“Bitcoin‘s Rebound: The Plot Thickens!”

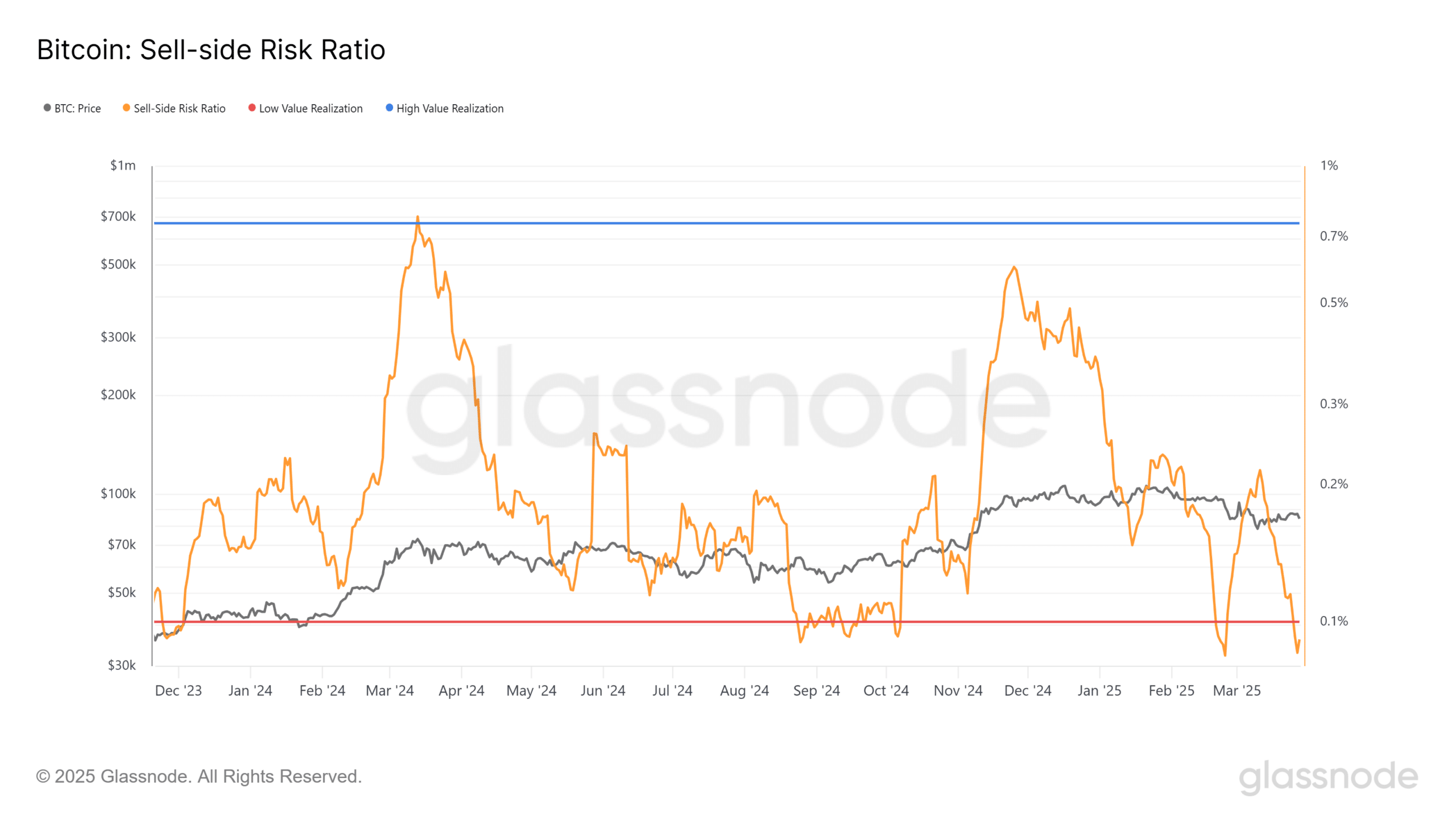

- Oh, dearie, Bitcoin’s Sell-Side Risk Ratio has plummeted to 0.086%, a level that’s simply screaming ‘buy, buy, buy!’ 🤑

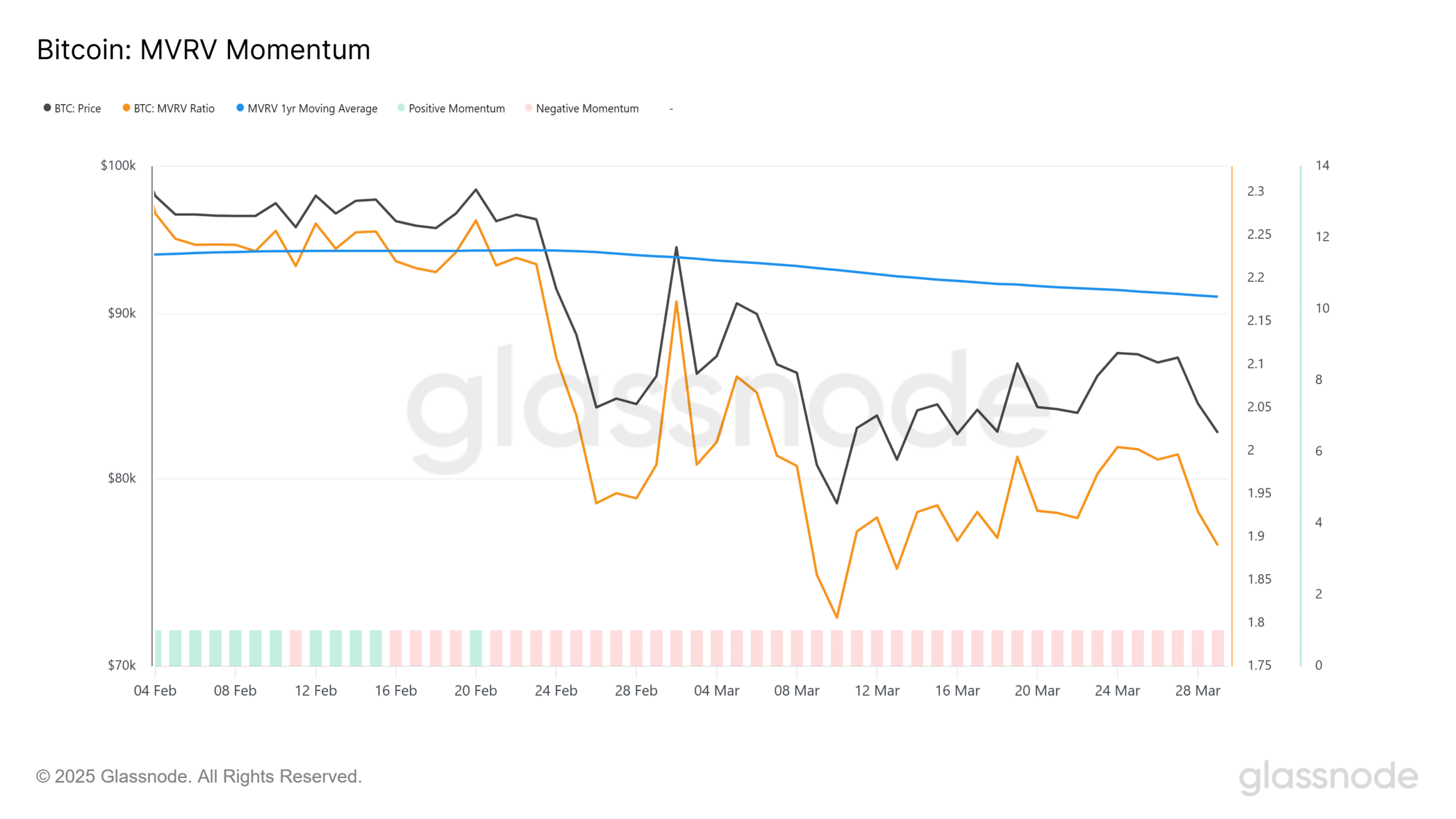

- And, darling, MVRV momentum may flip bullish if it crosses above its 70-day moving average. How thrilling! 🤩

It seems, old chap, that Bitcoin [BTC] is gearing up for a fresh rally, with two key on-chain indicators flashing those delightful reversal signals. 🎉

🚨 BREAKING: Trump's Tariffs May Rock EUR/USD!

Shocking new analysis predicts massive volatility ahead. Markets brace for impact!

View Urgent ForecastThe latest drop in the sell-side risk ratio and a potential bullish crossover in MVRV momentum are bringing a dash of optimism back to the market. One can almost smell the champagne corks popping! 🥂

Below the historical rebound zone, darling!

Bitcoin’s Ssell-Side Risk Ratio has taken a tumble, landing at 0.086%, its lowest level in months. How quaint! 🙄

Historically, this metric falling below 0.1% has marked those strong bounce-back zones, reflecting suppressed realized profits relative to market cap. Ah, the plot thickens! 📚

These low-risk periods often coincide with investors’ hesitation to sell, reducing overhead pressure on price. How lovely for the bulls! 😊

The last time the ratio dipped below this level was during Bitcoin’s correction in September 2024, just before it staged a recovery to new highs in Q4. Ah, the memories! 📆

Currently, the ratio is again signaling a limited risk of profit-taking, setting the stage for a possible reversal if buying momentum returns. One can almost hear the sound of coins clinking! 💸

Bitcoin MVRV on the verge of a bullish crossover, darling!

The 70-day MVRV momentum is on the cusp of breaking above its moving average, a crossover that has historically confirmed bottom formations. How thrilling! 🎊

The MVRV ratio, which compares market value to realized value, is often used to identify undervaluation zones. Ah, the thrill of the chase! 🏃♂️

Bitcoin’s MVRV ratio has remained below the 70-day average for weeks, mirroring the pre-bullish setups observed in late October and January. Ah, déjà vu! 🤯

A confirmed breakout could act as the final confirmation of a bottom, particularly as the broader macro environment stabilizes. One can almost hear the sound of champagne corks popping again! 🥂

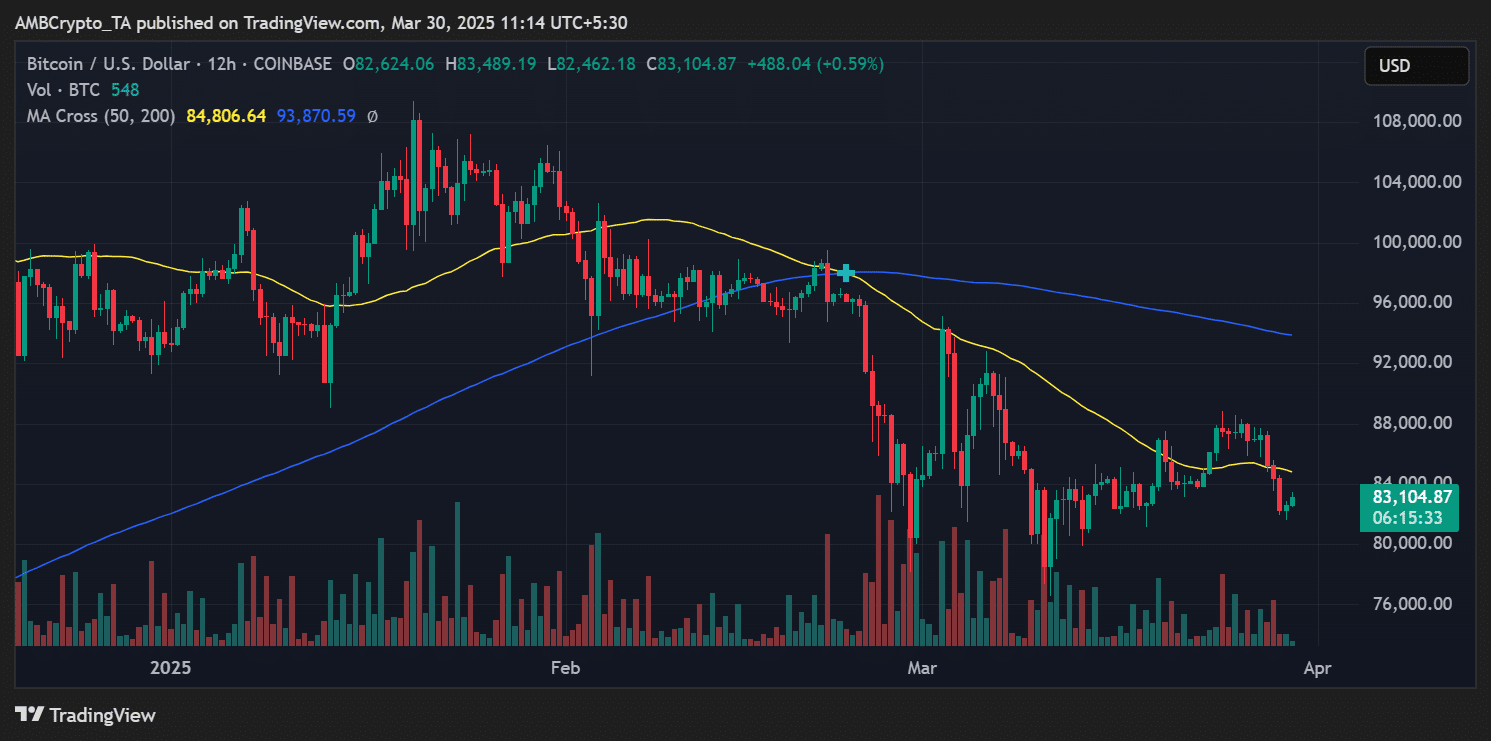

Bitcoin price struggles below key moving averages, darling!

Bitcoin traded around $81,100 at press time, with the 50-day and 200-day moving averages at $84,934 and $93,916, respectively. How…predictable. 🙄

The inability to reclaim the 50-day MA remains a short-term concern. However, the technical setup and on-chain metrics suggest sellers are exhausted, and accumulation is gradually returning. Ah, the plot thickens! 📚

If BTC reclaims $85K, it could unlock bullish momentum toward the $90K psychological barrier. Until then, the market may range, with the current setup favoring accumulation strategies. One can almost smell the coffee brewing! ☕️

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-03-30 18:19