- Global liquidity in stablecoins could push crypto prices higher.

- Key indicators say Bitcoin is poised for break out.

As a seasoned crypto investor with years of experience navigating market cycles, I can confidently say that October is traditionally a bullish month for Bitcoin. With an average gain of 22.9% during this period over the past nine years, it’s hard not to be optimistic about BTC‘s potential performance in October 2024.

Generally speaking, September tends to be a challenging time for Bitcoin and various investment categories, as it’s often associated with bearish trends. Conversely, October has historically been a robust period for bullish growth, with Bitcoin [BTC] demonstrating positive returns in 8 out of the last 9 Octobers

Typically, the value of Bitcoin tends to increase by around 22.9% during this specific month. This long-term pattern might be a reason for the regular purchasing activity observed in the options market

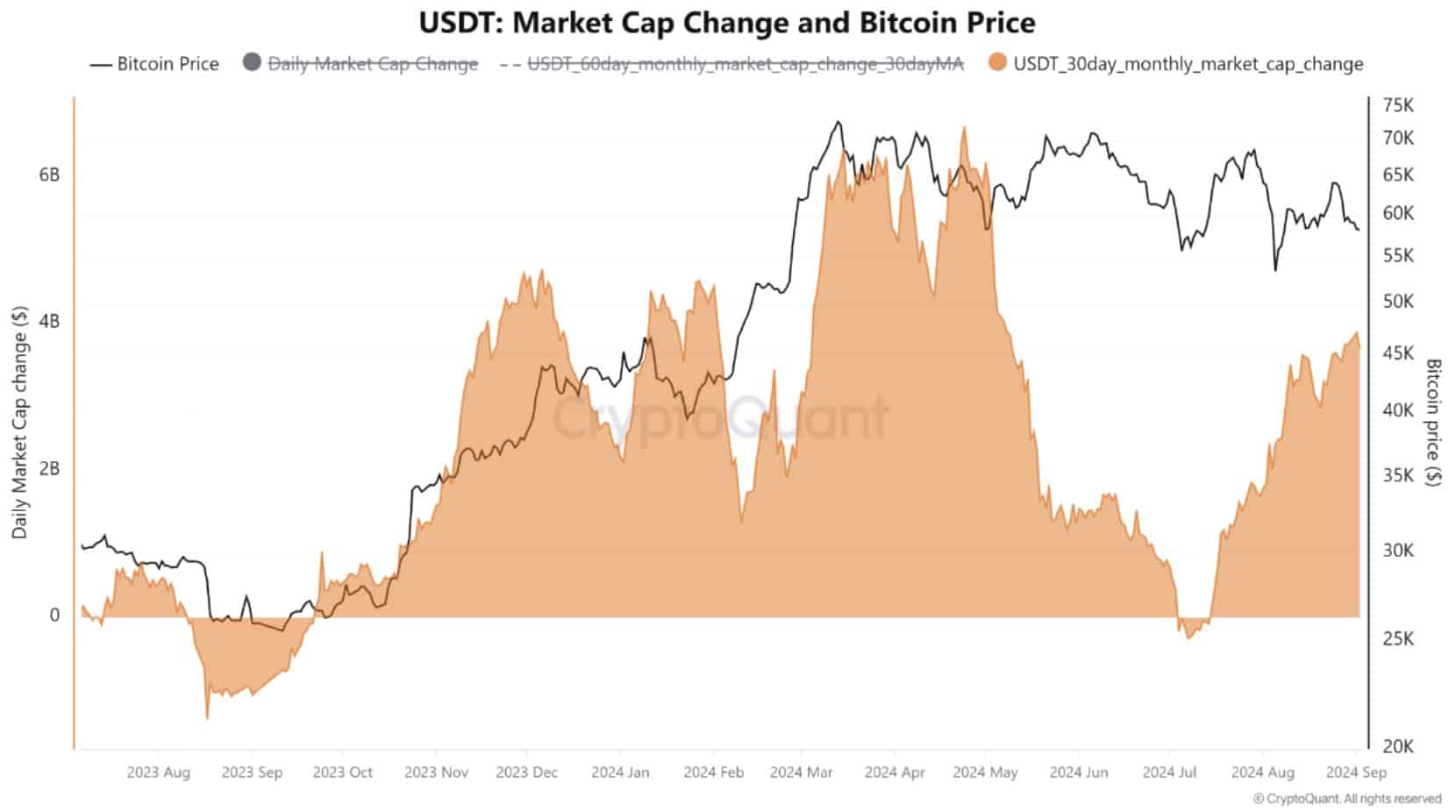

As the amount of liquid funds in the cryptocurrency market grows, a significant portion remains unused. A large chunk of this capital is presently held in stablecoins, poised to influence Bitcoin’s price

When this “firepower” eventually enters the market, it could lead to a significant move.

Bitcoin is in consolidation

Over the past month, I’ve noticed that the fluctuations of Bitcoin have been quite limited. Historically, such tight trading ranges often signal an impending significant price shift, whether upward or downward

If Bitcoin undergoes a significant decrease again, it might finish its ongoing phase and recover powerfully thereafter. The weekly perspective indicates some vulnerability, which isn’t favorable if the Bitcoin price is anticipated to hit new peaks in October

Yet, there’s still a chance for this event to unfold. What’s crucial is for Bitcoin to move beyond its current phase of stability and continue moving forward unabated

If the money now stored in stablecoins gets transferred to Bitcoin, it might cause the price to surge past its current range, possibly fueling an extended bull market trend

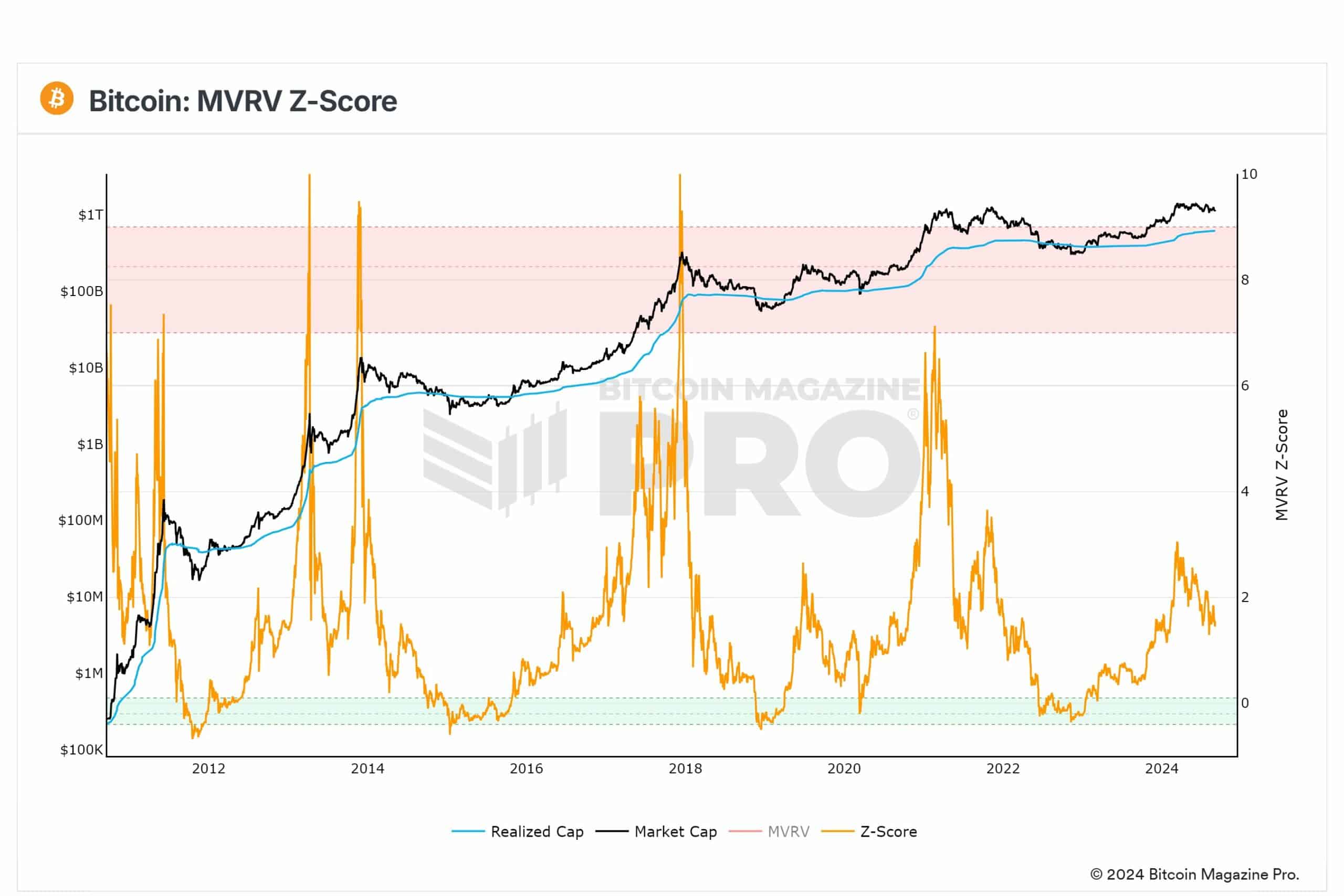

Bitcoin still has room to grow

Currently, the Market Value to Realized Value (MVRV) Z-Score stands approximately at 1.8, indicating a moderately positive outlook in the market, but it’s not yet at an extremely optimistic level

This rating suggests that Bitcoin has potential for further development, but it’s important to exercise caution because a persistent increase in this score might lead to an overvalued market

8 score suggests that the current cycle might still be in its infancy or even escalating further. Keeping a close eye on this figure is crucial as it may offer early indications of an impending market top, given the increasing Bitcoin price

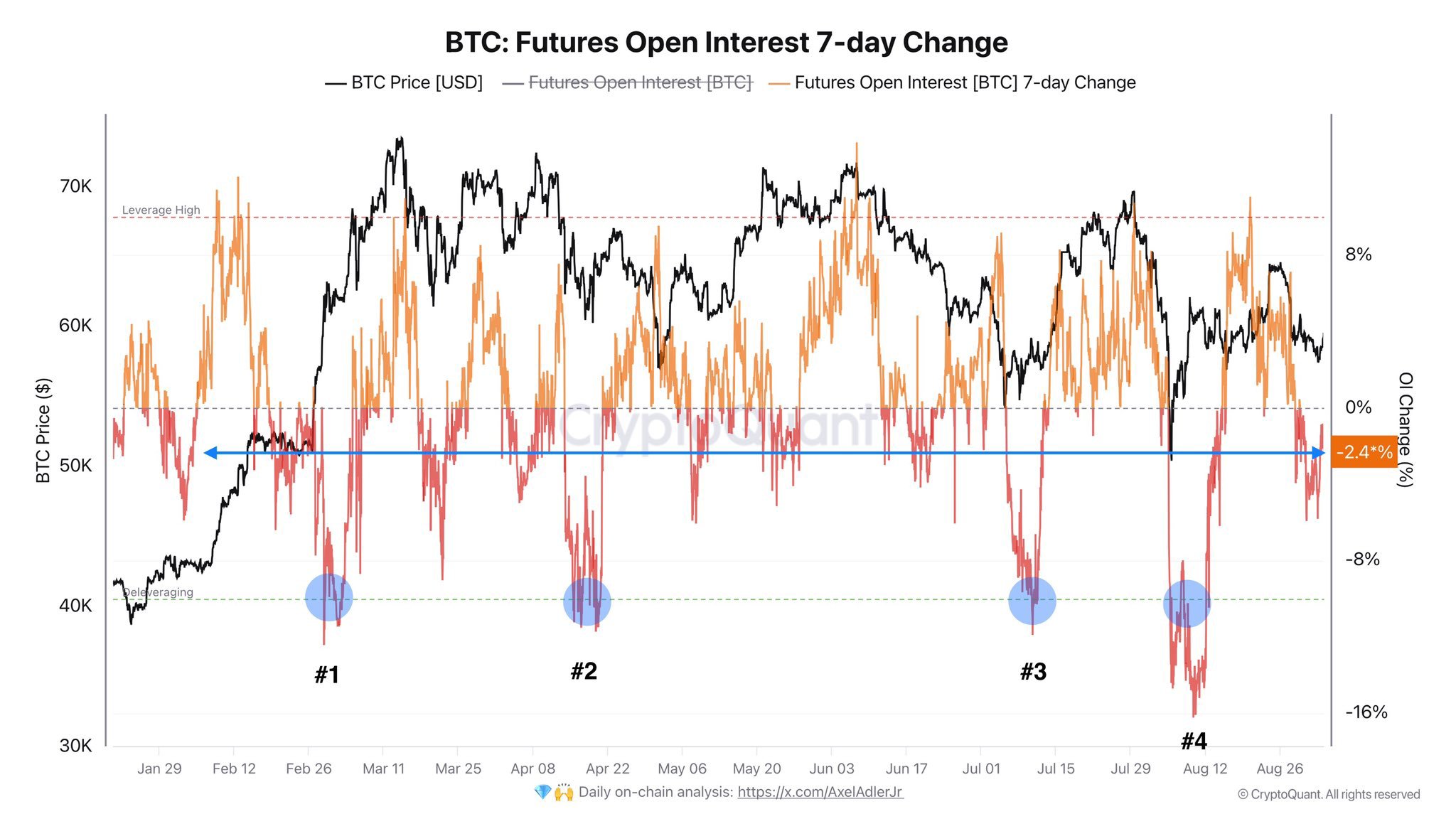

The short to medium term open interest

Over the next few weeks to months, my findings indicate that open interest (OI) levels are quite substantial, potentially impeding a steady uptrend. To foster a more balanced market, it’s crucial for open interest to dip by approximately 10%. This adjustment could pave the way for a smoother, healthier market dynamics

Lately, after a temporary surge due to the recent dip, the price of Bitcoin has returned to its initial level following OI’s (Open Interest) reset

This reboot is a good indication, since it lessens the probability of a significant market crash and boosts the possibility of prolonged sideways trading in shorter time periods. If market circumstances get better, Bitcoin’s value might soar even higher

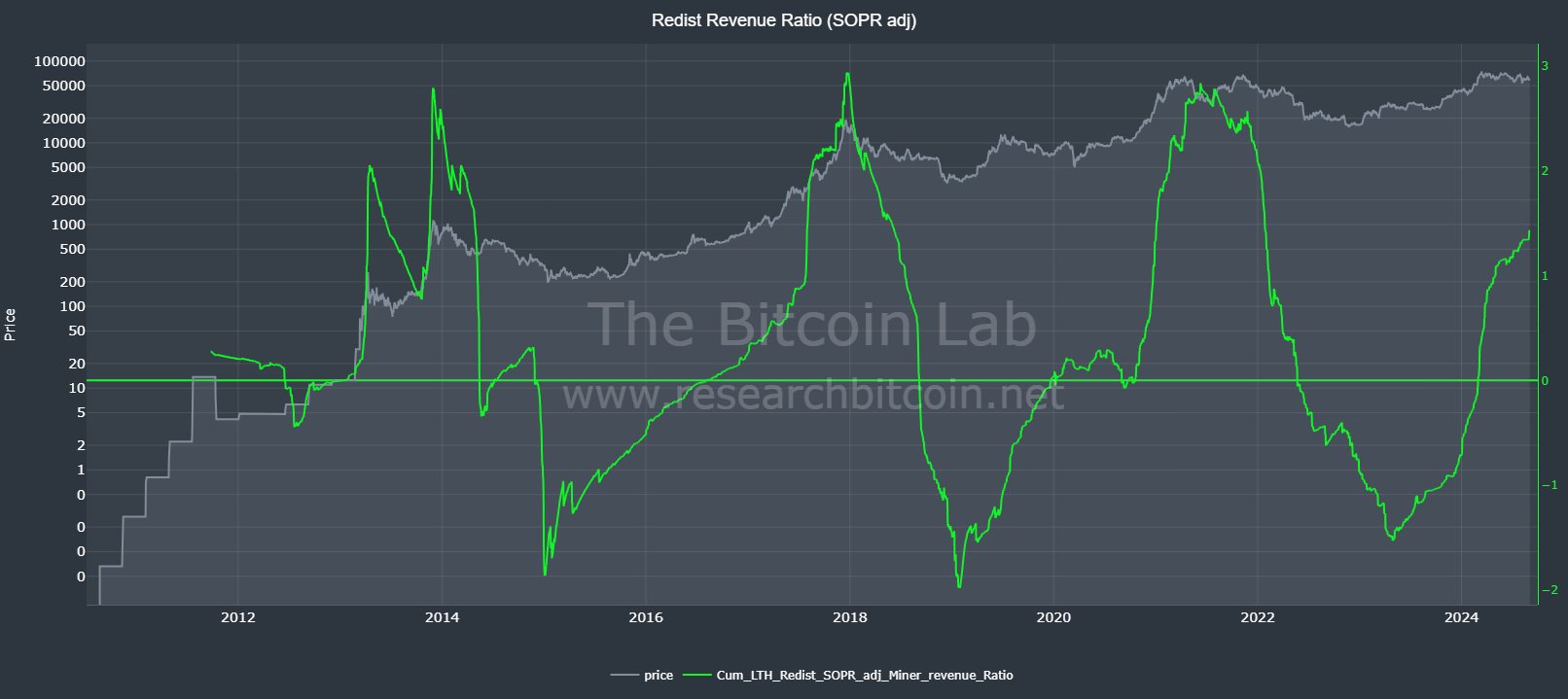

HODL cycles and periodicity

The Redistributed Revenue Ratio, which compares long-term holder activity to Proof of Work incentives, shows a clear pattern of HODL cycles.

The ratio adjusted with the Spent Output Profit Ratio (SOPR) is around 1.5, suggesting that Bitcoin has not peaked yet.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In my analysis, as the global pool of liquidity expands and stablecoins find their way into Bitcoin’s market, a substantial increase in its price seems imminent

It’s quite possible that when this capital flows into the market, Bitcoin could be among the main recipients, which might lead to an increase in its price

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2024-09-04 19:09