-

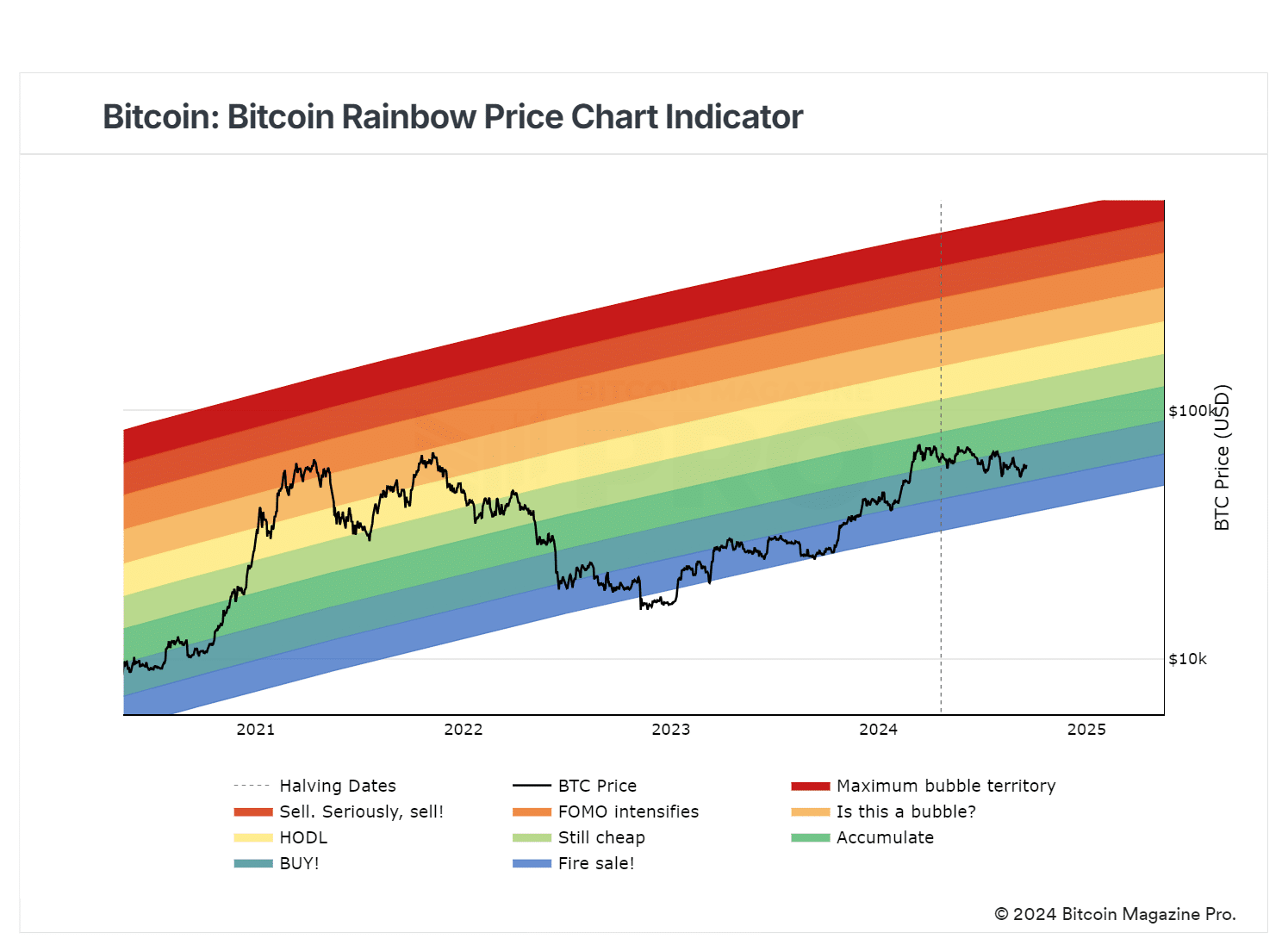

Bitcoin Rainbow Chart flashed a buy signal for the asset.

QCP Capital shared a similar long-term bullish outlook for BTC.

As a seasoned crypto investor with a knack for navigating the tumultuous waters of the digital asset market, I find myself intrigued by the recent developments in Bitcoin’s price action. The Bitcoin Rainbow Chart flashing a ‘buy’ signal and QCP Capital’s long-term bullish outlook have piqued my interest, particularly given the Fed’s recent pivot.

For more than half a year now, the value of Bitcoin (BTC) has stayed within a range, fluctuating between approximately $60,000 and $70,000, occasionally experiencing steep declines that dip below the $60,000 mark.

Despite some players finding the sideways structure unappealing, the Bitcoin Rainbow Chart indicated a strong buying chance for the asset as it suggested a shift in the Fed’s stance.

The graph serves as an evaluation tool, using a spectrum of colors derived from previous trends and data, to help determine if a particular asset is either overvalued or undervalued.

The current price action was within the second color band, signaling a great buy opportunity.

More room for BTC to grow?

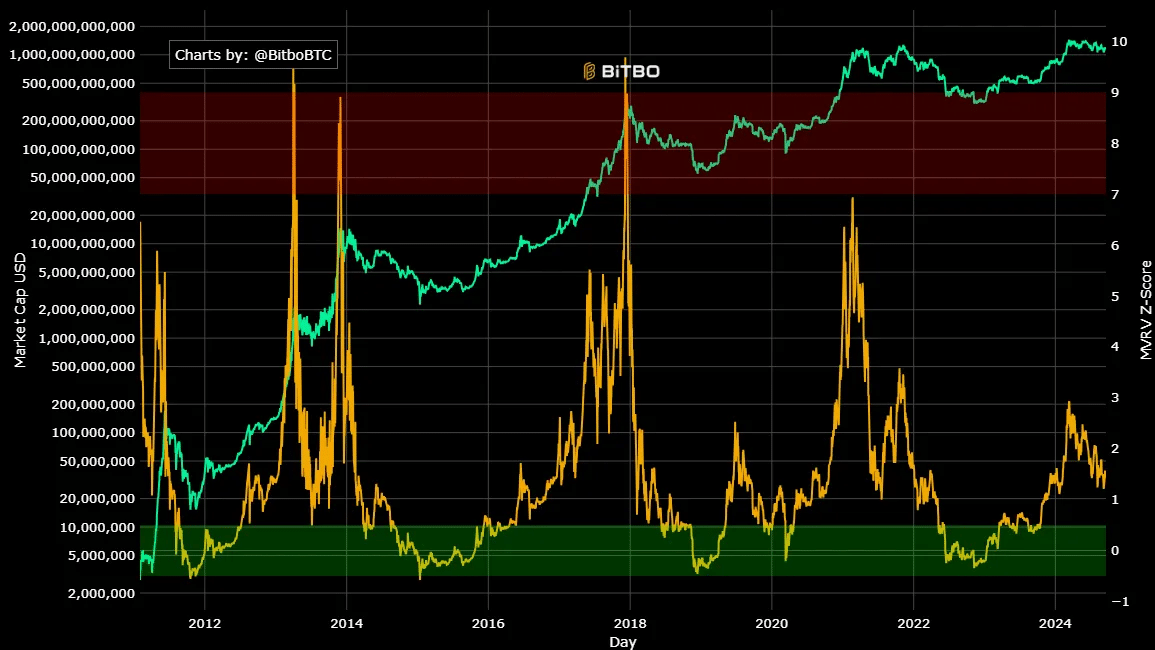

The drop in Bitcoin’s price was supported by a well-known market cycle peak indicator called the MVRV Z-score (Market Value to Realized Value), which has historically signaled a top for Bitcoin when it reaches between 7 and 10.

Simply put, the recent readings imply there’s potential for Bitcoin prices to increase further. If this occurs, current Bitcoin prices could be considered an excellent deal.

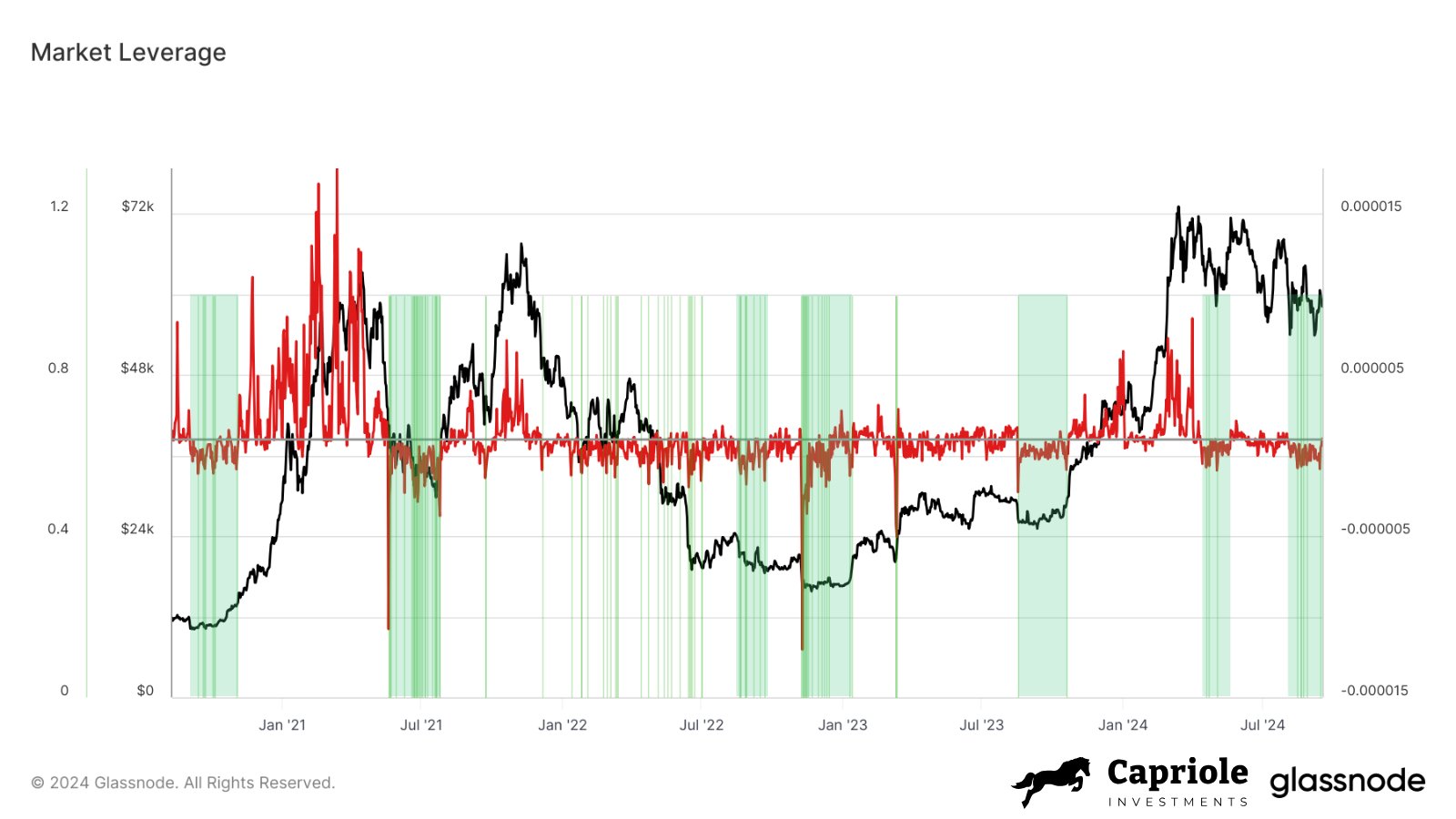

Speculators’ positioning further mirrored this bullish outlook, especially in the Futures market. According to Edwards Charles, founder of crypto VC firm Capriole Investments, the markets were in a BTC perpetual bullish regime.

For context, bullish perpetual (marked green) denoted rising market leverage and opened perpetual contracts.

This implies that a larger number of investors are increasing their risk levels by utilizing margin to trade long-term, self-executing contracts. This pattern often indicates anticipated price surges in the future and, in the past, has been linked with significant low points in Bitcoin prices.

On the other hand, employing market leverage involves a significant risk of liquidation that can lead to substantial volatility in potential losses.

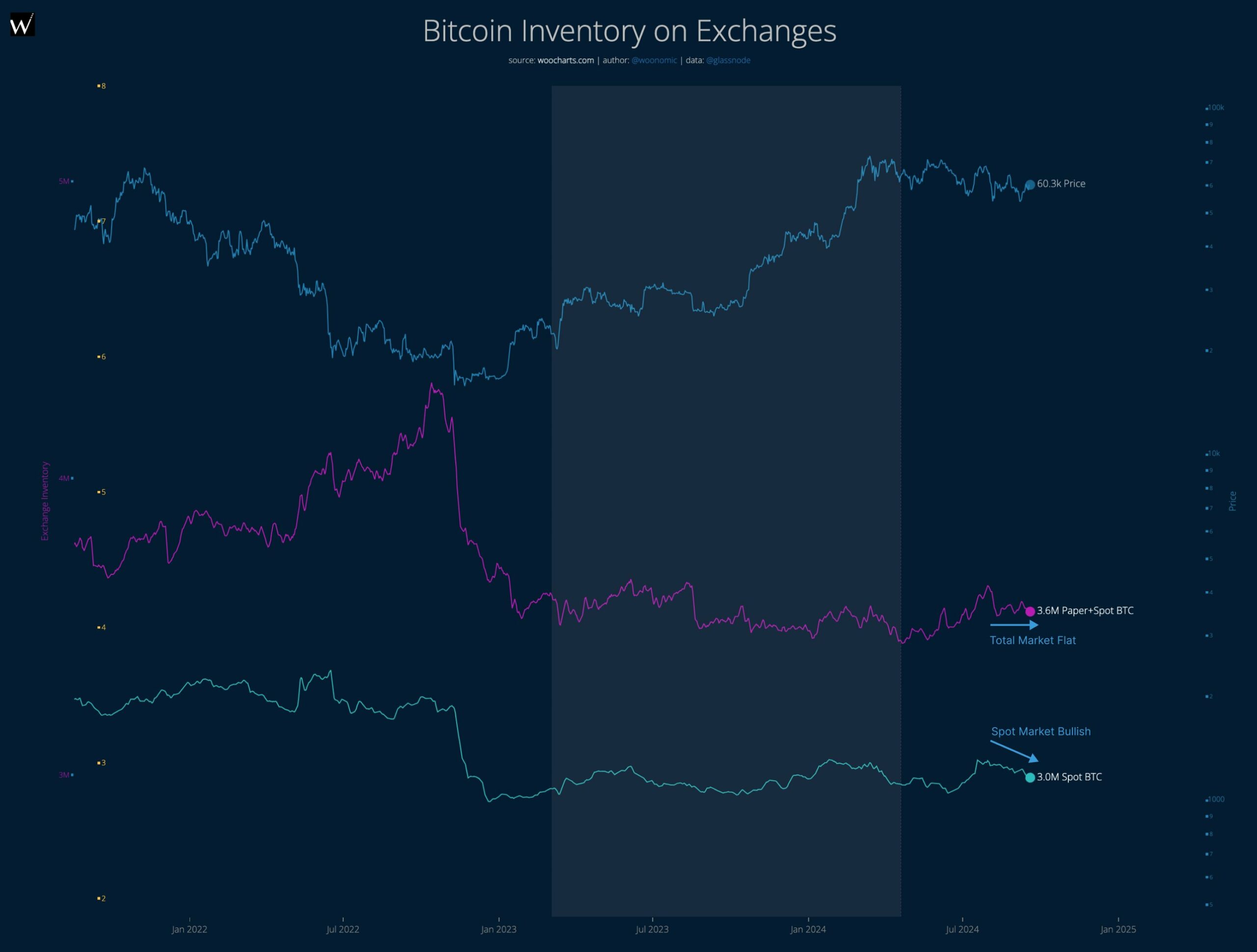

According to Bitcoin expert Willy Woo, while he maintains a cautious sense of optimism, he hasn’t seen a clear shift to a bullish trend for the asset yet.

At the moment, the balance between demand and supply is leaning slightly bearish, but there are indicators suggesting a shift towards a bullish trend if certain sell-offs occur. However, it’s important to remain cautious as optimism is tentative.

However, crypto trading firm QCP Capital maintained a long-term bullish outlook for BTC amid Fed pivot. It stated,

Beginning a series of reductions in interest rates to bring them back to normal levels boosts the appeal of tangible assets as a means of value storage. Despite possible declines and increased market fluctuations, keep your focus on the road leading to rising Bitcoin prices.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-18 21:11