-

More BTC has left the exchanges in the last few days.

BTC was still trading below the $60,000 price range.

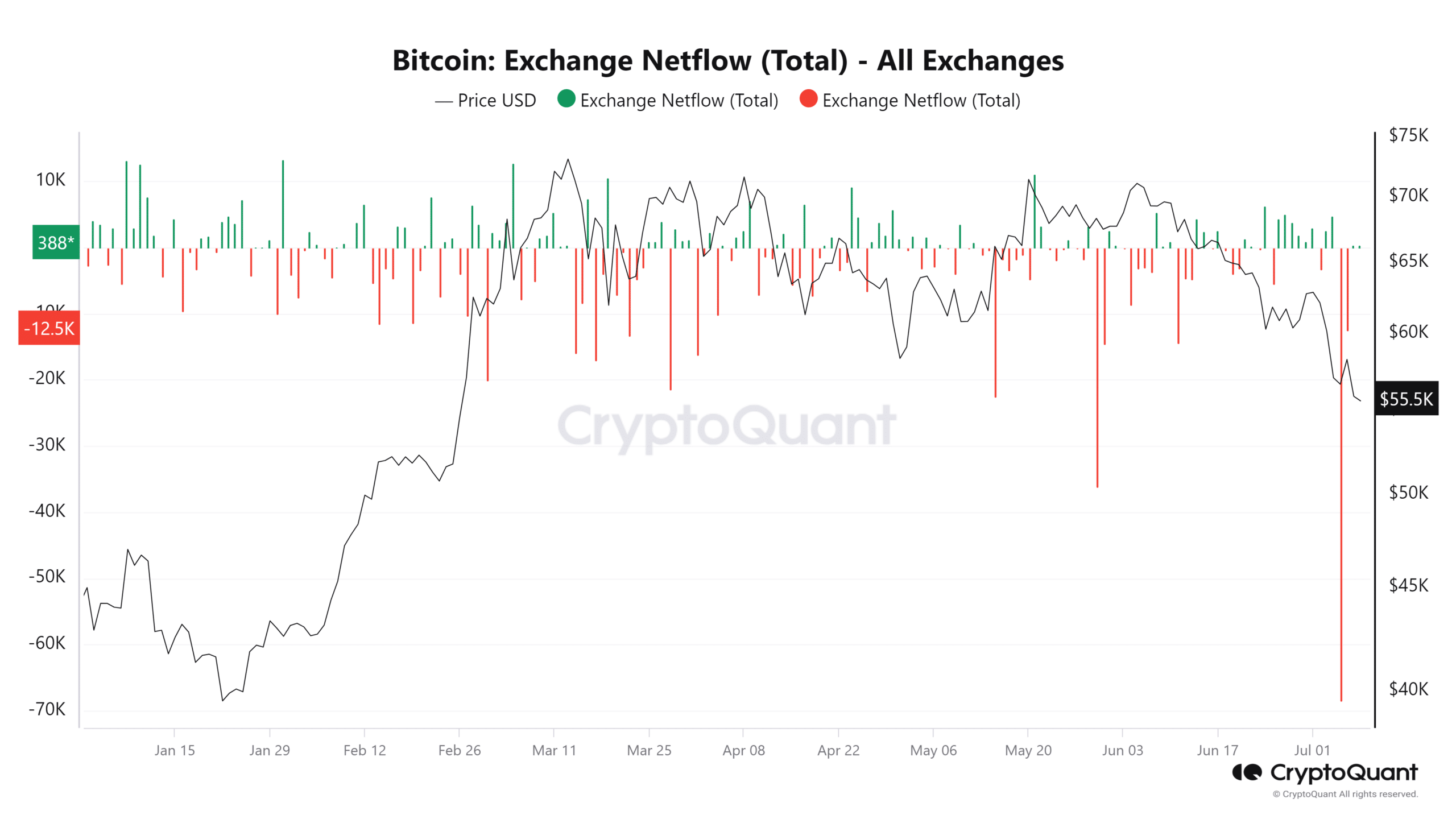

As a researcher with a background in cryptocurrency analysis, I find the recent trend of Bitcoin (BTC) withdrawals from exchanges intriguing, given the current bearish market conditions. The significant net outflow observed on July 5th and 6th, totaling over -81,000 BTC worth approximately $4.5 billion, stands out as particularly noteworthy.

Bitcoin‘s value has taken a noticeable dip since the start of the month. It’s intriguing that despite this drop, a considerable amount of Bitcoin has been withdrawn from digital exchanges. This trend is unexpected considering the large-scale selling reportedly transpired in recent times.

Bitcoin netflow shows massive withdrawals

Recently, Bitcoin has exhibited an intriguing pattern regarding its flow on exchanges.

Based on the examination of the cryptocurrency flow data from CryptoQuant, it was observed that more Bitcoin (BTC) has been leaving wallets than entering them in the past few days. The information brought to light July 5th as a notable day, with approximately 68,500 BTC being taken out of wallets netted against around 34,000 BTC being deposited.

On that particular day, the value of the transaction reached an annual peak of around $3.8 billion, equivalent to 12,550 BTC with the current exchange rate. The following day witnessed a significant withdrawal of approximately 12,550 BTC from exchanges, translating to roughly $730.9 million in value.

The recent decrease in Bitcoin being taken out of cryptocurrency exchanges, particularly during price drops, is worth paying attention to.

As a financial analyst, I would interpret such movements as a sign of confidence from Bitcoin holders. They choose to keep their assets instead of selling, even when the price surpasses previous support levels. This behavior is often viewed as a bullish indicator.

Investors frequently exhibit this conduct based on a shared belief that prices will bounce back, leading them to move their assets out of their portfolios and into their personal storage.

Bitcoin sees slight improvement

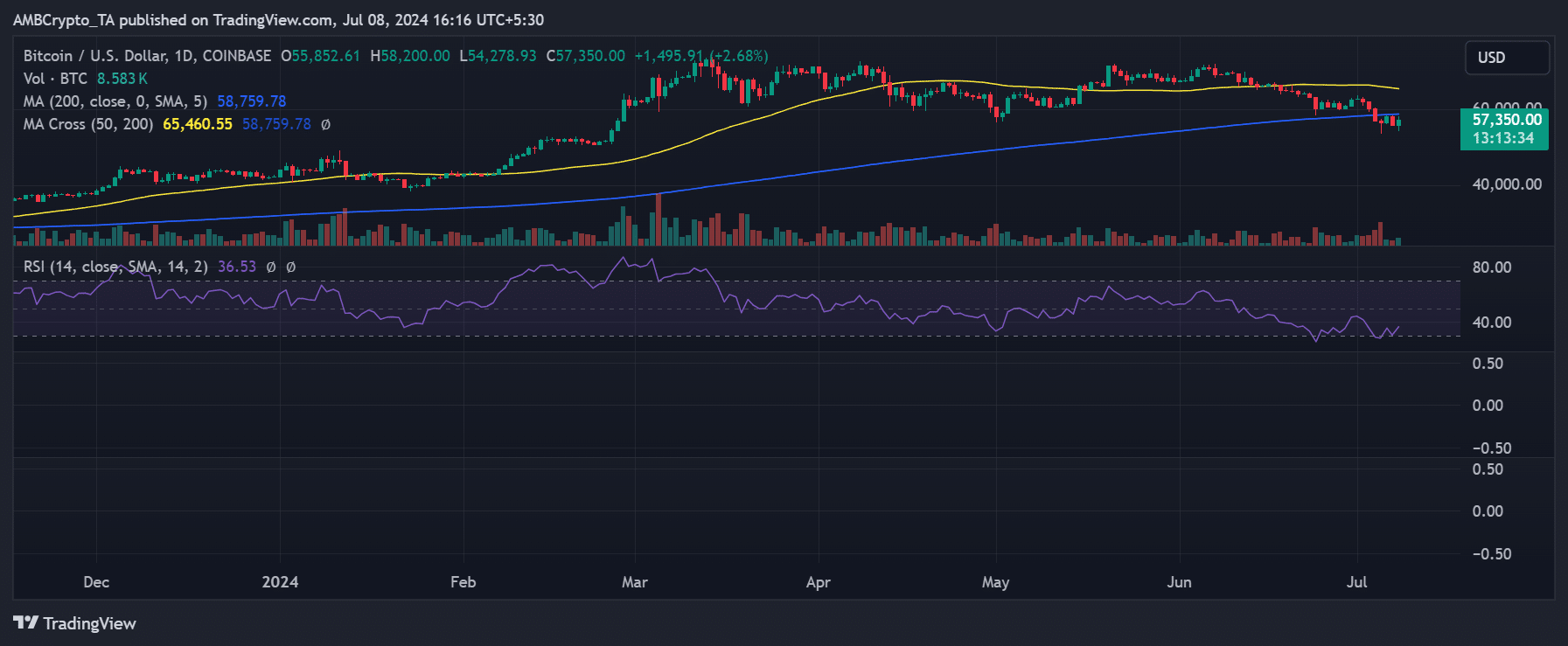

As a researcher examining Bitcoin’s daily price movements with AMBCrypto, I’ve observed that its long-term moving average, signified by the blue line on the chart, is currently serving as a notable resistance level. This resistance lies approximately within the $58,900 to $59,000 range.

At present, Bitcoin was priced around $57,200, representing a 2.1% rise. This growth came after a significant 4.10% drop in the preceding trading day that saw its value reach roughly $55,850.

The Relative Strength Index (RSI), which helps identify overbought and oversold conditions, was registering a reading of less than 37. This signified that the asset was experiencing a robust downward trend. An RSI below this threshold usually implies that the asset is significantly oversold, meaning selling activity has been particularly strong.

More holders remain at a loss

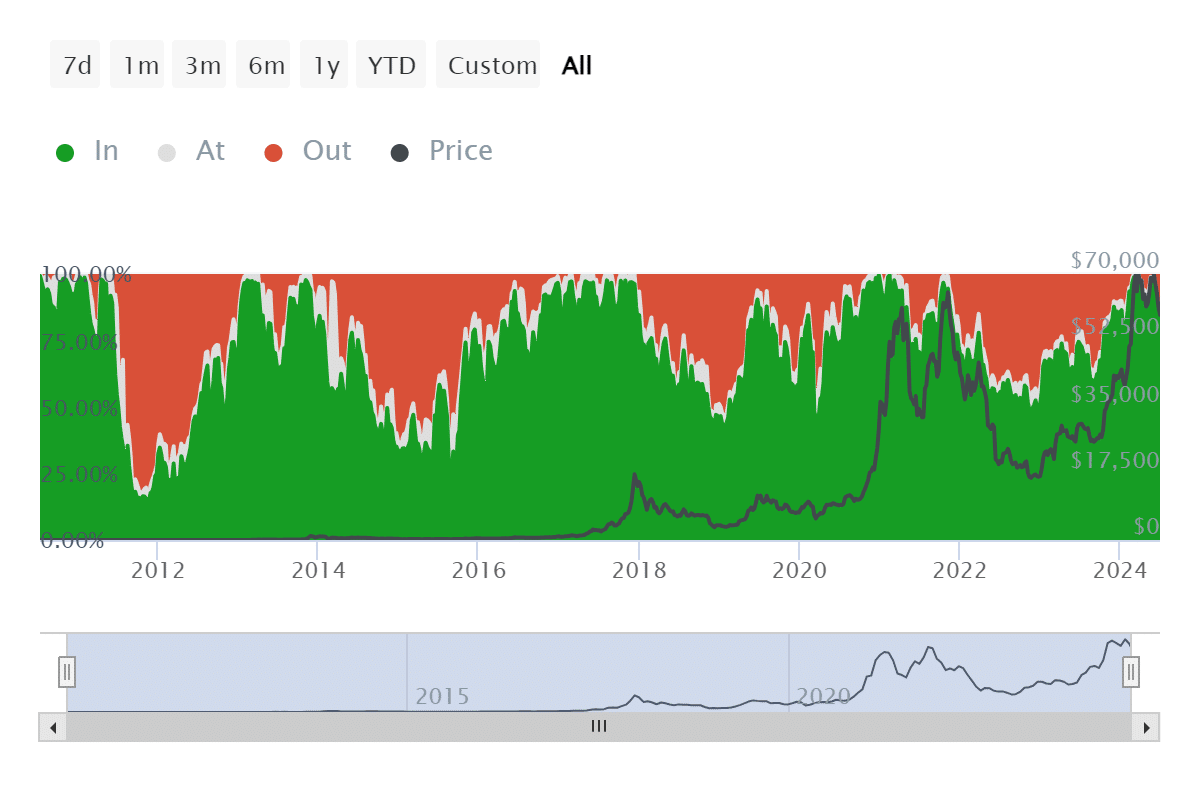

As a data analyst at IntoTheBlock, I’ve been examining Bitcoin holder profitability trends. The insights reveal that a considerable number of investors are presently incurring losses.

Read Bitcoin (BTC) Price Prediction 2024-25

According to the Global In/Out of Money index, around 5.43 million Bitcoin holders, representing roughly 64% of the total, currently hold their cryptocurrency at a price below what they originally paid.

Conversely, about 2.87 million addresses, representing nearly 34% of holders, are profitable.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-09 02:15