- With increased adoption, Bitcoin’s on-chain data confirmed a “local” bottom at $90K.

- However, breaking $99K amid macro volatility requires solid groundwork.

As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the current market situation presents an intriguing opportunity for strategic investors like myself. The recent dip in Bitcoin’s price to around $90K has been met with strong support from on-chain data, suggesting a potential local bottom formation.

Inflation in the U.S. rose slightly in October, ticking up by 0.2% monthly, spooking the stock markets. The S&P 500 snapped its seven-day winning streak as the “Trump dump” that followed the election began to fade.

Instead, Bitcoin [BTC] bucked the trend of U.S. stock indices, surging approximately 4% to finish at $95,883. This recovery occurred after four consecutive days of decline, following its peak of $99,317.

Over a week has passed since Bitcoin’s surge linked to political events cooled down, but its ability to hold strong in the face of growing economic worries, such as concerns over escalating consumer prices due to increased tariffs, is notable.

Over the recent days leading up to Thanksgiving, this market trend has ignited discussion about potential future movements. American investors might maintain their interest in trading, which could potentially drive Bitcoin’s value back up towards $99K.

However, this bullish hypothesis awaits confirmation from convincing on-chain data.

BTC on-chain data signals bottom formation

Instead of reaching over 90 in March, like it did before, the index is currently holding under that limit now. Yet, the widespread enthusiasm presents a valuable chance for tactical investors to reap profits. These investors might depart as multi-millionaires or billionaires throughout this phase.

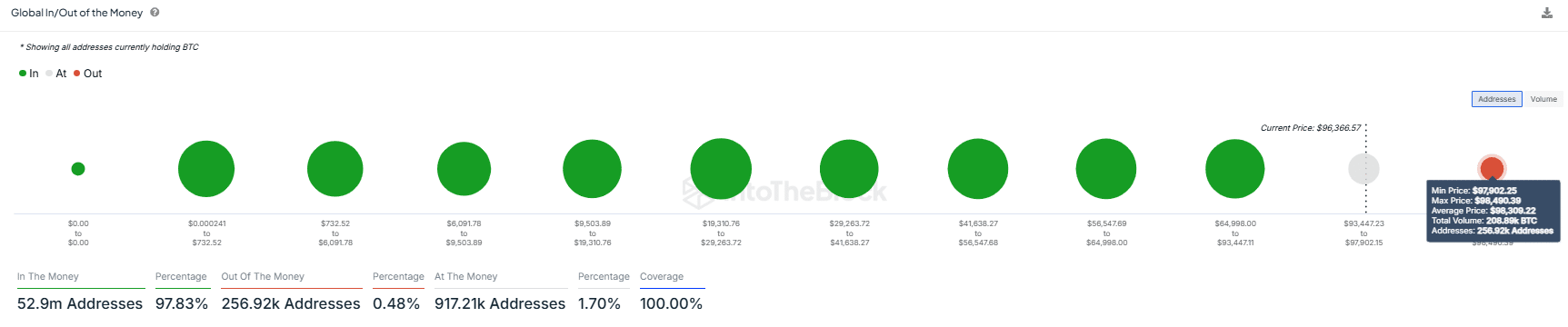

Additionally, as the “Trump trade” concludes, roughly a million Bitcoins, which were purchased at an average cost of around $93,447 by 917,000 different wallets, are relying on optimistic on-chain data to substantiate their belief in reaching the $100K goal.

As a crypto investor, I find it intriguing to observe Bitcoin’s robustness in the face of escalating inflationary pressures, which could suggest that we might be approaching the formation of a bottom around the $90K mark. This level, albeit briefly tested, has been seen as an offloading point for short-term holders.

This might establish a robust foundation for future fear of missing out (FOMO), perhaps encouraging long-term dedication and preparing the groundwork for another upsurge, as shown in the graph that follows.

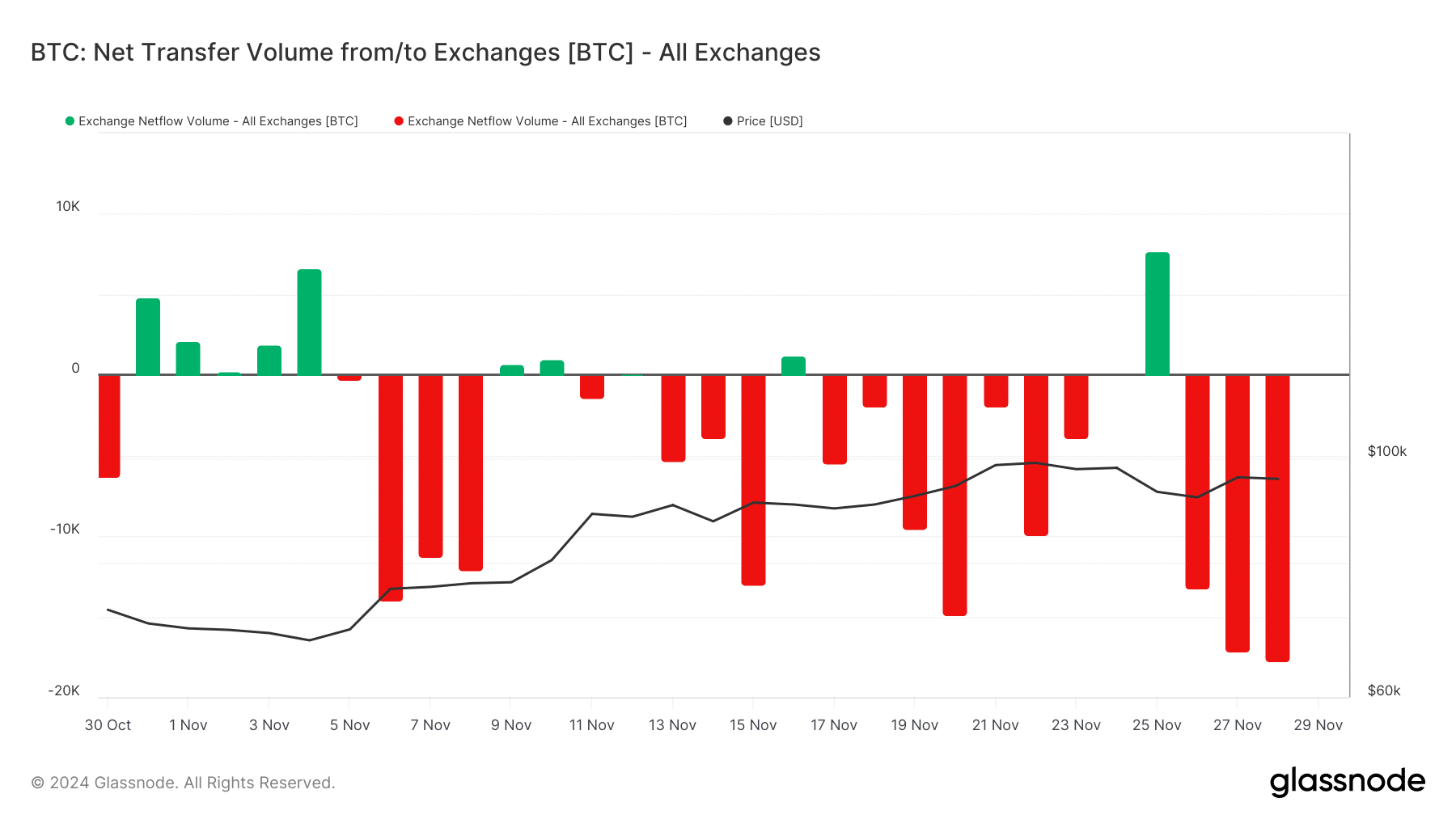

3 days past, a negative net flow spurred substantial trading by individual investors, amassing approximately 13,000 Bitcoins at an average cost of around $91,000 each.

This buildup strengthens a significant liquidity area, setting the stage for possible gains in the market as investors seize what they see as discounted opportunities.

Moreover, major participants appear to be expressing thanks for the bullish trend during this Thanksgiving, as over 20,000 BTC were taken out. This action helped in the price recovering within the range of $96K.

As an analyst, I’ve observed a strategic move by both retail and institutional investors who seized the recent price drop to $90K as an opportunity. Their actions have significantly increased adoption, creating a noteworthy uptick. This collective effort has served to counterbalance the downward pressure exerted by short-term holders (STHs), thereby reinforcing a robust support level at the bottom.

As a researcher, I must emphasize that although a potential low point seems to be established, it’s crucial to recognize that this could merely be a “temporary” or “regional” trough within the market, rather than the definitive “overall” or “global” bottom of the market cycle.

Until Bitcoin demonstrates activity comparable to past periods considered “high-risk,” such as around the $99K mark where significant resistance persists, a reversal in its current trend remains potential.

99K resistance requires both micro and macro support

The data from Bitcoin’s blockchain indicates robust backing at around $90,000. This could suggest that investor responses may halt any further drops, paving the way for a possible recovery and the formation of a temporary base.

Due to recent developments, the value of Bitcoin has once again reached around $96K. This new level signifies a recovery of its total earnings that were lost in the closing trades prior to the election period.

Over the next few days, keeping an eye on those Bitcoin transaction data sets will be essential to ascertain if BTC manages to maintain its position between $95K and $97K. If it does, this stability might open up possibilities for a rise towards $99K, where substantial action is anticipated.

Initially, approximately 256,920 addresses containing roughly 208,000 Bitcoins bought at an average cost of about $98,309 each will be considered profitable (or “in the money”). The decisions made by these owners regarding their Bitcoin holdings could significantly impact Bitcoin’s price movement.

Additionally, it’s important to note that both “expectation” and “action” will be crucial factors. While some might find it unlikely for the price to surpass $100K, fueled by social media buzz, others might start implementing their sell plans, as suggested by recent market trends.

Consequently, determining if $99K becomes the new minimum value for analysis will require considering both specific on-chain information and wider economic patterns.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to a recent poll, traders have become more confident that the Federal Reserve will decrease interest rates by 0.25% during their December gathering. Currently, the market estimates a likelihood of approximately 65% for this event, which is an increase from 56% a week prior.

This transition might establish a robust base for Bitcoin to surpass the $100,000 threshold. This is more likely if accompanied by favorable on-chain indicators, such as increased whale activity, institutional investments, and strong commitment from long-term holders at around the $99,000 price level.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-29 14:16