-

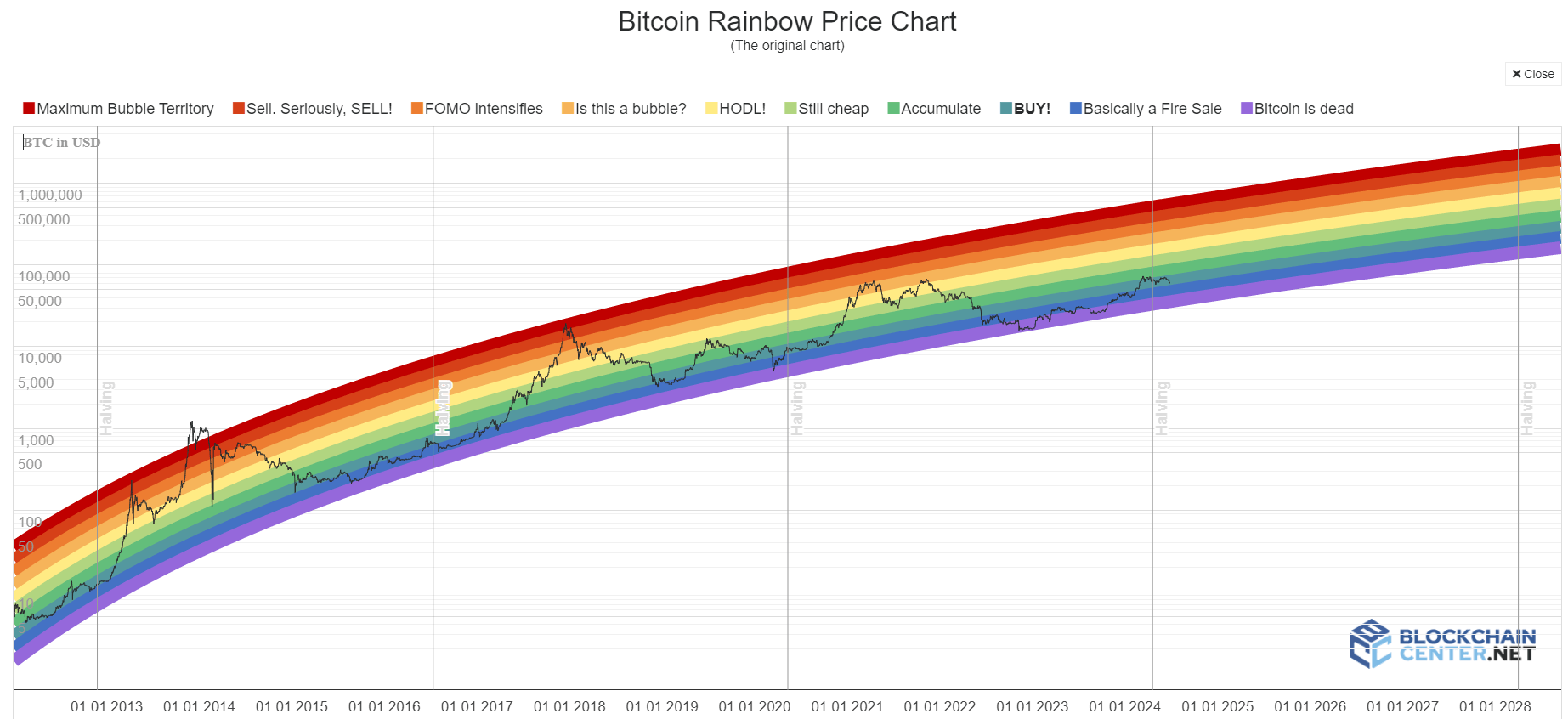

The Bitcoin Rainbow Chart showed that investors must “BUY!” more BTC.

The sentiment has been bearish in the past two weeks, and further price drops are possible.

As a researcher with experience in cryptocurrency markets, I have been closely monitoring Bitcoin’s price action over the past few weeks. The recent retest of the $60k support zone has brought back memories of two months ago when the same level acted as a crucial support after a sharp price plunge to $56k.

Bitcoin’s price hovered close to the $60,000 mark of resistance yet again. Around two months prior, this level had served as a support following a significant drop in value to $56,000.

In the past, there was a pervasive sense of fear among investors, leading them to exercise caution. Similarly, this apprehensive feeling persists among investors today.

Although the recent price fluctuations suggested a bearish attitude, Bitcoin’s long-term trajectory remained robustly bullish. Over the last half year, starting from the $38.5k low in late January, Bitcoin experienced an impressive surge of approximately 55% in value.

The price has established a new lower high at $56,500, making it a significant support point that investors will aim to protect in the upcoming period.

The Bitcoin Rainbow Chart indicates that it’s a good opportunity for investors to purchase Bitcoin, as this visualization of its price history on a logarithmic scale may help identify prospective peak points in the market cycle.

Gauging the cycle top from the Bitcoin Rainbow Chart

As a market analyst, I’d describe it this way: The vibrant chart distinguishes distinct areas ranging from “Bitcoin is extinct” to “Full-blown bubble.” Currently, Bitcoin falls under the aggressive “BUY!” label at present values.

As an analyst, I can tell you that at the current moment, the chart indicates that there is still a significant amount of room for price exploration in this market cycle.

Based on AMBCrypto’s analysis, each of the last two peak Bitcoin cycles happened around 17-18 months following the halving event. Therefore, it is estimated that the next peak could occur sometime between September and October 2025.

In the year 2021, Bitcoin failed to surpass the “Is this a bubble?” price level. Taking a cautious approach, AMBCrypto predicted that Bitcoin may not reach the “HODL” price range this time around.

With a cautious assessment, Bitcoin’s worth is projected to reach $260,000. If Bitcoin enters the “bubble” debate, the estimated price could soar up to an astonishing $373,000.

As a financial analyst, I would advise you to consider marking a significant event in your calendar: the potential sale of Bitcoin at a price above $250,000, which could occur as early as September 2025.

While the Bitcoin Rainbow Chart and historical halving and top patterns provide some insights, it’s essential to note that this analysis isn’t definitive. The price predictions derived from these factors should be taken with caution.

To better judge the peak of the market cycle, investors should exercise caution and closely examine price trends as well as on-chain data.

Buyer weakness was highlighted

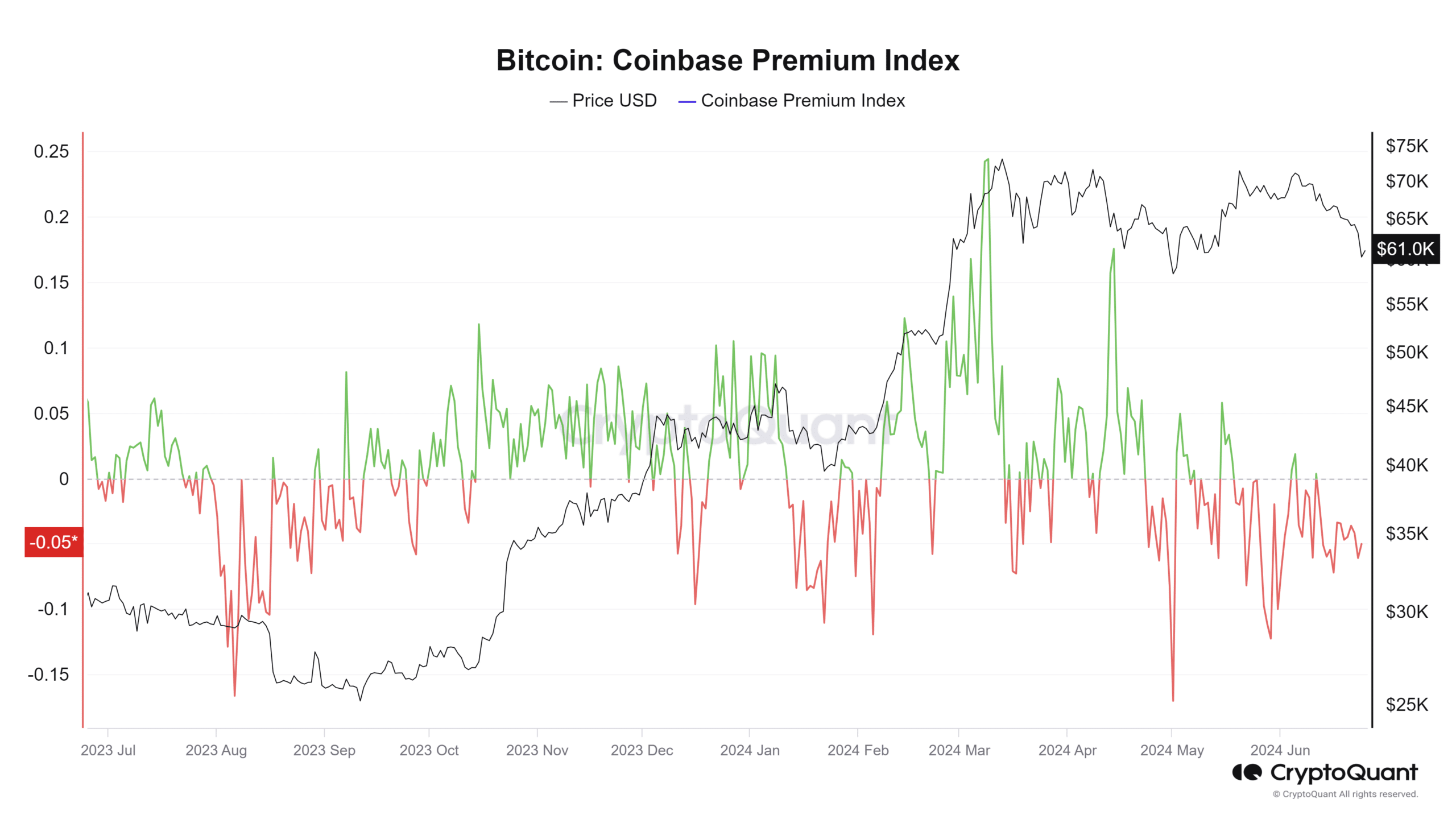

As a crypto investor, I’ve noticed that the Coinbase Premium Index has been showing a downward trend for the past month. This means that the price of Bitcoin on Coinbase has been slightly lower than its equivalent price on Binance with USDT pairing, amounting to a difference of nearly 0.1%.

Over the past six weeks, there has been a noticeable decrease in U.S. investor enthusiasm for Bitcoin based on the data from the Index. While the Index indicated positive sentiments towards Bitcoin during March and April 2024, more recent developments have caused a significant change in investor sentiment.

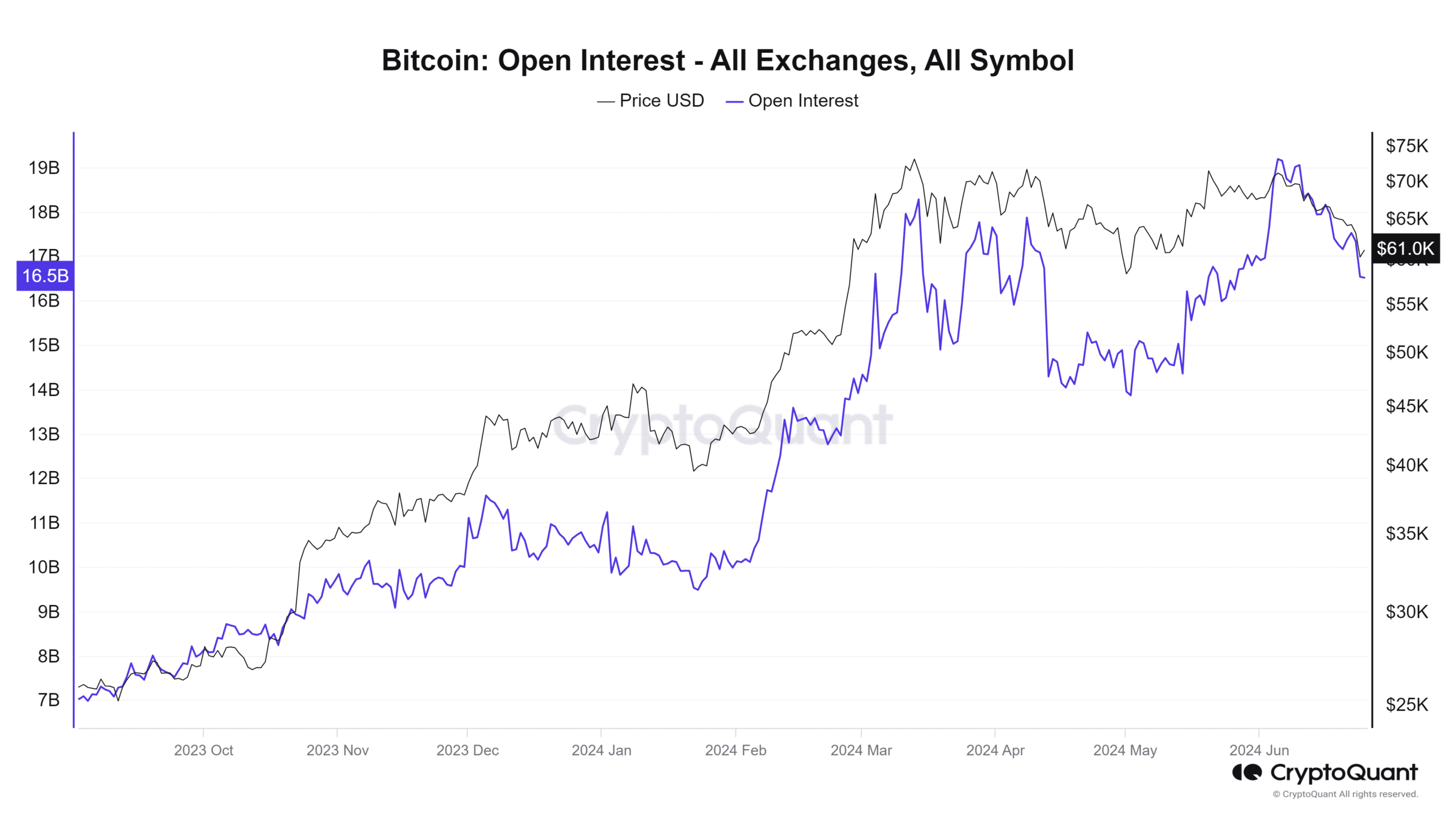

One indicator of pessimistic market feelings was the significant decline in Open Interest. On June 6th, this figure amounted to $19.1 billion. Currently, with a 14.6% price decrease, Open Interest has dropped to $16.5 billion.

As a researcher observing the futures market, I noticed that the majority of participants chose not to enter long positions on Bitcoin (BTC) due to its persistent downtrend over the past few weeks.

In the long term, this could be beneficial as it eliminates overextended bullish positions, steering the price trend towards a more balanced and market-determined trajectory.

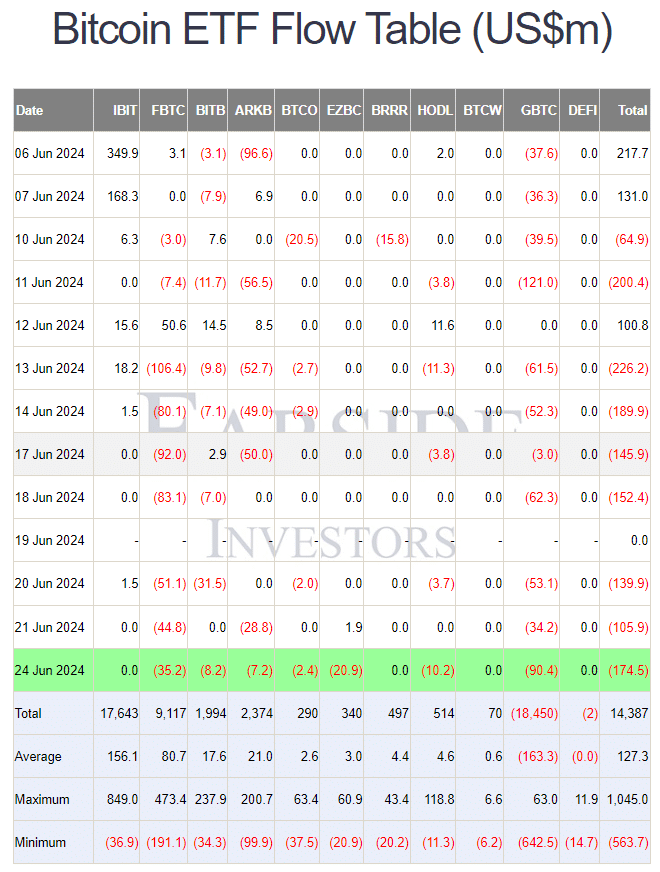

According to AMBCrypto’s analysis, the Bitcoin ETF inflows data from Farside Investors showed a negative trend over the past week, which contrasted with the initial week of June. This change underscored the evolving investor sentiment yet again.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In a recent report, AMBCrypto highlighted that the current price dip might go deeper south.

The recent developments regarding Mt. Gox and the ongoing repayments to affected clients from a decade-old hack have contributed to a challenging atmosphere in the cryptocurrency market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-26 07:04