-

Market sentiment was bearish over the last four months as BTC faced consistent rejections from local highs

Selling pressure has not abated and could force another major southbound move

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles – from the dotcom bubble to the 2008 financial crisis and the subsequent recovery. The current state of Bitcoin [BTC] reminds me of the late-90s when everyone was hyped about the next big thing but reality took a different turn.

The halving event for Bitcoin (BTC) took place on April 19th, 2024, but as of now, the anticipated price surge hasn’t happened yet. Currently, the Crypto Fear and Greed Index stands at 46, indicating a neutral attitude among investors.

On the weekly chart, Bitcoin continues to present a bearish structure, with BTC setting lower highs and lower lows since late May. Insights into stablecoin flows reinforced the bearish view of the crypto-market over the coming weeks.

Suspicions of a deeper price correction

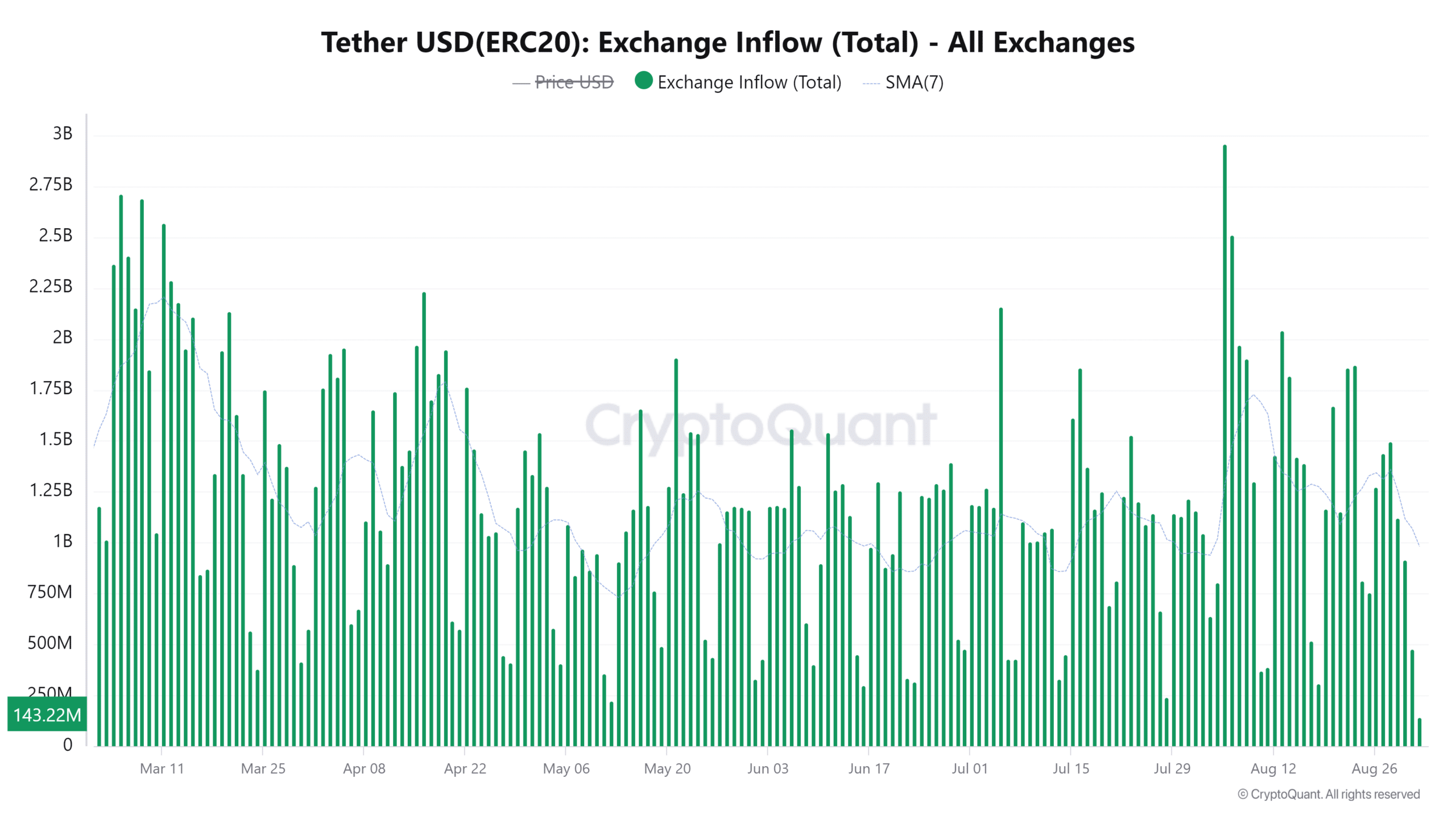

According to an analysis by CryptoQuant Insights’ theKriptolik, there has been a substantial decrease in the amount of Tether [USDT] being deposited into exchanges. Upon closer examination by AMBCrypto, they discovered that these stablecoin deposits into exchanges were at their lowest point in the past six months.

During significant declines in Bitcoin’s and the broader cryptocurrency market’s prices, there is often a substantial increase in stablecoin inflows. This suggests that investors are taking advantage of price dips to expand their cryptocurrency portfolios by purchasing more coins.

On the 5th of August, a significant decrease in Bitcoin’s price was observed, with it falling from $58,300 to $49,000 – representing a decline of approximately 15.9%. Remarkably, inflows of stablecoins amounted to $2.9 billion on that day.

Consequently, the observation of minimal activity in Tether exchanges during Bitcoin’s dip below $60k could suggest concerning developments. This might indicate that experienced investors are anticipating a more significant price decrease before investing in the market.

How low can the next move go?

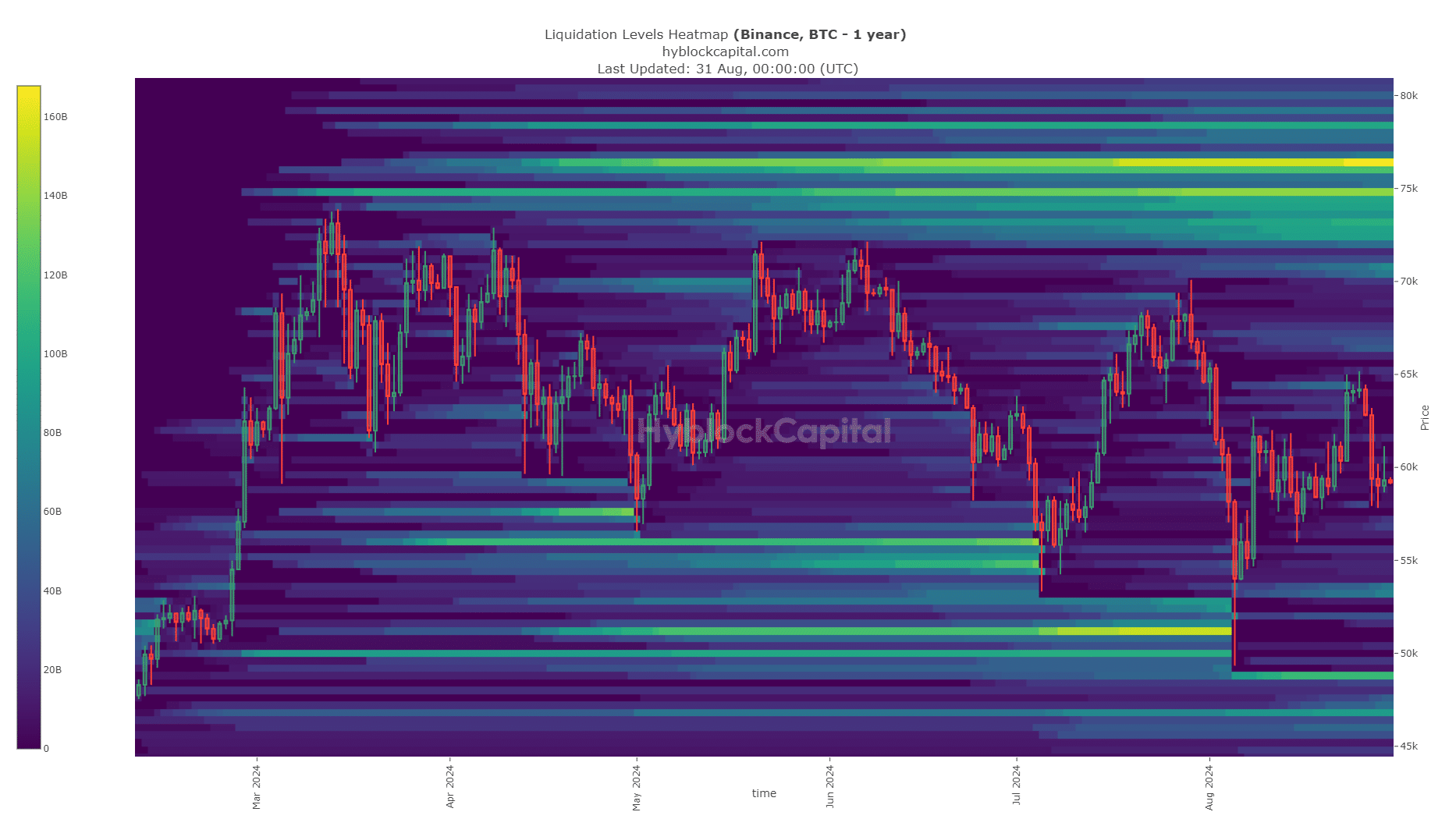

According to AMBCrypto’s analysis, the potential key resistance points for Bitcoin are located at approximately $48,800 and $46,600. Additionally, there appears to be a concentration of liquidity around $53,600. If the price of BTC falls below $56,000, these levels could serve as possible targets for its downward movement.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A recent report warned that a plunge below $56k could lead to a much deeper correction. The bull-bear market cycle showed bearish dominance, and the findings from the Tether exchange flows reinforced this bearish view.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-09-02 05:11