- Bitcoin transactions have dropped.

- Miners are currently underpaid as Runes transactions dropped.

As a researcher with extensive experience in blockchain analysis, I have closely monitored Bitcoin’s [BTC] transaction trends and miner revenue. Following the Bitcoin halving event, Runes emerged as a significant contributor to network activity, resulting in substantial fees for miners. However, the impact of Runes on miner revenue seems to be waning.

Following the halving process, Bitcoin [BTC] transaction fees saw an unwelcome surge, causing miner fees to rise accordingly.

After the halving event, Runes played a notable role in boosting the network’s transactions. Nevertheless, this heightened activity has since decreased, leading to reduced transaction fees and miner income.

Runes continue to contribute to Bitcoin transactions

As a researcher examining transaction data from Glassnode, I’ve discovered that Rune, an anonymous entity, has paid around $117 million in Bitcoin transaction fees up to this point. Impressively, over half of these fees were incurred on the very day of the Bitcoin halving event.

The fees connected with these transactions caused a significant surge in network usage, resulting in increased earnings for miners.

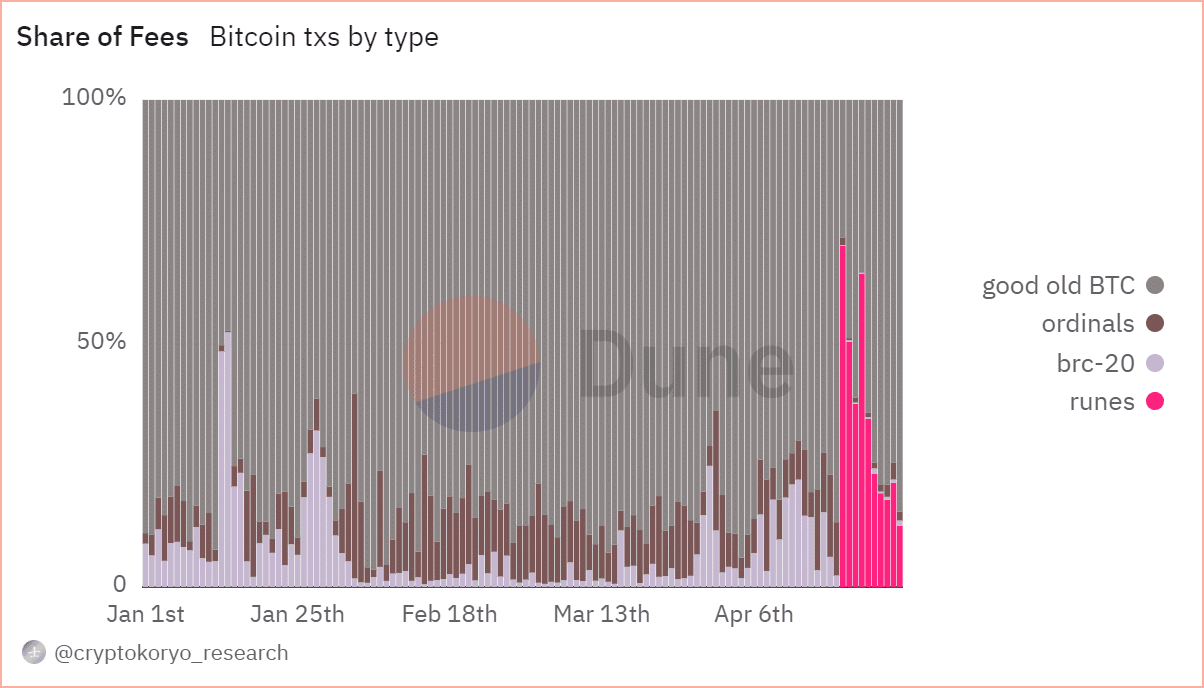

An in-depth examination of the Dune data uncovered that Runes came in second place for number of transactions.

Up until the point of publication, Runes had represented approximately 19.1% of all transactions, making it the second most active participant in network fees. However, its significant contribution to fees has noticeably diminished.

At press time, Runes contributed over 12% of total network fees.

Runes effect fading on Bitcoin miners

I recently came across an intriguing finding from AMBCrypto’s examination of Bitcoin miner fees. It appears that during this specific time, these fees didn’t cover the actual cost of mining for me as a crypto investor and miner. In simpler terms, miners were not being adequately compensated for their efforts.

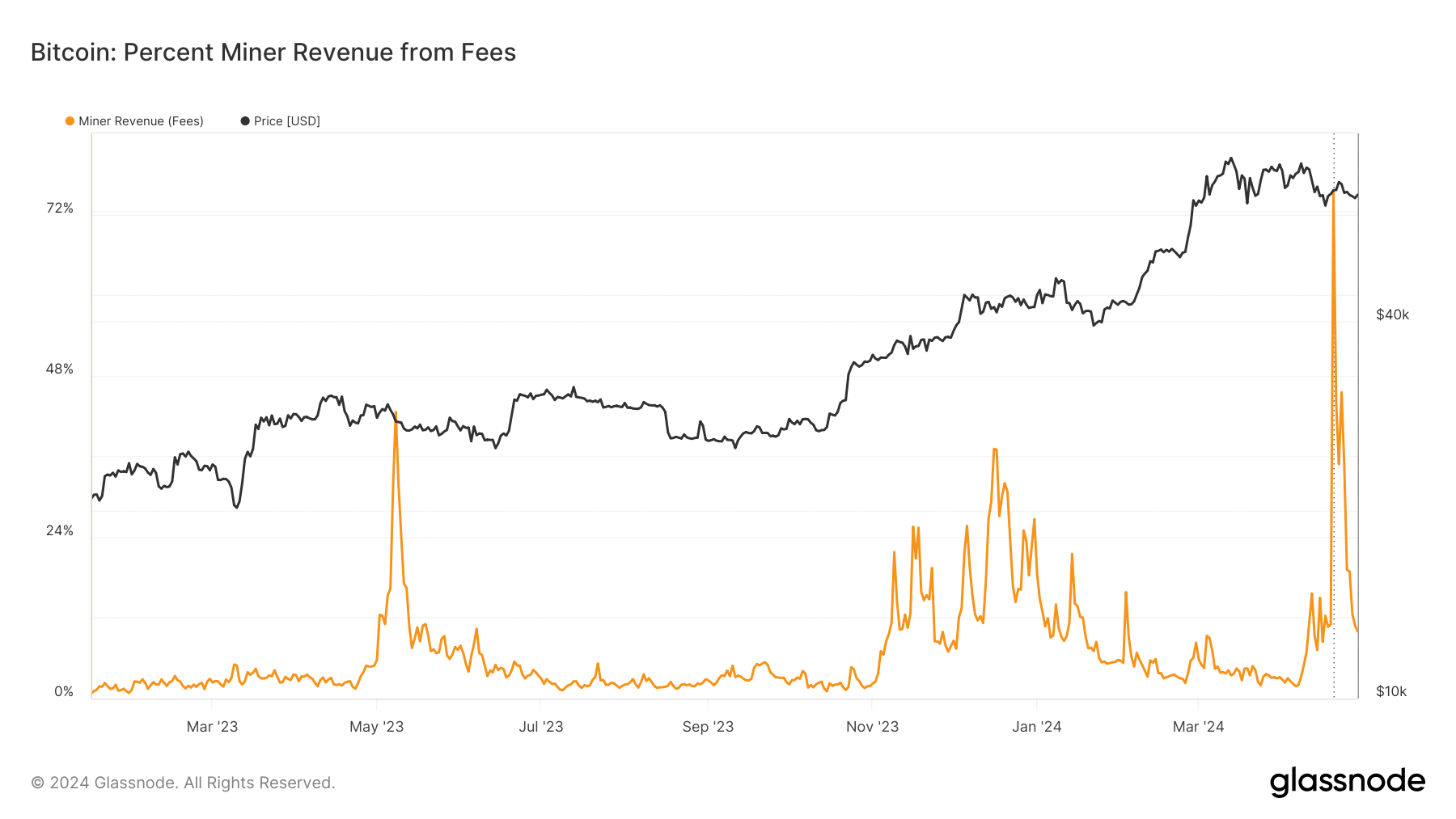

According to data from Glassnode, miner revenues have fallen below zero, signifying that the mining difficulty surpasses the rewards being earned.

The fee metric on Glassnode exhibited a substantial decrease, currently sitting at approximately 45 BTC.

At present, the miner revenue share hovers around 10%, marking a significant decrease from previous levels. In contrast, miner revenues and transaction fees used to surpass 40% and 1,200 BTC, respectively, before this decline.

The increase in metrics can mainly be attributed to the rise in transactions initiated by Rune. Nevertheless, as the number of Rune transactions decreases, so do the fees and accompanying metrics.

In total, the number of Bitcoin transactions continues to be relatively small as traders hold off on making large trades, hoping for a price increase.

BTC wipes off initial gains

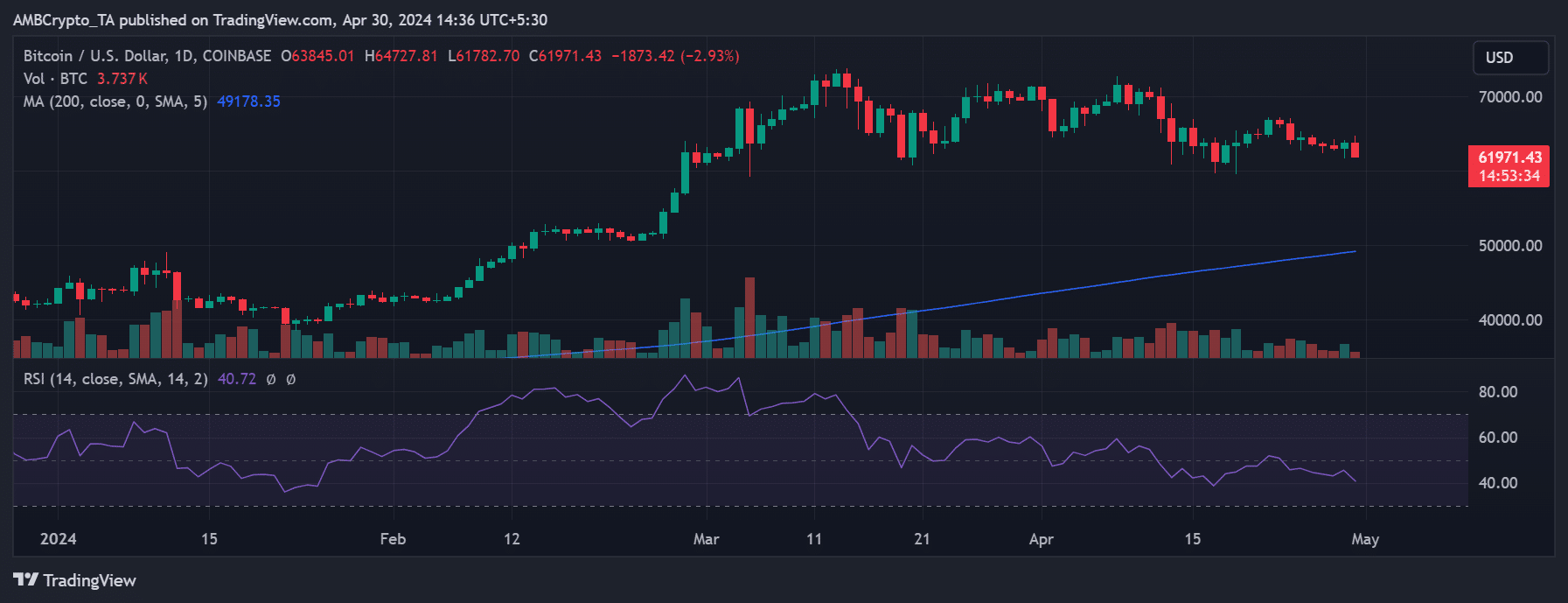

As a researcher studying the cryptocurrency market trends, I’ve noticed that according to AMBCrypto’s analysis, Bitcoin has been following a downward trend. Currently, its price hovers around $61,900, representing a nearly 3% decrease from previous levels.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In contrast to the uptick of more than 1% experienced in the last trading day, BTC witnessed a turnaround in this session.

The RSI of this security suggested that its downtrend grew more pronounced as it diverged further from the neutral threshold.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WCT PREDICTION. WCT cryptocurrency

2024-05-01 01:11