-

Over $2.5 billion worth of Bitcoin shorts liquidations were reportedly behind the slight recovery.

BTC is expected to be more volatile towards the end of the week as sentiment improves.

As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market swings and trends. The latest developments in Bitcoin (BTC) have certainly piqued my interest.

The price of Bitcoin (BTC) surpassed $60,000 again, as market sentiments brightened slightly. It’s possible that the increased number of leveraged short positions being liquidated contributed to this somewhat optimistic result.

During the weekend, both Bitcoin and the broader cryptocurrency market exhibited intense fear. However, over the past three days, there’s been a noticeable recovery.

According to the most recent information from the Fear & Greed Index, there has been a steady improvement; currently, the index stands at 30 as of the current reading.

The strong upward trend in Bitcoin could potentially be attributed to the forced sale of highly-leveraged bets against it. Evidence points to approximately $2.5 billion being liquidated from these positions.

This resulted in some buying pressure.

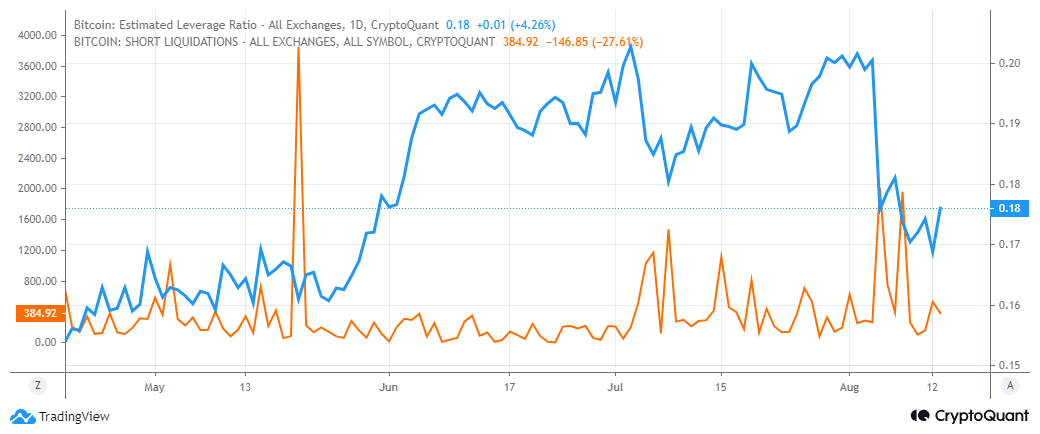

As an analyst, I observed a significant increase in Bitcoin’s short positions liquidation, amounting to approximately 231%, recorded on the 12th of August, according to on-chain data from CryptoQuant. This temporary decrease in demand for leverage led to a two-month low, but subsequently, we started witnessing an uptrend.

Upon examining the heat distribution of Bitcoin on Binance, our analysis revealed a significant accumulation of approximately 81.5 million bullish positions (longs) between the prices of $60,852 and $60,880.

With the rise in predicted borrowing levels (leverage ratio) and an overall positive change in attitudes (improving sentiment), there seemed to be a slow move toward increased optimism, leaning more towards a bullish perspective.

Is Bitcoin headed for more volatility ahead?

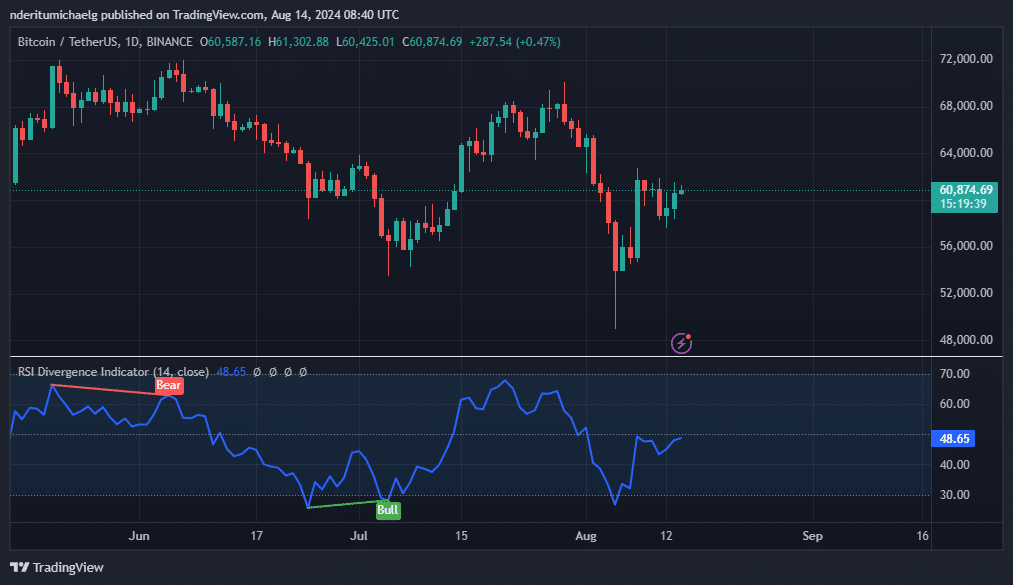

At the moment of reporting, Bitcoin was valued at approximately $60,890. If there’s a strong surge ahead, it might challenge the resistance level around $61,700, an area where Bitcoin has encountered resistance and reduced interest in recent times.

It’s not unexpected that this price range aligns with the 50% Relative Strength Index (RSI) level. This could be the reason behind the increase in short positions around this level, as traders are likely predicting further price drops.

Over the past few days, a combination of minimal interest (low demand) and quick selling off (short liquidations) seems to have confined prices in a tight band. Yet, it’s worth considering another possible factor as well.

In general, economic data releases often cause a lull in market activity beforehand due to anticipation. However, following the release of the data, there’s typically an increase in market activity as traders react to the new information.

Anticipation is high in the market as we approach this week, with several key economic indicators set to be revealed. Among them is the Producer Price Index (PPI) data, which was made public yesterday.

As a crypto investor, I’m bracing myself for today’s release of CPI data, which could spark increased market volatility and possibly set off a significant price movement beyond our current trading range.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As an analyst, I find myself observing a notable equilibrium in the Bitcoin market, which appears to reflect a prevailing sense of ambiguity. The escalating number of leveraged short positions hints at an increasing wave of bearish sentiments among investors.

Conversely, there’s been a noticeable improvement in market sentiment over the past few days, which suggests a high likelihood of a surge past the present resistance level.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-08-15 02:17