- Bitcoin has a bullish structure after flipping $67k to support.

- The lack of volume might cut short an uptrend.

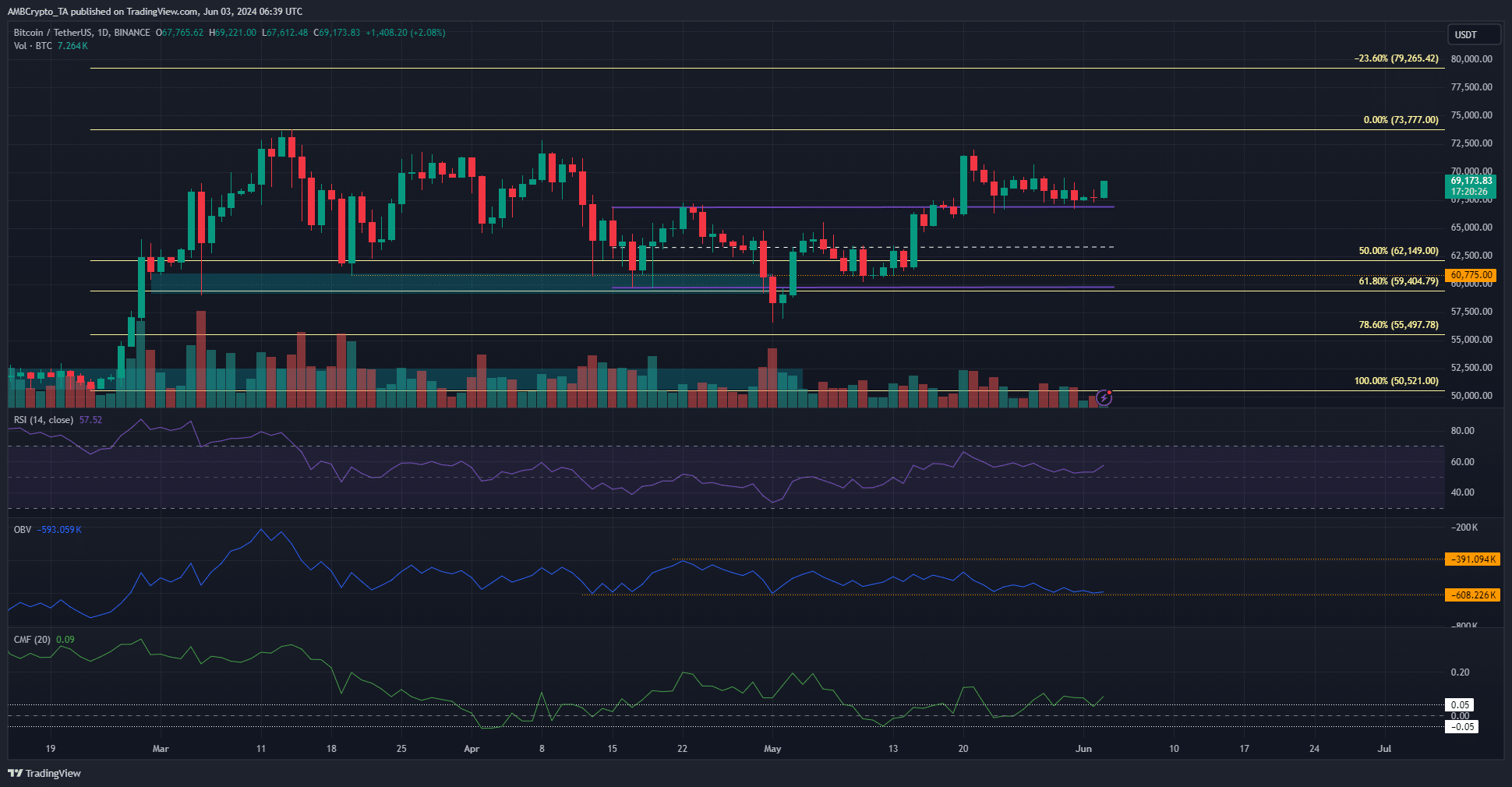

As a researcher with experience in analyzing cryptocurrency markets, I believe Bitcoin’s structure is bullish after flipping $67k to support. However, the lack of trading volume raises concerns that this uptrend might be cut short. In my analysis, I have observed conflicting signals from various volume indicators.

I’ve observed a nearly 3.6% rise in Bitcoin’s [BTC] value since its dip on the last Friday of May. At that time, Bitcoin hovered slightly above the crucial support level of $67k, with minimal signs of bullish energy emerging.

The market’s situation may be shifting, but the trading activity has been lackluster so far. For a genuine rally to materialize, bulls need to put in more effort and produce stronger signs of a breakout. Is it imminent that the market will surge, or should we anticipate an extended period of sideways movement?

Resolving the conflicting volume indicators

As an analyst, I’ve observed that after a strong rally in late February, Bitcoin (BTC) experienced a pullback, reaching a low of around $59,000 in mid-April. This level represented a 61.8% retracement of the previous upward move. Following this retreat, BTC has rebounded effectively. The Relative Strength Index (RSI) on the daily chart has surpassed the neutral threshold of 50, indicating a positive shift in momentum.

Despite the price surpassing its previous range, the On-Balance Volume (OBV) remained unyielding within that span. This was a troubling sign as it was hovering near its April lows.

The recent advances were at risk of being reversed promptly, given the absence of significant purchasing activity.

In contrast, a rise in the CMF beyond 0.05 signaled substantial incoming capital, while the volume indicators presented conflicting results.

As a researcher studying Bitcoin price movements, I have observed that while there were strong bullish indicators, the absence of significant trading volume over the past two weeks has weakened my confidence in making a bullish prediction for Bitcoin’s price.

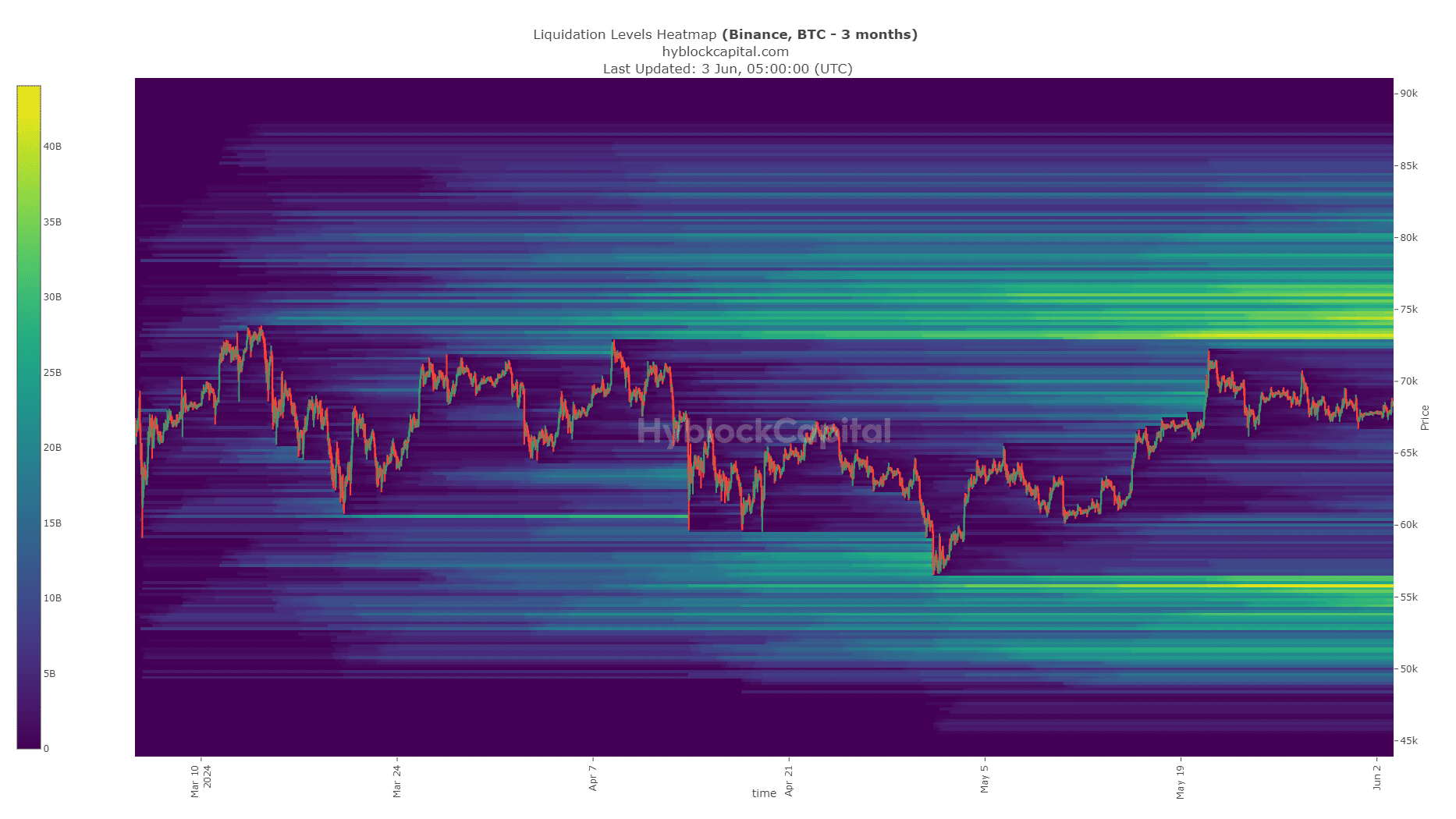

The liquidation cluster could pull BTC toward $75k

A significant grouping of Bitcoin’s liquidation levels, located between $73,000 and $75,200, is likely to exert a powerful attracting force on price movements. Conversely, the area around $65,600 also holds some significance.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the Bitcoin market, I’ve observed that the trading volume has been notably low recently. This indicates that the Bitcoin price may stabilize in the vicinity of $70,000 for the remainder of this week, or perhaps even extend beyond that timeframe.

As long as the volume remains low and the price fails to surpass $73,500, it’s likely that a trading range will develop for both traders and investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-03 18:15