- Long-term Bitcoin holders have accelerated selling activity as BTC forms successive new highs.

- Spot Bitcoin ETFs are absorbing the sell-side pressure, giving room for BTC to extend its rally.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed the ebb and flow of Bitcoin’s price action more times than I can count. The current scenario is reminiscent of a familiar pattern – long-term holders cashing out as BTC hits new highs, while institutional demand through Spot Bitcoin ETFs absorbs the selling pressure.

In simple terms, Bitcoin (BTC) is consistently surpassing other digital currencies as it sets new record highs. Currently, Bitcoin’s trading price is at approximately $97,350, and its total market value stands around $1.92 trillion. Since the beginning of Q4, there has been a 52% increase in the value of Bitcoin.

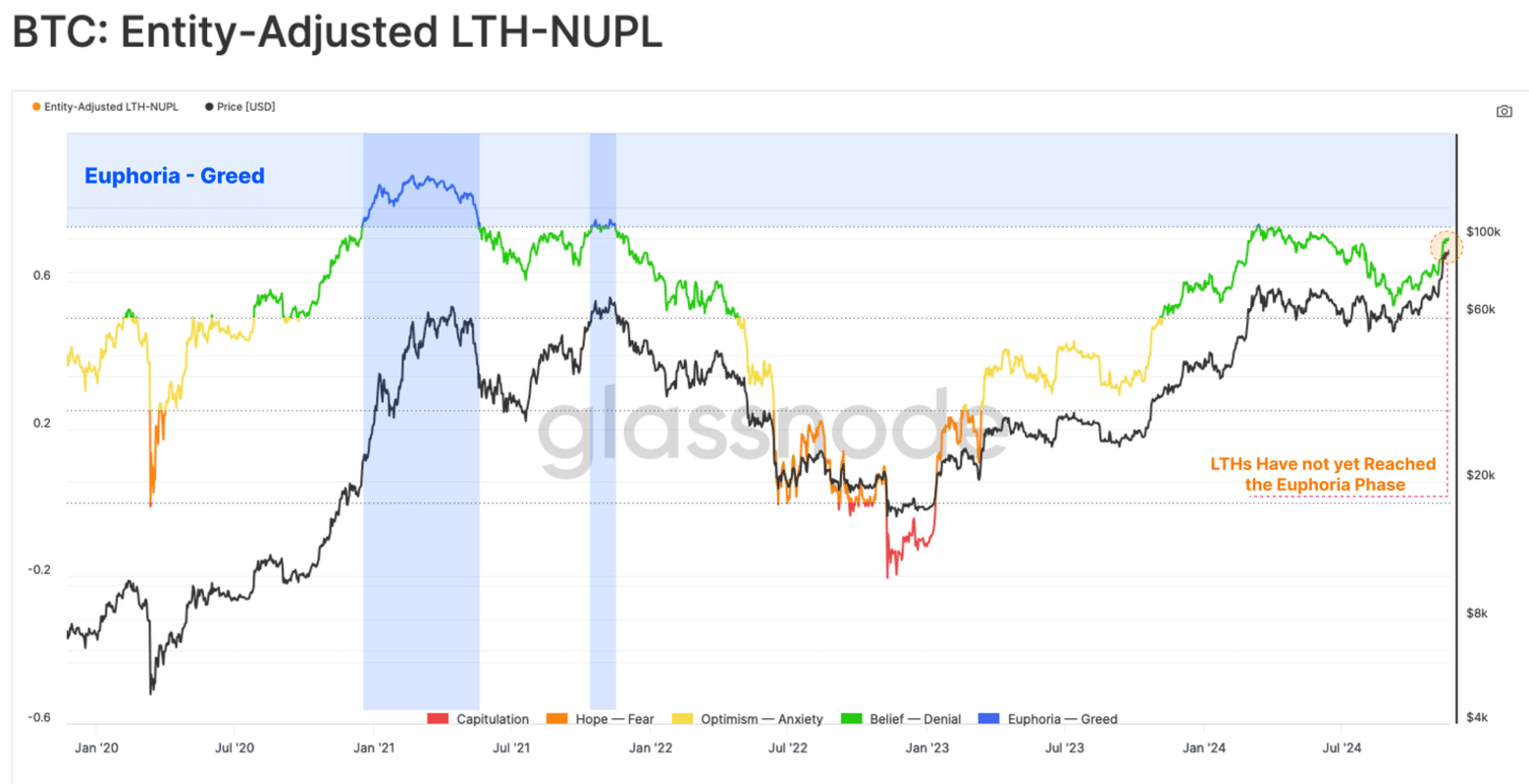

According to Glassnode’s recent weekly analysis, every long-term Bitcoin holder is currently seeing a profit. Nevertheless, their Net Unrealized Profit/Loss (NUPL) level is at 0.75, indicating that they have not yet reached the point of extreme excitement or greed as described in market sentiment models.

Typically, long-term investors tend to sell at highs and purchase when prices are lower. Following a similar trend, it appears they are doing so again as their Bitcoin holdings fell by over 200,000 coins following the recent surge above $75,000 two weeks ago.

As a long-term Bitcoin investor, I’ve noticed that about 14 million BTC are being held by long-term investors according to Glassnode. This means that if these holders decide to cash out quickly due to profit-taking, it could potentially slow down or halt the current upward trend of Bitcoin’s price.

As a researcher studying Bitcoin dynamics, I’ve observed that two crucial elements have shielded Bitcoin from intense sell-pressure: the prevailing expectation for price increases and robust institutional demand, which swiftly snatches up the coins put up for sale.

Spot Bitcoin ETFs are absorbing selling pressure

Through Bitcoin spot ETFs on the stock market, institutional investors have been taking up the selling pressure that long-term holders are putting out in the Bitcoin market.

According to SoSoValue’s data, the average weekly investments into these ETFs over the last week have ranged from $1 billion to approximately $2 billion.

According to Glassnode, from October 8th to November 13th, approximately 93% of the Bitcoins sold by long-term investors were purchased by Bitcoin ETFs. This significant purchase helped maintain stable Bitcoin prices during this period.

Over the last seven days, I’ve observed a notable increase in selling actions by long-term investors. This selling trend appears to be stronger than the buying interest from ETFs, creating a potential imbalance. If this imbalance persists, it might lead to market fluctuations due to the disparity between supply and demand.

Are short-term Bitcoin holders also taking profits?

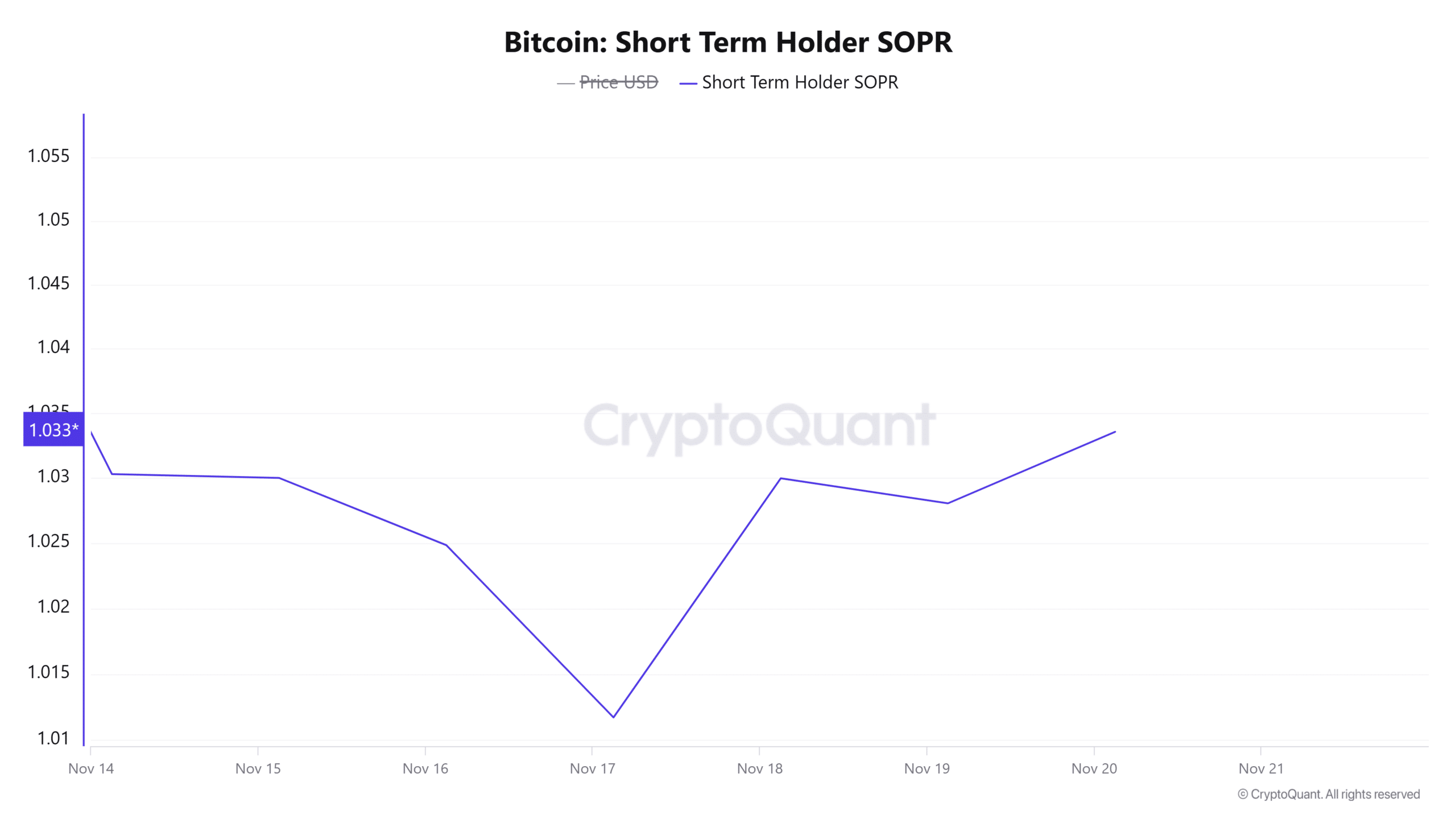

According to data from CryptoQuant, the Short-Term Holder Profit Ratio (STHPR) has reached its peak in over a week.

The SOPR ratio of 1.03 indicates that the coins being transferred by these traders are currently worth about 3% more than what they initially paid for them. This implies that short-term holders have not yet reached peak levels of profit, which might discourage them from cashing out since they anticipate further price rises.

Furthermore, given the current market mood showing high optimism, short-term investors, known for profiting from quick price fluctuations, may decide to hang onto or even buy more cryptocurrencies over the short term.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin short sellers re-enter the market

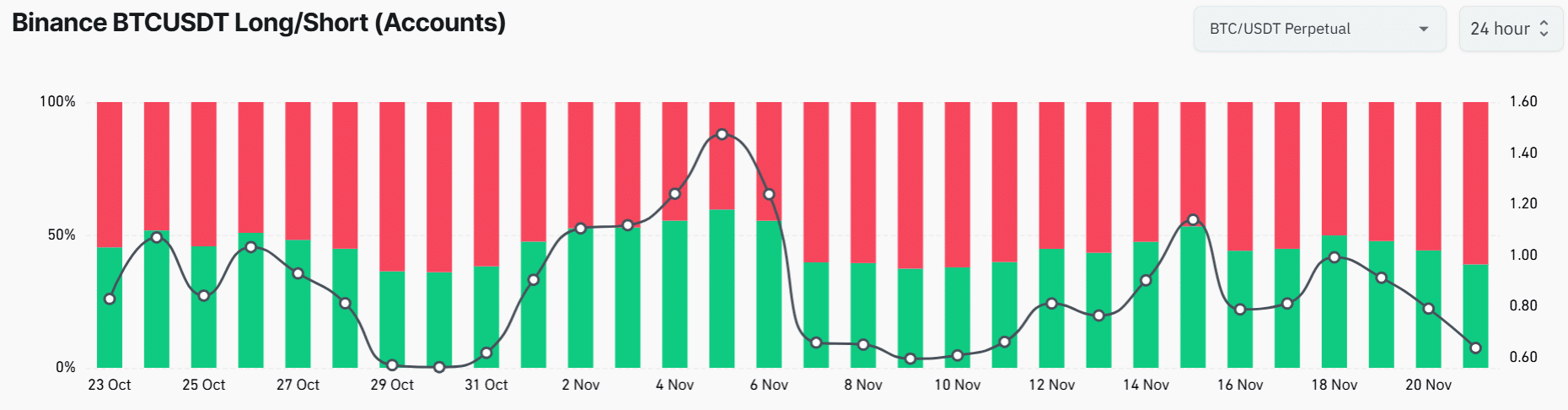

It appears that the distribution stage of long-term Bitcoin holders has influenced the Bitcoin futures market significantly. Interestingly, as many as 61% of traders on Binance are currently betting against Bitcoin by opening short positions, which is the highest level seen in more than a week.

A rise in short positions indicates that traders believe $100,000 serves as a robust barrier for Bitcoin’s price increase. Yet, should Bitcoin surpass this value, a short squeeze may ensue, leading to compulsory purchases and potentially extending the upward trend in its price.

Read More

2024-11-22 00:08