- Bitcoin has recovered above $60,000, with analysts predicting a possible surge to $116,000.

- Increased whale transactions and rising open interest suggest growing market confidence in Bitcoin’s next move.

As a seasoned researcher with a knack for unraveling the mysteries of the cryptocurrency market, I find myself intrigued by the recent surge in Bitcoin’s price. The technical analysis presented by Javon Marks, coupled with the increasing whale transactions and rising open interest, paints an optimistic picture for Bitcoin’s future.

Over the past few weeks, I’ve noticed that Bitcoin [BTC] has been encountering significant resistance at the $60,000 mark. As recent as August 15th, it dipped below the $58,000 threshold.

I’ve experienced some ups and downs in my crypto journey, but the digital currency I’m invested in has demonstrated remarkable resilience. After a dip, it’s managed to bounce back and regain the $60,000 mark, currently trading at $60,820 as we speak.

Over the past day, there’s been a 3.9% growth, while the past week has seen a 2.4% uptick. This could suggest a possible change in market opinions or attitudes.

The rise in prices once again is fueling excitement and hope among cryptocurrency enthusiasts. Notably, renowned crypto expert Javon Marks has expressed his viewpoint on Bitcoin’s future, suggesting a substantial increase in its value.

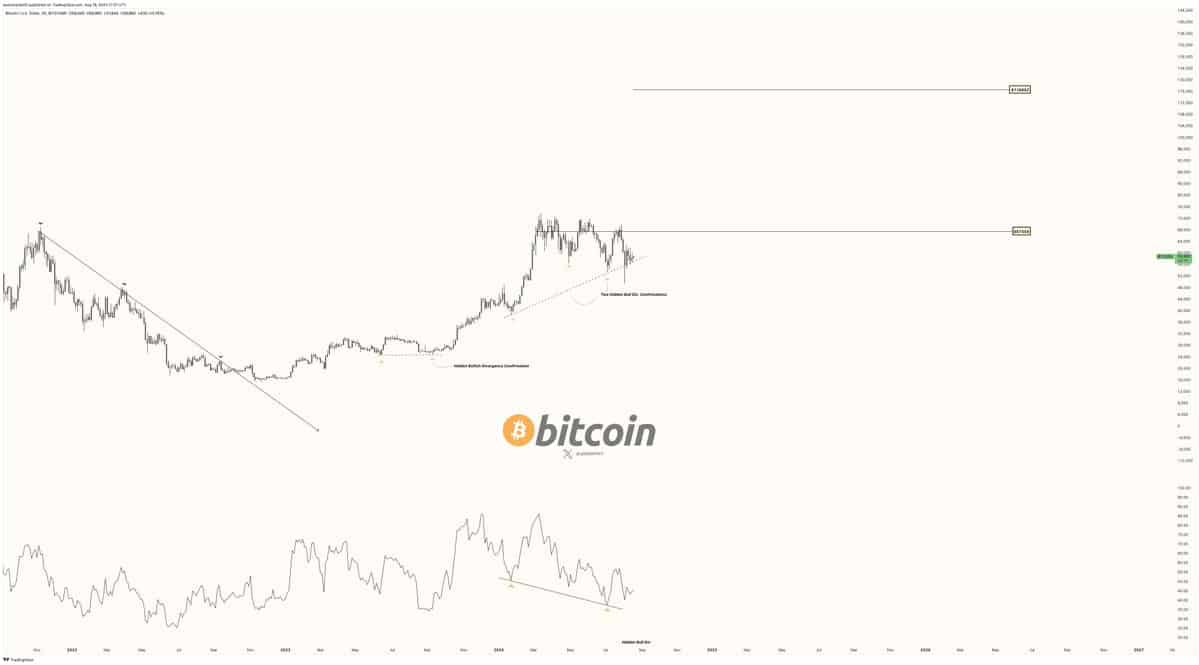

Marks highlighted a key technical pattern, known as the Hidden Bullish Divergence, which he believes could propel Bitcoin to new heights in the coming weeks.

Bitcoin’s path to $116,000: A technical perspective

Based on Javon Marks’ analysis, it seems that Bitcoin might be gearing up for a significant surge in value, as indicated by its recent price fluctuations.

He pointed out that as Bitcoin is still coming off of a major Hidden Bull Divergence pattern, sights can remain on a push back above the $67,559 target.

He added that should Bitcoin reclaim this target, it be a “massive breakthrough for the next phase of this bull cycle.

Marks stated,

As an analyst, I foresee a significant opportunity for Bitcoin. If we manage to break and hold above the current target, a rapid surge of approximately 72% or $116,652 could be in store. This potential increase may outpace many expectations regarding its speed of ascent.

I posit that the recent undulations in Bitcoin’s value near the $67,559 mark serve as a precursor to the subsequent advancement within the current bullish trend, according to Mark’s analysis.

If the cryptocurrency can maintain momentum and break through this crucial resistance again, it could open the door to a surge into the six-figure range.

Nevertheless, although the technical aspects seem encouraging, it’s crucial to examine Bitcoin’s foundational elements to gauge the probability of such a surge.

Fundamental analysis: Whale activity and open interest

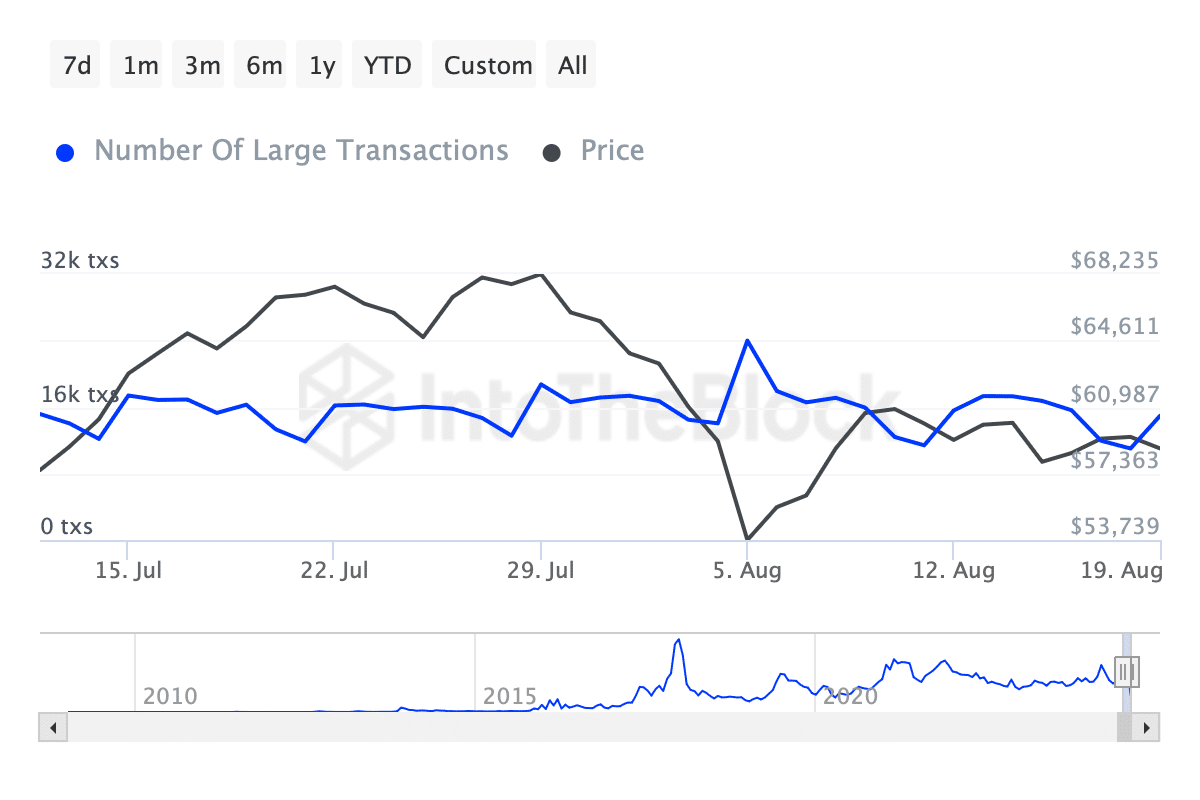

As a dedicated researcher delving into the intricacies of Bitcoin, I’ve discovered that beyond merely focusing on technical indicators, understanding its fundamentals offers valuable insights into future price movements. One crucial aspect to keep an eye on is whale activity – these are substantial transactions involving large quantities of Bitcoin. Monitoring such activity can potentially provide a glimpse into the market’s sentiment and predictive trends.

As an analyst, I’ve noticed a significant uptick in whale transactions surpassing $100,000 according to data from IntoTheBlock. On August 5th, these transactions peaked at approximately 23,980 before dipping below the 15,000 mark.

Currently, the number of such transactions is on the rise again, approaching 15k as of today.

An uptick in whale-sized Bitcoin transactions might indicate that major investors are amassing Bitcoins, potentially causing a rise in its price due to increased demand.

It’s frequently observed that whales (large investors) can impact financial markets, and their increasing fascination with Bitcoin may signal a positive outlook towards cryptocurrency’s potential for continued growth.

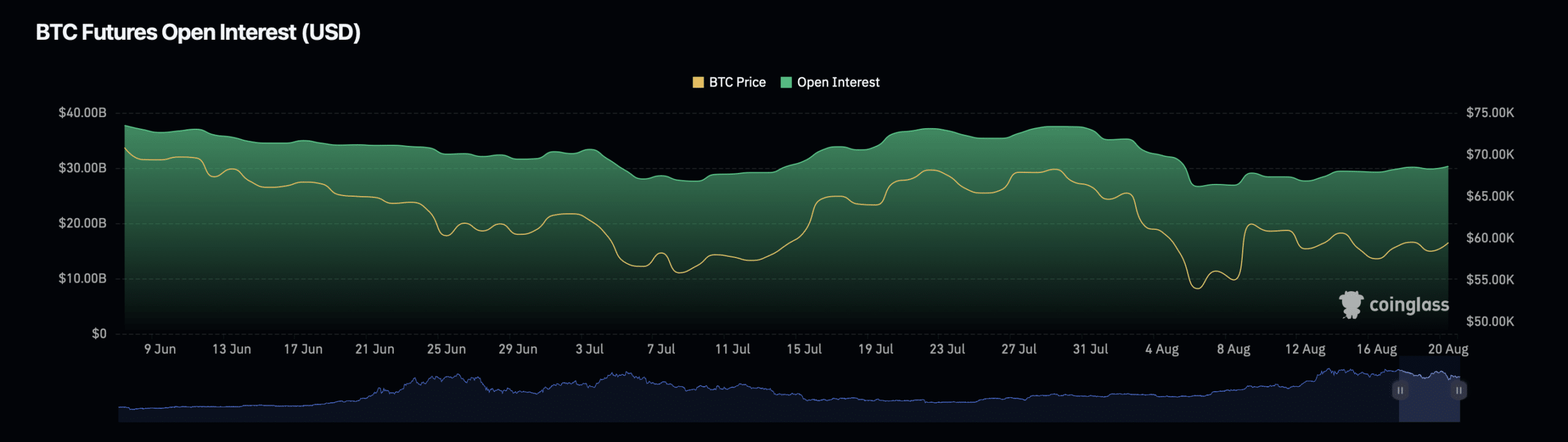

Besides the rise in whale activities, it’s worth noting that the amount of Bitcoin’s open interest, which represents the total number of active derivative contracts, has significantly grown as well.

Based on information from Coinglass, Bitcoin’s open interest has grown by 3.61% over the past day, amounting to a value of about $31.38 billion. This growth is also accompanied by a significant increase of 48.49% in open interest volume, currently sitting at approximately $55.79 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

An increase in open interest indicates that more traders are placing wagers on Bitcoin’s upcoming price fluctuations, thereby strengthening the optimistic outlook about the digital currency’s market trend.

Indeed, it’s prudent to stay vigilant, given that a rise in open interest might trigger higher market fluctuations. This is especially true when the market trends opposite to most of these open positions.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-08-20 15:04