-

Bitcoin saw extra sell pressure on Friday as economic data hammered down on market sentiment

BTC might regain some momentum as the price dips into a potential buy zone

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of bull and bear markets. Friday’s Bitcoin selloff was a stark reminder that even the most resilient crypto can succumb to economic headwinds. However, as they say, every cloud has a silver lining.

On Friday, I witnessed a predominance of Bitcoin bearish sentiments that drove the market down by nearly 6%. For quite some time now, the top crypto has been experiencing a slump, and various economic reports have significantly impacted its trajectory during the past few weeks.

On Friday, Bitcoin showed signs of pessimism due to disappointing unemployment data. The figures exceeded expectations, causing the overall U.S. unemployment rate to increase to 4.3%. This unexpected rise sparked concerns about a potential recession, which in turn led investors to adopt a bearish attitude towards BTC and other market assets.

Is Bitcoin ready to push back up?

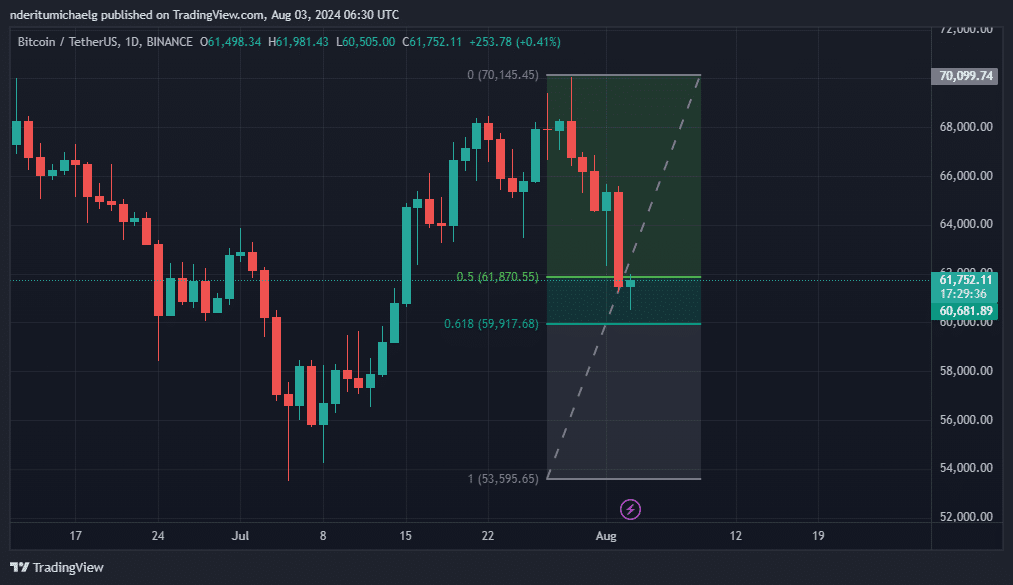

Bitcoin has experienced a decrease of approximately 13% since its peak price on Monday, largely due to the ongoing bearish trend. This decline has placed Bitcoin in a significant potential buying range, which we had earlier identified as noteworthy.

As a seasoned trader with over a decade of experience under my belt, I have found that Fibonacci retracement levels can be incredibly useful for identifying potential buy zones. In this case, based on the analysis, I would recommend keeping an eye on the price range between $61,870 and $59,917 as a potential entry point for a buy. This range is derived from the Fibonacci retracement of the cryptocurrency’s July lows to its highest recent levels, a technique I have found to be reliable in the past. While past performance is not always indicative of future results, this strategy has served me well over the years and I believe it could be worth considering for those looking to make a move in the market.

Currently, when I’m typing this, Bitcoin (BTC) is worth approximately $61,727. This suggests a significant increase in demand as investors seem to be taking advantage of lower prices. Interestingly, this price point also falls within the previously mentioned Fibonacci retracement zone.

Based on my years of market analysis and observation, this development could indicate a decrease in sell pressure. Given my past experiences, I have seen similar situations where reduced selling can lead to a substantial uptrend. So, the question that arises is whether this reduction will be sufficient to maintain a significant upward momentum going forward.

Bitcoin whales on the move

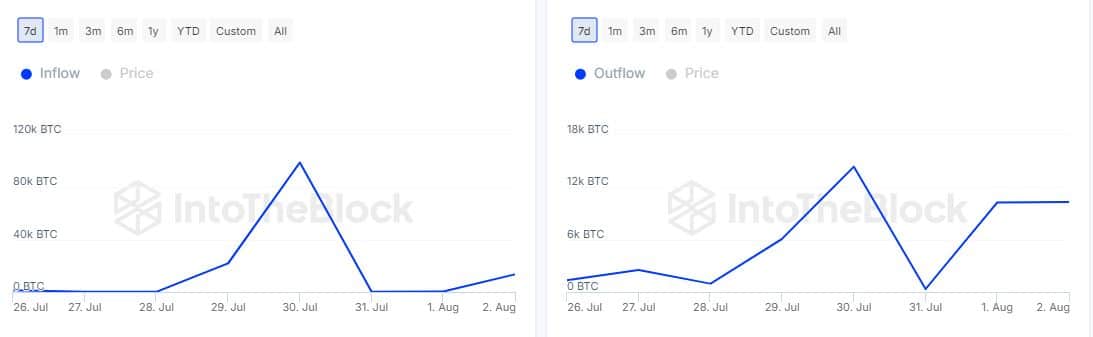

It was found that large Bitcoin holders, often referred to as “whales,” have been transferring funds between their digital wallets. On July 30th, whale inflows reached a high of 99,000 BTC. Additionally, the inflow of Bitcoin increased from 391.8 BTC on August 1st to approximately 13,490 BTC during yesterday’s trading session, indicating a growth trend.

This may be a sign that whales accumulated a significant amount of Bitcoin across the board.

Contrarily, the highest outflow of Bitcoin by whales occurred on July 30 at 14,370 BTC, which then decreased to 340 BTC the following day. More recently, on August 2, outflows peaked at 10,330 BTC higher than before. The overall inflow into whale wallets was greater than outflows, suggesting that whales have been buying or holding onto Bitcoin.

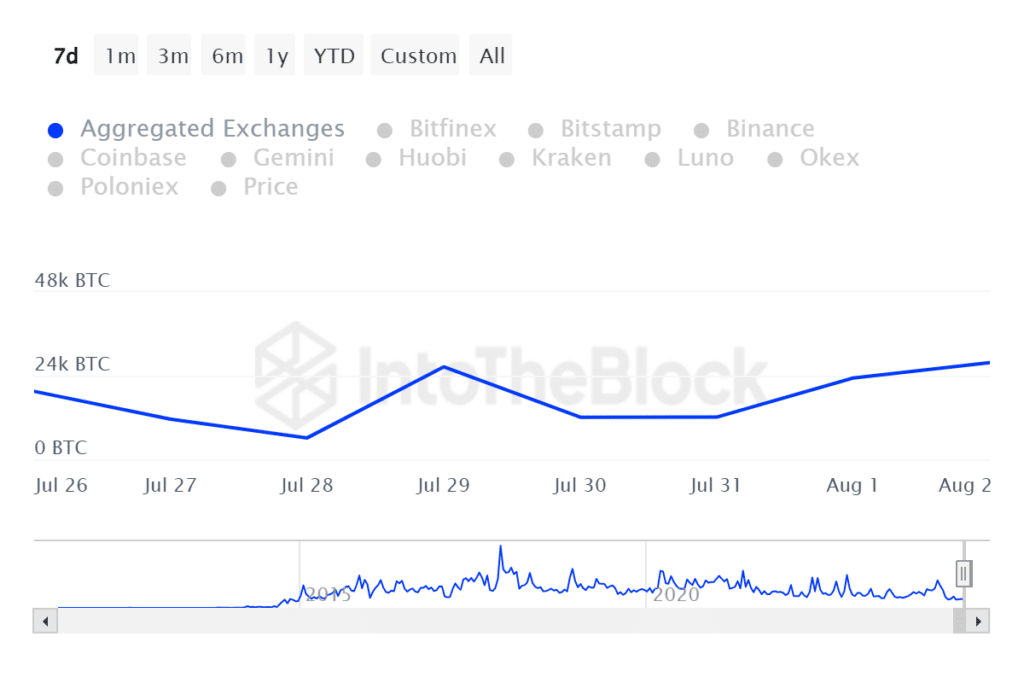

Additionally, we examined the volume of Bitcoin entering and leaving exchanges as a means of assessing whether there was more demand for buying or selling.

Yesterday’s Bitcoin trading saw the highest aggregate exchange outflow of approximately 27,730 Bitcoins.

During that trading period, Bitcoin saw approximately 16,850 Bitcoins leaving various wallets, which translates to a total of 10,880 Bitcoins leaving the market, equivalent to more than $671 million in purchasing power being withdrawn.

Therefore, it appears that a significant number of Bitcoin (BTC) were withdrawn from exchanges during last Friday’s trading, suggesting that traders, even large ones known as whales, have been accumulating. This could potentially signal a recovery trend for the upcoming week, but if selling pressure continues to grow, this may not hold true.

Read More

2024-08-03 19:03