- Bitcoin’s volatility may push the price to $50K despite market optimism.

- Investor sentiment was divided over buying the dip.

As a seasoned crypto investor with a few years under my belt, I’ve learned to keep an open mind and be prepared for the volatile swings of the market. While the potential for Bitcoin hitting $70K or even higher is an exciting prospect, I can’t ignore the warning signs that suggest a potential drop to $50K might be on the horizon.

As a cryptocurrency analyst, I’ve been closely monitoring the price trend of Bitcoin (BTC). Although there have been speculations about it reaching new heights above $70,000, the current trajectory raises some concerns for me.

As a researcher, I’ve come across various perspectives on this issue, and while some individuals seem unfazed, Anthony Pompliano expressed his views in a discussion with Fox Business recently.

It’s become increasingly clear to retail investors and institutions alike that Bitcoin’s value will significantly increase in the next 5-10 years. Consequently, during market downturns, they view these as potential buying opportunities rather than causes for concern.

Echoing similar sentiment was X (formerly Twitter) account Bitcoin for Freedom.

“If this dip makes you scared you need to study #bitcoin more.”

As a market analyst, I’ve observed that the latest market volatility has sparked renewed interest in the time-honored approach of “buying the dip.” This strategy, which involves purchasing securities when their prices have declined, has once again become an allure for traders and investors on the hunt for potential deals.

There are contrasting views

As a crypto investor, I’ve come across various viewpoints regarding the current market situation. While some are hopeful about the future prospects, I’ve also encountered voices of caution. One such voice belongs to Markus Thielen, the CEO of 10x Research. In his post, he expressed a more cautious stance, implying that the present moment might not be the most opportune time for undiluted optimism.

In his recent blog post, Thielen claimed,

As a researcher studying market trends, I would rephrase it as follows: “The breakdown of support levels may lead to an escalation in price decreases as sellers rush to exit their positions. At this point, only inexperienced traders are considering purchases. This downward trend could potentially push the price towards the low $50,000 range.”

Thielen had the same views a few months ago, wherein he had noted,

It might be premature to make a purchase for the dip yet. Technically speaking, Bitcoin could still drop below $60,000 before starting a significant uptrend.

As a researcher studying the cryptocurrency market, I’m curious to find out whether Bitcoin will contradict Thielen’s forecast or prove it correct by dipping down to $50,000.

Bitcoin’s recent market trends

As a researcher, I’d express it this way: Based on current market data from CoinMarketCap, Bitcoin (BTC) is priced at $57,730.17. This represents a 4% decrease in value compared to the past 24 hours.

On July 3rd, there was a net withdrawal of approximately $20.5 million from Bitcoin ETFs, such as the ones tracking the Bitcoin market.

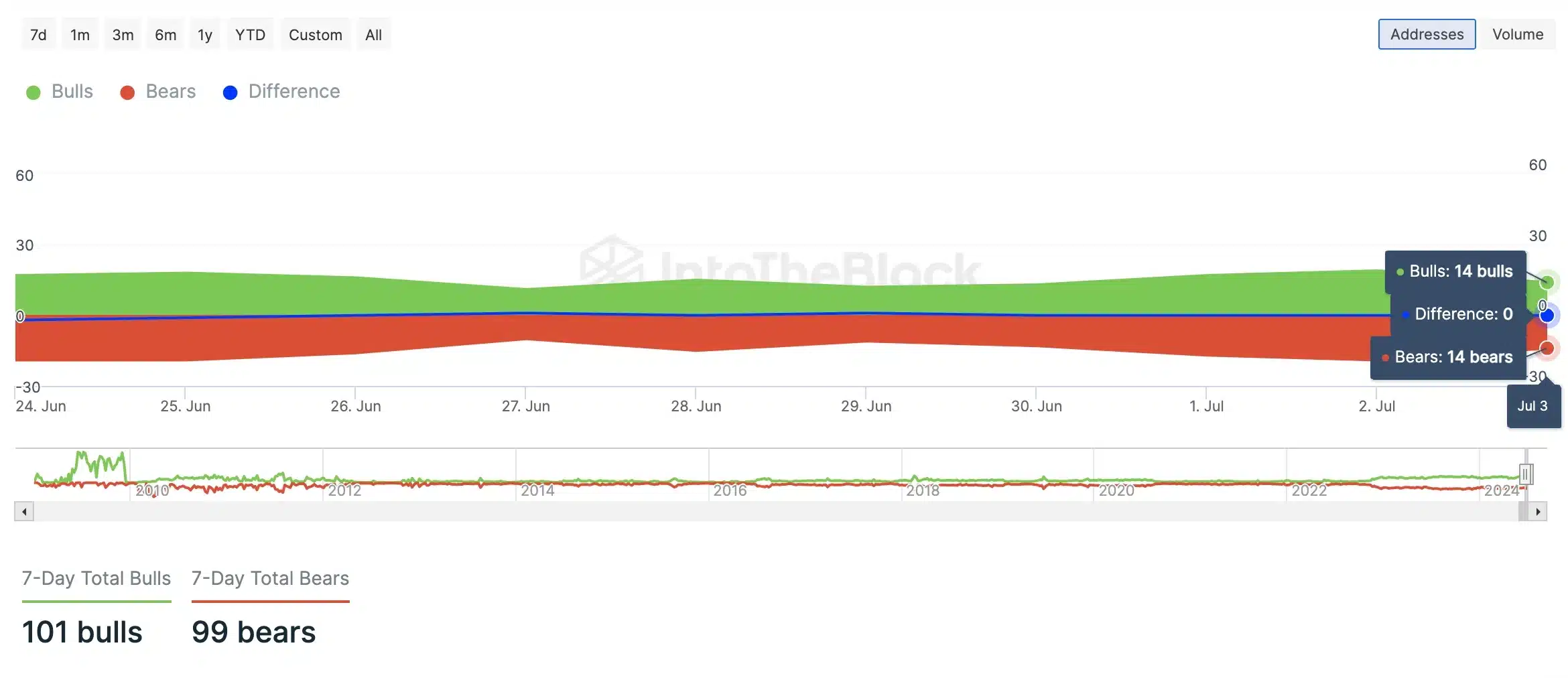

As a crypto investor, I’ve been closely monitoring the market trends using IntoTheBlock’s Bears and Bulls data. Surprisingly, there seemed to be no clear advantage for either the bulls or bears as of July 3rd. The data indicated an equal balance between buying and selling pressure, suggesting a neutral market situation.

As a researcher analyzing the Bitcoin Exchange-Traded Fund (ETF) flow data for the month of July, I’ve noticed an intriguing trend: during only three specific trading days, more funds flowed into the BTC ETF than out.

I analyzed the Bitcoin Exchange-Traded Fund (ETF) data, and on the first day of July, there were inflows totaling $129.5 million. This is a substantial increase compared to the combined outflows of $34.2 million on both the second and third of July.

Notably, June saw maximum outflows for BTC ETFs, but as Q3 began, there were signs of improvement.

Read More

2024-07-05 03:03