Well, here we are again, folks. The Bitcoin market, having had a lovely, somewhat volatile time over the past two weeks, is now facing the dreaded “sell-off” storm. It’s like a rollercoaster, except, you know, without the safety harness. Between April 5 and 8, Bitcoin saw a staggering 9.01% drop. As of now, the price is hovering just 2.48% above where it started the month. Which, let’s be honest, is a bit like saying you’re only 2.48% farther from the edge of a cliff. The panic is real, and it’s not just coming from the usual suspects.

The Short-Term Holders Are Making a Run for It 🏃♂️

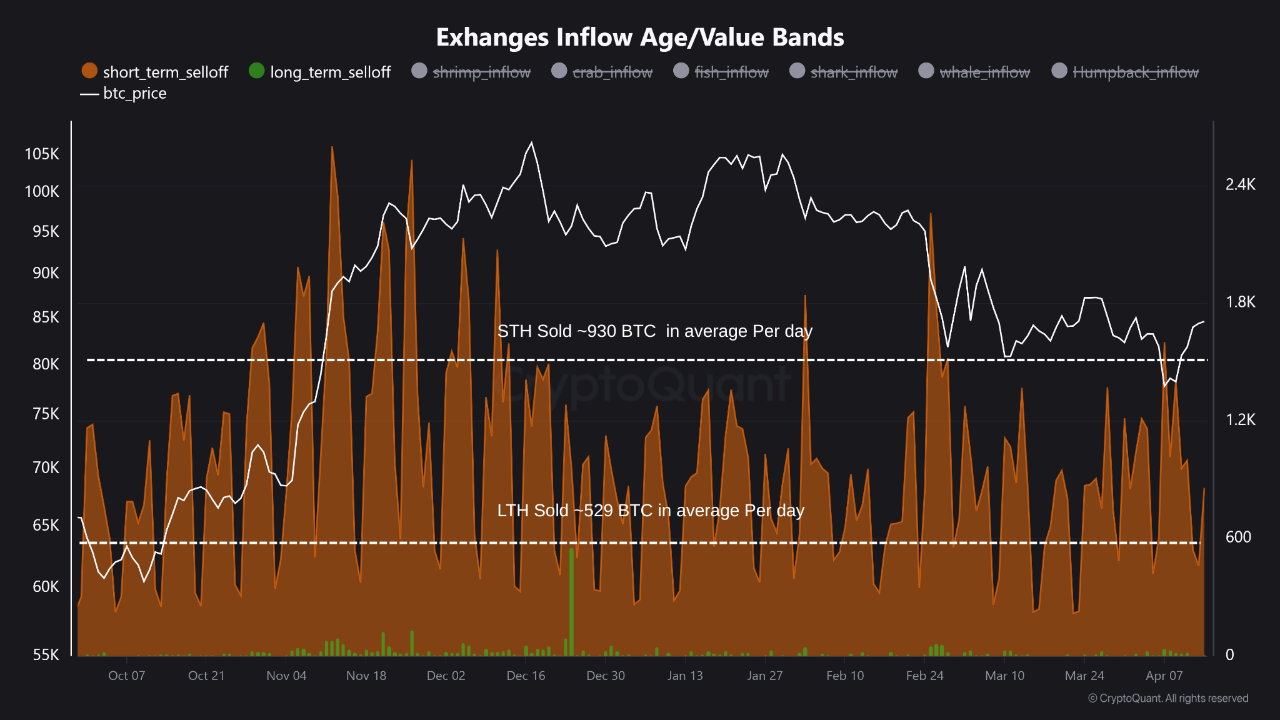

Now, here’s where it gets juicy. It turns out that the short-term holders—those cheeky folks who couldn’t hold onto their BTC if their lives depended on it—are the ones driving this sell-off. According to CryptoQuant (aka the all-seeing oracle of blockchain), short-term holders are sending 401 more BTC tokens to exchanges every single day than their long-term counterparts. Imagine that—401 more tokens. It’s like a sudden rush to the exit of a spaceship about to re-enter Earth’s atmosphere. And guess who’s keeping their cool? The long-term holders, obviously.

Who’s Selling the Most? Spoiler: It’s Not the Whales 🐋

Next up, we break down who’s really panicking in the Bitcoin sea. Apparently, it’s the Shrimps and Sharks that are getting jittery. Yes, you read that right. These are the small to mid-sized holders—those with under 1 BTC (Shrimps) and up to 1,000 BTC (Sharks)—who are sending their coins to exchanges like it’s Black Friday. Meanwhile, the Whales, the ones who actually have enough BTC to purchase a small country, are barely even budging. They’re sending just 70 BTC per day. The Whales are sitting there like, “I’m not worried, I’ll just take a nap while this all blows over.”

Here’s the breakdown for all you crypto enthusiasts:

- Shrimps (<1 BTC): 480 BTC per day

- Crabs (1-10 BTC): 102 BTC per day

- Fish (10-100 BTC): 341 BTC per day

- Sharks (100-1,000 BTC): 402 BTC per day

- Whales (>1,000 BTC): 70 BTC per day

It’s clear. The Whales are snoozing, while the smaller fish are flapping around in a panic. They’ve clearly read the “How to Fret Over Bitcoin in 10 Easy Steps” guide.

Is This a Classic Case of “Shackout” Before the Next Big Rally? 🏁

Ah, yes. The classic “Shackout”—a term coined by absolutely no one, but it sounds cool, so we’re using it. What we’re seeing here is likely a short-term panic sell-off before the inevitable and much-anticipated rally. Yes, you heard it right. The smaller wallets might be freaking out, but the big players—the long-term holders and the Whales—are sitting back with their feet up, sipping a digital Mai Tai, and not even sweating. Historically, these types of market shake-ups are like the storm before the calm, or in this case, before a bullish surge that makes everyone wish they’d held on for a little bit longer.

In the last week, BTC has gained a modest 3.1%, and in the past 24 hours, it’s surged by at least 0.7%. Sure, it’s not “moon-landing” territory, but it’s a sign that things are maybe, just maybe, getting back on track.

What Does This All Mean for Bitcoin’s Near-Term Price Action? 💰

In the short term, Bitcoin is like that unpredictable friend who shows up to your party and does something weird—volatile. The smaller investors are jittery, but here’s the kicker: the big players are not. That’s the bullish sign. When the whales and long-term holders are holding steady, it’s like having a sturdy anchor in a storm. The recent dip might be a mere blip, and once the panic subsides, we could see a rebound. The current price range for Bitcoin is a cozy $82,711.41 to $86,460.73, with the price currently sitting at $84,412. Let’s see if it holds steady or rockets upward.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Trust us, you don’t want to be the last to know. 😉

FAQs

Why has Bitcoin price dropped in the last two weeks?

Well, it’s a classic case of the short-term holders freaking out, driving a 9.01% drop between April 5 and 8. Nice, right?

How much will 1 Bitcoin cost in 2025?

According to our “totally trustworthy” predictions, BTC could peak at $168k in 2025 if the bulls are feeling particularly frisky.

How much will 1 Bitcoin be worth in 2030?

Brace yourselves—$901,383.47. Yeah, that’s a thing that could happen. 🚀

How much will the price of Bitcoin be in 2040?

Prepare for this number to give you a mild heart attack: $13,532,059.98. It’s not science fiction. Or is it? 🤔

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-04-17 13:38