitcoin’s price is likely to increase, AMBCrypto examined user activity and expansion within the network.

According to IntoTheBlock’s metrics, there are new addresses, active addresses, and zero-balance addresses. The term “active addresses” refers to the number of unique users currently engaging in transactions on the network.

Instead of “New addresses, on the other hand, mean the number of addresses conducting their initial transaction,” you could say: “On the contrary, a rise in new addresses signifies the number of addresses making their first Bitcoin transaction.” At present, there has been an increase of 6.47% in the past week for active Bitcoin addresses recording their inaugural transactions.

New accounts saw little growth, increasing by only a small percentage, whereas the number of zero-balance addresses experienced a significant jump by 22%. Adler’s perspective suggests that this trend might lead to further price declines.

According to a recent report by AMBCrypto, a cryptocurrency analyst has forecasted that Bitcoin’s price could potentially drop to around $54,000. Although this may not materialize in the immediate future, the digital currency might decline and approach the $61,000 mark on the charts.

Holders continue to sell

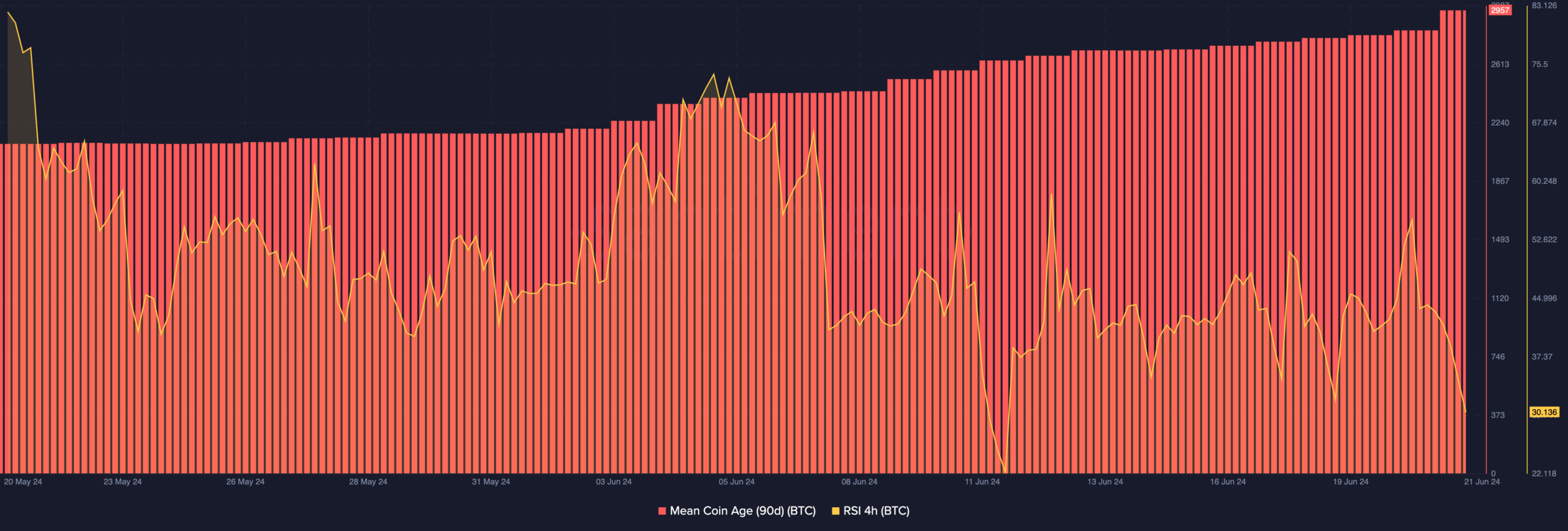

Additionally, we examined the Mean Coin Age (MCA), which represents the typical age of all coins considering their purchase prices. An increase in this metric implies that older coins are being transferred from their previous depositories.

Generally speaking, a declining Market Cap (MCA) suggests that fewer holders are selling their coins in the market. On the contrary, when the MCA rises, it indicates an increased number of transactions with coins being bought rather than sold. As a result, market participants are not only acquiring new coins but also withdrawing them to secure cold wallets for long-term storage.

As of now, Bitcoin’s moving average convergence divergence (MACD) line, which tracks the 90-day price trend, continues to rise since June 1st. If this upward momentum persists, there is a possibility that the Bitcoin price may decrease and reach the predicted level of $61,000.

As an analyst, I’ve observed a decline in the Relative Strength Index (RSI) on the 4-hour chart. This indicator, which I use to measure an asset’s momentum, has dipped, potentially signaling a shift in price trend or increased volatility.

One way to rephrase this in clear and conversational language: The Relative Strength Index (RSI) of Bitcoin also indicates whether it is overbought or oversold. A reading of 70 or more signifies overbought, while a value below 30 suggests oversold conditions. At the current moment, Bitcoin’s RSI was hovering near the oversold threshold.

Is your portfolio green? Check the Bitcoin Profit Calculator

This indicates that momentum has been bearish. As such, a further price fall could be possible.

If purchasing intensity rises, the cost could bounce back. Regarding demand, it may stay suppressed for the upcoming weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-06-22 08:07