- Runes have been designed as a new way to mint fungible tokens on the Bitcoin network.

- Since its launch, 10,739 Rune tokens have been created.

As someone who closely follows the cryptocurrency scene, I’ve been intrigued by the recent surge of interest in Runes, a new way to create fungible tokens directly on the Bitcoin network. Since its launch on April 20th, Runes have taken the Bitcoin network by storm, with daily transactions reaching an all-time high of 802,977 on April 23rd.

On April 23rd, the use of Runes in Bitcoin [BTC] transactions reached a peak, based on statistics from Runes Alpha.

On that day, 802,977 transactions involving Runes were completed.

I’ve observed that a grand total of 52,365 Runes transactions have taken place so far in our system. This adds up to an impressive 2,560,005 transactions since its debut on the 20th of April, following the fourth halving event of Bitcoin.

Runes take up space on the Bitcoin network

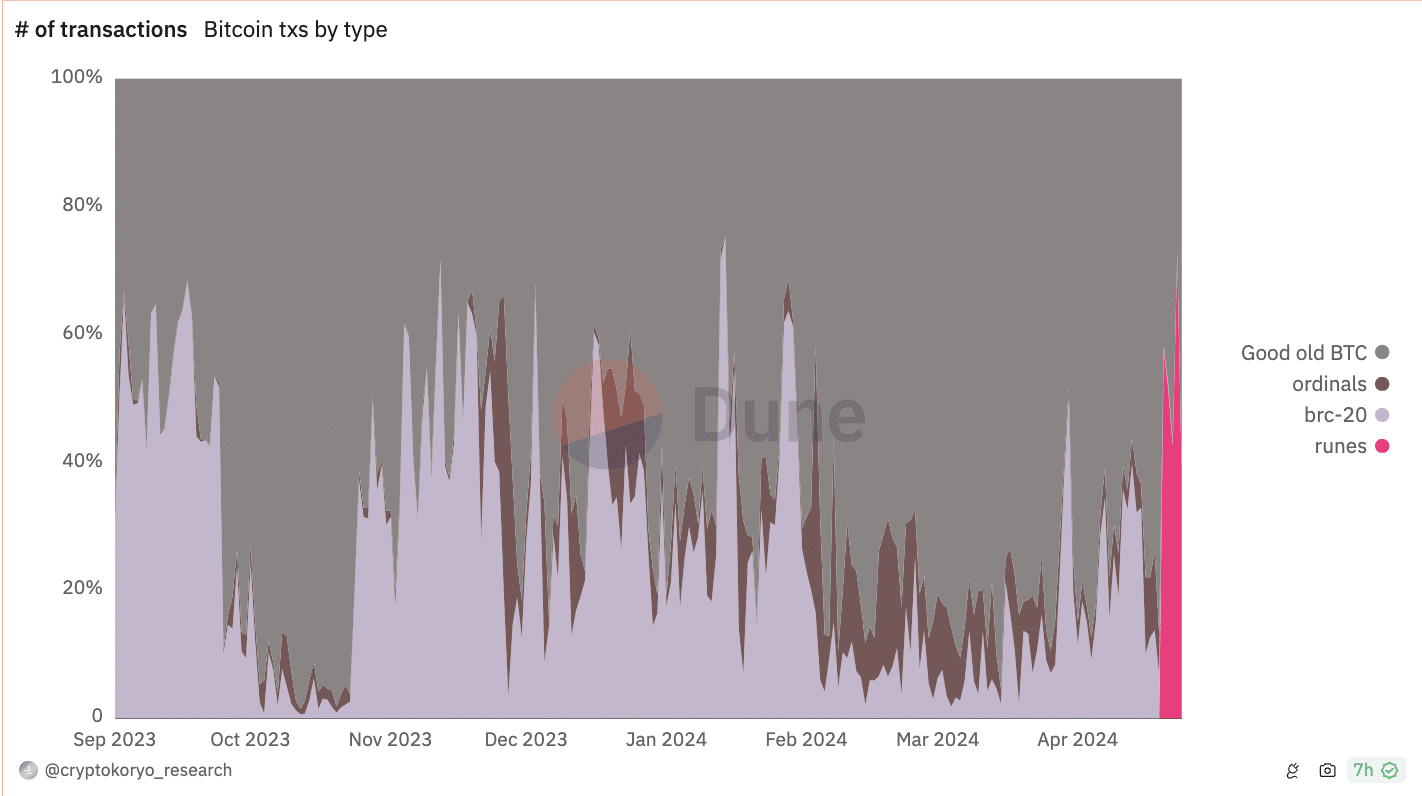

Based on data from a Crypto Koryo-prepared Dune Analytics dashboard, Runes have seen the busiest transaction activity on the Bitcoin network starting from the 20th of April.

Upon the unveiling of the Runes protocol, approximately five out of every ten transactions on the Bitcoin network were processed through it. Concurrently, transactions signifying the exchange of Bitcoins accounted for a little under forty-two percent of the total daily transactions.

I’ve observed that ordinals and other BRC-20 tokens accounted for only 0.7% of the total number of transactions processed by the layer one network.

On the 23rd of April, the significant increase in Runes’ daily Bitcoin transactions led to a proportion of 78% in the total number of transactions on the Bitcoin network for that day.

According to Dune Analytics’ findings, more transactions involving Runes took place compared to Bitcoin sales transactions on the network that day, amounting to a difference of 45%.

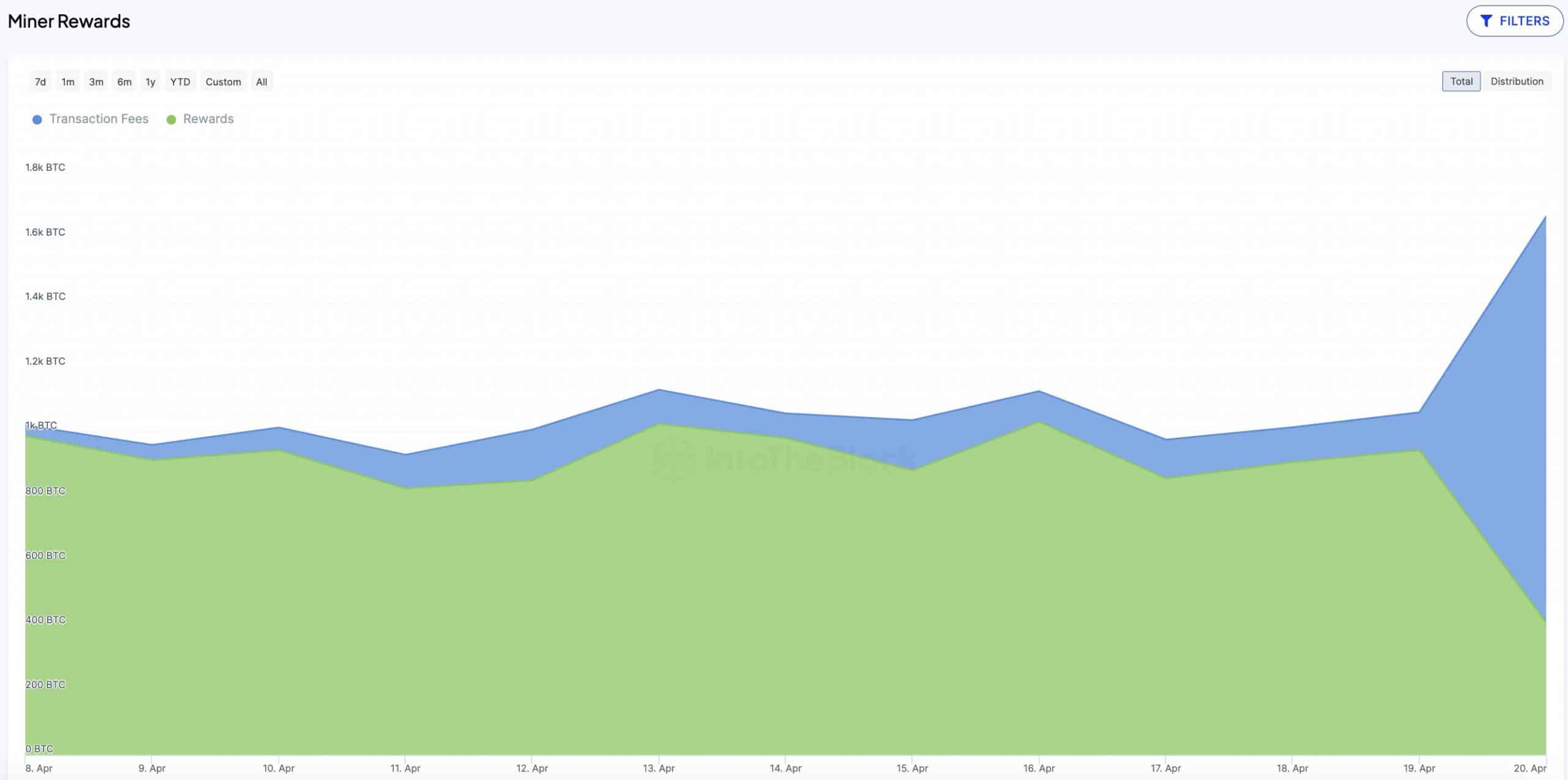

I recently observed a significant trend unfolding on the Bitcoin network. On the 20th of April, Runes transactions accounted for approximately five out of every ten fee payments, amounting to a whopping 57%. This surge in fees resulted in an all-time high for the network’s total transaction costs, surpassing $80 million.

I observed the network’s transaction fees reaching an unprecedented height of $128 on that particular day, exceeding the previous peak of $30 during the initial surge of interest in Ordinals.

I’ve noticed an significant increase in Bitcoin network transaction fees recently, leading to a substantial hike in miner revenues. Surprisingly, this surge came about even as the inflationary rewards for miners were cut in half following the last halving event.

Per IntoTheBlock’s data, miners’ revenue exceeded $100 million on the halving day.

On that day, the 20th of April, only 38% of the total network fees were attributed to Bitcoin sales transactions when compared to other types of transactions.

Decline in new etching

As an observer, I can explain that according to the Runes Protocol, there are three distinct transaction types: etching, minting, and transferring. When it comes to etching, users have the ability to establish new Rune tokens based on predefined conditions.

Using the blockchain feature called minting, users have the ability to create new tokens based on pre-existing designs. These freshly created tokens can then be transferred to various digital wallets for safekeeping or exchange with other users.

I’ve noticed an intriguing trend with Runes lately: while the number of daily transactions has been on the rise, the creation of new etchings has been decreasing since the halving event. On the 20th of April, the tally of Rune tokens that were etched stood at 2647.

Although the number of new Runes created has decreased significantly, with only under 1000 produced as of April 23rd, data from Runes Alpha shows that a total of 10,739 Runes have been generated since its inception.

A new way to do things

I’ve come across an intriguing development in the world of Bitcoin: the Runes Protocol. This innovative creation, brought to life by Casey Rodricks, who is known as the originator of Bitcoin Ordinals, represents a fresh approach to generating fungible tokens right on the Bitcoin blockchain itself. In essence, it’s just another way of saying that using this new standard, we can issue fungible tokens directly onto the existing Bitcoin infrastructure.

In March 2023, a anonymous programmer named Domo introduced the BRC-20 token standard, enabling the creation of interchangeable tokens on the Bitcoin network for the first time.

The demand for these assets surged, pushing their total value to exceed one billion dollars by June of that very year. Yet, with heightened interest came network overload issues for Bitcoin.

A large number of unspent transaction outputs (UTXOs) were created, clogging the network.

Previously mentioned, on the 3rd of December, the number of BRC-20 tokens produced surpassed 450,000.

Over 267,000 Bitcoin transactions piled up, waiting to be confirmed for hours and leading to a substantial traffic jam on the network.

I noticed an issue with the network’s mempool recently. The influx of pending transactions caused the size of the mempool to balloon up to 1.54 GB. Regrettably, this surpassed the mempool’s intended capacity of only 300 MB.

How does it work?

The Runes Protocol incorporates Bitcoin’s Unspent Transaction Output (UTXO) system and utilizes the OP_RETURN command in its network transactions.

When a new Rune token is created, it is attached to a specific UTXO.

As an observer, I can explain that within a Bitcoin transaction, details related to the digital token like its label, divisible nature, emblem, minting conditions, and quantity are encoded utilizing the OP_RETURN operator in the Unspent Transaction Output (UTXO) instead.

This is done so the UTXO is marked as a Rune-carrying unit.

When initiating a transaction to transfer a Rune token, you’re essentially sending the Unspent Transaction Output (UTXO) containing the encoded token information.

In simpler terms, the transaction determines the number of Rune tokens to be transferred from an existing UTXO, and generates fresh UTXOs for the leftover balance and the newly obtained tokens.

Runes’ design minimizes the requirement for detailed token contract info on the Bitcoin network, thereby reducing unnecessary data and alleviating potential network congestion.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-04-25 16:08