- Bitcoin pushed to noteworthy short-term zone, raising possibility of short-term profit-taking.

- Recent sell shocks have retail traders on the sidelines, will price discovery trigger the next wave of FOMO?

As a seasoned analyst with extensive experience in the cryptocurrency market, I’ve witnessed the ebb and flow of Bitcoin prices over the years. The recent surge above $66,000 for the first time in three weeks is an exciting development that has raised the possibility of short-term profit-taking.

On July 17th, Bitcoin’s price surpassed $66,000 for the initial time in over three weeks. This upward trend was driven by robust buying pressure, influenced by various factors such as:

This fresh rally has triggered hopes among BTC holders, of a potential push into price discovery.

Bitcoin’s recent impressive gains suggest renewed optimism among investors, but some remain hesitant about reaching a new all-time high without encountering significant obstacles.

The price surge of Bitcoin (BTC) has currently surpassed the average purchase price for its short-term holders. This condition might lead to a shift in the market trend or encounter significant resistance from sellers.

When Bitcoin’s price surpasses the amount short-term investors originally paid, it could indicate that they might choose to sell their holdings, potentially signaling profit-taking among this group. However, if there’s a strong belief in further price gains, even bears may be hesitant to enter the market due to lack of significant bearish sentiment.

Retail traders are still on the sidelines

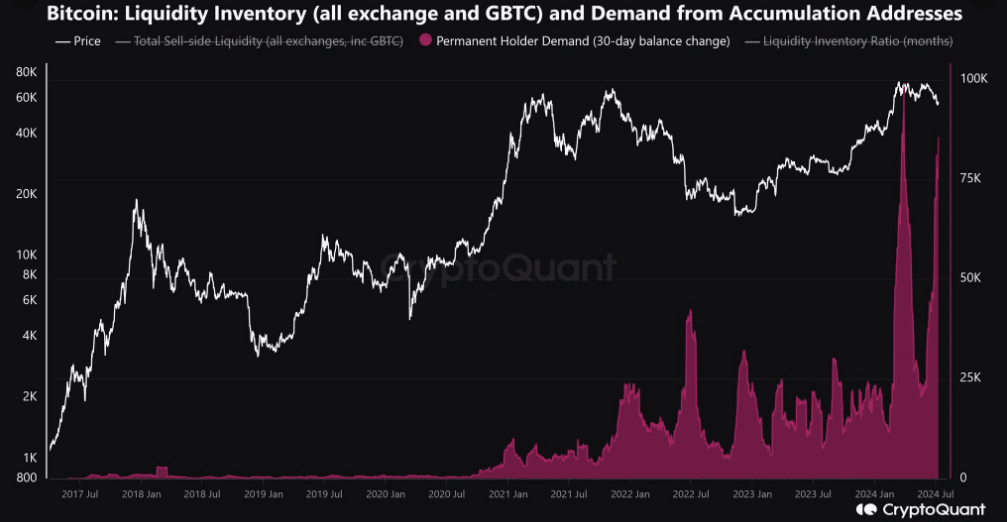

The data suggests a relatively low turnout from retail investors during the recent market rally. In simpler terms, the rally we’ve observed over the past two weeks has been primarily driven by large institutional investors and “whales” (high net worth individuals with significant financial resources).

A sign that the retail class are still fearful about the impact of the Mt. Gox Bitcoin sell-off.

Based on current information, Bitcoin is approximately $8,000 short of triggering a substantial price increase. Additionally, there’s potential for further growth before encountering the next notable resistance point.

Investors who purchased the recent price dips are expected to take profits in the coming days, potentially causing a brief market retreat.

Currently, institutional buyers are aggressively purchasing Bitcoin ETF shares, creating significant demand that counteracts any selling pressure on the market. The recent dip below $60,000 caught many large investors and individual traders off guard, allowing them to take advantage of the situation by gradually investing more in Bitcoin at lower prices.

What does the current market environment mean for Bitcoin?

The pessimistic state of Bitcoin throughout much of June and the initial part of July could be the reason for decreased enthusiasm among individual investors. Low involvement in the market, coupled with heightened interest rates that weaken retail buying ability, might be contributing factors.

From a different perspective, the increased demands from institutions could rekindle enthusiasm in the market. At the same time, it’s worth noting that there are signs of rising demand among long-term investors as well.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The expanding stockpile of long-term Bitcoin holders is a promising long-term indicator, potentially reinforcing the belief that prices may rise in the future.

In simpler terms, if market trends persist, there could be a strong urge to buy among retail investors in the coming days or weeks, leading to further potential gains. However, this could also mean increased chances for significant price drops due to mass selling.

Read More

2024-07-17 22:15