-

More Bitcoin holders have remained in profit despite the recent decline.

BTC was trading above $66,000 at press time.

As a dedicated researcher closely following the Bitcoin market, I have witnessed its volatility and price fluctuations over the past few months. The recent decline in BTC‘s price was followed by a series of uptrends that brought it back above $66,000 at press time.

As a crypto investor, I’ve noticed that Bitcoin’s [BTC] latest price fluctuations have brought varying fortunes for different categories of investors. Some of us have reaped substantial profits from these market swings.

An analysis of when Bitcoin was acquired, its initial cost versus its present value, and additional elements identified the category of investors who gained the most benefit from their transactions.

Bitcoin trades at over $66,000

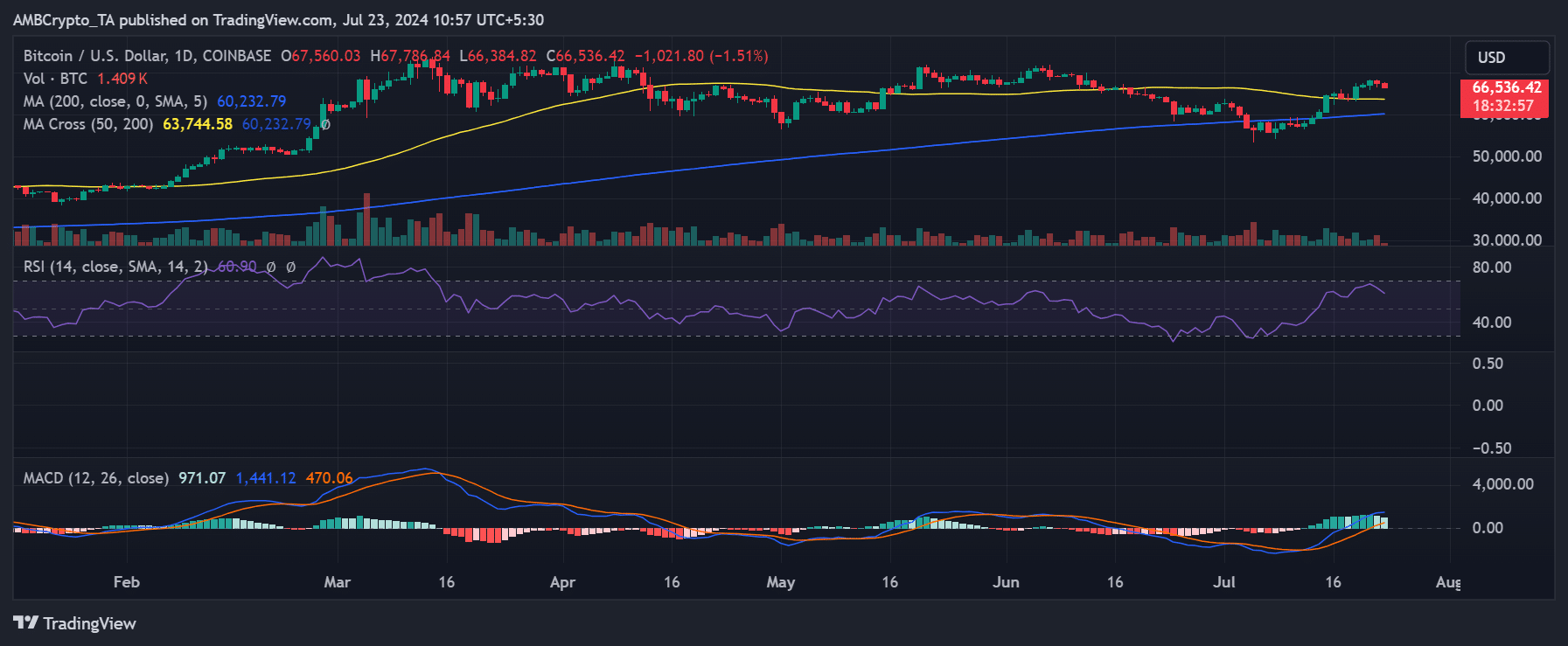

Analyzing Bitcoin’s price movements on a daily basis revealed several upward trends, enabling it to reclaim a notable price point.

As a crypto investor, I’ve noticed an intriguing development based on AMBCrypto’s analysis. On the 21st of July, Bitcoin’s price surged past $68,000, representing a noteworthy gain of over 1% in value for me and my fellow investors.

The upward trend reached its highest point following several days of gains, a significant rebound given the dramatic decline at the onset of the month.

Although there have been setbacks that caused some losses of previous gains, the value still holds above the $60,000 mark. Currently, it is priced around $66,500, experiencing a minor dip of approximately 1%.

How the rise affected holders

The Global In/Out of Money Index analysis on IntoTheBlock offered an insightful perspective on Bitcoin’s present condition.

At the current Bitcoin price, the majority of Bitcoin holders find themselves in a profitable position. To be more precise, approximately 49 million addresses, which account for around 92% of all existing wallets, have previously bought Bitcoin at a lower price and are now making a profit.

As an analyst, I can tell you that the data presented here indicates a thriving market condition, with most market players having reaped substantial benefits from previous price surges.

As a crypto investor, I’ve noticed that around 2.2 million wallets, which is roughly 4.14% of the total number of holders, experienced losses. This means that these investors might have bought their coins or tokens when prices were higher than they currently are.

Approximately 2 million addresses were neutral, neither earning a profit nor incurring a loss, comprising roughly 3.78% of the total number of holders.

The statistics strongly indicated a generally optimistic attitude towards Bitcoin in the market. The RSI, which was approximately 60, served to reinforce this positive outlook.

As a market analyst, I would interpret an RSI value surpassing 50 as a bullish indicator. This means that the market may be experiencing positive momentum and could potentially continue its upward trend.

Long-term holders enjoying more profit

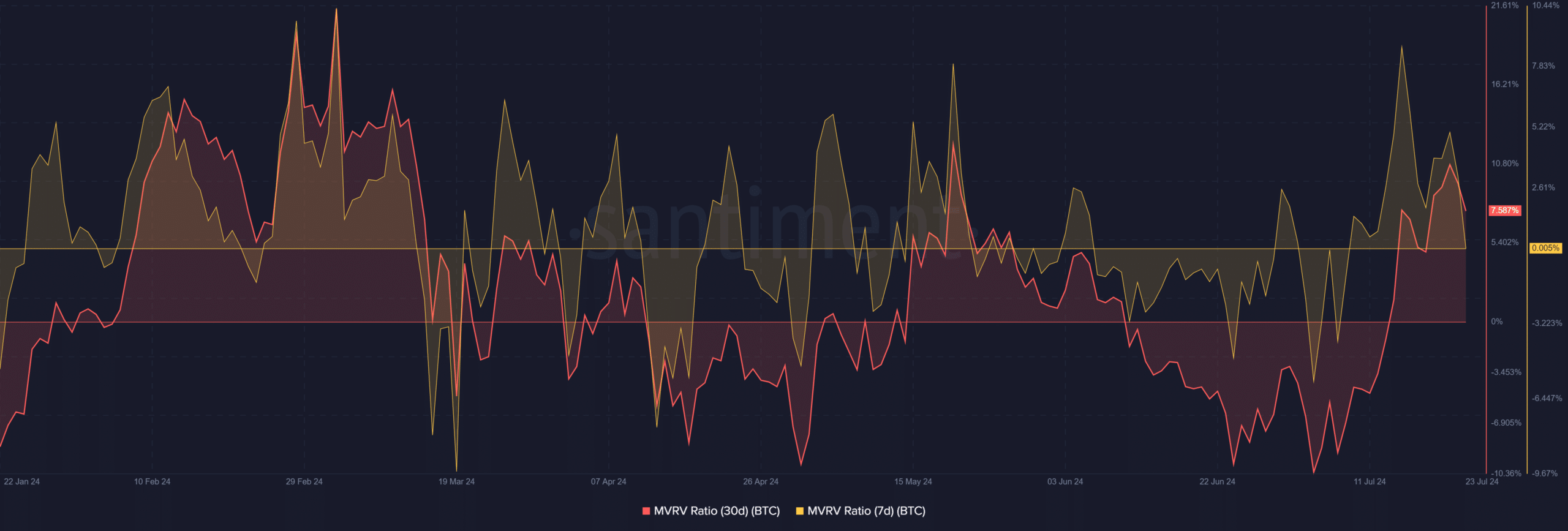

An in-depth analysis by AMBCrypto on Bitcoin’s Market Value to Realized Value (MVRV) ratios across various timeframes sheds light on the distinct experiences of different groups of investors.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Recent buyers have made a small profit on average over the past week, as indicated by the seven-day MVRV of 0.6%. Nevertheless, this figure is decreasing, suggesting that the short-term profits for these new purchases may soon vanish.

As a long-term Bitcoin investor, I found the 30-day MVRV (Moving Average Value Realized) to be more encouraging. With a figure above 8%, it indicated that those who bought Bitcoin one month ago have earned substantial profits compared to more recent purchasers.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-23 19:03