- Bitcoin showed signs of recovery as its weekly and daily charts were green.

- Market indicators and metrics hinted at a price correction.

As a seasoned crypto investor who has seen Bitcoin’s volatile rollercoaster ride over the past decade, I find myself cautiously optimistic about the current market scenario. The recent price hikes are certainly encouraging, but the indicators suggest that we might be heading towards another correction.

Over the recent weeks, Bitcoin (BTC) has experienced a series of downward adjustments in price, putting strain on its upward trend. However, the previous week seemed to bring good fortune for investors, as the leading cryptocurrency saw an increase in value.

However, a new report has suggested that BTC might once again fall victim to a correction.

Bitcoin rally is facing trouble

Recently, Bitcoin’s surge has encountered some difficulties, as it’s had trouble surpassing the $66k mark. But, the past 24 hours have shown more promising indications. According to CoinMarketCap, the coin’s price has risen by over 1.5% in this period. As of now, Bitcoin is being traded at $63,896.05.

As a crypto investor, I’ve noticed that the recent price surge has placed approximately 48.9 million Bitcoin wallets in a profitable position, which represents a staggering 91% of all existing Bitcoin wallets. However, it’s important to remember that this isn’t the end of the road for Bitcoin. The possibility still remains that the current rally could come to an end.

According to his post, Bitcoin’s (BTC) value seems to be following a specific pattern or range, known as a channel.

The bad news was that the coin had already faced rejection three times when it approached the resistance of the pattern. Therefore, it indicated that this recently gained bullish momentum might not last. So, AMBCrypto planned to dig deeper.

What’s next for BTC?

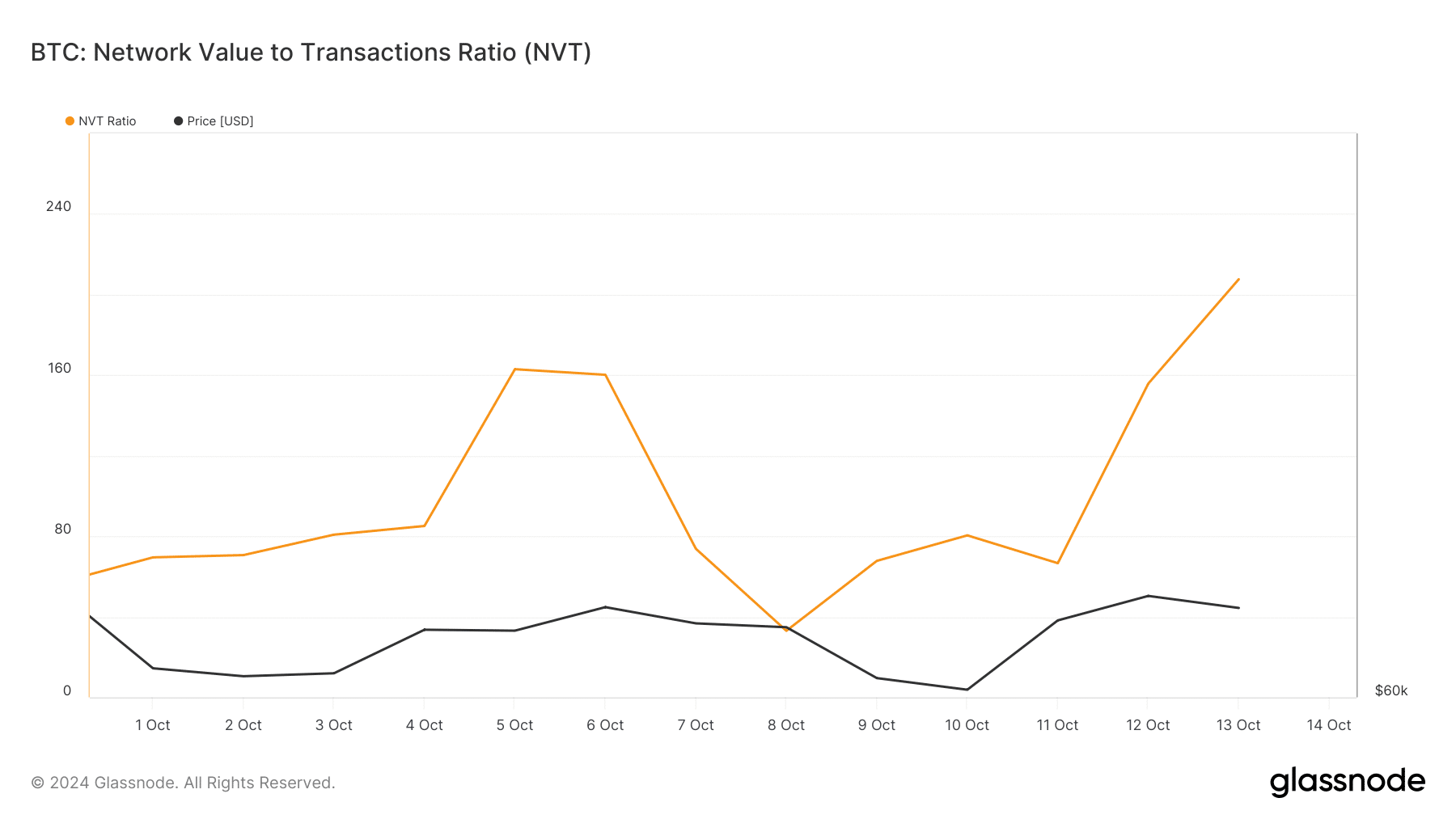

According to our examination of Glassnode’s data, a specific indicator pointed towards a pause in Bitcoin’s upward trend. We discovered that the Bitcoin’s NVT ratio went up. When this metric increases, it suggests that the asset may be overpriced, potentially leading to a decrease in its value.

We also found that the coin’s long/short ratio dropped. This meant that there were more short positions in the market than long positions. A rise in the number of short positions can be interpreted as a bearish signal.

On the other hand, it wasn’t all good news for the bears. For instance, the Bitcoin reserve on exchanges was decreasing as per CryptoQuant, suggesting an increase in buying pressure. This trend usually leads to price increases.

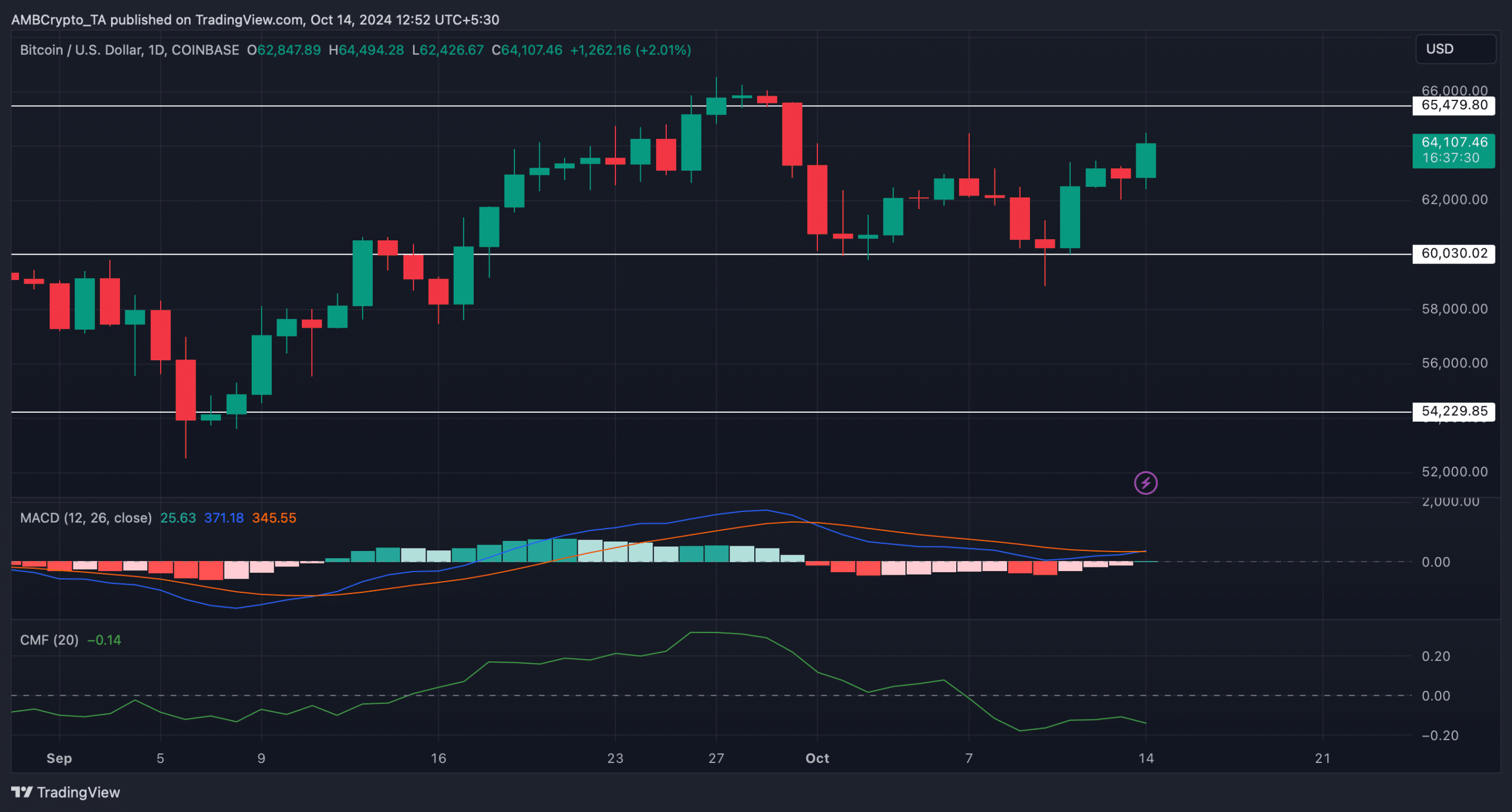

To get a clearer picture of what’s likely to happen with Bitcoin’s price surge, AMBCrypto analyzed its daily graph. The technical signs pointed towards a potentially pessimistic outlook. Bitcoin’s Moving Average Convergence Divergence (MACD) suggested a bearish edge in the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I’ve noticed an intriguing trend: The Chaikin Money Flow (CMF) of this particular cryptocurrency has shown a decrease as well. This shift could potentially indicate a price decline, which might signal the end of the Bitcoin rally and a possible return to the $60k level for this coin.

Nonetheless, in case of a continued price rise, BTC might test its resistance at $65.4k again.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-14 13:11