- Bitcoin has rebounded 8.9%, approaching a critical $70K resistance level, with analysts predicting a potential breakout.

- Key metrics like open interest volume and NVT ratio suggest strong market interest and potential for further gains.

As a seasoned crypto investor with over a decade of experience navigating the ever-evolving cryptocurrency landscape, I find myself cautiously optimistic about Bitcoin’s current trajectory. Having witnessed numerous bull runs and bear markets, I am well aware that the road to success is paved with uncertainty.

Bitcoin [BTC] has been regaining its footing following a substantial dip to approximately $50,000 on the 5th of August this month. At present, the foremost cryptocurrency is being traded at around $63,742, representing an uptick of 8.9% over the last seven days.

The fluctuation in Bitcoin’s price has ignited debates among cryptocurrency experts regarding its possible trajectory in the near future. A notable expert, known as Mags, has recently voiced his opinions about X, examining the recent trends in Bitcoin’s price.

Breakout above $70,000 near?

Mags highlighted that Bitcoin’s current sideways movement should not necessarily be viewed as bearish. He pointed out that before each major move, Bitcoin typically undergoes a period of consolidation within a specific range.

Historically, these consolidation phases have lasted between 8 to 30 weeks.

Currently, Bitcoin has been in a period of consolidation for about 25 weeks. Although it’s tricky to pinpoint how long this phase will last, it’s important to note that Bitcoin is still experiencing a bull market, as highlighted by Mags.

If this pattern holds, he suggested that the eventual breakout could be significant.

Approaching the pivotal $70,000 barrier with Bitcoin, I too find myself contemplating a possible breakthrough, as fellow analysts voice their insights.

Captain Faibik, a prominent cryptocurrency analyst on platform X, pointed out that although Bitcoin bulls seem to be leading at present, the real challenge is yet to come.

It’s possible he thought that the price of Bitcoin could challenge the $70,000 barrier again this week, yet he expressed doubts about whether the buyers would be able to surpass this significant point of resistance.

Fundamental indicators: What they signal for Bitcoin’s future

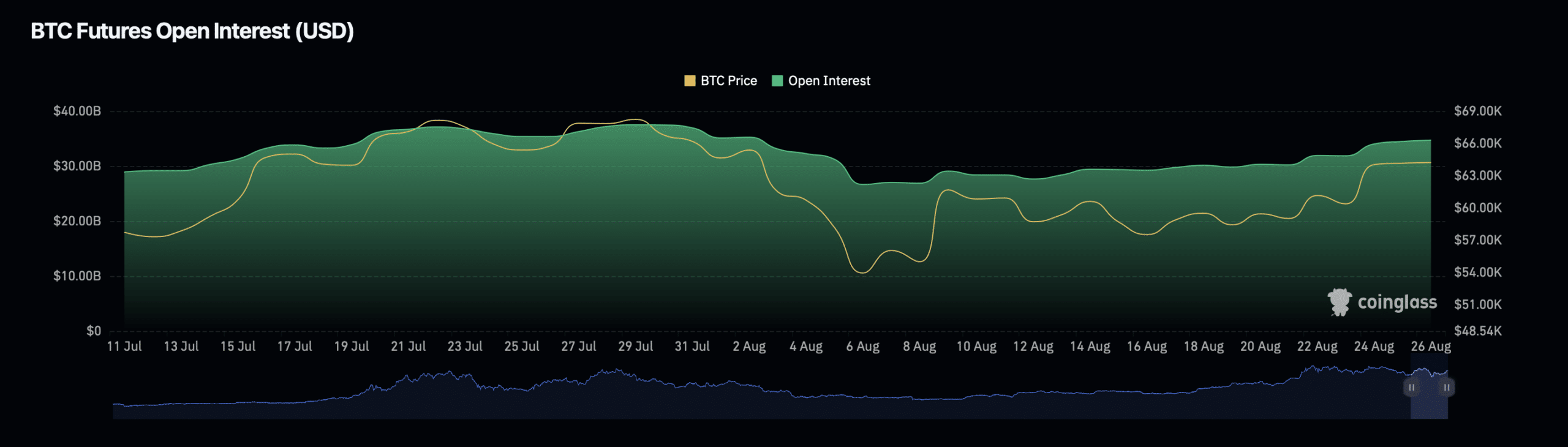

To appreciate Bitcoin’s possibility for continued growth, it’s beneficial to look at its core foundations. As per statistics from Coinglass, Bitcoin’s open interest has experienced a modest dip of about 1% within the last day, which now puts its total value at approximately $34.39 billion.

As an analyst, I would express open interest as the aggregate quantity of unresolved derivative agreements, like futures and options, that still remain unsettled.

A decrease in the number of outstanding contracts, often referred to as open interest, might signal less market engagement or a change in traders’ feelings about the market direction.

However, despite this decline, Bitcoin’s open interest volume, which measures the total value of these contracts, has increased by 1.84% over the same period, reaching $39.06 billion.

This growth indicates that even though the quantity of contracts may have dropped, the worth of the remaining ones seems to be escalating. This could imply that traders might be growing more optimistic about Bitcoin’s immediate future.

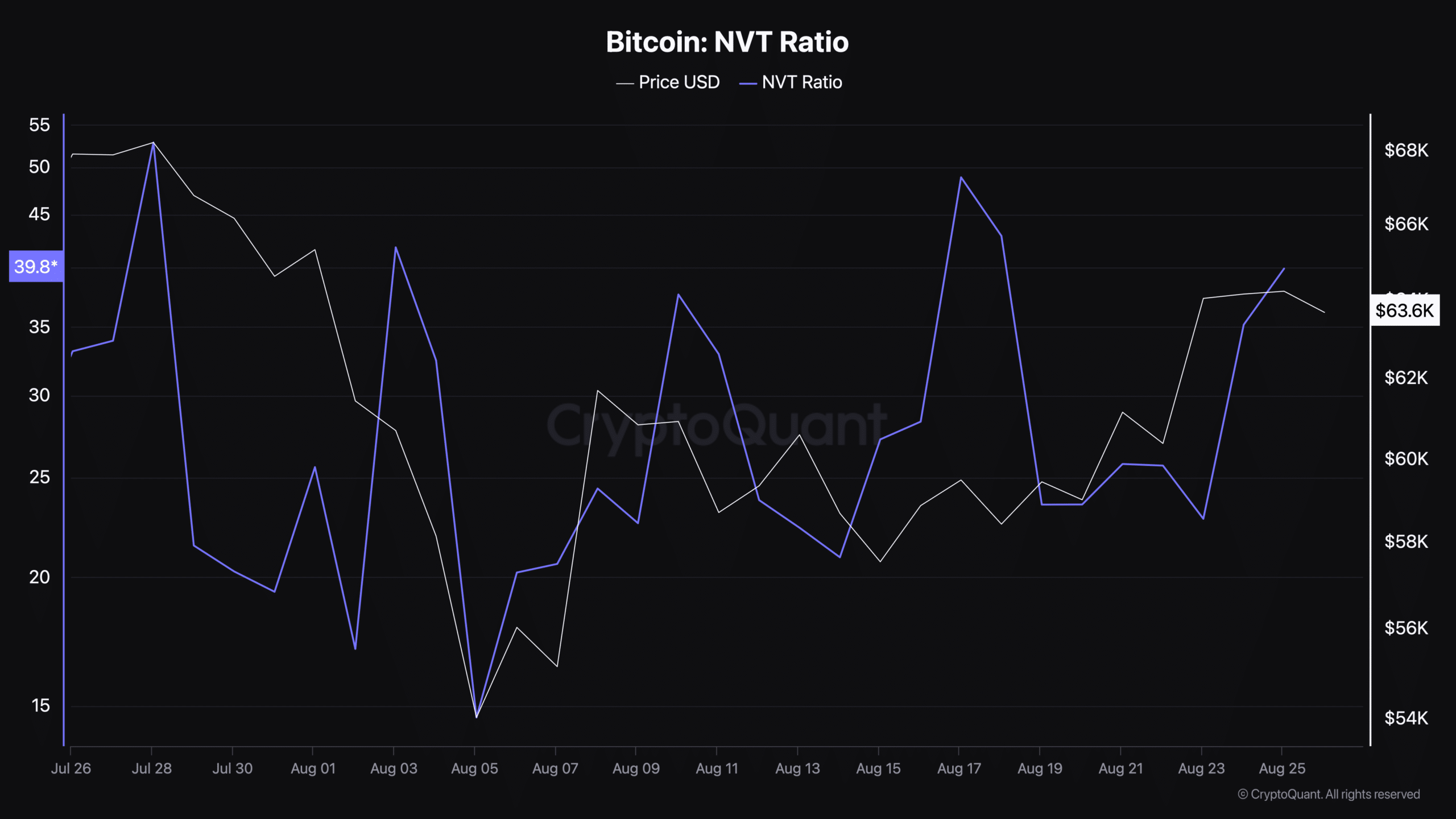

Another key metric to consider is Bitcoin’s Network Value to Transactions (NVT) ratio, which is currently on the rise, sitting at 39.8 according to data from CryptoQuant.

As a researcher delving into the intricacies of Bitcoin, I’ve found a valuable tool called the NVT ratio. This metric provides an insightful comparison by measuring Bitcoin’s market capitalization against the transaction volume on its very own network.

An increased Non-Value Transaction (NVT) ratio might suggest that Bitcoin’s price is inflated compared to the amount of transactions it processes, which could be a warning signal to exercise caution.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As an analyst, I’m noting a potential indication that the market anticipates increased transaction volumes in the future. This perceived growth could indeed be supporting the current valuation levels.

From my perspective as a crypto investor, when I see Bitcoin’s Network Value to Transactions (NVT) ratio on the rise, it seems to suggest that the market is expecting further price growth. This optimistic outlook appears to be backed by the overall positive trend in the cryptocurrency market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-27 03:04