- Bitcoin reserves have sparked intense controversy, with countries deeply divided on their potential.

- As Japan faces mounting economic pressure, could its struggles provide the perfect case study?

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I find myself intrigued by Japan’s current predicament and its potential approach to Bitcoin reserves. Having witnessed the rise and fall of numerous cryptocurrencies, I can attest that this technology holds immense promise, but also carries significant risks.

In light of Japan’s economic struggles against the mighty U.S. dollar, the question of whether to embrace Bitcoin reserves is not an easy one. On the one hand, the allure of a limited and inflation-resistant asset like Bitcoin is undeniable. However, the volatility that comes with it could potentially add more instability to an already fragile economy.

Looking at Japan’s demographic crisis and the challenges it presents, one can’t help but wonder if embracing Bitcoin reserves might be akin to trying to catch a falling knife – risky, but perhaps necessary for survival in the long run. After all, as they say in crypto circles, “Don’t try to catch a falling bull by its horns.”

In this ever-evolving world of digital assets, it seems that only time will tell if Japan and other nations will find the courage to dive into the crypto waters. For now, I’ll be keeping a close eye on the trends, ready to adjust my own portfolio accordingly – or perhaps even take a dip myself!

The discussion on Bitcoin’s [BTC] reserve holdings is causing a split in the financial market. While some view it as an essential safeguard against the unpredictability of the U.S. dollar, others are apprehensive due to the potential speculative hazards associated with it.

The difference between their positions is so clear-cut that both the Federal Reserve and the Trump administration hold opposing views on this topic, with distinctly contrasting stances.

Currently, Japan has entered the discussion, expressing apprehensions regarding the possible risks associated with holding Bitcoin within their international reserve assets.

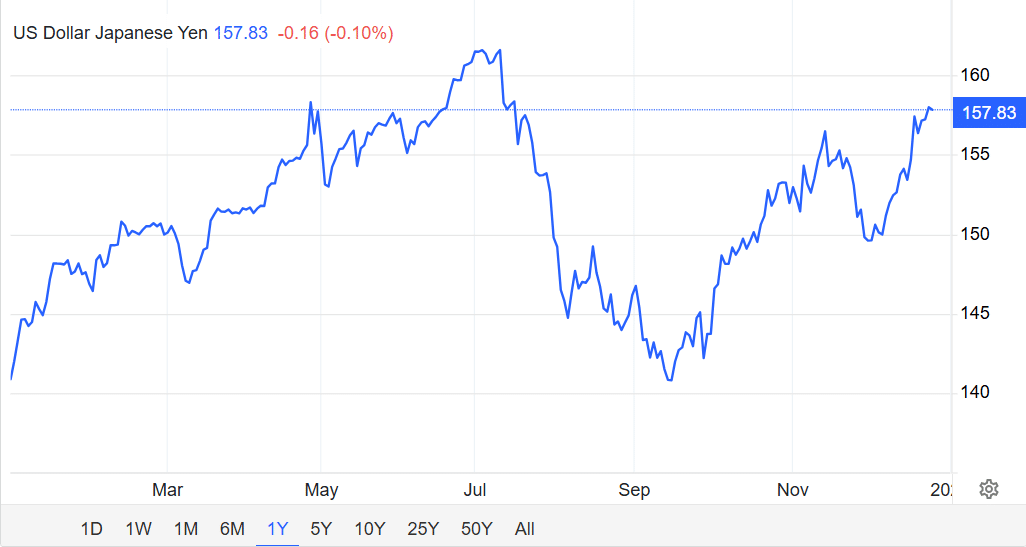

However, it’s important to note this fact: The Japanese yen has reached a five-month low compared to the U.S. dollar, adding to the list of G20 currencies finding it challenging to maintain their strength amidst the dollar’s robust position.

Is it possible that Japan’s conservative stance on holding Bitcoins will later be viewed as a lost chance? Alternatively, could the financial stress drive Japan (and other countries) to acknowledge Bitcoin as a genuine contender in the financial world?

Unraveling Japan’s economic storm in 2025

The recent FOMC rate cut triggered a ripple effect across markets, sparking an ‘unexpected’ twist.

On December 18th, when news about the Federal Reserve’s decision broke, the U.S. Dollar Index spiked to an impressive two-year peak of 108.54.

In just a few short days, the consequences were swift and severe. Bitcoin saw a steep drop of 14%, while various international currencies weakened significantly under the strain. Even the Japanese yen wasn’t immune, sliding down to a five-month low of 158 yen per dollar.

Source : Trading Economics

Initially, the Bank of Japan (BOJ) maintained its stance, not adjusting interest rates. However, a potential turbulence could be on the horizon.

Over the long term, a rising U.S. dollar could have wide-ranging effects, potentially leading to an increase in prices, or inflation.

Indications have become apparent. In November 2024, Japan’s annual inflation rate surged to 2.9%, a significant increase from 2.3% the month before, which represents its highest level since October 2023. This figure is not just a statistical abstraction; it carries real-world implications.

The significant increase in inflation serves as a warning of things to follow. With inflation on the rise and the powerful U.S. dollar, Japan finds itself in a challenging position. The cost of imports is escalating, creating a pinch for both businesses and consumers alike.

This situation transpires amidst Japan’s demographic predicament, characterized by a rapidly growing older population and decreasing birth rates.

This scenario unfolds in the face of Japan’s demographic dilemma, which involves an increasing elderly populace and shrinking number of births.

Or:

The events take place under the shadow of Japan’s demographic quandary – a rising senior citizen population and falling birth rates.

This shift is weakening the labor force, making the challenges of 2025 even more daunting.

So, are Bitcoin reserves the right solution?

The response isn’t straightforward – it’s somewhat yes and no. While Bitcoin’s scarce nature can make it a good protection against increasing inflation, on the other side, it also carries significant volatility that might counteract its role as an effective hedge.

As a crypto investor, I see that unlike traditional currencies like the U.S. dollar, which can be printed in large quantities, Bitcoin’s limited supply provides a valuable protection for economies, including Japan, against potential currency devaluation.

Having witnessed the rollercoaster ride of cryptocurrency markets, I can confidently say that as someone who appreciates financial stability, I find Bitcoin a risky proposition for Japan. My personal experience in finance has taught me that volatility, especially in an asset like Bitcoin, can lead to unpredictable fluctuations that could potentially destabilize the economy of a country like Japan, which places great emphasis on maintaining stability. This is a concern that warrants careful consideration for those who are planning to invest or use Bitcoin in the Land of the Rising Sun.

Given the growing pressure on Japan’s economy, the concept of adopting Bitcoin reserves might no longer appear as unconventional as it used to. In fact, it may soon be crucial for maintaining economic stability and resilience.

As a crypto investor, I’m noticing that this shift isn’t confined to the realm of national economies alone. Even major exchanges are increasingly accumulating Bitcoin. For example, Bitfinex’s Bitcoin reserves have recently surpassed $230 million, a level last seen three years ago – demonstrating a growing interest and confidence in Bitcoin on their platform.

From my personal experience as a long-time investor and observer of financial markets, I can confidently say that Bitcoin is increasingly being viewed as a safety net by many countries due to the growing volatility in global markets. This trend is likely to result in a significant influx of liquidity into the Bitcoin market, as investors seek refuge from traditional investment vehicles. As an investor myself, I am closely monitoring the situation and preparing for increased demand on exchanges. The potential for growth in this digital currency is immense, and I believe that those who are proactive in navigating this new landscape stand to reap substantial rewards.

Read Bitcoin’s [BTC] Price Prediction 2025-26

As the U.S. dollar remains dominant, numerous economies are exploring potential alternatives. Bitcoins might be a promising solution, yet their success hinges on achieving price stability throughout the upcoming year.

Should it come to pass, utilizing Bitcoin for both hedging and transactional purposes might cease to be an elusive ambition.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-29 10:20