- Bitcoin see spikes in slippage as traders advised to take caution.

- Bitcoin concentrated liquidation levels are near $60K.

As a seasoned analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market volatility and trends. The current state of Bitcoin [BTC] is intriguing, to say the least. While it’s undeniably impressive that BTC has managed to sustain above $63k, the recent spikes in slippage and concentrated liquidation levels near $60K are cause for caution.

Currently, Bitcoin’s price hovers above $63,000, indicating robust strength in its momentum. According to recent market indications, there’s a possibility that Bitcoin could potentially increase further.

Nevertheless, market fluctuations might grow because of the recent surges in slippage, potentially causing temporary corrections. If Bitcoin maintains above a certain threshold of $62,500, this could be an important level to keep an eye on.

Should Bitcoin drop beneath that particular threshold, a series of margin calls might trigger, potentially driving the price down further. Nevertheless, Bitcoin’s general uptrend persists, and there could be support around the $60,000 price range.

Bitcoin liquidation updates

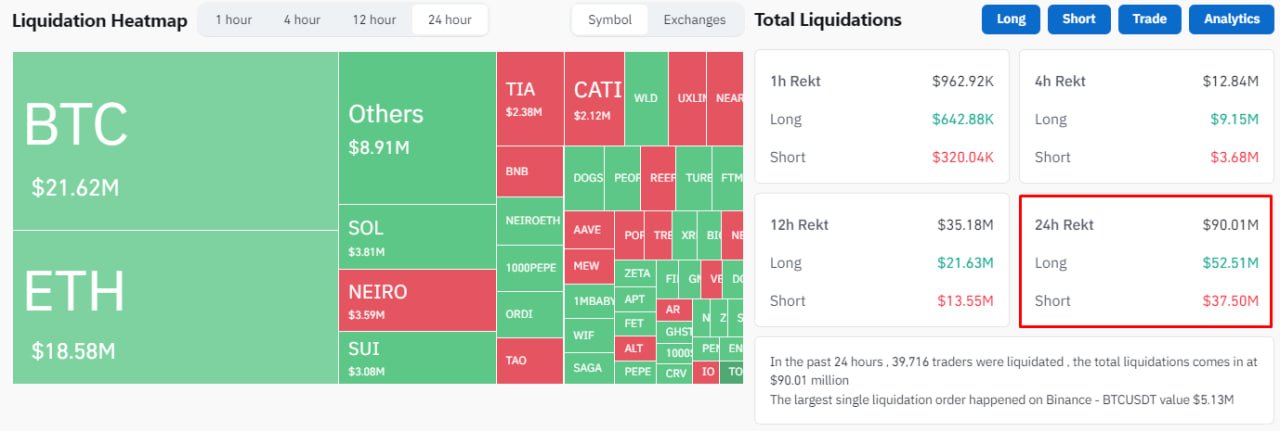

As I delve into the dynamics of Bitcoin’s market fluctuations, it’s evident that liquidations remain a significant factor influencing its price swings. Over the past 24 hours, Bitcoin underwent a total liquidation value of approximately $23.29 million. Out of this amount, $16.42 million was associated with long positions, while $6.87 million was attributed to short positions.

In the wider cryptocurrency market, approximately 39,721 traders had their positions closed (liquidated), resulting in a total of around $90.03 million being liquidated. The largest individual liquidation order was executed on the Binance platform for the Bitcoin/Tether pair, amounting to roughly $5.13 million.

Liquidations may frequently signal possible turning points or areas of potential change in the market, giving us clues about where the price could move going forward.

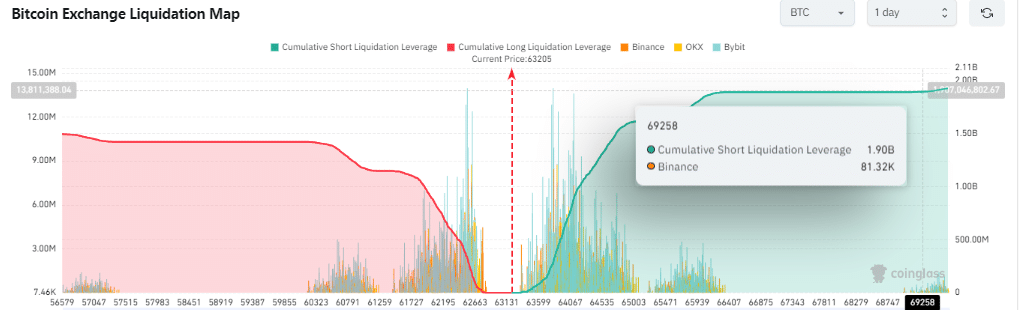

Moving ahead, should Bitcoin surge to $69k, approximately $1.9 billion in holdings may be liquidated, impacting about 81,320 trades. This price level is anticipated, but a temporary dip might happen before Bitcoin ascends towards $69k.

Users on social media networks should exercise caution too, given that they might need to adjust their risk management strategies for short liquidations, especially since financial markets are experiencing increased volatility again. On platform X (previously known as Twitter), DeFi Mann wrote something similar.

If you want to handle your own liquidation at 70k, be mindful of your risks. Otherwise, the market may take control and complete the liquidation within the upcoming two weeks on its terms.

Liquidation levels concentration

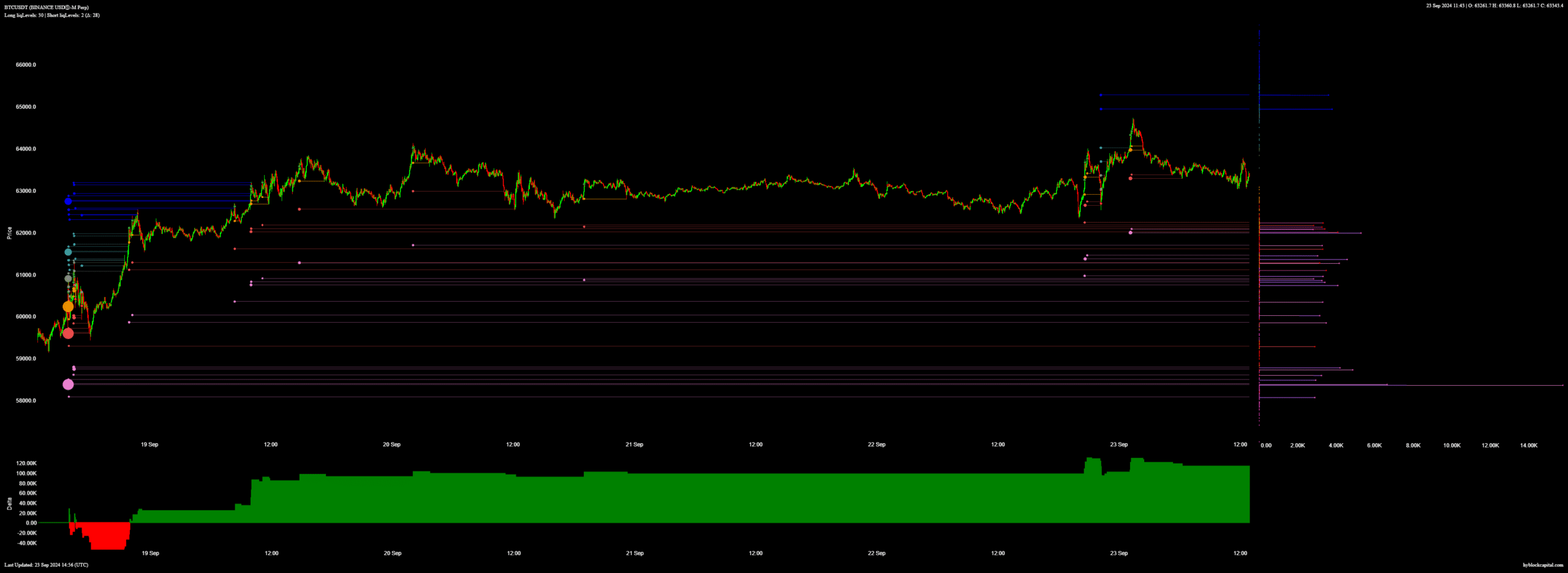

As an analyst, I’ve pointed out some crucial zones where Bitcoin could experience significant price swings, based on the concentration of traders’ positions that might get liquidated. These spots signal potential volatility in the market.

The maximum amounts of Bitcoin being sold off (liquidation levels) are around $62,500 and $60,000. If the price falls below these points, it may cause more sell-offs (liquidations), resulting in greater market instability and potential price drops.

Read Bitcoin (BTC) Price Prediction 2024-25

Bitcoin continues to hold its ground, showing signs of possible upward momentum. Yet, it’s crucial for traders to stay alert, as there might be an increase in volatility and potential forced selling events, especially if Bitcoin falls beneath significant thresholds such as $62,500.

Under beneficial market circumstances, Bitcoin might persist in rising, aiming for increased prices in the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-24 22:15