- Mapping Bitcoin’s price prediction as BTC breaks out of a six-month consolidation.

- This bull run’s price discovery phase could push BTC beyond $200k.

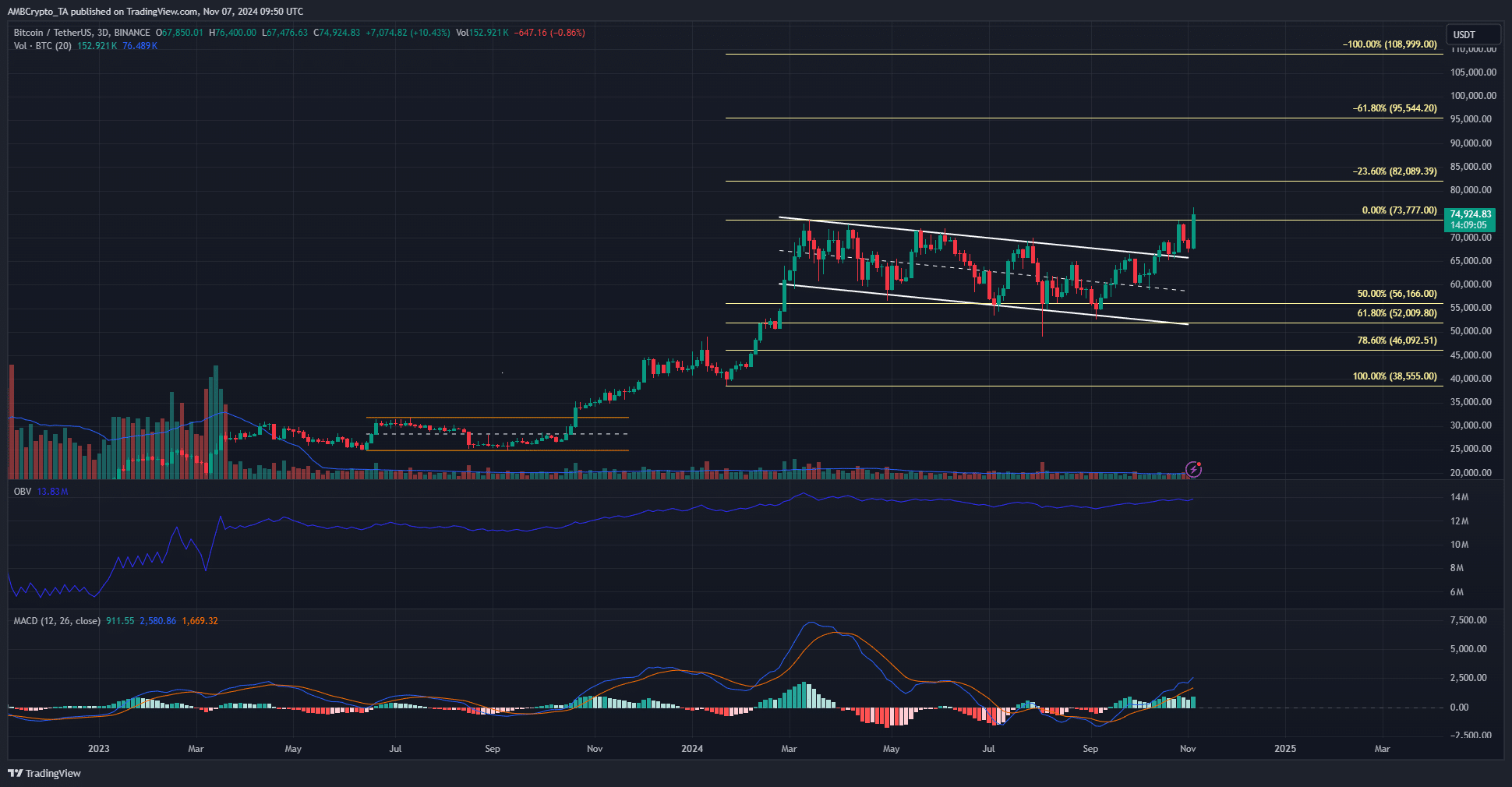

As a seasoned crypto investor with a decade of experience under my belt, I find myself increasingly optimistic about Bitcoin’s potential price trajectory. The recent breakout from a six-month consolidation and the new all-time high at $76.4k have set the stage for what could be a remarkable bull run.

As an analyst, I experienced a significant milestone when Bitcoin [BTC] reached a record peak of $76.4k on the 6th of November, following the U.S. elections that resulted in Donald Trump’s re-election victory.

Trump’s pro-crypto stance and promises could aid Bitcoin and the rest of the crypto sphere.

Bitcoin price prediction- a repeat of 2020 in sight?

The year 2020 was a BTC halving year, as well as a U.S. presidential election year.

By November 2020, Bitcoin’s momentum was optimistic. As soon as the outcome of the U.S. election became clear, the market experienced a decrease in doubt and swiftly began to escalate.

A similar scenario could play out in the coming weeks.

In approximately five months last time around, there was a massive increase of 319% in Bitcoin’s value. If we were to experience something similar, by the beginning of April 2025, Bitcoin could potentially reach $288k. But it’s extremely improbable that such a scenario will occur.

Over time, each successive cycle of Bitcoin’s growth has yielded smaller returns over a longer duration compared to the previous one, which makes predicting its long-term performance quite challenging.

In simpler terms, the Fibonacci levels help identify potential future price points, yet it’s possible that the price could reach $109k by the year 2025 – this might not come as a shock.

Based on the data we’re seeing from on-chain analysis, Bitcoin appears to be relatively early in its current bull market, indicating that we may not have reached the peak just yet.

Using the previous run to predict this one

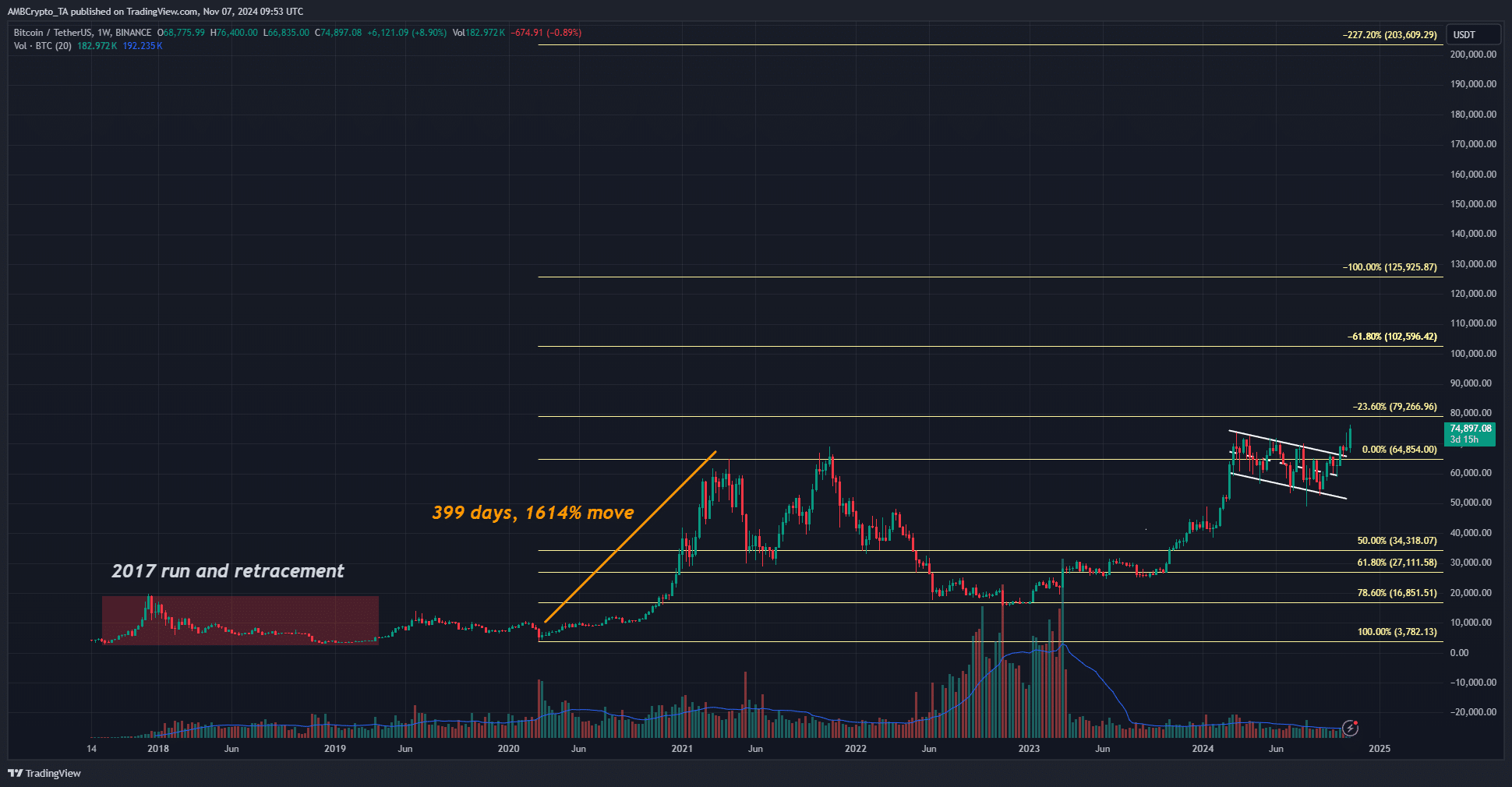

Back in 2017, I found myself captivated by the surge of Bitcoin, which soared an impressive 600% within a span of mere three months. Just a year prior, many had written it off as defunct.

Looking back at historical price movements, it’s clear that a significant portion of the earlier gains had been reverted by 2019. However, the subsequent bull market kicked off in 2020.

By examining an alternate sequence of Fibonacci ratios, it’s apparent that the market’s pullback in 2022 found support near the 78.6% mark, suggesting a period of consolidation.

Remark: The peaks reached in March, rather than those in November, were selected due to the lack of substantial activity following that period.

The 2017 run’s 227% extension was $58.4k, close to Bitcoin’s weekly session closes in early 2021.

Consequently, it’s plausible that the price of Bitcoin could surpass $225,000 in this cycle, potentially peaking 10-15% higher than its current record high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Given that each subsequent Bitcoin cycle tends to decelerate, reaching a target price of over $200k might require an additional year or even longer.

Simultaneously, several well-respected analysts and market players, including Ki Young Ju, think it may be challenging for prices to surpass $100k.

Read More

2024-11-07 20:39