- Bitcoin has reclaimed a key resistance of $65K, generating enthusiasm in the market.

- However, this may not yet confirm a bull market.

As a seasoned crypto investor with battle scars from numerous market cycles, I can tell you that Bitcoin’s latest break above $65K has certainly ignited some excitement. However, I’ve learned to take such milestones with a grain of salt and not jump into premature conclusions.

Currently, Bitcoin [BTC] has successfully surpassed the $65K barrier, indicating a promising trend. However, this doesn’t necessarily mean we have definitive proof of a full-blown bull market just yet.

Historically, price points such as the current $65K have tended to act as mental hurdles during previous market upswings. Overcoming this threshold holds importance because it signifies the recapture of an important previous resistance level.

However, simply breaking it isn’t enough. Further steps are required to confirm a bull run to $74K.

Why is $65K a psychological barrier for Bitcoin

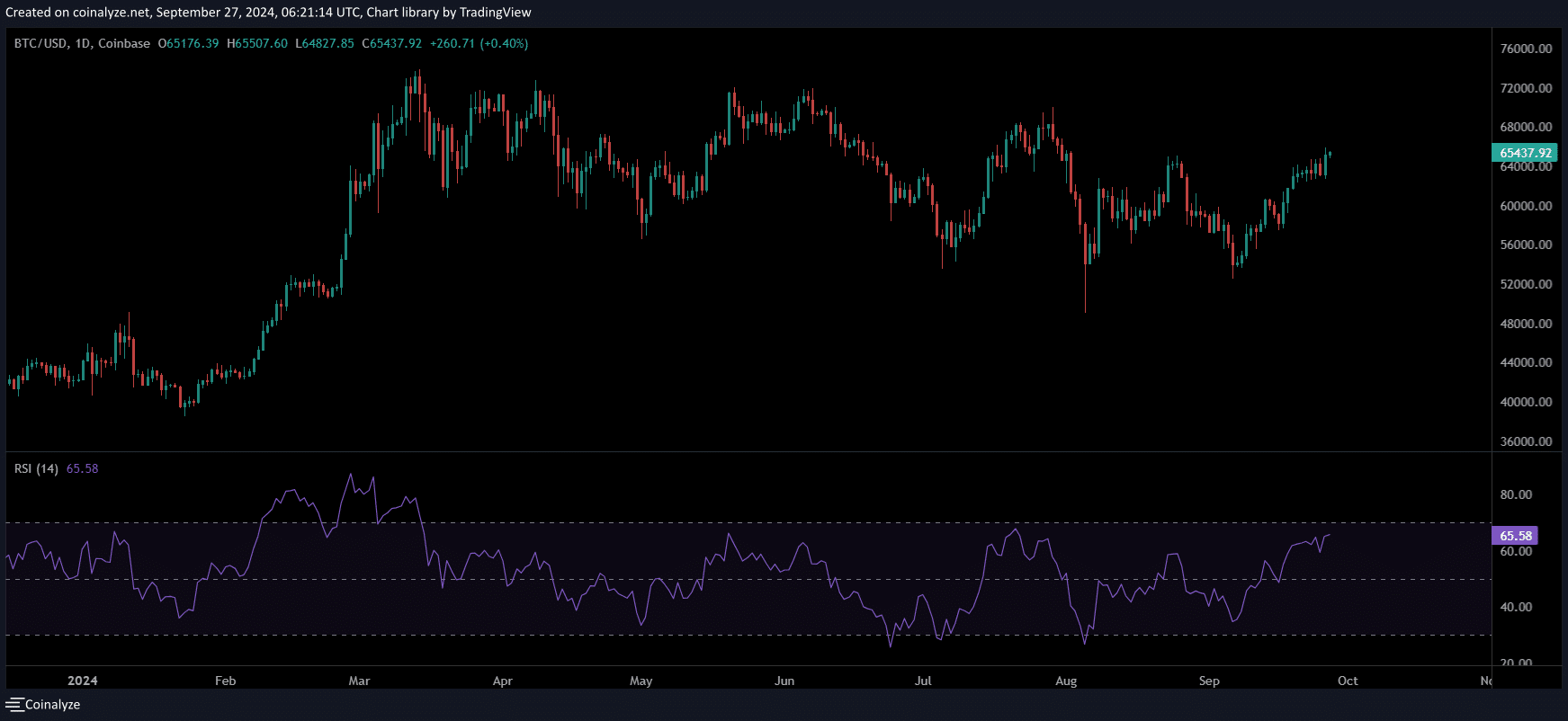

Historically, when a significant resistance level is encountered, it typically signifies robust buying interest, often manifesting as Relative Strength Index (RSI) readings that exceed overbought territory.

Emotionally speaking, such a swift jump to $66K might instill a sense of caution in traders. This sudden surge may spark worries about overreaching, potentially leading to a steeper correction down the line.

For example, when Bitcoin (BTC) reached its all-time high (ATH) of $73,000 in March, the Relative Strength Index (RSI) stayed above 70 for more than a month. This suggested that a pullback was imminent, and indeed, BTC subsequently fell back to $61,000.

As per AMBCrypto, it’s crucial for Bitcoin to stay above the $66,000 mark if it wants to keep its bullish momentum going. Ideally, it should move upwards, but if it needs to correct itself, it should briefly dip to around $61,000 before regaining strength again.

Source : Coinalyze

At present, the Relative Strength Index (RSI) appears to reflect past pullback markers as Bitcoin surpasses significant resistance thresholds. This could make traders cautious and prompt them to cash out, suspecting an impending downturn.

In short, without a pullback, Bitcoin’s price could quickly become overextended. Therefore,

Retracement might be needed next

According to AMBCrypto, if Bitcoin falls back to around $61K, it could provide evidence that the former resistance level of $65K has now become a support level.

As a researcher studying market dynamics, I can express this concept in layman’s terms as follows: By focusing on this specific support level, I am providing an opportunity for bulls to showcase their power and resilience, essentially proving they can hold their ground here.

Should this tendency continue, it could potentially draw in additional investors seeking entry points at lower costs, thereby facilitating Bitcoin’s potential surge beyond $70K.

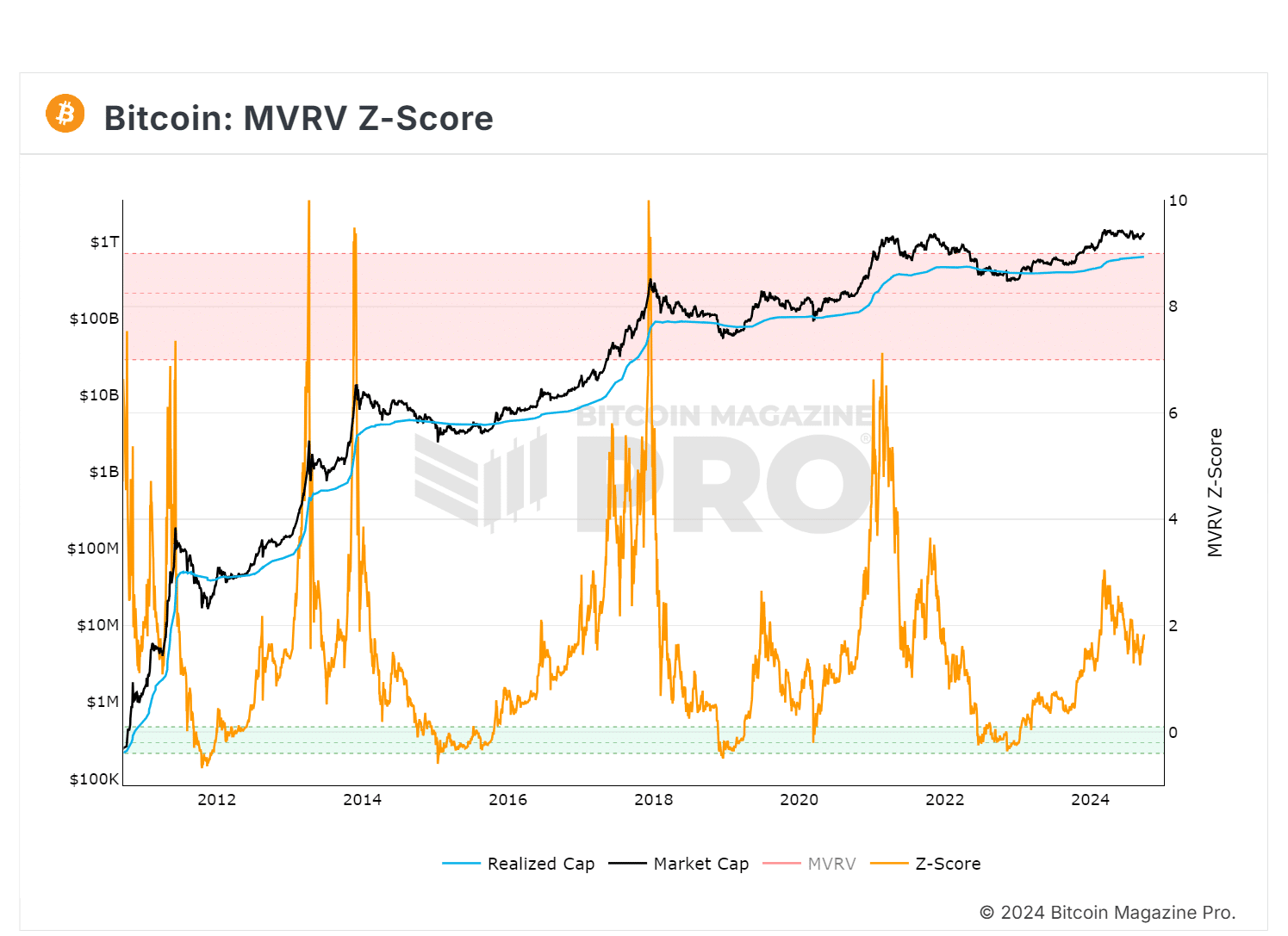

Source : Bitcoin Magazine Pro

Normally, when the Z-score reaches the green box, it tends to trigger a bull market surge that can be identified by the high point touching the red band, signifying a market that’s running too hot.

Consequently, a drop in price to around $61K might create a favorable environment for stronger purchasing, potentially allowing Bitcoin to challenge its initial all-time high again.

The key will be to hold

Instead, Bitcoin skips over $61K and shoots straight up to $66K, indicating robust demand from buyers who are keen to invest in the market immediately, rather than holding back for a lower price point.

Despite appearing improbable, this could indicate a positive sign, suggesting there’s sufficient demand to keep prices elevated. In other words, for the bull market to persist, Bitcoin should ideally stay above $66K and potentially rise even higher.

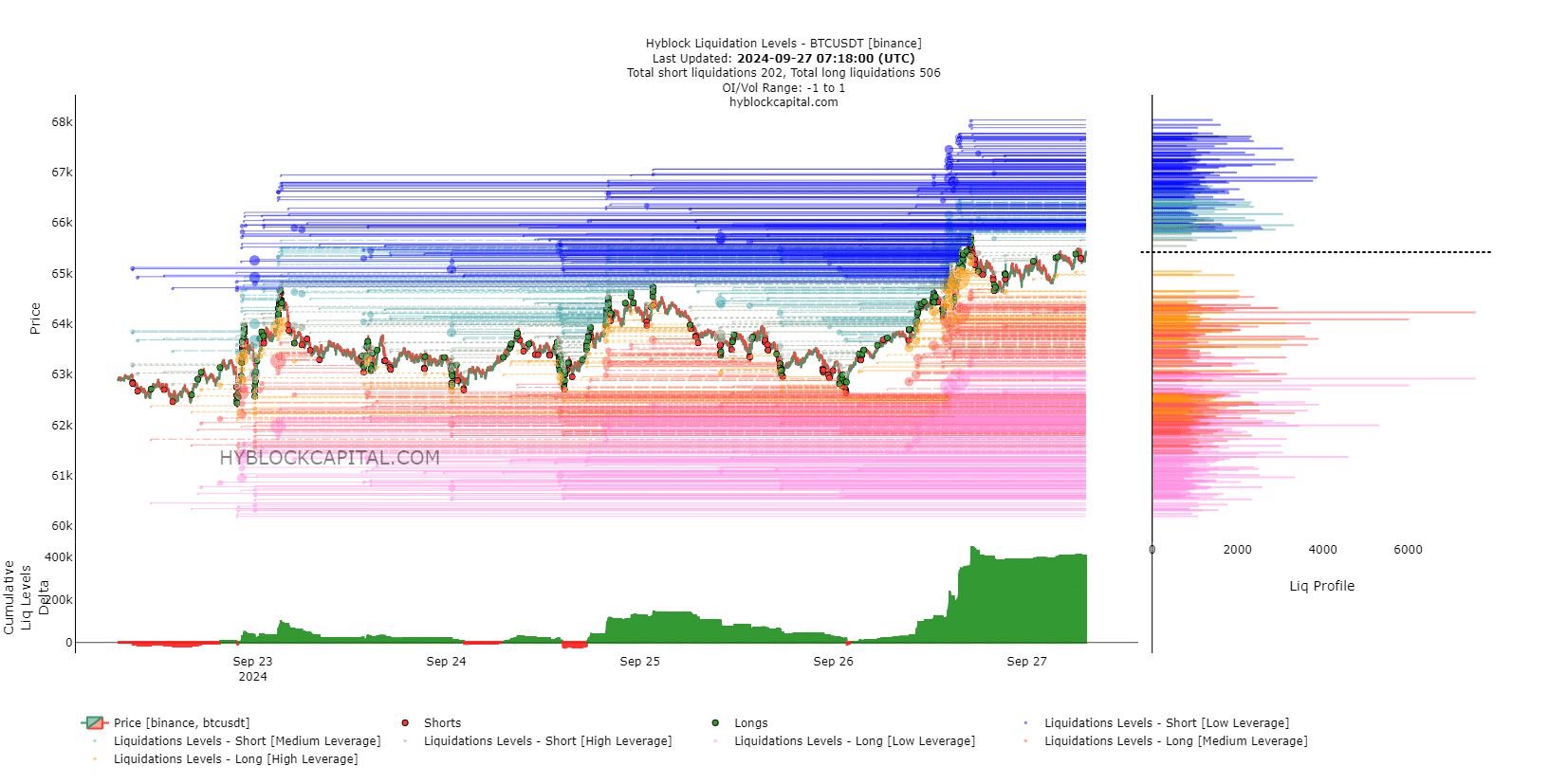

Over the last three days, I’ve observed an influx of long positions as Bitcoin approached the $65K resistance. The market participants seemed optimistic that bulls would maintain this level.

Source : HyblockCapital

Read Bitcoin’s [BTC] Price Prediction 2024-25

Nevertheless, as short sellers reappear, there’s a possibility that a withdrawal by long positions could cause a pullback to around $61K, supporting AMBCrypto’s theory. In summary, the bullish trend exceeding $70K depends on the bulls managing to maintain the $66K resistance level.

If we don’t see a drop to around $61K, it’s important that we do so to verify support, minimize fluctuations, entice more buyers, and pave the way for a prolonged uptrend towards $74K.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-27 18:16