- Bitcoin briefly dropped below $100K before rebounding to $101,496, marking volatility post-FOMC announcement.

- Coinbase sees $1.1 billion Bitcoin outflow, signaling strong institutional demand and ETF-driven accumulation.

As a seasoned crypto investor with battle scars from numerous market cycles, I can confidently say that Bitcoin’s price fluctuations are as predictable as the weather in San Francisco—unpredictable but always exciting! The recent drop below $100K, followed by an immediate rebound, is just another day in the life of a crypto investor.

As an analyst, I’ve observed substantial volatility in Bitcoin’s (BTC) value over the past day, largely due to the results of the Federal Open Market Committee (FOMC) meeting and the subsequent speech by Federal Reserve Chairman Jerome Powell.

Initially, the value of the asset plummeted significantly, dropping as low as $98,000, which represented a decrease of more than 5% within a single day. Yet, surprisingly, this cryptocurrency seemed to bounce back swiftly, surpassing the $100,000 threshold and even peaking at around $105,000 earlier today.

Currently, Bitcoin is being exchanged for approximately $101,496, marking a 2.6% decline in its value over the last 24 hours and a 6.1% fall since it reached its highest point ever (peak price).

As an analyst, I’ve found myself captivated by the recent drastic changes in Bitcoin’s price, which underscores its inherent volatility. Yet, it also serves as a testament to the unwavering determination of investors. My fellow analysts and I have been keeping a keen eye on these price swings, with our gaze now shifting towards institutional activity and its potential influence on market dynamics.

According to an analysis by Burak Kesmeci, a researcher at CryptoQuant, there’s been a noteworthy shift in the way Bitcoin’s market behaves.

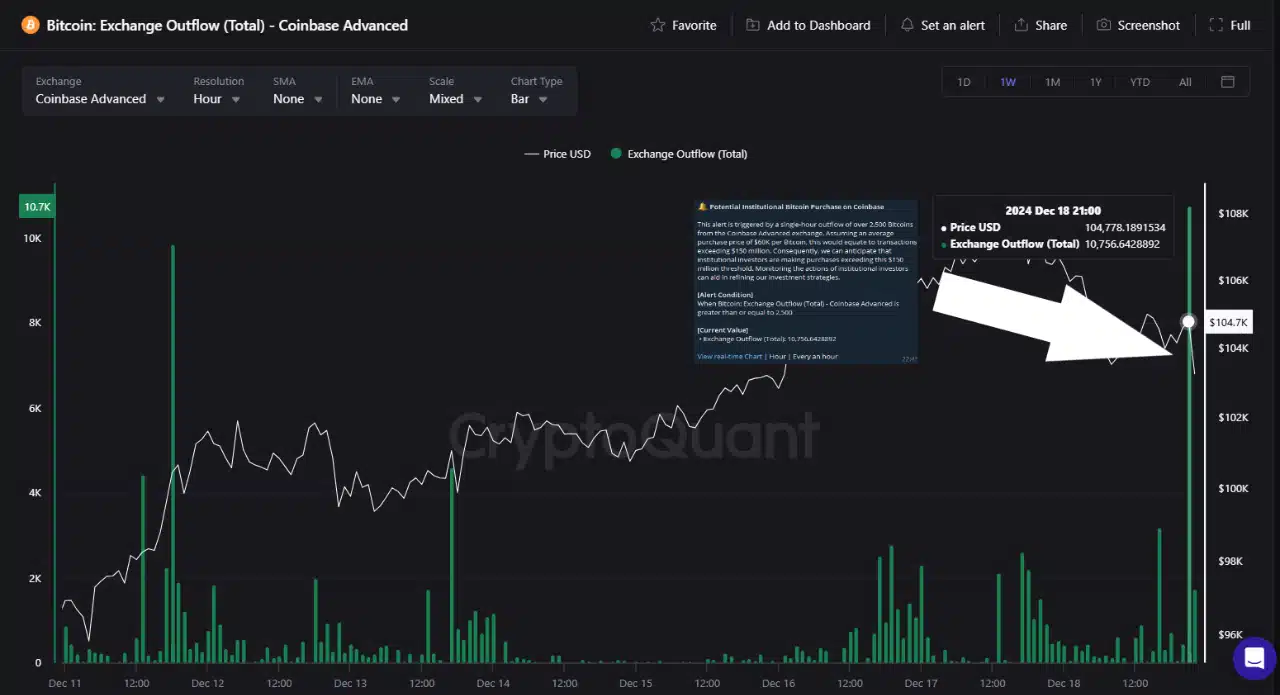

Massive Coinbase outflow signals institutional interest

As reported by Kesmeci, an extraordinary amount of Bitcoin was taken out of Coinbase during the FOMC announcement. In a single hour, around 10,756 Bitcoins, equating to roughly $1.1 billion, were removed from the platform.

As a crypto investor, I noticed recently that a significant amount of Bitcoin was moved in two separate transactions. The first transaction accounted for approximately 8,093 BTC, while the second one involved around 2,557 BTC. This substantial outflow appears to indicate either institutional buying or intermediary purchases possibly related to Spot ETF demand – a trend that mirrors similar institutional activity observed over the past year.

Kesmeci emphasized the growing role of institutional investors in Bitcoin’s market structure.

He noted,

Investors based in the United States persistently amass Bitcoin, remaining unfazed by price swings or economic dips.

The analyst pointed out that these major deals highlight the impact that financial entities such as RIOT and MARA have on propelling market activity, especially during crucial occasions like when interest rates are announced.

Bitcoin metrics signal mixed short-term outlook

Although the actions taken by institutions suggest a positive, long-term perspective towards Bitcoin, some crucial factors hint at an ambiguous short-term forecast for Bitcoin.

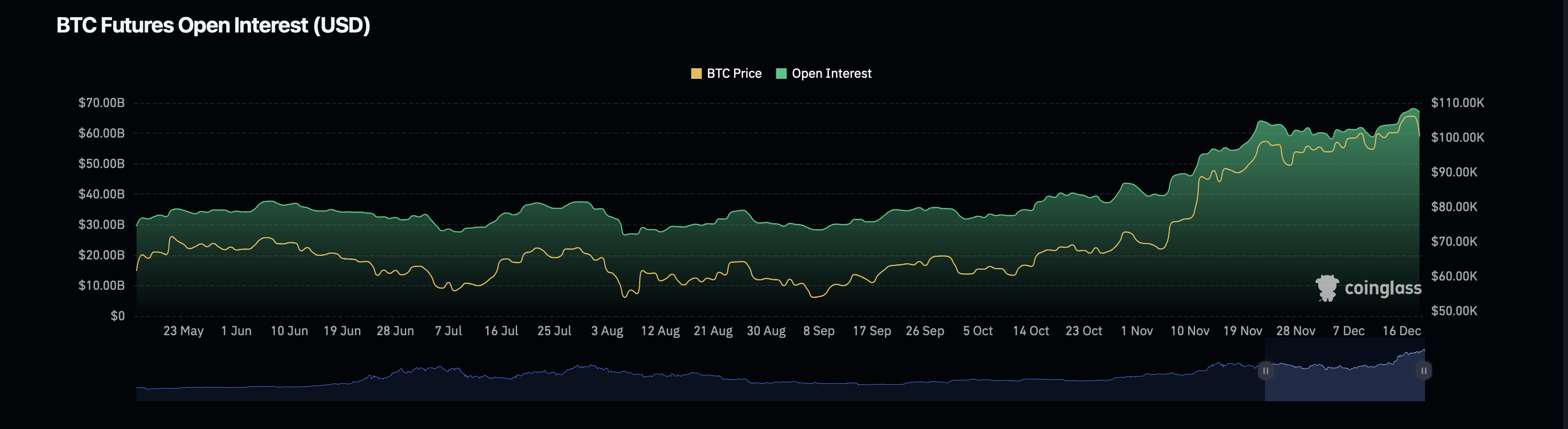

According to Coinglass, the value of open Bitcoin interests dropped by about 0.90%, now standing at approximately $68.14 billion. However, it’s worth noting that the volume of these open interests has significantly increased by 36%, amounting to $148.57 billion—indicating a rise in trading activity.

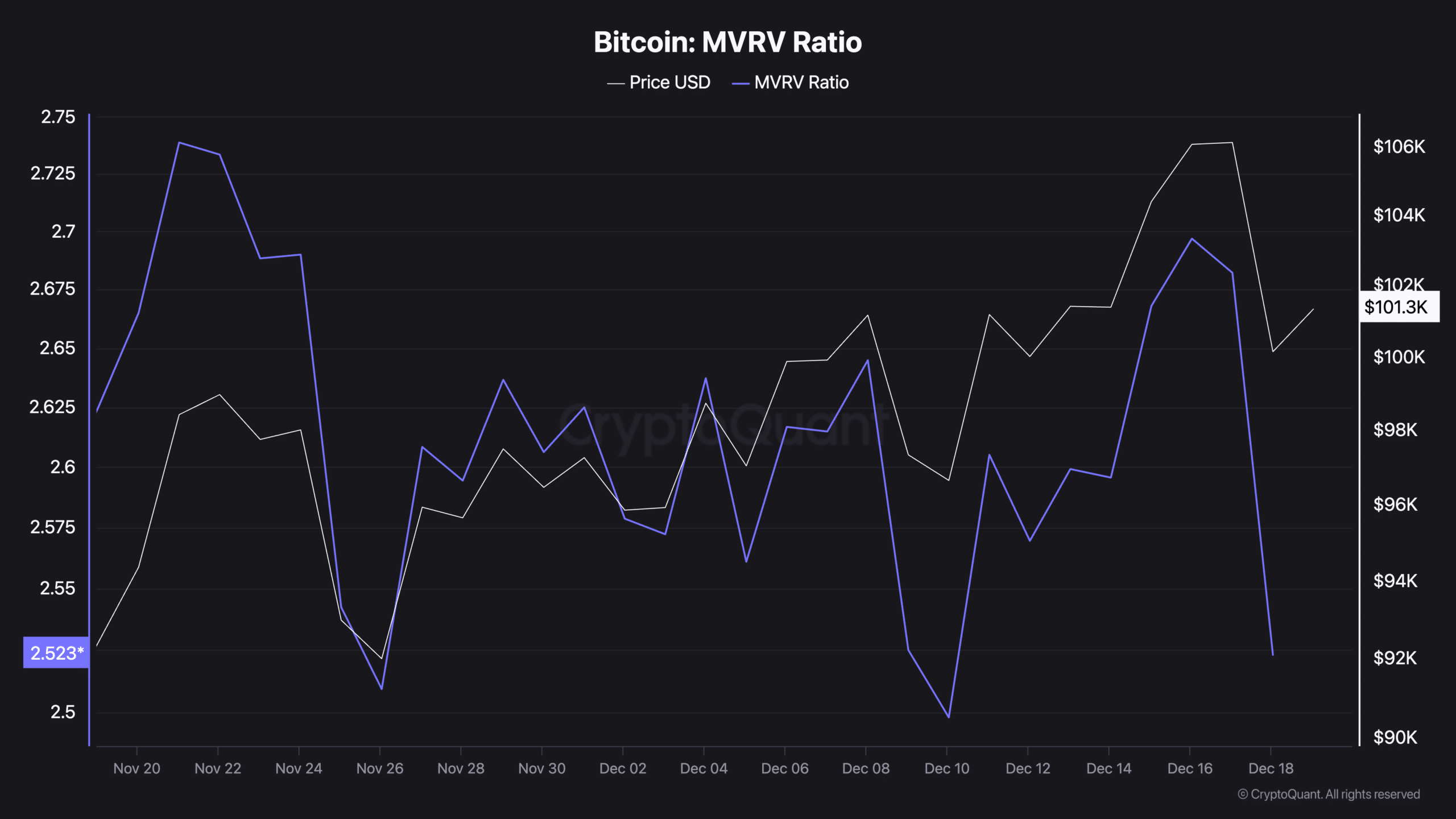

The MVRV (Market Value to Realized Value) ratio, another significant indicator, has undergone noteworthy fluctuations. This ratio evaluates if Bitcoin appears overpriced or underpriced by comparing its present market value to the price at which it was actually sold in the past.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simple terms, a ratio greater than 1 usually means that something is profitable for its owners, and larger numbers might hint at possible overpricing. The Market Value to Realized Value (MVRV) ratio of Bitcoin recently peaked at 2.69, but it decreased to 2.52 after the price fall.

This decrease indicates a possible shift in market opinion towards being more cautious, where traders might be considering adjusting their short-term investments.

Source; CryptoQuant

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-19 19:04